xxz114

Investment Summary

Lufax Holding Ltd (NYSE:LU) (herein: “the company,” “LU,” or “Lufax”) is a consumer finance company based in China comprising two business segments targeting China’s small business owners and growing middle class: wealth management and loan facilitation. Both business segments are aligned with China’s 14th 5-year plan, an incredibly important aspect of operating in China. Additionally, Lufax has the financial and operational backing of the world’s largest insurance company: Ping An Insurance (OTCPK:PNGAY).

Despite currently experiencing headwinds due to ongoing COVID lockdowns in China and a weakening macroenvironment, Lufax remains profitable with LTM net income margins of 21%. More importantly, its balance sheet remains steadfast, leveraged at only 1.4x debt/EBITDA and maintaining 17% unrestricted cash/assets.

For many, investing in China is understandably a nonstarter. However, for those seeking some exposure in their portfolio, Lufax currently trades at 0.3x tangible book value, suggesting a 338% upside even ignoring any catalysts and simply returning to normalized economic environment cycle. At the same time, Lufax is aggressively buying back shares, re-upping its latest program with another $500M repurchase plan. We are content to patiently wait for Lufax to resume growth in an improved environment while receiving its 10%+ dividend returns and share buybacks. Though the road back to a normal economic environment will not be smooth, we believe Lufax has a titanium balance sheet to weather these stormy times and exit as the undisputed leader in the consumer finance industry.

We will begin with a look into the balance sheet and asset quality of the company, and then the risks and regulations that Lufax operates in. Lastly, we will look into valuation and catalysts. This article will only focus on the loan facilitation business since the wealth management business, though an important and rapidly growing portion of the overall business, still only amounts to 3 – 4% of total income. We conclude this article by assigning a Strong Buy rating to Lufax.

Balance Sheet and Asset Quality

The 2008 Financial Crisis has taught (or should have) that any investment into a financial company must include a discussion on its loan portfolio and balance sheet, especially as the world is now vacillating around a global recession.

In its second quarter report, new loans facilitated by Lufax decreased 15% year-over-year, with outstanding balance of loans facilitated standing at RMB661 billion. From that total, 36% of the loans are held on the balance sheet, with 58% of the on-balance sheet loans secured (herein referred to as the “secured portfolio”). The portion of the secured portfolio for which Lufax is directly liable is 18%, or RMB42 billion. The remaining assets on the secured portfolio are insured by 3rd party insurance companies, mostly its counterparty partner, Ping An.

The company has stated that virtually all of its directly liable loans in its secured portfolio are backed by real estate assets. Naturally, “real estate-backed securities” sparks dreadful images, such as the 2008 Financial Crisis and more recently, China’s Evergrande default debacle. To put things in context, real estate-backed securities make up only 6% of total outstanding loans Lufax facilitates.

| Total Loans Outstanding | On-Balance Sheet | Secured Portfolio | Insured Loans |

Property Backed Loans |

|---|---|---|---|---|

| RMB661 B | RMB238 B | RMB139 B | RMB111 B | RMB42 B |

Table: Loan portfolio breakdown of the Company (Source: 2Q FY22 Earnings)

Lufax currently maintains a 1.4x leverage ratio, with RMB98 B in net assets, which more than covers the property-backed loans in case of a total wipeout of China’s property sector. In fact, Lufax’s cash on hand of RMB64 B alone is able to withstand such an apocalyptic scenario. This points to the fortitude of the company’s balance sheet to withstand the current economic climate. The company last reported a 30+ day delinquency rate of 1.4%–relatively flat since earlier in this year during the height of China COVID lockdowns–on its secured portfolio, indicating a more reasonable write-off scenario, as things stand, of RMB0.6 B.

It is only fair to note that the secured portfolio only makes up 58% of the on-balance sheet loans while the remaining RMB99 B is unsecured. This is perhaps the riskiest aspect of Lufax’s loan portfolio, though management has already started to address this with increases to their loan loss provisions by 164% to RMB7.5 B as of 1H FY22. The 30+ day delinquency rate for the company’s unsecured portfolio was last reported at 3.6%, a marked increase from 3.0% earlier this year, explaining management’s decision to increase loan loss provisions. Still, a complete write-off of those bad loans amounts to less than RMB4.0 B, well within the loan loss provisions.

