Alessandro Biascioli/iStock via Getty Images

This article was co-produced with Cappuccino Finance.

On December 31, 2010, I published my first real estate investment trust (‘REIT’) article on Seeking Alpha.

Gosh, but how long ago that was.

It wasn’t my first piece there. I’d previously written about Walgreens (WBA), auto parts retailers, and Rite Aid (RAD). The first got five comments. The second got four. And the third got seven.

But then I published “Single Tenant Net-Leased Investments: The SWAN Strategy,” which pushed me into the double-digits. It made me wonder if I was onto something people wanted to hear about.

Perhaps they even needed to hear about it.

I know I did.

Life had been extremely difficult since the 2008 crash, when my entire commercial real estate empire – across multiple strip-mall properties with several franchise operations I was running myself – crashed and burned around me.

And while my exact situation with my exact losses were unique to me… so many other people had their own stories. As I wrote in the opening lines of “The Swan Strategy”:

“With over 157 failed banks this year and the likelihood of more failures in the months and years to come, commercial real estate (‘CRE’) is experiencing record disruption within all asset types.”

Remember those days and the effects they had on all of us?

Today, they keep saying we’re not headed back there. And, in all fairness, there are numerous indicators that back them up.

Then again, the economy is far from stellar, and the bears have a lot to point to as well.

A Lackluster Yesteryear

But back to then for another moment. We’ll discuss “now” again shortly.

The article continued with:

“The speculative lending market is all but dead, and the few remaining banks lending on CRE assets are seeking only high-quality loans paired with substantial equity invested. Most major CRE asset classes have been hammered by exposure to a variety of economic conditions such as high unemployment and poor underwriting fundamentals.

“The assets with shorter lease terms and non-credit tenants have all been plagued with higher vacancy rates and a high percentage of troubled and distressed loans.”

In that environment, I noted, “One asset class that provides the least risk and management responsibility is the single-tenant net-leased category.” Investors there could much better sleep well at night (‘SWAN’) than elsewhere.

“The SWAN strategy,” I added, “could be represented by the following formula… Credit + Long Lease + Rent Bumps.”

In other words, companies with strong balance sheets, long-term contracts with their tenants, and scheduled rent increases tend to do very well for dividend-minded investors long term.

Now, admittedly, these companies aren’t always REITs. I did add that:

“There are quite a few STNL products ranging from public REITs… [to] non-traded REITs… alternative co-ownership products… and customized investments. With bond returns at an all-time low… and many other CRE classes underwater, now is the time to consider investing in single-tenant net-leased assets as a bond replacement strategy.”

That would almost undoubtedly help you sleep well at night.

Incidentally, the reason for all those ellipses (i.e., …) above is because I had actual recommendations in the original text. These almost 12 full years later, they may or may not be good buys today.

But the strategy that fueled my choosing them?

That is still very much intact.

A SWAN for Every Season

SWAN stocks are always worth buying into and holding onto at the right prices. That’s why they’re SWANs.

Let me explain.

Trends come and go. The stock market falls and rises, sometimes jarringly so, as we’ve seen so many times this year in both directions.

But even when their stocks are down, SWANs are still classics.

They might not be the flashiest holdings when the bulls are running wild. But they do provide steady gains and faithful dividend payments nonetheless as the economic sun shines.

And when the clouds come out and the bears start roaring?

They continue to offer faithful dividend payments – complete with the reassurance that their share prices will bounce back better than ever in due time.

So when the housing market crashes, as it did in 2008, SWANs are worth holding onto. And when inflation is breaking businesses’ and individuals’ backs alike, as they are now, SWANs are worth holding onto still.

Moreover, they’re worth holding onto when you’re in your 20s, your 40s, your 60s, your 80s… and beyond!

That’s why I consider this to be the final piece to that generational series I started weeks ago. The one that recommended:

I know I’ve said a few times now that it was my final article in that series before remembering – or being reminded – that I’d missed an age bracket. Even so, I think I can safely call this one the true culmination.

Because this one is for everyone: a true REIT portfolio built to stand the test of time.

Realty Income Corporation (O)

Realty Income owns over 10,000 properties in all 50 states (and a couple of international locations). Realty Income pays monthly dividends.

