John Scott/DigitalVision via Getty Images

The stock market is in a tug of war between rising interest rates and corporate profits, and we saw that dynamic in spades yesterday. The 10-year Treasury yield hit a new multi-year high of 2.86%, which pressures the value of stocks in general and growth names in particular. At the same time, corporate profits are outperforming estimates so far this earnings season with financials leading the charge. While bond yields have risen dramatically, they are still not high enough to be a competitive alternative to the stocks of companies with earnings growth and attractive dividend yields. This is especially true with an elevated inflation rate that results in what are still negative real (inflation-adjusted) yields. I think it may take a 10-year yield of 4% to undermine the bull market, but that doesn’t appear to be in the cards for 2022.

Finviz

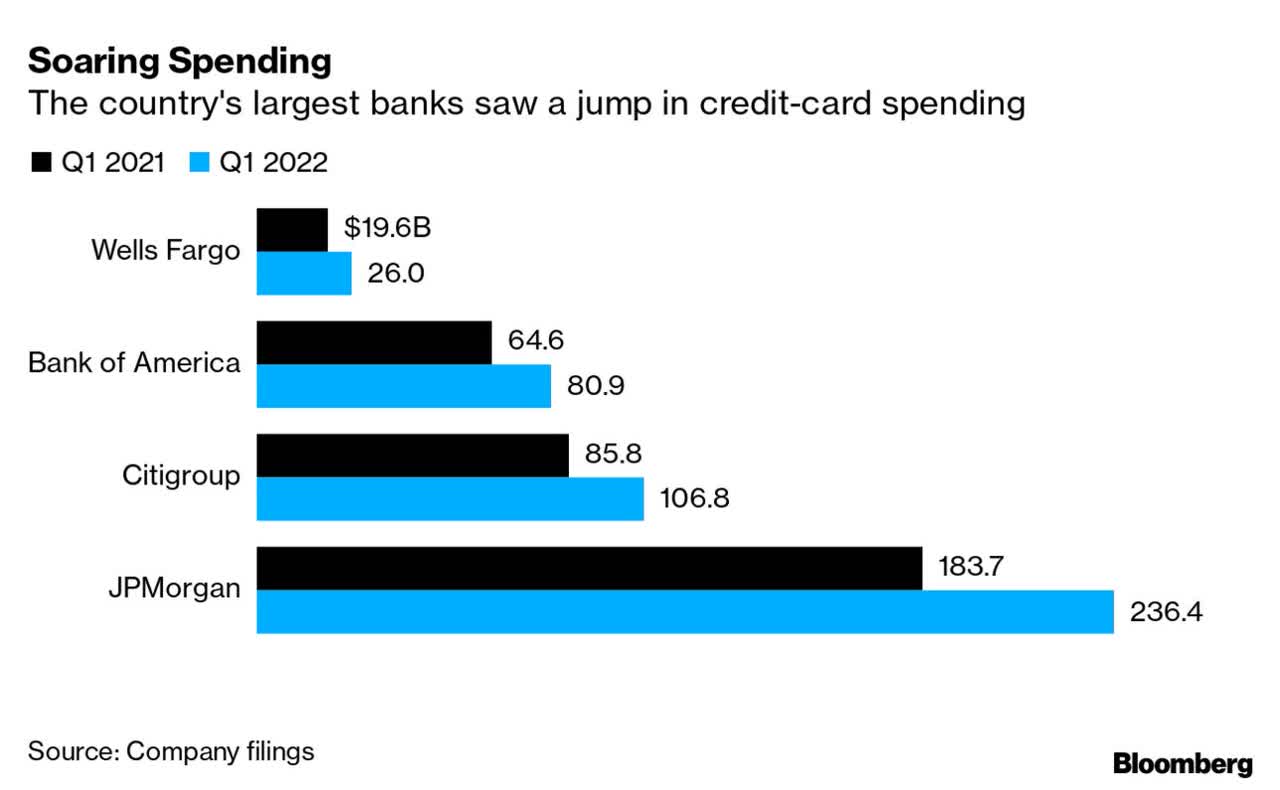

Wall Street seems to be obsessed about forecasting the next recession. Goldman Sachs places the odds of one occurring at 35% over the next two years. Morgan Stanley’s Chief Equity Strategist Mike Wilson may be cheering for one so that his bearish market call comes to fruition. He asserted yesterday that signs are emerging of a disappointing first quarter earnings season, but I have no idea what he is talking about. Estimates have been rising since the beginning of April. As for recession, there is nothing in bank earnings reports to suggest one is close. To the contrary, the largest banks say spending on credit cards is rising as consumers are traveling and eating out more, while charge-off rates for bad loans hover near historic lows.

Bloomberg

That does not sound like a recession is on the horizon. In fact, Bank of America disclosed in its upbeat earnings report yesterday that average credit card balances have fallen 8% since the pandemic roiled our economy in the first quarter of 2020, while the average checking account balance has increased 39%. Those figures include subprime borrowers. This sounds more like a strengthening economy than one in the late stage of the economic cycle that precedes recession. Even more impressive is the fact that consumers were fueled with stimulus checks one year ago, yet spending levels are holding up regardless.