Finally, we note that the company is still growing its total loan balance, targeting higher-quality customers and enterprises. The pursuit of higher-quality customers is reflected with a lower take-rate of just under 9% (which is still significantly higher than its peers); but, given the turbulent economic conditions, particularly in China, we view this as a good balance between growth and prudence.

Regulations and Risks

The biggest risk to an investment in Lufax is its growing share of credit-bearing risk as a percentage of its total loan portfolio. Reading through the 20-F, the company has been ramping up its credit-bearing risk portions from 2.2% to 16.6% between the years 2019 and 2021. As of Q2 2022, this portion stands at 21.2%. This is due to recent China Banking and Insurance Regulatory Commission rulings in 2020 and further in 2021, known as Circular 24, that stipulate that lending partners to commercial banks, such as Lufax, must be held liable for no less than 30% of the loan amount in an effort to spread risk and reduce stress on Tier-1 capital on the Chinese banking sector. Lufax is progressing towards complying with this new regulation by taking on risk that is either insured by 3rd parties, backed by real estate assets, or held unsecured on the balance sheet. While we will continue to monitor this risk portfolio, given the company’s strong balance sheet, use of 3rd party insurers, and prudent capital conservation, this risk is currently not a concern for us.

In troubling times, the credit-bearing risk can lead to devastating consequences, as Lehman Brothers demonstrated in 2008. To this point, Chinese law prohibits leverage on risk-bearing portion from exceeding 15x, a non-issue as Lufax currently maintains leverage of only 1.4x, indicating management’s restraint during uncertain macroeconomic times.

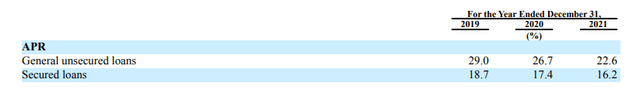

Third, China’s Supreme Court in 2020 ruled that a lending rate cap of 24% ARR be placed on all lending companies. Lufax is ahead of this curve and, as of 2021, is well below this cap as seen in the table below. The company, perhaps due to its extremely close ties to Ping An, is well ahead of keeping up with regulations and ensuring alignment with PRC laws.

Lufax APR between 2019 and 2021 (Lufax 2021 20-F)

The biggest risk, as we’ve stated, is share of credit-bearing risk that Lufax is required to hold; in particular, there is the risk that the current Chinese economic climate may exacerbate the company’s credit-bearing risk. This article laid out its view on the company’s ability to withstand such risks earlier regarding the company’s balance sheet, but it is ultimately up to investors to determine their acceptable level of risk. In the next section, we lay out why we believe the company’s current valuation prices in a significant margin of safety to account for these risks.

Valuation

Perhaps the most interesting portion of Lufax, certainly to value investors, is the valuation of the company. First and foremost, it should be stated that Lufax enjoys significant competitive advantages that establish a “moat” against its competitor peer group. These advantages are: 1) its enormous lending agent workforce, 2) its extremely close partnership with Ping An, and 3) its robust, large balance sheet and industry-leading cost of capital.

Regarding the company’s workforce, Lufax employs over 90,000 people, orders of magnitude larger than its peers.

| Company | LU | SOFI | LC | UPST | QFIN | FINV |

|---|---|---|---|---|---|---|

| Employees | 92380 | 2500 | 1384 | 1497 | 2129 | 4259 |

Table: Total number of employees (Source: Seeking Alpha)

