gerenme

The combination of lots of cheap money and smart brains were great for Blackstone (NYSE:BX) shareholders for many years up until November 2021. Then reality hit the market. If the credit markets return to normal pricing and normal availability of capital, those in real estate and alternative asset management will need more than Phi Beta Kappa employees to achieve great returns for their clients and shareholders. Normal may actually be a negative for Blackstone, in my opinion.

Asset Manager Business Model

A brief overview of Blackstone’s business structure and operating model is needed because it seems that some think Blackstone Inc. is a REIT – it is not. It does manage some REITs, including BREIT and Blackstone Mortgage Trust (BXMT). BXMT is a publicly traded mortgage REIT and investors pay the current trading price just like a stock. BREIT, however, is a non-publicly traded REIT where investors buy at net asset value, which I consider just a desk-top value and may not reflect the actual current market value. (There are restrictions on investing in BREIT that are beyond the scope of this article.)

Blackstone is an asset manager that has, as of June 30, $320 billion real estate, $276 billion private equity, $80 billion hedge funds, and $265 billion credit/insurance assets under management. Blackstone Inc. is a “controlled company” because Series ll Preferred shareholders control more than 50% of the voting power. If BX shareholders are unhappy, they can’t expect some outside activist to change the company. They can only sell. BX shareholders are also on the very bottom of the pecking order for payment from the success of Blackstone.

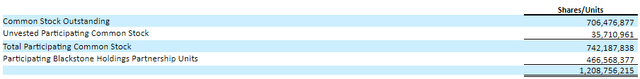

There is some confusion regarding how total equity capitalization is properly determined and what numbers should be used for estimating Blackstone’s valuation. You should not, in my opinion, just use common stock outstanding. These are the total shares of common stock and Blackstone Holdings Partnership Units entitled to participate in dividends and distributions:

Equity Shares and Partnership Units (sec.gov)

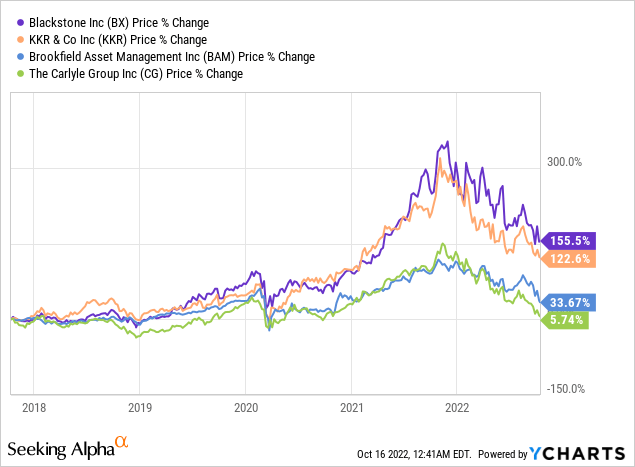

Some investors also make the mistake, in my opinion, of comparing them to BlackRock (BLK). BlackRock has under management a large number of mutual funds and ETFs, but Backstone does not. They both have “black” in their names and are across Park Avenue from each other, which may have caused some of the confusion. Instead of comparing Blackstone to BlackRock I feel that comparing them to KKR (KKR), Carlyle Group (CG), and Brookfield Asset Management (BAM) would be more appropriate.

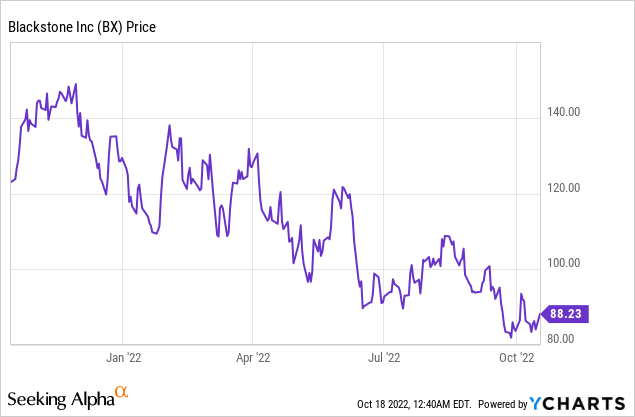

BX One Year Stock Prices

Five-Year Percentage Stock Price Change

Continued Problems for Asset Managers

Real estate and alternative asset managers are facing a credit market that is in the process of changing dramatically. It is finally returning to a much more normal and rational pricing of credit that existed years ago before the completely irrational QE1 and QE2 Federal reserve policies and the recent giving everybody trillions of dollars by federal government.

I am expecting that money managers will continue to be hurt by lower money supply growth, higher interest rates, recession, a weak office real estate market, and their fee structure.

