J2R

ABB’s (NYSE:ABB) third quarter did not exceed our expectations or blow us away, but it showed the company is moving in the right direction: it looks like ABB is going to meet its margin targets one year early, made progress reshaping the portfolio by divesting some non-core operations including its remaining 19.9% stake in Hitachi Energy, and completing the Accelleron spin-off. ABB also reaffirmed that it remains committed to listing the E-mobility division when market conditions are more appropriate. It was another strong quarter for orders, the seventh consecutive period with a book-to-bill ratio above 1.

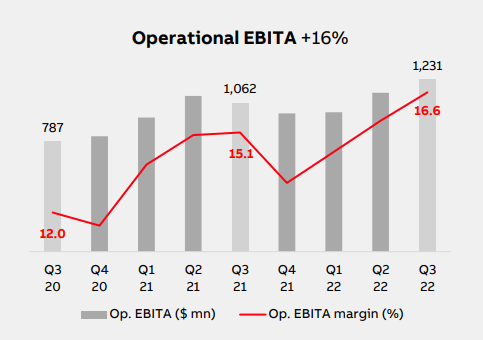

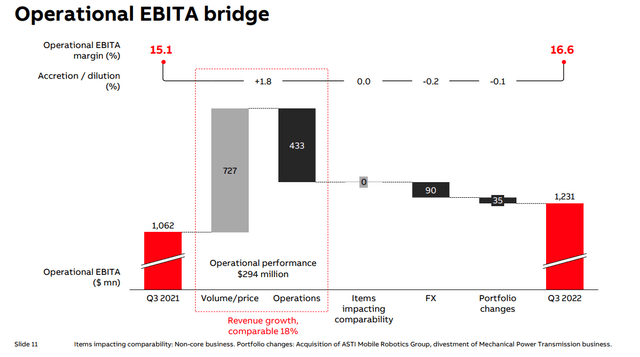

The highlight for the quarter was no doubt the strong operating EBITA margin of 16.6%, an increase of 150 bps. ABB achieved this thanks to higher volumes, good operational performance, and price management. This shows that ABB is becoming a more efficient and profitable company.

One big negative however was the Kusile project, a legacy project dating back to 2015 that triggered a nonoperational provision of $325 million in the quarter. ABB had previously agreed to pay around $100 million in 2020 to power company Eskom to settle a probe into improper payments and compliance issues related to this project. That ABB engaged in this type of behavior is a huge disappointment. Hopefully now that the company has new management this will not happen again. As a result of this charge, EPS declined from last year, with EPS of $0.19 a 41% decline from the previous year. Cash flow from operating activities came in at $791 million, also a decline from the previous year of 28%, but an improvement from the previous quarter. The order backlog remained at a high level of $19.4 billion.

Financials

Gross profit margin saw a meaningful improvement of 90 basis points to 33.5%. High volumes clearly helped, but it was also the result of good price execution of close to 7% for the Group. Operational EBITA increased by 16%, with improvements noted in all business areas except for a slight decline in Robotics & Discrete Automation. The margin trajectory is clearly moving in the right direction.

ABB Investor Presentation

As can be seen in the operational EBITA bridge, most of the improvements were the result of volume & price, as well as improved operations.

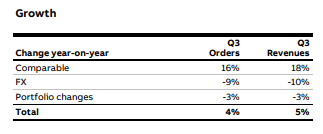

Orders and revenues

The impact from changes in exchange rates, especially the very strong US dollar, weighed on total order growth. The underlying customer demand remained healthy however, resulting in order growth of 4% (16% comparable), y/y. Total order intake for ABB amounted to $8,188 million, with improvement in most divisions. Meanwhile, revenues improved by 5% (18% comparable) with improvements in virtually all divisions and partially as a result of robust price increases.

ABB Investor Presentation

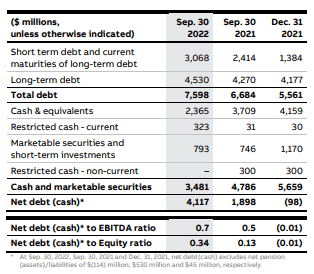

Balance sheet

The balance sheet remains extremely conservative, with net debt amounting to $4,117 million at the end of the quarter. Still, that is a significant increase from $1,898 million the previous year. As a result the net debt to EBITDA ratio has increased to 0.7x from 0.5x the previous year, but clearly leverage remains quite reasonable.

ABB Investor Presentation

Guidance

For the fourth quarter of 2022, ABB anticipates low double-digit comparable revenue growth, with sequentially lower operational EBITA margin. For the full-year 2022, the company expects to achieve early the 2023 target of an Operational EBITA margin of at least 15%.