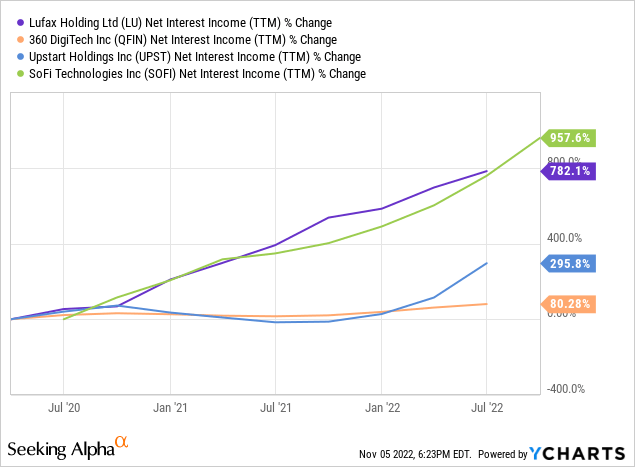

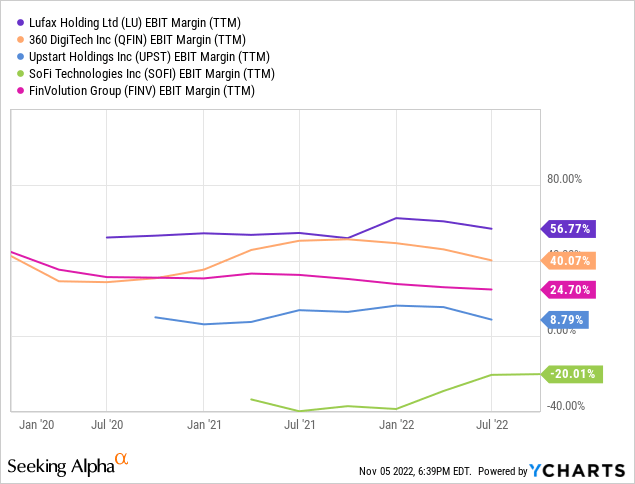

The vast majority of these employees are boots-on-the-ground lending agents that reach out to small business owners and have enabled Lufax to scale-in and scale-out with a significant variable cost structure. This model has allowed Lufax to target different geographic regions and different economic cycles and take advantage of different growth opportunities, which is reflected by its enormous growth in net interest income since 2020 of nearly 800%. Impressively, Lufax maintains a return on equity of over 16%, net income margins of over 20%, and operating margins of 50% despite such a massive workforce, indicating a high-quality company that is efficiently run.

While SoFi Technologies (SOFI) has experienced larger growth in net interest income, largely due to its recent banking charter, SOFI still operates at negative operating margin and net income, along with a questionable balance sheet. As for the company’s other foreign peer, Upstart Holdings (UPST) is (barely) profitable and trades at a P/E of 21 and P/B of 2.17, with operating margins in the single digits and a return on equity that has rapidly deteriorated given the current economic climate in the United States.

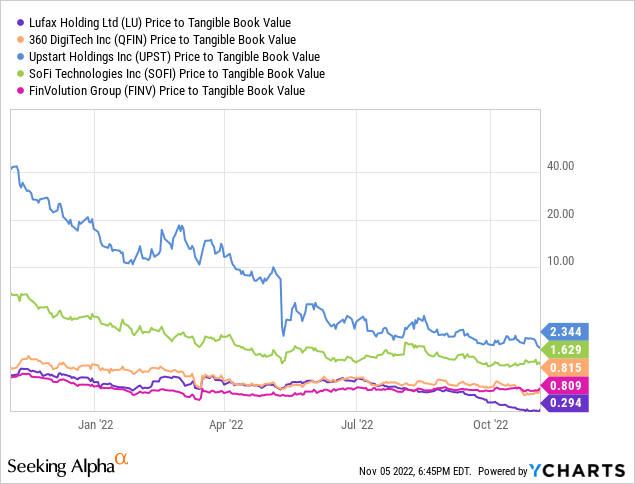

As for the company’s domestic peers, 360 DigiTech (QFIN) and FinVolution Group (FINV) are also trading at depressed levels, but nowhere near the tangible book ratio of 0.3x of Lufax. Furthermore, we believe advantages (2) and (3) come into play to set Lufax apart from its domestic peers. The company’s close ties to Ping An enable Lufax to take on more leverage with much lower cost of capital, and therefore higher take rates of 9% compared to less than 4% for its peers, and larger growth drivers when economic activity in China recovers. The robust balance sheet of Lufax allows it to hit the ground running once this occurs and therefore continue to grow its customer base even during China’s current economic downturn. Lastly, Lufax mostly targets a different customer base than its domestic peers, namely small business owners, which is much more aligned with China’s national strategy than the personal microloan focus of FINV and QFIN.

