Kameleon007

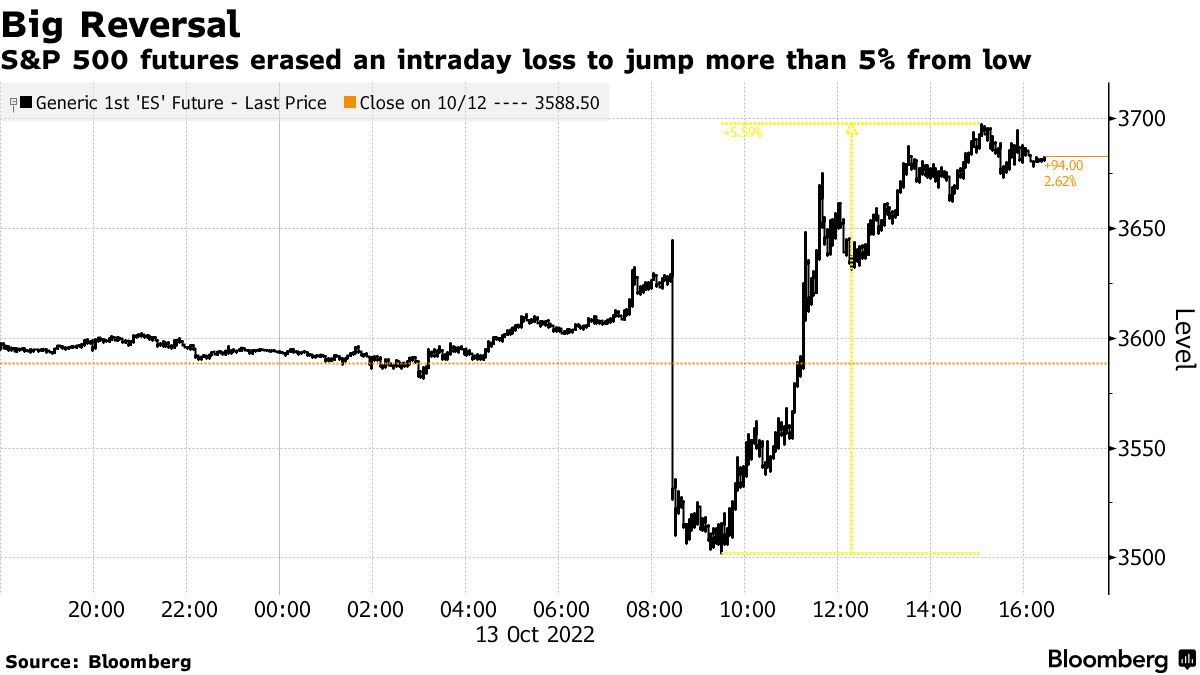

Yesterday saw a stunning reversal of fortunes for the major market averages from the open to the close. Stocks plunged at the beginning of trading in reaction to a Consumer Price Index report for September that ran hotter than expected, driving the S&P 500 down to a level that erased half its bull market gains from the summer of 2020 low. The reversal started almost immediately, resulting in a swing from bottom to top of 5.6%. The bears will argue that yesterday was a technical bounce from oversold levels, which was further fueled by a tsunami of short covering. That may be true, but there is also an argument to be made that investors are finally starting to look at the inflation picture ahead rather than the report focusing on the past 12 months.

Finviz

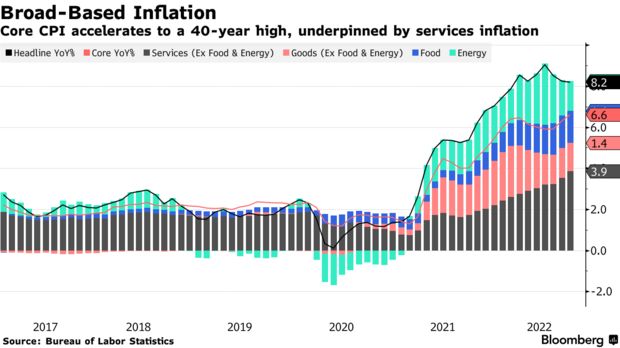

The headline number fell from 8.3% to 8.2% on an annualized basis, which was largely due to energy price declines. The core rate, which excludes food and energy, rose to 6.6%, which is what led to panic at the open. This was one tenth above the March high of 6.5%, leading to fears of more rate increases by the Federal Reserve. Consequently, the 2-year Treasury yield soared to 4.47% and Fed funds futures priced in a peak short-term rate of 4.75% by next March. Why then did stocks sustain a historic rally all the way into the close?