They have a very well diversified portfolio consisting of grocery stores, convenience stores, restaurants, drug stores, automotive, and others. Also, their assets are geographically diversified. The most concentrated state (Texas) only represents 11.1% of their total portfolio annualized contractual rent.

Realty Income has a stable and strong balance sheet and capital structure. Their debt service & fixed charge coverage ratio is at 5.5x, and their debt maturity schedule is well managed over the next several years.

Both Moody’s and Standard & Poor’s rated their credit high (A3 for Moody’s and A- for Standard & Poor’s), and their credit rating outlooks are stable.

Realty Income’s dividend is well covered, represented by an AFFO payout ratio of 76.61% and cash dividend payout ratio of 76.55%. I expect them to carry on their consecutive dividend growth streak and continue to reward shareholders.

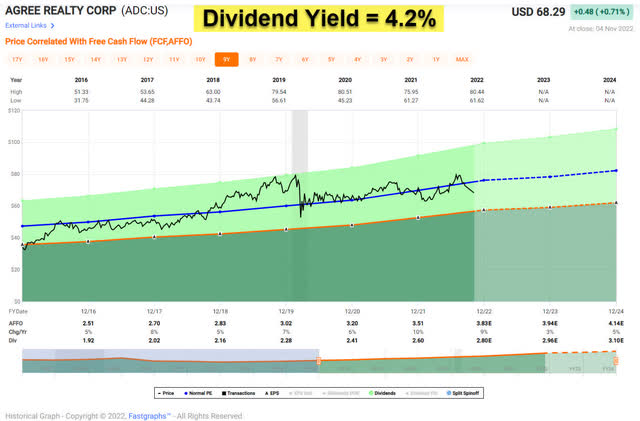

Agree Realty Corporation (ADC)

Agree Realty Corporation is a fully integrated REIT that focuses on owning, acquiring, developing, and managing retail properties. They have over 1,700 properties, and top tenants include Walmart, Tractor Supply Company, Best Buy, and Dollar General.

Agree Realty has been growing nicely in the past several years, and their dividend growth has been solid (6.8%, 5-year CAGR).

Agree Realty has a formidable balance sheet. They will not see significant debt maturity until 2028, and their fixed charge coverage ratio stands at 5.0x. The credit ratings are Baa1 and BBB with stable outlooks.

With increasing investment activity and this impressive balance sheet, I expect Agree Realty to continue their growth well into the future. Their stock price is well within the Buy zone based on iREIT ratings tracker, and the margin of safety is 8% at this point.

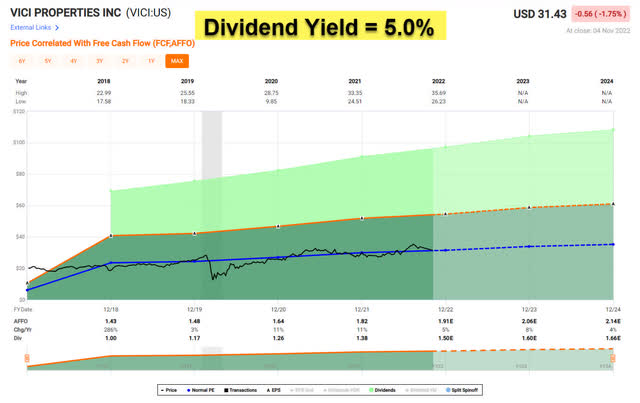

VICI Properties (VICI)

VICI Properties is an experiential REIT that owns one of the largest portfolios of casino, hospitality, and entertainment destinations. Their portfolio includes assets like Caesars Palace, MGM grand, and Venetian. VICI has been growing at a solid pace over the past several years.

Their stock price is well undervalued at this point. The valuation metrics like P/AFFO of 16.99x and P/FFO of 14.35x are well under their 5-year average.

The margin of safety on the iREIT ratings tracker shows 13%. With world-leading premium assets in their portfolio and great operational performance, I believe the market will realize this mistake, and the stock price of VICI Properties will appreciate in the long run.

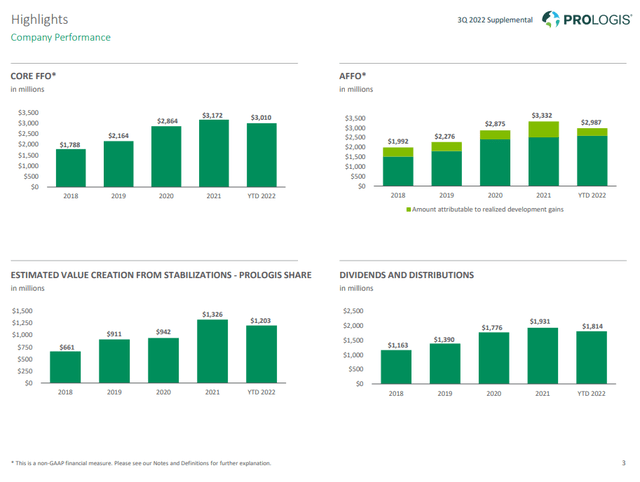

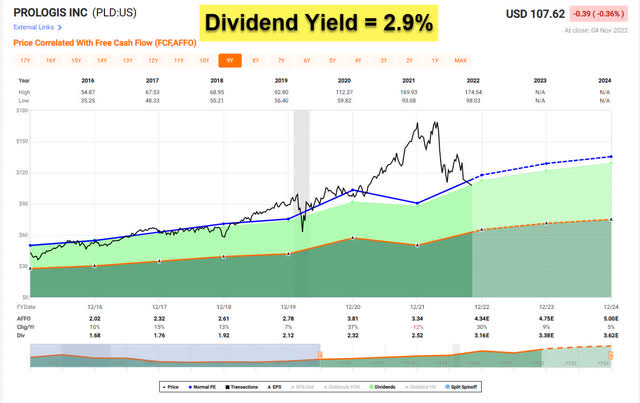

Prologis (PLD)

Prologis is a global REIT that owns, manages, develops, and acquires high quality logistics facilities in multiple countries around the world. Their properties are in high-barrier and high growth markets.

With an ever-growing demand for last mile delivery and e-commerce, the Logistics business has been growing substantially and I expect it to continue to do so in the future.

Prologis’ dividend represents both safety and growth. Their dividend growth rate has been outstanding at 11.5% per year (5-year CAGR), and it recently accelerated. The dividend growth rate for the trailing twelve months was 21.57%.

Also, their dividend is safe. AFFO payout ratio is only at 58.13%, and cash dividend payout ratio is at 62.59%. For investors who want to invest in a growing trend, the logistics industry and Prologis is a great choice.

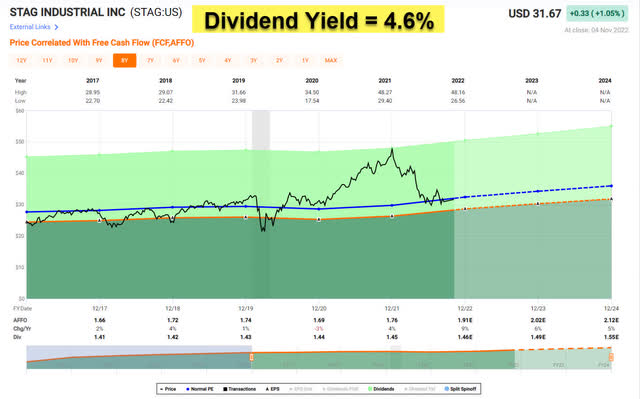

STAG Industrial (STAG)

STAG Industrial focuses on industrial properties across the U.S. Their business strategy is 1) to identify properties for acquisition that offer relative value across all locations, industrial property types, and tenants through principled application of their own risk assessment model, 2) to operate their properties efficiently and cost effectively, and 3) capitalize the existing properties opportunistically.

STAG industrial is doing a great job of maintaining a strong balance sheet and the required liquidity to achieve their business model. They have total estimated liquidity of $920 M, and their net debt to EBITDAre ratio is at 5.1x.

Their strong balance sheet and liquidity puts them in a position to grow, and they are planning to acquire $700 M to $1.1 B additional properties. Along the way they plan to dispose of $200 M to $300 M.