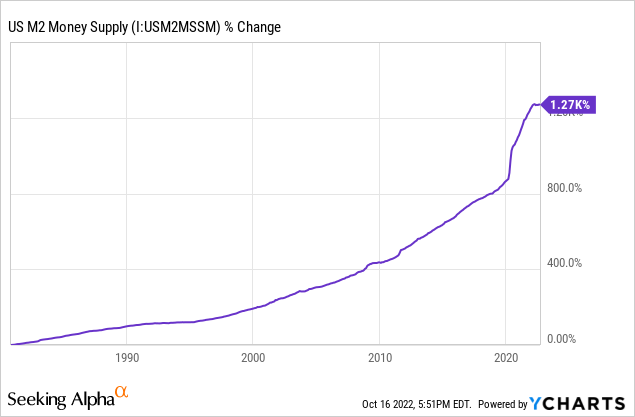

Lots of Money Was Printed

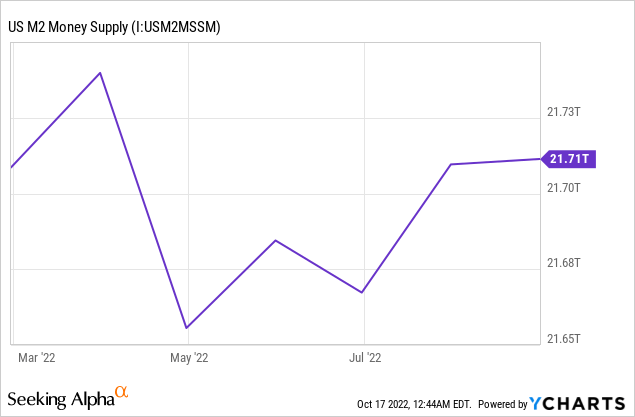

After explosive growth, there is finally less money being printed this year. Hopefully this policy of no-growth/low growth will again be the standard policy. Besides tighter money based on Fed actions, banks seem to be less willing to lend to asset managers as was reported last month that Citibank was reducing subscription-line financing to $20 billion from $65 billion over the next few months. While this type of financing is not usually used by Blackstone it could be an indication of potential future reduced bank financing availability.

30 Year M2 Money Supply Growth

M2 Money Supply From 2/1/022 to Present

Some may counter that new money is not an issue for Blackstone as indicated by new capital still coming in and $170.1 billion “dry powder” as of June 30 sitting there ready to be invested. In my opinion, all this cash they have is indicative of the problem associated with the Fed printing tons of money in the past. It may take some time before a slow/non-growth in M2 is reflected in their dry powder and AUM.

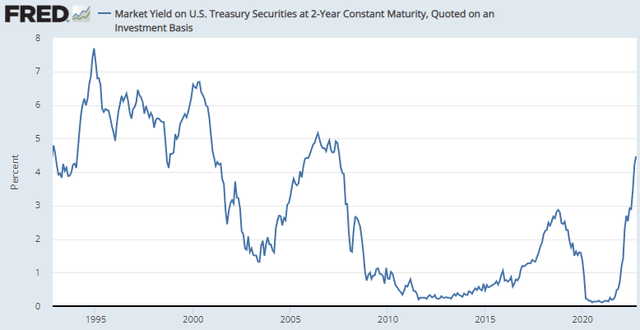

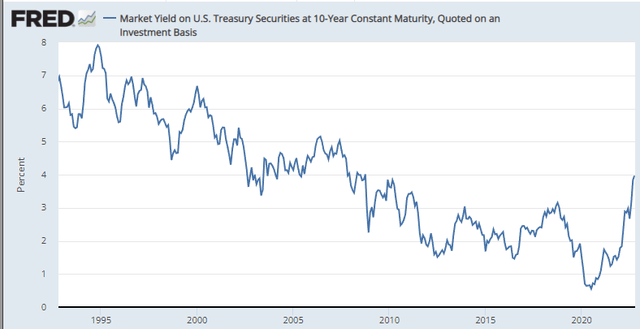

Money Was Very Cheap

Besides having a lot of money floating around, it was cheap – very cheap. For example, they were able to issue in August 2021 $650 million 1.625% 2028 unsecured notes, $800 million 2.0% 2032 unsecured notes, and $550 million 2.85% 2051 unsecured notes. This seems like a very smart deal for Blackstone because the 2.0%’32 notes are currently trading at 73 and the 2.85%’51 notes are at 57. It does not take a genius to make a very nice long-term profit when your cost of capital is only 2%.