Bloomberg

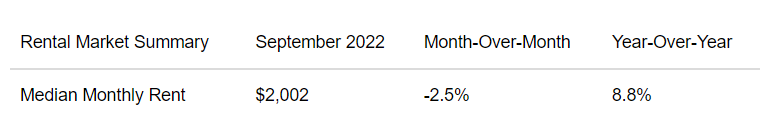

The core rate increase was driven largely by housing costs, which account for nearly 40% of the index. Yet the housing sector has run into a brick wall in recent weeks with mortgage rates soaring to nearly 7%. Astute investors recognize that the housing components of the index move slowly, but that home price appreciation has peaked. Prices nationwide are likely to start declining on a monthly basis, as the S&P CoreLogic Case-Shiller National Home Price Index did for the first time in July. As a result, it is very unlikely that home owners will assume they can rent their own homes for more tomorrow than they can today, which will weigh on the owners’ equivalent rent (OER) calculation of the index. The housing tailwind for the core CPI is about to become just as stiff a headwind over the coming year.

Bloomberg

Additionally, Redfin reported yesterday that rent growth decelerated for the fourth consecutive month to the first single-digit annualized increase in more than a year. Median monthly rent actually declined 2.5% in September to what is now an 8.8% increase and half the rate from six months ago. The writing is on the wall for a significant decline in the core rate of inflation over the coming year, due primarily to housing costs.

Seeking Alpha

Perhaps that contributed to the positive price action we saw yesterday. If it did not, it certainly will in the coming months. Remember that markets look forward and typically leave the bearish consensus behind at turning points. While yesterday’s surge was clearly more technical in nature, the strength of the rally should give bulls more than just hope based on historical precedent.

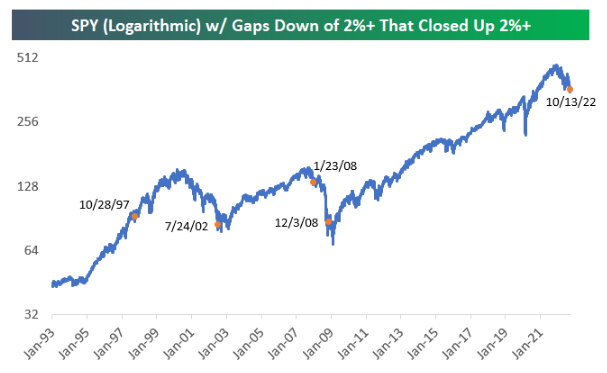

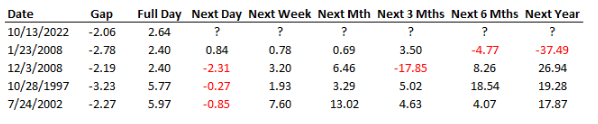

Bespoke noted yesterday that the S&P 500’s miraculous rally of more than 2% by day’s end from a decline of more than 2% at the open has occurred just four other times over the past 30 years.

Bespoke

Three of the four periods saw the S&P 500 surge double digits over the year that followed, which is my base case. The fourth was a disaster, because it preceded the financial crisis that led to the Great Recession. Those are pretty good odds, but another statistic from yesterday’s trading strengthens the bullish narrative.

Bespoke

Yesterday also saw panic buying to the extent that 45% of all the stocks on the NYSE traded on an uptick. According to SentimenTrader, that was the second highest percentage over the past 25 years on a day after the S&P 500 hit a 52-week low. The performance figures over the past 30 years for the 12-months that followed the same occurrence are stunningly bullish. In fact, the index was higher 1, 2, 3, 6, and 12 months later.

Combine yesterday’s 52-week low with a historic 5.6% intraday reversal that resulted in 45% of all NYSE issues trading on an uptick and you have a resoundingly bullish precedent. It is one I would not bet against. This further strengthens my resolve that the expansion will continue, inflation will start to come down more rapidly, and the Fed will not be forced to tighten monetary policy as restrictively as the consensus now expects.

Be the first to comment