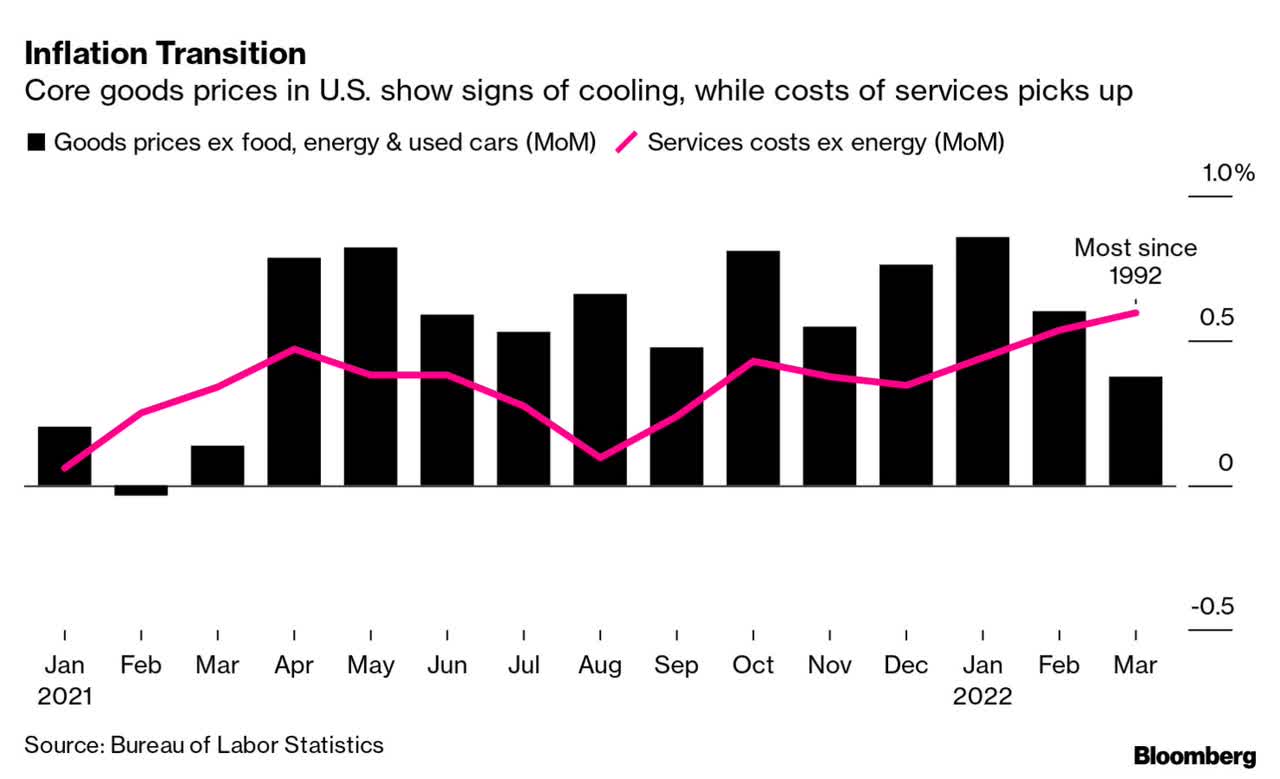

The full reopening of the economy has consumers shifting their spending focus from goods to services, which is starting to have an impact on prices that should assuage inflation concerns later this year. As inventories for goods have improved and demand has started to wane, price increases are abating. The rise in borrowing costs is also having an impact. We are seeing this happen in the used and new car market now. The increase in mortgage rates to a more than decade high should have a similar effect on home prices and the ancillary goods that come with a home purchase.

Bloomberg

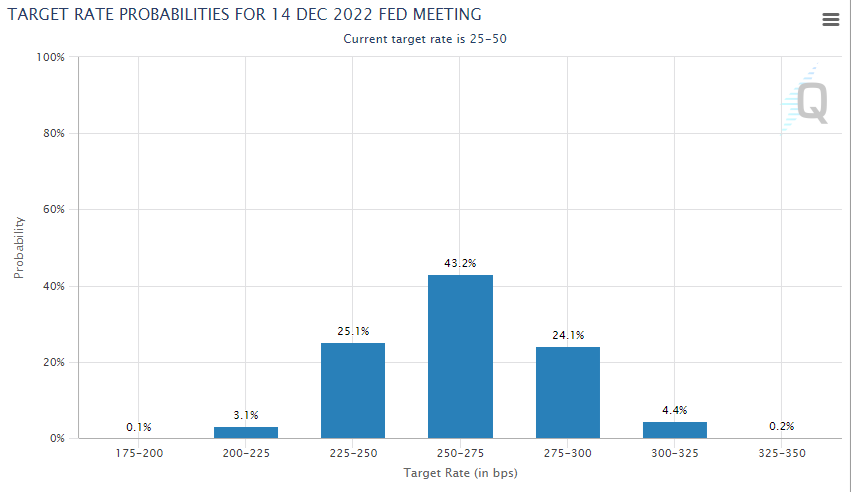

It is important to remember that as hawkish as the Fed has telegraphed it intends to be this year, the financial markets have already done most of the work for the central bank. Mortgage rates have risen to approximately 5% for a fixed-rate 30-year loan. The 2-year Treasury yield at 2.46% has already accounted for short-term rates rising from just 0.25% to 2.5% by the end of this year, which is in line with the Fed funds futures expectation.

CME Group

One scenario that is not being considered is an inflation rate that cools faster than the consensus expects, lowering the probability that the Fed funds rate falls within the 2.50-2.75% range that investors expect today. The latest Bloomberg survey of economists expects the Consumer Price Index to average 5.7% in the fourth quarter of this year, which is up from the prior estimate of 4.5%. I think that as the year-over-year comparisons become more difficult for key components of the index we will see an average that is much lower than 5.7%. That could result in a Fed that is less hawkish than it is today, which would be a tailwind for risk assets, especially if we continue to see sustainable economic and earnings growth. A decline in 2-year Treasury yields could be the first indication that this is happening. As a result, stocks would be the winner in the tug-of-war between interest rates and earnings.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment