Scott Olson

Investment Thesis: While Volvo has seen strong sales growth in the most recent quarter, future earnings growth will hinge significantly on revenues outpacing a rise in the cost of sales and production.

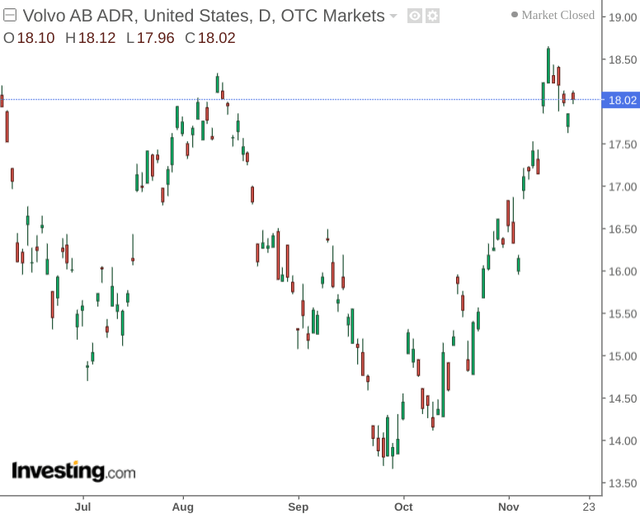

In an article last month, I made the argument that AB Volvo (OTCPK:VLVLY) has seen strong sales growth across its Trucks segment and could potentially be attractively valued on an earnings basis. However, I also cautioned that investors might want to see more evidence of growth before the stock delivers further upside.

However, it appears my views were overly conservative – with the stock up by over 15% since my last article:

The purpose of this article is to investigate whether AB Volvo can sustain the upside we have seen going forward, particularly in light of the company’s most recent earnings results.

Performance

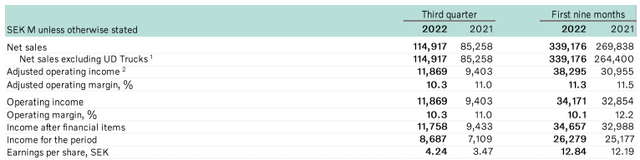

One noteworthy point to make about Volvo Group’s Q3 2022 results is that net sales saw a strong increase of 25% on a nine-month basis, while earnings per share in SEK saw a 5% increase.

Volvo Group: Report on the Third Quarter 2022

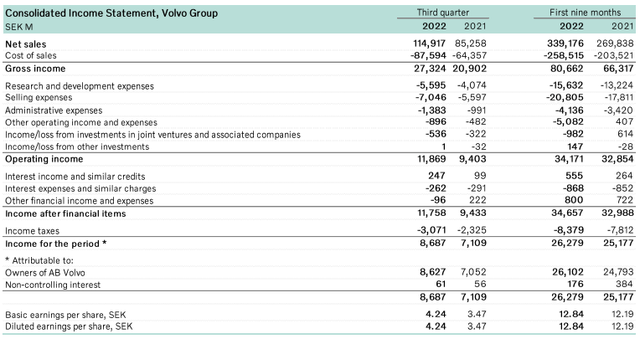

From looking at the company’s income statement, we can see that while sales have seen a significant rise as compared to last year – this has also been accompanied by a significant rise in the cost of sales as well as significant increases across Research and development and Selling expenses.

Volvo Group: Report on the Third Quarter 2022

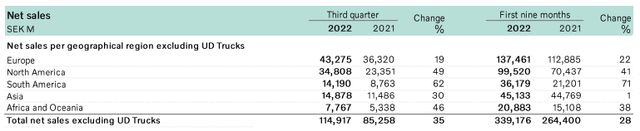

Additionally, when looking at sales by geography and vehicle type, it is noteworthy that North America showed a significantly higher increase in sales as compared to Europe.

Net sales by geographical region

Volvo Group Report on the third quarter 2022

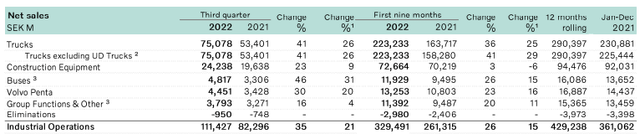

Moreover, the Trucks segment continued to be the best performing segment on a percentage basis, along with the segment accounting for 68% of total sales for the first nine months of 2022.

Net sales by vehicles

Volvo Group Report on the third quarter 2022

While sales growth has been encouraging – and this has clearly been reflected in the boost in share price – I take the view that investors will be paying more attention to earnings growth and whether revenue growth will significantly outpace the growth in cost of sales going forward.

Additionally, I had previously pointed out that the company’s quick ratio (calculated as cash and cash equivalents plus accounts receivable plus other receivables and marketable securities all over current liabilities) had fallen slightly from December 2021 to June 2022, pointing out that a fall in the ratio below 0.5 might be of concern to investors that Volvo Group could find it difficult to meet its current liabilities.

For the most recent quarter, we can see that the ratio is up just slightly to 0.58, with an increase in cash and cash equivalents also being accompanied by a rise in current liabilities:

| Dec 2021 | Jun 2022 | Sep 2022 | |

| Cash and cash equivalents | 62,126 | 54,268 | 71,906 |

| Accounts receivable | 40,776 | 47,015 | 45,640 |

| Other receivables | 16,742 | 17,578 | 17,715 |

| Marketable securities | 167 | 92 | 98 |

| Current liabilities | 190,457 | 213,694 | 233,429 |

| Quick ratio | 0.63 | 0.56 | 0.58 |

Source: Figures sourced from Volvo Group: Report on the Third Quarter 2022. Figures provided in millions of SEK (Swedish Krona), except the quick ratio. Quick ratio calculated by author.

Looking Forward

Going forward, Volvo Group has significant potential to bolster sales across the Trucks segment further. Specifically, this quarter marked the start of production of heavy-duty electric trucks as well as an agreement with Amazon (AMZN) to supply 20 of these trucks to the company.

As a leading truck manufacturer worldwide – Volvo does have significant potential to become a dominant player across the electric trucks market.

With that being said, the company will still face significant competition from Daimler Truck (OTCPK:DTGHF) – which remains the largest truck manufacturer in the world and recently saw higher than expected results in its own third quarter due to strong unit sales.

Additionally, with the race towards vehicle electrification heating up – there is a strong chance that Volvo will see its cost base rise significantly as it attempts to scale up its operations and bring more electric trucks to market.

Conclusion

To conclude, AB Volvo has seen significant sales growth over the past quarter. While the stock has responded well to this news, future earnings growth will hinge significantly on revenues outpacing a rise in the cost of sales and production. My overall conclusion is that while Volvo has seen strong sales – earnings growth will need to rise more robustly to justify a bullish view.

Be the first to comment