Combining their active acquisition strategy with strong growth in same store rents, I expect STAG Industrial to continue to expand.

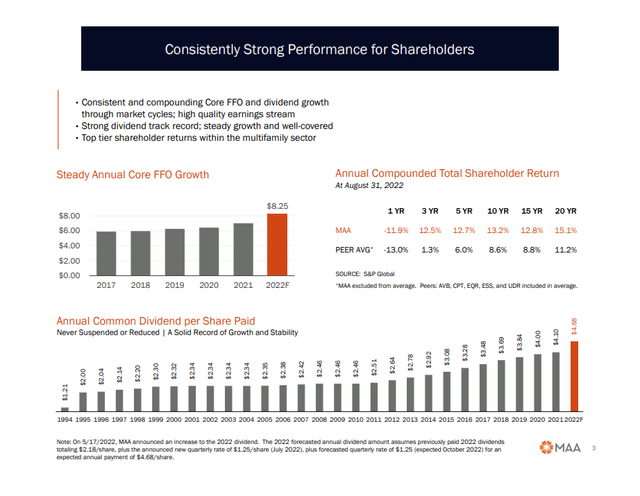

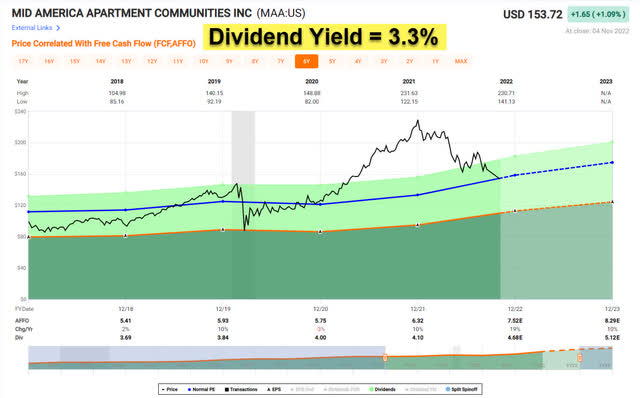

Mid-America Apartment Communities (MAA)

Mid-America Apartment Communities owns, acquires, develops, and manages apartment communities located in the Southeast, Southwest, and Mid-Atlantic regions of the U.S.

They have over 100,000 apartment units in their portfolio, and they have a superbly strong balance sheet. Their net debt to Adjusted EBITDAre is at 3.97x, and their credit rating from S&P is at A-.

Aided by the U.S. housing shortage, Mid-America’s well managed development pipeline has allowed it to grow at a solid pace in the past several years. Their annual compounded total shareholder return has been 15.1% for the past 20 years.

Given their current pipeline and strong balance sheet, they have the resources to continue their growth streak.

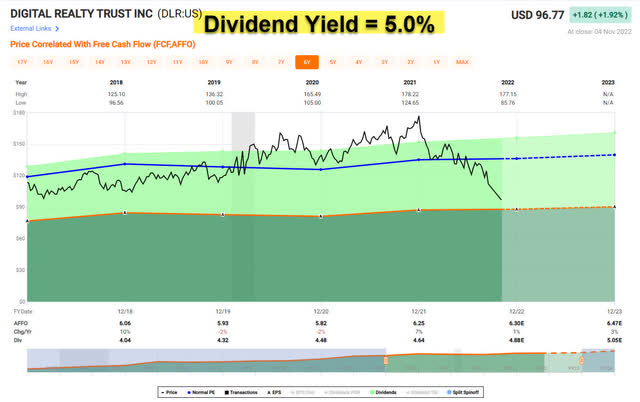

Digital Realty Trust (DLR)

As we are well aware, just about all industries are digitalizing their assets and moving to take advantage of big data. As more and more companies join the trend, the demand for data centers has been increasing rapidly.

Digital Realty Trust is one of the best REITs to take advantage of the movement. Digital Realty Trust is a leading global provider of data centers, colocation, and interconnection solutions.

Since 2005, their Core FFO per share has increased at the pace of 10% per year, and they have raised the dividend for 17 years in a row. Their dividend is safe at this point, demonstrated by FFO payout ratio of 71.62% and AFFO payout ratio of 78.63%.