Valuation

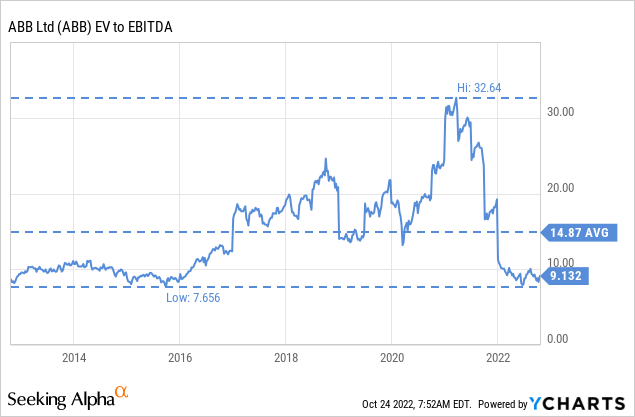

We continue to find value in ABB shares at current levels, with them trading significantly below their ten year EV/EBITDA average.

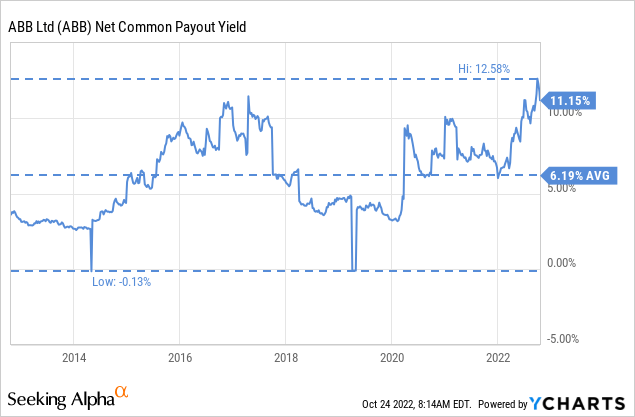

Even more impressive, ABB is returning huge amounts of capital to shareholders. The net common payout yield, which combines the share buyback yield and the dividend yield, is close to a ten year maximum at ~11%. ABB launched a new share buyback program of up to $3 billion on April 1st. As part of this program, ABB completed in the third quarter the return to its shareholders of the remaining $1.2 billion out of the $7.8 billion of cash proceeds from the Power Grids divestment. Once this is completed we expect buybacks to moderate going forward.

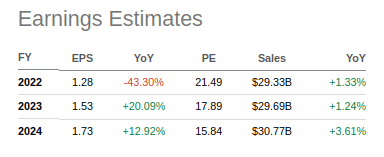

Looking at forward earnings estimates, shares look very reasonably valued as well. Analyst expect meaningful earnings growth for the next couple of years, resulting in shares trading at only ~15x fiscal year 2024 earnings estimates.

Seeking Alpha

Risks

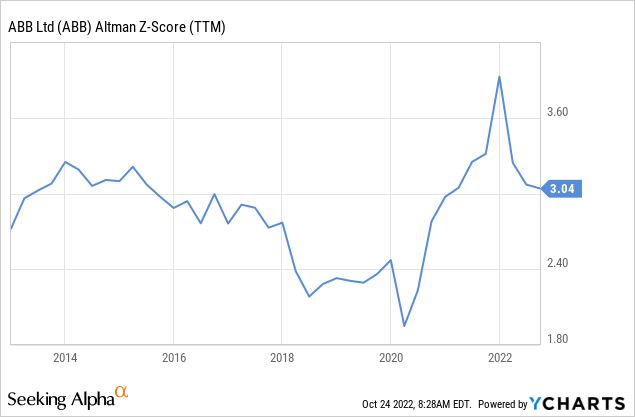

With the electrification and automation trends still going strong, margins and profitability improving at ABB, and a solid balance sheet, we are not too worried about the company. The Altman Z-score is above the critical 3.0 threshold, but it has come down given that the company has increased its financial leverage. At this point our biggest concern is the company’s culture, given what happened with the Kusile project. Fortunately the company has new management, and they have promised that they are taking steps to make sure something like that does not happen again.

Conclusion

ABB’s Q3 results showed the company is moving in the right direction, but it took a significant hit from past mistakes. There was a big difference between operational results and net financial results due to the nonoperational charges. Financially, the biggest positive was arguably the operating EBITA margin of 16.6%, but revenue and order growth were quite solid as well. Given the operational improvements and the still relatively low valuation, we believe shares continue to offer value at current prices.

Be the first to comment