aapsky/iStock via Getty Images

You know, there is a thin line between hope and confidence. What separates the two is rationality.”― Abhaidev

Another day, another EV concern whose stock has cratered in recent quarters gets put in the spotlight. Today, we take our first in-depth look at The Lion Electric Company (NYSE:LEV) which came public just under two years ago and whose stock has already found itself in ‘Busted IPO‘ territory. Brighter horizons ahead or a potential falling knife? We attempt to answer that question via the analysis below.

LEV – Stock Chart (Seeking Alpha)

Company Overview:

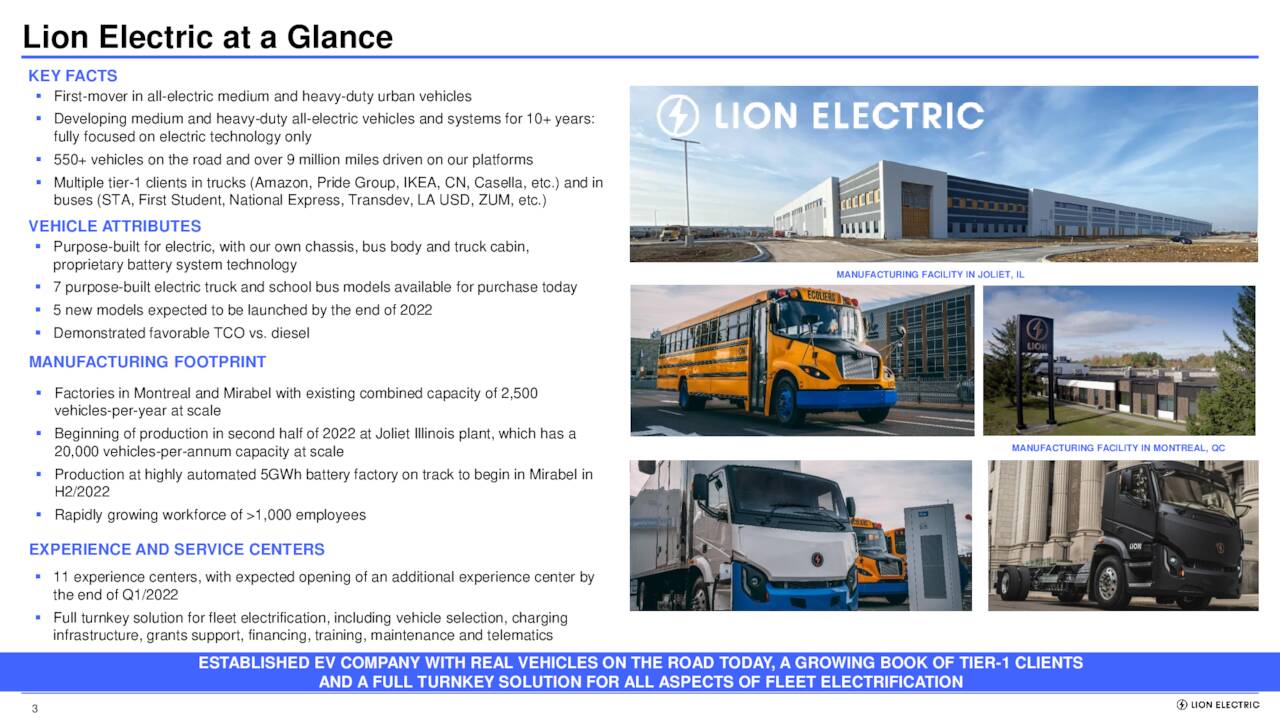

February Company Presentation

The Lion Electric Group is headquartered just outside of Montreal. The company manufactures, and distributes purpose-built all-electric medium and heavy-duty urban vehicles in North America. Its product offerings include battery systems, chassis, bus bodies, and truck cabins. The stock currently trades around $7.50 a share and sports an approximate market value of $1.4 billion.