The recent drop in stock price pushed their dividend yield up above 5%, and it is a great time for investors to grab some shares of Digital Realty Trust.

American Tower Corporation (AMT)

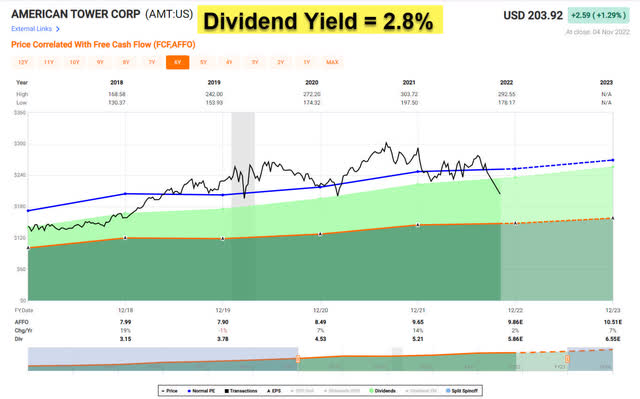

American Tower Corporation is a leading REIT that focuses on multi-tenant communications real estate. Their portfolio consists of more than 200,000 communications sites.

The need for more and more wireless communication is increasing, and American Tower’s revenue and profit has been rising nicely in the past several years.

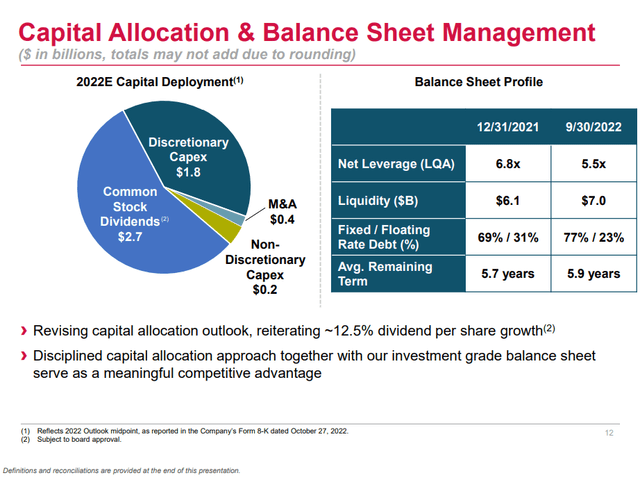

American Tower has a solid balance sheet and favorable capital structure to continue their strong performance. Their net leverage ratio stands at 5.5x, and their liquidity is over $7.0 B at this point. They have increased their dividend substantially in the past 10 years with a dividend growth rate of 24.04% per year.

Their dividend is safe at this point with a cash dividend payout ratio of 79.7% and AFFO payout ratio of 58.24%.

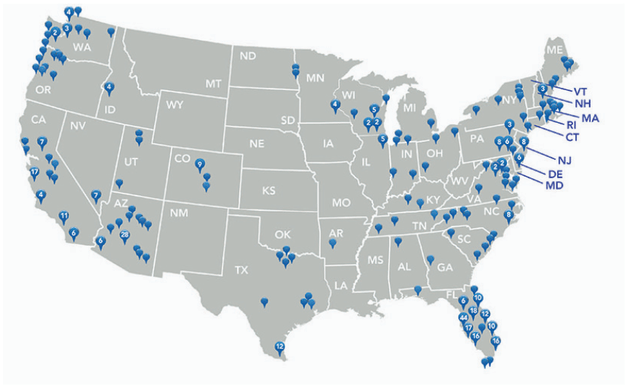

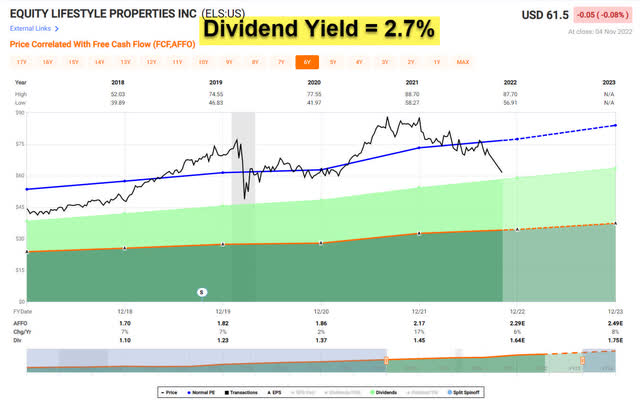

Equity LifeStyle Properties (ELS)

Equity LifeStyle Properties leases their land to customers with manufactured homes and cottages, and RVs. They offer both long and short lease terms. Compared to other types of REITs, their business model is characterized by low maintenance costs and low turnover.