2-Year U.S. Treasury Note Yields Thirty Years

2-Year UST Note Yield (fred.stlouisfed.org)

10-Year U.S. Treasury Note Yields Thirty Years

10-Year UST Note Yield (fred.stlouisfed.org)

Higher interest rates negatively impact Blackstone in a number of different ways. It kills the equity market. Lower equity prices mean lower fee income that is based on the value of the asset and lower (or even no) incentive revenue. Higher borrowing costs for their distressed company investments increases the risk of default on those debt securities owned and even the potential of getting wiped out on distressed equity investments. Higher interest rates have a negative impact on real estate holdings as cash flow is decreased with higher interest expenses on mortgages at the property level.

While I assume none of this is new information for most BX investors, the reality is that either interest rates will continue to increase significantly, or the inflation rate must drop. Currently we have negative interest rates after factoring a CPI over 8%. Even if the Fed is able to get inflation down to 2-3%, I think fixed-income investors in UST notes/bonds will require a positive inflation adjusted return in the future. That would mean a return of “normal” 4-5% interest rates on UST notes and bonds. No more cheap money. The return to normal is actually a negative for Blackstone, in my opinion.

Incentives-A Major Issue

Blackstone often posts very impressive returns for those who invested in their various entities that they manage. This is because they have very, very smart employees. Over the years I talked with many of them, including at my gym that was about two blocks away from their Park Avenue headquarters. I did not have to explain an investment idea/concept more than once – they understood it immediately. Very sharp people who are also extremely well-paid for successful ideas. When you mix a ton of very cheap capital and some brains, you get top returns.

I am not sure if BX shareholders fully understand just how much of an incentive the employees receive for the returns that they help achieve. Looking at 2021 results. Revenue increased about $16.5 billion from the prior year. “Performance allocation compensation” increased $5.4 billion from the prior year. This implies that besides any fixed salaries, some employees/bosses received about a 33% incentive of the increased total revenue. Wow. Looking over 2Q 2022 results. There is a line on the income statement under revenue for $99.598 million incentive fees and under expenses for $45.363 million for incentive fee compensation. This implies a 45.5% incentive fee compensation for employees/bosses. Again Wow. The first six months revenue dropped $4.8 billion and performance allocation compensation dropped $1.9 billion. It, therefore, works both ways. The incentives might currently be negatively impacted by the fee structure because some Blackstone entities have an incentive fee percentage that kicks in only above a certain amount, such as above a 5% or 7% annual return.

Some BX shareholders might worry that with less than robust returns for investors in their funds that there might be claw backs of prior fees. Yes, but nothing major. As of June 30, the potential claw back was only a little over $100 million and even if the assets dropped to be worth $0.00, the total claw back would be a maximum of about $5.8 billion. Per BX share amount, therefore, is currently just a token amount.

There are also issues about how to value assets that fees, including various incentive fees, are based on. There were recent media reports that the SEC is looking into how fees are determined on assets that are being written down. This, in my opinion, is nothing new. Assets that dropped significantly in value have always been a very complicated regulatory issue for determining fees.

Real Estate Industry Exposure

I am going to be very brief about their real estate industry exposure. An entire article is needed to really cover this issue. I have serious problems with two areas, and I have a positive view on one. First, the positive. I like rental apartments in most of the country. I covered this industry in more detail in my article on the REIT Preferred Apartment Communities (APTS), which Blackstone purchased this summer. (About double the price from my “buy” APTS article).

I do not like office buildings. If, in theory, real estate is a good hedge against inflation, why has the average national office listing price dropped 2.4% year-over-year according to a recent real estate media report? The CPI is up over 8%. Parts of Florida, such as Miami, are doing fairly well. In New York City I still see very few people going in and out of office buildings. A lot of people like working from home or at least on most days. No commutes. No worries about what to wear. You can’t just use replacement costs for offices that are much higher because of inflation. You need to look at the present value of estimated future cash flow and that is being hurt by higher operating expenses, higher interest rates on mortgages, and flat/lower lease income because of lower occupancy rates.

The second area I don’t like is student housing. Very simple. I think there will be more and more of a trend of at home learning via the internet and less need for on-campus student housing. It is much cheaper to be at home. (Of course, there are some students who go away to school just to get away from their parents and need student housing.)

Conclusion

As I finish writing this article, BX stock is rising in the very early pre-market from Monday’s close. The stock price is fairly highly correlated with the rest of the market because BX investors think that fee income will increase as assets under management rise. Rational. But it ignores other issues.

I took a macro concept approach when looking at Blackstone that considers issues that had a huge positive impact on BX over the years, but have already begun to move in directions that might have a very negative impact on BX. It was not an attempt to analyze various metrics that I expect other writers will cover after their 3Q report on October 20.

I think the economy is going back to normal eventually. No more massive printing of money. No more QE1 and QE2 insanity. A return to positive real interest rates. Fee structures will be looked at more closely when investment returns are no longer spectacular. I rate BX a long-term sell. I think there could be alternatives that give investors a safer dividend income going forward.

Be the first to comment