LEV – Company Overview (February Company Presentation)

The company is constructing a battery manufacturing plant and innovation center in Quebec as well as a manufacturing facility for zero-emission medium and heavy-duty vehicles in Joliet, Illinois.

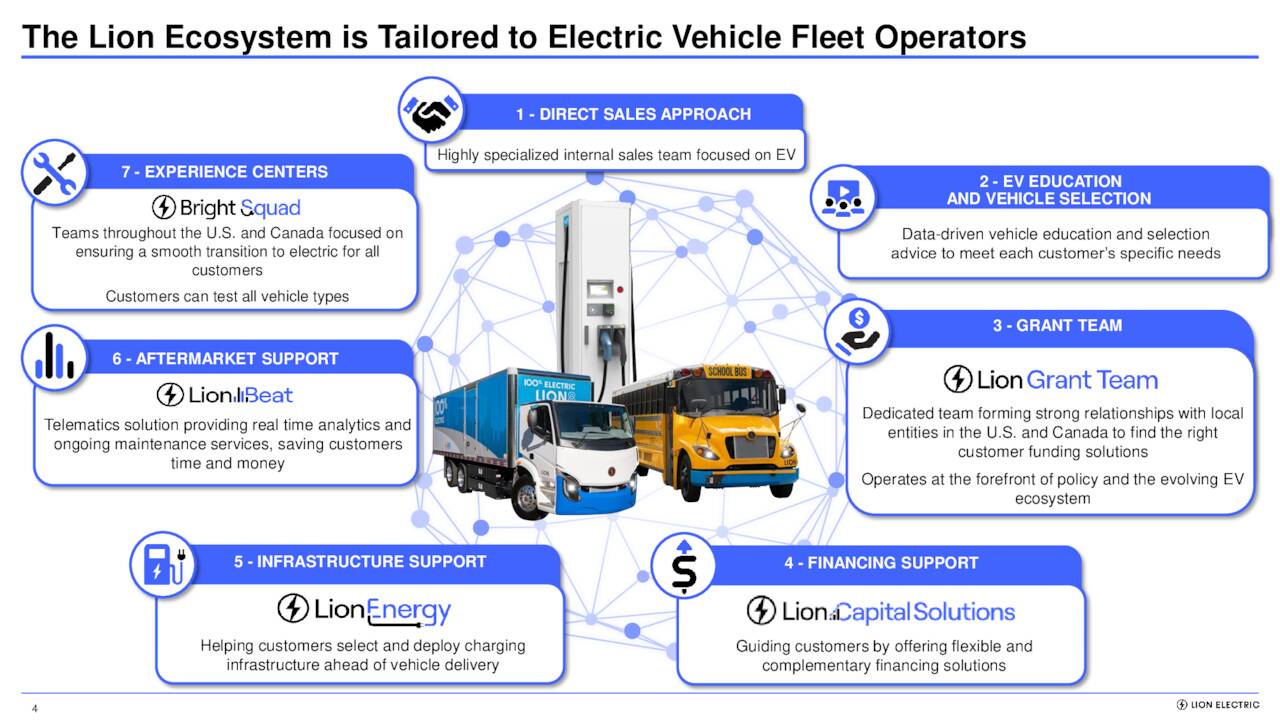

Company Ecosystem – Products & Services (February Company Presentation)

Fourth Quarter Results:

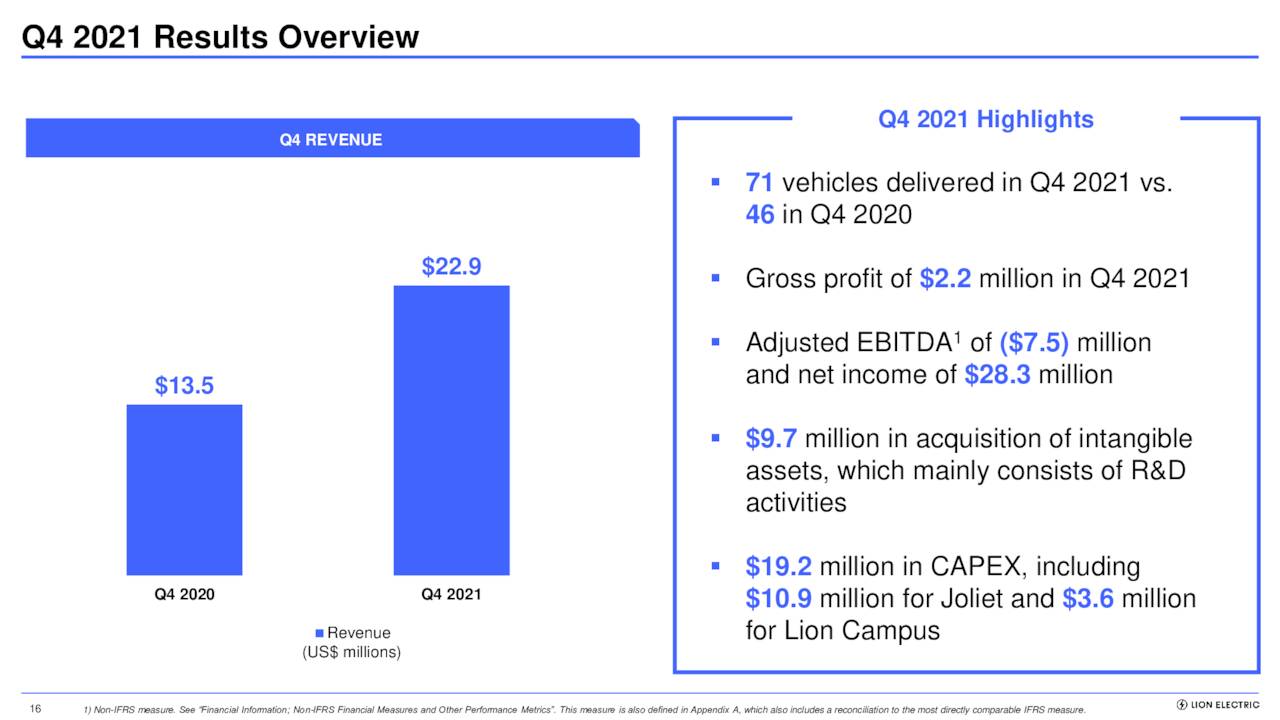

February Company Presentation

On February 24th, the company posted fourth quarter earnings. On a GAAP basis, The Lion Electric Group made 14 cents a share or $28.3 million for the quarter. However, this included a $46.6 million gain related to non-cash decrease in the fair value of share warrant obligations and a $5 million charge related to non-cash share-based compensation. Revenues rose to $22.9 million from just $9.4 million in the same quarter a year ago. This was significantly above the consensus estimate.

