RichVintage/E+ via Getty Images

[This article was originally published March 23 for members and trial subscribers of Inside the Income Factory.]

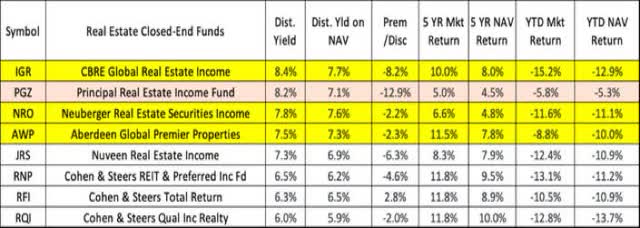

Here are the eight real estate funds listed in CEF Connect. There is actually a ninth, Cohen & Steers Real Estate Opportunity (RLTY) that was just started about a month ago, that I’m not considering yet. (Note if you go to CEF Connect to update these stats that it has IGR’s distribution yield wrong. Calculate it with its correct distribution of $0.06 per month. It’s still the highest yielding real estate fund.)

The three we own are:

- CBRE Global Real Estate Income (NYSE:IGR) is probably my current favorite, yielding 8.4% with a -8.2% discount and a good longer term record. It’s in our Hunker Down model and my personal portfolio.

- Neuberger Real Estate Securities Income (NRO), which yields 7.8%, with a -2.2% discount and also a pretty good longer term record (8-9% per annum over the past 10 years, although the table only goes out to five). It’s also in our Hunker Down model.

- Aberdeen Global Premier Properties (AWP), which yields 7.5%, also has a modest discount (-2.3%) and a good longer-term record. It’s in our Widow & Orphan model as well as in my personal portfolio.

SB

Note: What we already own is highlighted in yellow; what is under discussion as a potential addition is in pink. [Since originally publishing this article I have also purchased PGZ.]

A long-term investor can’t really go wrong with any of the other choices either. The three Cohen & Steers funds, RNP, RFI and RQI, and Nuveen’s JRS, all have good records too.

IGR is the one I am buying more of right now, with its highest yield of all the real estate closed-end funds (that it recently increased 20%), as well as the second biggest discount. But all three represent reasonable reinvestment candidates, so anyone who owns them and has them on automatic dividend reinvestment certainly has no reason to change.

Besides the three we already own, there is a fourth one, Principal Real Estate Income (PGZ), which is now also on my radar screen, although it had not been until I started writing this article. I had never taken PGZ too seriously over the years because it seemed smaller with assets of only about $100 million, and I felt a bit more secure with the larger real estate funds and their managers. But when I ran the numbers on the CEF Connect-listed real estate funds, I was interested to see PGZ near the top in terms of yield and discount, although its longer term return was not quite as good as some of the others. But then I checked further and see that its longer term performance since inception in 2013 is almost 8%, which compares favorably. Then I saw that its ownership by institutional investors has recently increased to over 25%, with activist Saba Investments (the same group that manages BRW, and the ETF CEFS) owning a major chunk.

So when I put all that together: 8% yield, big discount, activists circling, and – one more thing – a distribution that was just increased by 14% two months ago, it looks like a worthwhile speculation.

So while I’m not recommending replacing any of the “core” real estate funds in our models with PGZ at this point, I do plan to buy some into my personal portfolio, and keep a sharp eye out for tender offers or other actions that might come along to boost its value. The fact that it has such a large discount may be what attracted the activists and institutional investors, so it wouldn’t be surprising to see them encourage (i.e. force) actions to try to remedy that, such as a tender offer. (Link here for more info on activist strategies.)

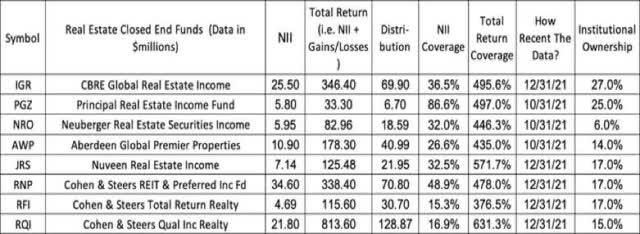

Distribution Coverage

Note that all three of our current real estate funds (IGR, AWP, and NRO) had excellent coverage of their distributions by their GAAP income during their most recent reported financial periods, with greater than 400% coverage in every case. In fact, the entire industry had excellent coverage, as you can see if you go down the list.

SB

PGZ stands out as actually having had better coverage by its net investment income (NII), which means it is apparently not as dependent as its peers on capital gains in its real estate portfolio to cover its distribution. This makes it relatively even more attractive.

Credit vs. Equity Risk

By now many readers are tired of my comparison of investing in credit as “betting on horses to merely finish the race”, whereas when you buy equity it’s like betting on the horse to actually win, place or show. In other words, with a credit bet all the company has to do is stay alive and pay its debts. So even a mediocre performance where the stock goes nowhere will be a successful investment for the buyers of the firm’s debt. But equity investors are making BOTH a credit bet (i.e. that the company will stay alive and pay its debts, otherwise its equity will be worthless) AND an additional bet that the company will not only stay alive, but will excel (i.e grow its earnings) and therefore be worth more as an equity investment. If you’re NOT tired of this and want to read more about it, check out this recent article.

For that reason, it wouldn’t be rational to buy the equity in a company unless you expect the return to be GREATER than whatever you would be paid as a credit investor (who of course is taking less risk).

That’s why I focus so much attention on finding ways to invest in credit or credit-like asset classes (high yield bonds, CLOs, BDCs, other fixed income) that pay equity-like returns (8-10% or so).

I consider funds that buy stock in REITs and other real estate companies, even though it may technically be “equity,” to be largely credit-like risks. That’s because real estate investing is very similar to “Income Factory” investing (or compatible with an Income Factory strategy) because the value of the investment largely depends on the cash flow provided by the office building, shopping center, cell phone tower, warehouse or other real estate being held. Most major real estate investors invest in assets with long-term tenants and predictable cash flows. It is those cash flows, and the credit of the tenants behind them, that gives the building or other real estate asset its value to a long-term investor. So I see real estate investing as very similar, in terms of the risks taken and the “river of cash” that it generates, to the credit and other fixed income assets (including even high-yielding equities like utilities, etc.) that make up such a large part of our Income Factory portfolios.

Summary/Conclusion

- Our existing real estate fund holdings – IGR, NRO, AWP – are all doing fine and merit reinvestment and compounding for those so inclined.

- IGR, having just increased it distribution, is my favorite of the three and the one I am putting more money into personally.

- PGZ, which I previously ignored and disregarded, now looks interesting (not just to me but to activist investors like Saba), and is worth a speculation, so I plan to buy some today.

That’s all folks! Look forward to your comments and questions.

Thanks!

Steve

Be the first to comment