Boosted by the U.S. housing shortage and people’s increasing preference to living in more remote locations, Equity LifeStyle has been growing nicely in the past several years.

Dividend growth has been strong. The dividend over the past 10 years has grown 14.21% annually. Also, their dividend is safe, demonstrated by a cash dividend ratio of 45.53% and AFFO payout ratio of 69.51%.

Their well-positioned balance sheet should also be reassuring for investors. The interest coverage ratio is at 5.7x, and the weighted average interest rate is at 3.5%.

Blackstone Mortgage (BXMT)

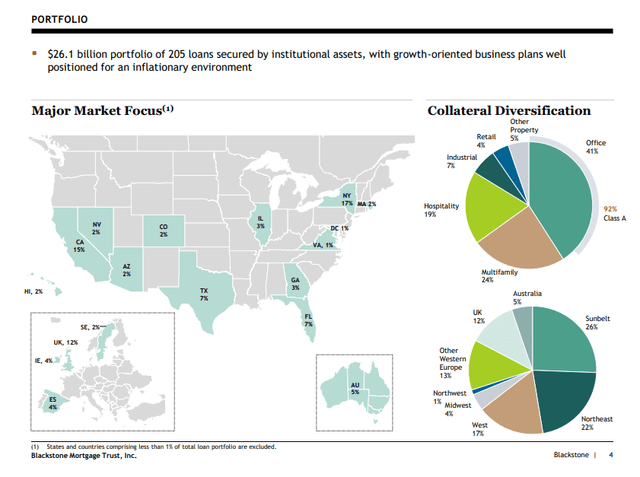

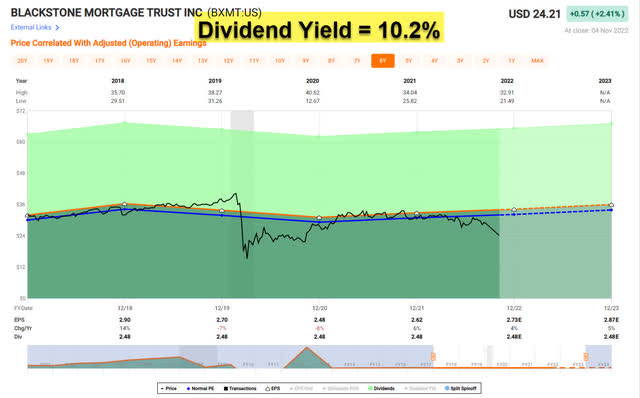

Blackstone Mortgage Trust is a commercial mortgage REIT that originates senior loans collateralized by commercial real estate in North America, Europe, and Australia. They have a very well diversified portfolio, and their business has been growing substantially in the past several years.

The higher interest rate environment and continued strong loan performance has brought strong EPS growth this year. Their EPS grew $0.62 in 1Q 2022 to $0.71 in 3Q 2022.

During the last earnings call, management expressed confidence in their future performance. They believe that the vast majority of their office portfolio is well positioned for the post pandemic environment. Also, they mentioned that the overall performance of their collateral assets continues to be strong.

I expect Blackstone Mortgage to continue their solid overall performance and reward shareholders with a strong dividend (current yield of 10.24%).

Conclusion

Warren Buffett famously said that his favorite holding period is forever.

A lot of research by financial institutions backs this up, showing that the longer you hold the stock, the better your chance of making big money.

Here is a portfolio of 10 great REITs that the investor can hold for life. They all have an outstanding track record, great balance sheet, and solid returns.

Investors can expect nice appreciation and dividends from this REIT portfolio. Put your money to work while you sleep soundly through the night.

iREIT on Alpha

Be the first to comment