niphon

Investment Thesis

AAON Inc.’s (NASDAQ:AAON) stock price has increased ~40% since our last article. In that article, we predicted that the company’s higher backlog levels and pricing actions would benefit revenue, whereas pricing actions and higher margin projects in the backlog should benefit margins. This played out well and the company reported strong results.

Looking forward, I believe these tailwinds should continue to benefit the company’s growth, along with the strong demand in its end markets and improvements in production levels. The company is benefiting from secular market share gains of customizable HVAC solutions. The stock is currently trading at 31.37x FY23 consensus EPS estimate which is lower than its five-year historical average. I have a buy rating on the stock given its solid growth prospects.

Revenue Outlook

The company’s net sales increased 75% Y/Y in Q3 FY22 driven by organic volume growth of 26.9%, pricing contribution of 24.4%, and 23.8% contribution from the acquisition of BasX in late 2021. The volume growth was due to the strong backlog levels and increased production. The production increase was due to improved productivity and an ~18% increase in organic headcount. The unit sales on a per day/per production employee basis were higher in the third quarter compared to Q1 and Q2 of 2022.

The overall demand for the company remained strong in the third quarter of 2022. The total backlog was up 183.1% Y/Y and 10.9% sequentially. On an organic basis, the total backlog was up 109.6% Y/Y and 4.7% sequentially. The organic bookings in the quarter were up 28% Y/Y and 36.7% sequentially, primarily driven by volumes. The bookings in BasX increased 67% sequentially, whereas its backlog grew 267.1% Y/Y since the end of 2021 and 33.8% sequentially. The company is continuing to increase its production levels to meet the demand in both the legacy and BasX businesses.

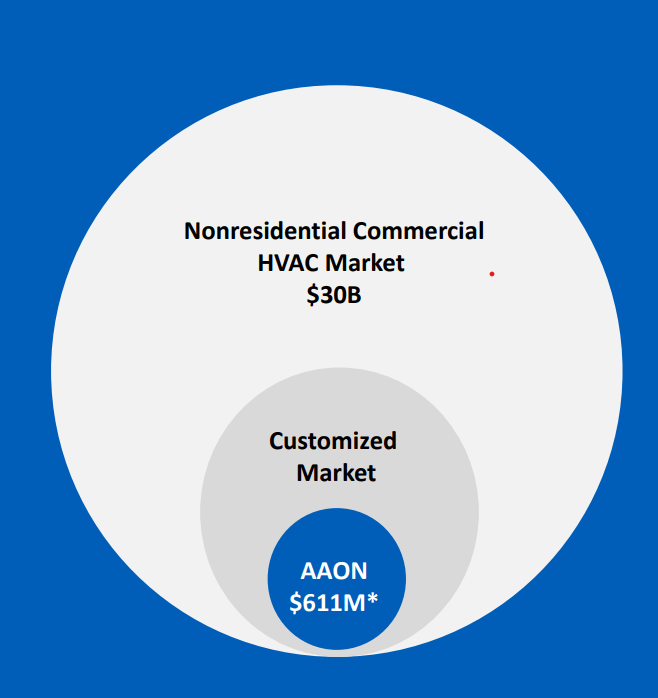

AAON’s Market Positioning (Investor Presentation) Company’s Investor Presentation