Turning to Lufax’s intrinsic valuation, we eschew an analysis of cash flow in favor of tangible book and, more strenuously, an analysis of its net current asset value per share (NCAVPS), which we believe are better metrics for companies in the financial sector. Since 2017, LU has grown its tangible book value from $1.54B to $12.82B, or a CAGR of 47%. The stock of LU currently sits at $3.8B, implying a tangible book value of 0.3x, which is frankly absurd. This is lower than even Citigroup (C), a bank with a quagmire of complexities and constant missteps, lower than both its U.S. peers, who are unprofitable enterprises, and lower than its domestic peers, in which LU is significantly better capitalized. Merely rerating LU’s valuation to that of Citigroup’s tangible book value of 0.6x would imply a doubling in the stock price, and bringing the tangible book value to parity with domestic peers would imply a 300% return.

Considering that Lufax operates out of China, we look at an even more conservative valuation: NCAVPS. In this scenario, we have the following:

- Total Current Assets: $52 B

- Less Total Liabilities: $41 B

- Less Restricted Cash: $4 B

- Total Outstanding Shares: 2.29 B

- Net Current Asset Value Per Share: $3.06

In other words, Lufax is what Benjamin Graham would call a Net-Net. The company is a Net-Net with strong profitability (though admittedly on the decline given the current Chinese climate) and returning 20 – 40% of net profit to shareholders in dividends, currently with a 10% yield. At the same time, Lufax is buying back shares, as one would hope given the absurd valuation prescribed to the company. As far as we can see, the company hits all the hallmarks of a value company.

Catalysts

Lufax does not necessarily need a catalyst beyond just having China’s economic macroenvironment to normalize. However, that doesn’t mean that such catalysts don’t exist to help improve the stock value.

First, China has called for improvements in their financial system and banking sector, particularly when it comes to small business owners and fair and open access to capital to its citizens by utilizing transformative digital technology. This is described in China’s 14th 5-year plan in multiple places, but perhaps most prominently in Article 48 “Optimize the Income Distribution Structure” where, quote:

We will increase the property-based income of urban and rural residents through multiple channels, increase the share of farmers’ value-added income from land, improve the dividend system of listed companies, and develop more innovative financial products that meet the needs of household wealth management.

This is aligned with Lufax’s wealth management business and, quote:

We will improve support policies for small and micro entrepreneurs and support the hard work and wealth accumulation of sole proprietors (个体工商户), people in flexible employment, and other groups.

This is aligned with Lufax’s target customers of small business owners for its loan facilitation business.

Lufax management has called out in its latest earnings report that near-term economic policies that directly support these initiatives would be a “surprise to the upside” for Lufax expected earnings in FY22. Given President Xi’s recent electoral victory and reorganization of his cabinet with economic-oriented staff, we believe there may be policy support in these areas in the near future.

Second, and perhaps the most monumental lift for Lufax, would be a shift in China’s zero-COVID lockdown policies. Already last week, China has lifted restrictions on foreigners to receive vaccinations. This is a first step in a long overdue push from the global economy to move China past COVID, which would lift lockdowns and immediately kickstart the economy. This would obviously be a boon to a company like Lufax that revels in increasing economic activity.

Lastly, this week, U.S. auditors completed their first round of audit inspections of Hong Kong-based companies. Although Lufax is based in Shanghai (whose auditor is PricewaterhouseCoopers Zhong Tian), progress and positive news between U.S. and China capital markets relations would benefit all Chinese companies and their foreign investors, perhaps opening Chinese company investor pools to a larger audience of institutional investor firms. As a hedge, Lufax is planning a secondary listing on the Hong Kong exchange in the second half of FY22, which at best opens Lufax to U.S. Hong Kong audits and a larger investor pool within its domestic region; at worst, it provides a safety net for investors to convert their shares to Hong Kong should the worst-case scenario of a U.S. exchange delisting occur.

Conclusion

We conclude this article with a strong buy rating on Lufax. We believe the patient value investor can enjoy a substantial yield from the company’s dividend policy while waiting for the economic cycle in China to normalize, while management executes as reasonable stewards of capital and strategically buys back shares and maintains prudent growth leverage. Several near-term catalysts can accelerate this timeline, though we caution that the road back to economic normalcy may not necessarily be a smooth linear curve.

Finally, as usual, though we believe the company to be a Strong Buy given its strong competitive position, fortress balance sheet, reasonable management capital allocators, and absurdly cheap valuation, we urge the prospective investor to pursue their own due diligence, and hope this article provides actionable material to aid in their endeavor.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment