brytta/E+ via Getty Images

The Q1 Earnings Season for the Gold Miners Index (GDX) is just around the corner, and one of the most recent companies to report its preliminary Q1 results is Victoria Gold (OTCPK:VITFF). Unfortunately, the production results were in line with the underwhelming FY2022 guidance, pointing to limited production growth this year. The good news is that this dampened short-term outlook is offset by a very bright medium-term outlook with Project 250 on deck. Given that some of the recent negative developments looked priced into the stock here, I would view further weakness below US$10.55 as a buying opportunity.

Victoria Gold Operations (Company Presentation)

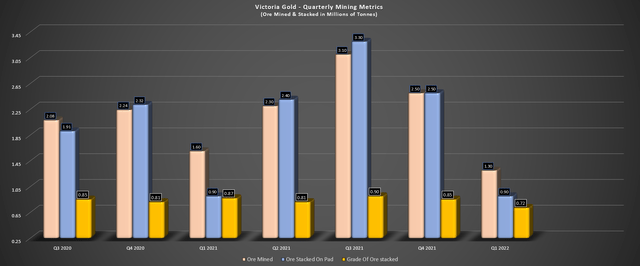

Last week, Victoria Gold released its preliminary Q1 results, reporting gold production of just ~24,400 ounces, a 50% decline sequentially, and a 9% decrease year-over-year. The large sequential decrease was not a surprise or anything to be alarmed about due to Victoria Gold’s seasonality (lower production in H1), but the year-over-year decline was a little surprising. The company noted that mining rates were lower (1.3 million tonnes vs. 1.6 million tonnes last year) due to the sufficient stockpiles built up. Still, the stacking rates were lower, coming in at just 0.90 million tonnes, down from 0.95 million tonnes last year.

Victoria Gold – Quarterly Operating Metrics (Company Filings, Author’s Chart)

In addition to fewer tonnes stacked on the pads, grades were also much lower, coming in at 0.72 grams per tonne of gold vs. 0.87 grams per tonne of gold in Q1 2021. This suggests a weaker H1 performance than I initially anticipated, meaning that Victoria will need an exceptional H2 performance to meet its guidance mid-point of ~177,5000 ounces. It is worth noting that Victoria did get its maintenance on its crushing/stacking facilities out of the way in this lower activity period, and the company had harsh weather in Q1 (minus 50-degree temperatures), which was a headwind.

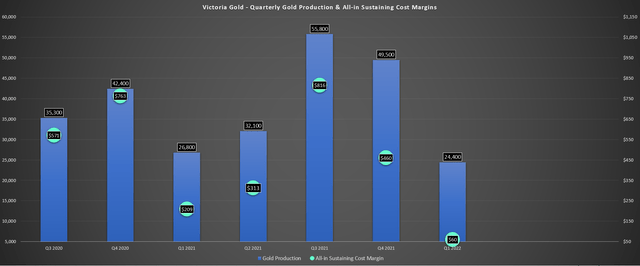

Victoria Gold – Quarterly Gold Production & AISC Margins + Q1 Estimates (Company Filings, Author’s Chart & Estimates)

Given the much lower gold production, costs will rise sharply in Q1, which was already expected due to this being the low point of the year from a seasonal standpoint. However, with less than 30,000 ounces of gold sales, all-in sustaining costs are likely [AISC] to soar to $1,800/oz, making Victoria one of the highest cost producers sector-wide in Q1. Obviously, costs will improve materially as the year progresses and costs decline due to higher production rates, but these higher costs could shock some investors.

As the chart above shows, we are likely to see AISC margins actually decline on a year-over-year basis despite a higher gold price, with all-in sustaining costs likely to come in below $100/oz in Q1 2022 (Q1 2021: $209/oz). This is not a huge deal, and FY2022 all-in sustaining costs are still likely to come in below $1,370/oz, pointing to AISC margins of $530/oz. However, in H1 2022, Victoria could see slight margin compression, which is the exact opposite of what most other producers will experience with only slightly higher costs but a higher gold price. Therefore, we could see an initial negative reaction to the Q1 financial results even if they’re largely pre-reported.

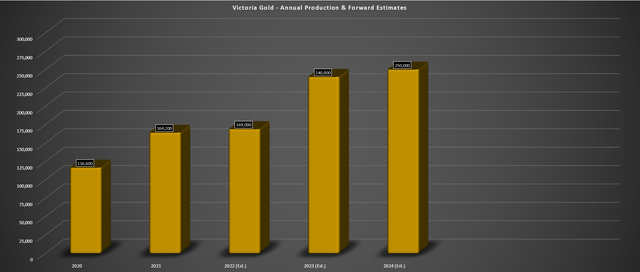

Victoria Gold – Annual Production & Forward Estimates (Company Filings, Author’s Chart & Estimates)

The good news is that while H1 will be weaker than I anticipated, and FY2022 production could come in below 175,000 ounces and miss the guidance mid-point once again, the company’s future is quite bright. This is because Victoria is confident in its Project 250 plans, which are expected to increase annual production to 250,000 ounces per annum. I have assumed a more conservative figure of 240,000 ounces, but this would still represent 45% growth from FY2019 levels, making Victoria an attractive growth story within the sector.

Victoria’s Project 250 Plan is expected to be achieved by installing a scalping screen system to bypass ore fines before the tertiary crushing circuit and direct this material to the heap leach facility. The other initiative is to decrease the downtime in Q1, extending the period of stacking from 9 months to 11 months per year, which will require two new 785 haul trucks and a loader. If the company can execute this successfully, this would boost the project’s NPV (5%), pulling forward ounces in the mine plan. Let’s look at Victoria’s valuation below to see if the recent share price decline has set up a buying opportunity.

Valuation & Technical Picture

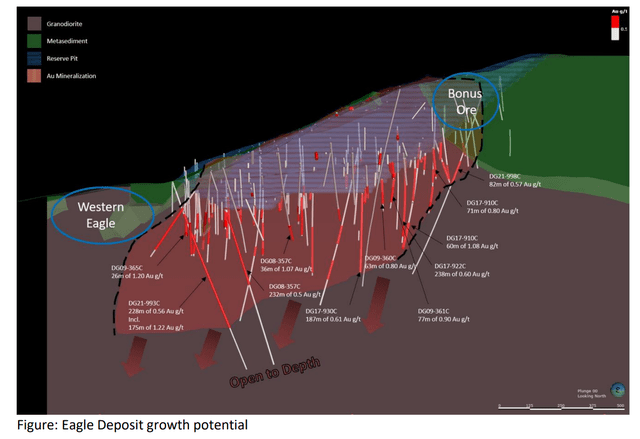

Victoria Gold ended the year with ~67 million fully diluted shares and has a market cap of ~$764 million and an enterprise value of ~$900 million at a current share price of US$11.40. This figure is well below its estimated net asset value of ~$1.14 billion after adding $120 million in exploration upside and subtracting out its net debt and estimated corporate G&A combined ($180 million). The most exciting of these targets is Raven, where we should see a maiden resource within the next 12 months. However, the company has also been seeing solid results from Lynx and Eagle Deep. Recent highlight intercepts are as follows:

- 32.3 meters at 2.0 grams per tonne gold (Lynx)

- 31.4 meters at 1.14 grams per tonne gold (Lynx)

- 18.4 meters at 3.42 grams per tonne gold (Lynx)

- 443.6 meters at 0.64 grams per tonne gold (Eagle Deep)

- 110.9 meters at 0.72 grams per tonne gold (Eagle Deep)

- 352 meters at 0.51 grams per tonne gold (Eagle Deep)

Eagle Deep Drilling (Company Website)

The above intercepts at Lynx are well above Victoria’s reserve grade of 0.65 grams per tonne of gold (Eagle/Olive), and while the Eagle Deep intercepts are similar to lower grades, they suggest the potential to extend the pit much deeper. This is based on mineralization extending to ~800 meters and well below the currently defined reserve pit. Between Raven, Lynx, and depth extensions at Eagle, the mine life could easily extend past 2031 (current estimate) and closer to 2035.

Based on what I believe to be a conservative multiple of 0.85x P/NAV, I see a fair value for Victoria of ~$970 million ($1,140 million x 0.85), or US$14.45 per share. This suggests a meaningful upside from current levels, pointing to the stock being reasonably valued here. However, when it comes to single-asset producers in Tier-1 jurisdictions, I prefer to buy at a minimum 25% discount to fair value. If we place a 25% discount on this conservative fair value, the ideal buy zone for the stock is US$10.80 or lower. So, while the stock is down sharply from its highs, it still hasn’t quite reached a low-risk buy zone from a valuation standpoint.

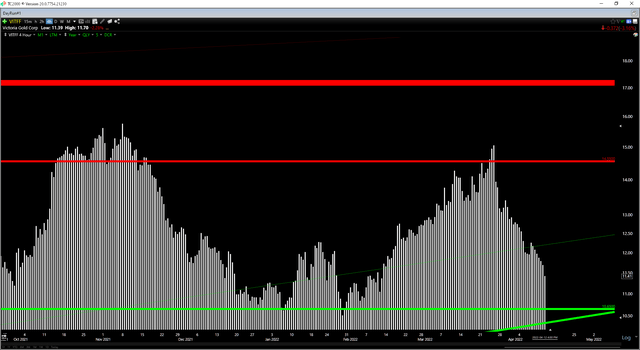

VITFF Daily Chart (TC2000.com)

Looking at the technical picture, we can see that Victoria put in a lower high in Q1 vs. Q4, a negative divergence vs. its peers. With the stock now trading in the lower portion of its expected trading range (US$10.55 – US$14.55), the setup is improving with Victoria close to support. However, a very ugly Q1 report is on deck, which suggests the possibility of a re-test of key support at US$10.55. Based on the expected Q1 miss and costs that could shock the market a little (~$1,800/oz AISC in Q1), I have reviewed my low-risk buy zone from US$11.30 to US$10.55 or lower.

Victoria Gold – Dore Bars (Company Presentation)

While a slow start to the year was to be expected due to seasonal factors, Q1 was much weaker than I expected, and the company’s guidance was also much softer than I anticipated. This miss and guidance have set Victoria up for minimal margin expansion in FY2022 and potential margin compression, while many other producers are enjoying margin expansion due to the higher gold price. The lower margins and weaker production do not dent Victoria’s attractive long-term outlook, but with reset expectations for FY2022, the stock could underperform its peers this year. Hence, I remain on the sidelines for now but would become more interested in the stock if it dips to US$10.55.

Be the first to comment