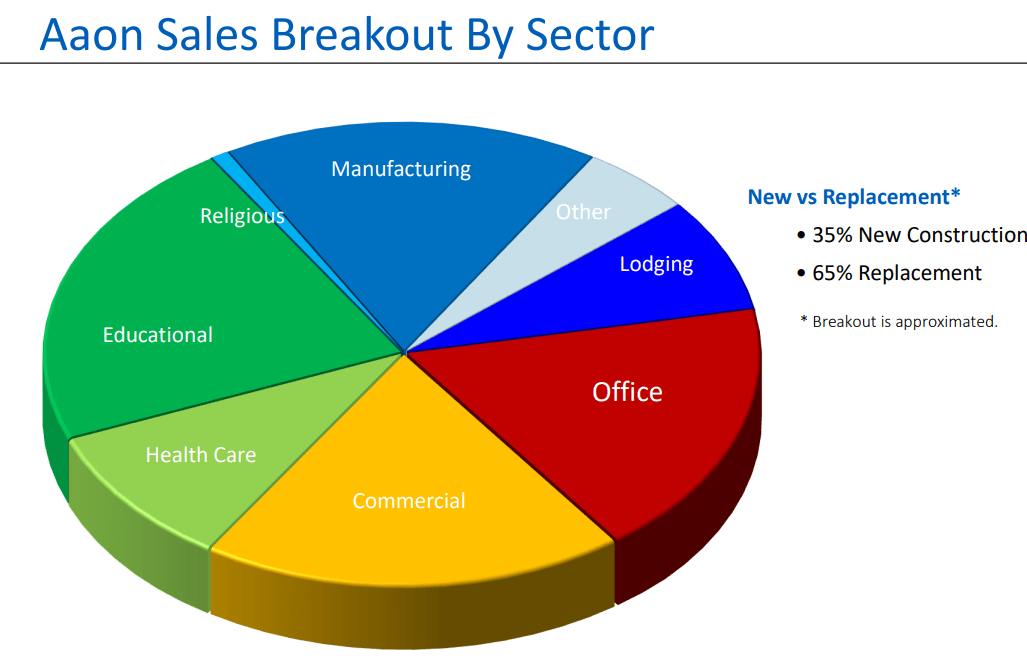

Looking forward, the demand for the company’s products in the data center, semiconductor, education, healthcare, and manufacturing facilities end markets remains strong. The strong demand in these end markets should completely offset the softness in the lodging and office building end markets. Unlike its peers, AAON is not experiencing a slowdown in demand, thanks to the company’s presence in the customized commercial HVAC market. The customized end market is experiencing good demand trends and growing market share due to the shift in preference towards high-performance equipment to meet indoor air quality, energy efficiency, and decarbonization requirements. Also, the replacement market is facing tailwinds related to indoor air quality improvements, environmental awareness, the high average age of existing equipment, etc. AAON generates ~65% of the total sales from the replacement industry.

Leading indicators, such as the Dodge Momentum Index, a 12-month leading indicator that measures the number of construction projects, are showing signs of strength in the non-residential market. The company is also working towards adding headcount, improving productivity, and continuing to invest in capacity to improve its lead times and bring down its backlog levels. Additionally, the company’s revenue should also benefit from the pricing actions taken in 2022. AAON plans to continue its pricing actions until there’s some stabilization in labor wages as well as electronic component costs. I believe the company’s revenue in 2023 should benefit from strong end-market demand, healthy backlog levels, improvements in production levels, and pricing actions.

Margin Outlook

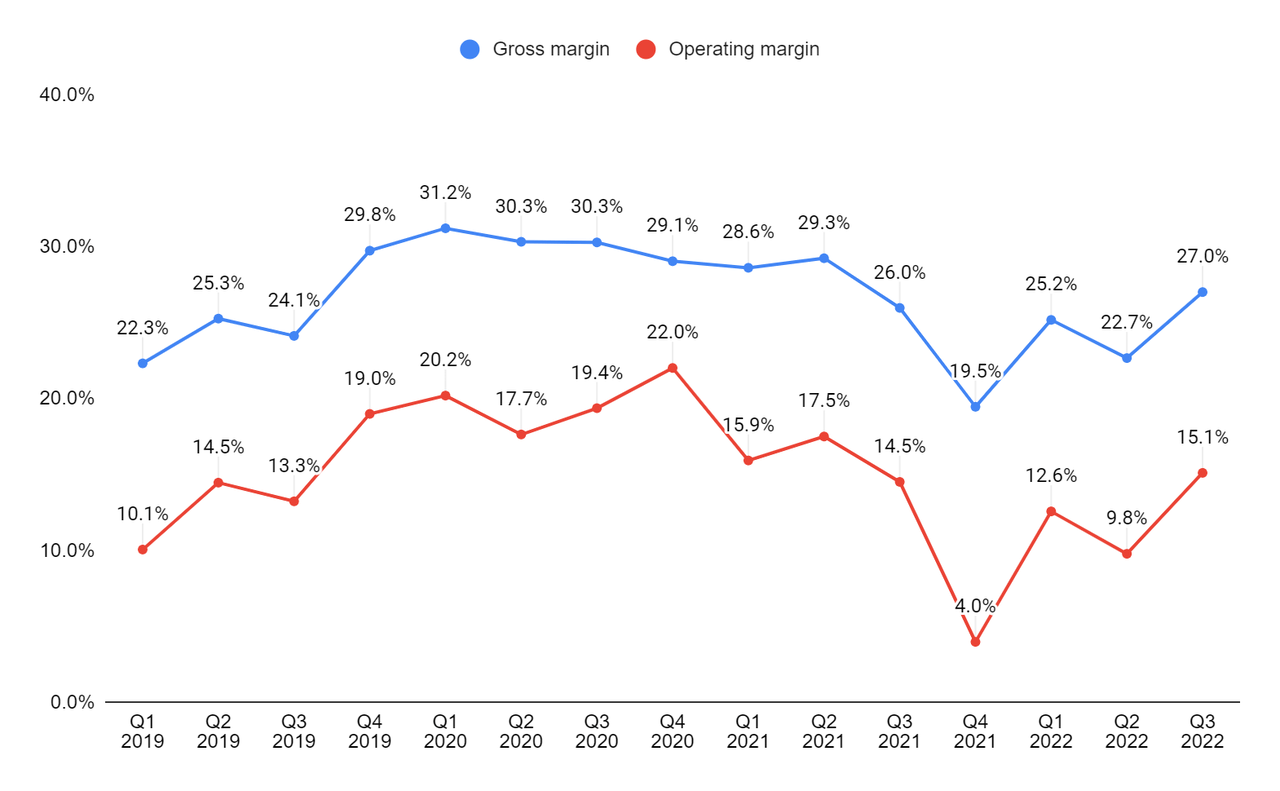

In Q3 2022, the gross margin improved by 100 bps Y/Y to 27%, driven by higher pricing and improved productivity, partially offset by higher costs and supply chain constraints. The operating margin improved by 60 bps Y/Y to 15.1%, benefiting from improved gross margin partially offset by increased SG&A as a percentage of sales by 40 bps Y/Y.

AAON’s gross margin and operating margin (Company data, GS Analytics Research)

Looking forward, the company has good margin profile projects in its backlog, which should help drive its gross margin. Additionally, the pricing actions along with the stabilization of input costs should also benefit margins. The company is working towards improving its productivity, which should continue to improve margins as the supply chain constraints get better. Recently, AAON made a decision to exit from a couple of product lines (contributing ~1% to the total revenue) in its water source heat pump business due to minimal pricing power. This should help the company to utilize the additional capacity towards the higher margin, high growth equipment. AAON’s Parts business, which contributes ~7% to the total sales, is the strongest gross margin business, and the company is focusing on growing this business.

Valuation & Conclusion

The stock is currently trading at 31.37x FY23 consensus EPS estimate of $2.42, which is lower than its five-year average forward P/E of 41.27x. The company’s revenue should benefit from the strong end market, healthy backlog levels, pricing actions, and improvement in production levels. The margins should further expand due to the stabilization in input costs, pricing actions, production improvements, and higher margin profile backlog. The company is benefiting from market share gains in customized non-residential HVAC solutions and is posting high top and bottom-line growth. Looking forward, I expect the company’s good growth to continue. Hence, I have a buy rating on the stock.

Be the first to comment