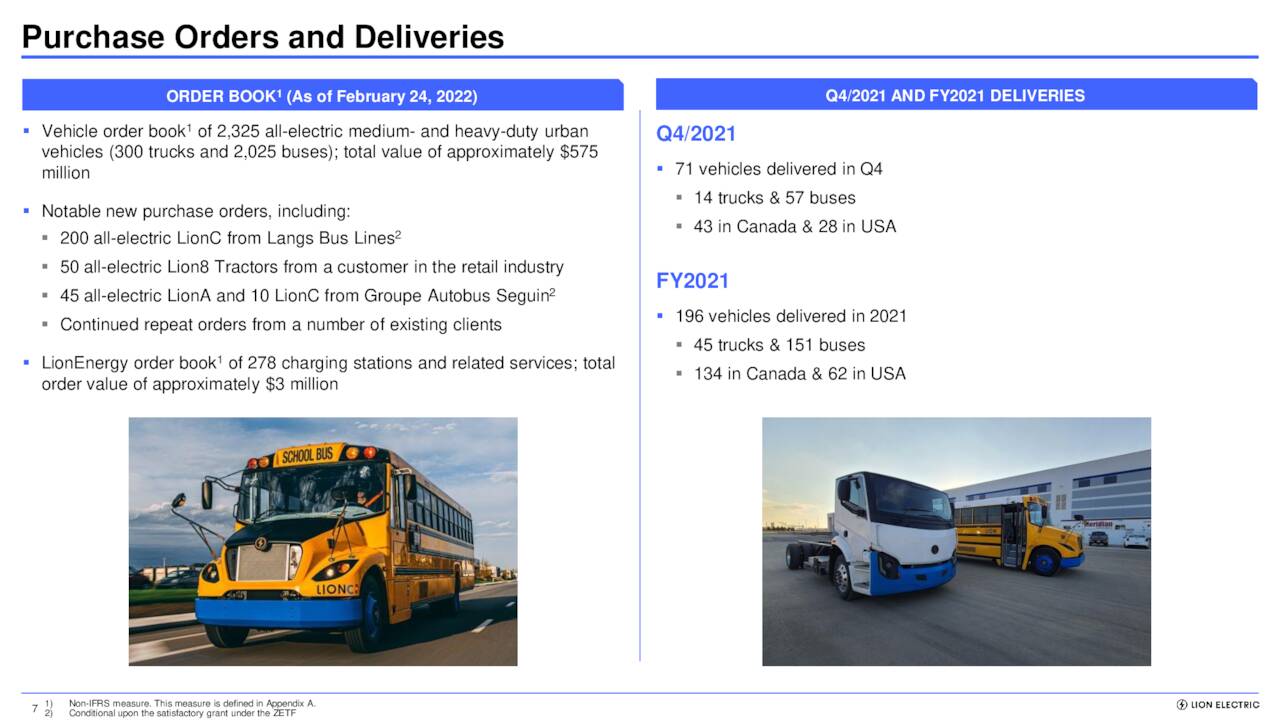

Order Book & Deliveries (February Company Presentation)

For the quarter, the company delivered 71 vehicles, compared with just 46 vehicles in year ago period. For FY2021, the company delivered 196 vehicles, compared with just 80 in FY2020. As of February 24th, the company’s vehicle order book stood at 2,325 all-electric medium-and heavy-duty urban vehicles. This is comprised of 300 trucks and 2,025 buses. This represents a combined total order value of approximately $575 million based on management’s projections. Since that update, the company has announced two small orders (I, II) for an additional 80 electric buses. The company’s order book also has 278 charging stations and related services contained within it, representing a total additional order value of $3 million.

Key Milestones (February Company Presentation)

Expenditures related to the Joliet Facility and the Lion Campus amounted to $19.2 million during the quarter. Management expects manufacturing to begin in Joliet in the second half of this year. At scale, this manufacturing facility will have the capacity to build 20,000 vehicles a year. The highly automated battery module assembly line at the Lion Campus has been ordered for initial testing, production of module prototypes and commercial production. Output should commence in the second half of this year. The Innovation Center which will house the company’s R&D activities should be complete sometime in 2023.

February Company Presentation

Analyst Commentary & Balance Sheet:

The analyst community has mixed views on the company currently. So far in 2022, both National Bank ($13 price target) and Canaccord Genuity ($12 price target) have reissued Buy ratings on the stock while Scotiabank ($11 price target) and BMO Capital ($8 price target) have maintained Hold ratings on the equity. Nearly 8% of the outstanding float is currently held short.

The company ended the last fiscal year with $241.7 million in cash and marketable securities on the balance. The company also has access to a committed revolving credit facility in the maximum principal amount of $100 million (which maximum principal amount was increased to $200 million on January 25, 2022). There is also available support from the Canadian federal and Quebec governments of up to approximately C$100 million (amounting to approximately C$50 million each) in connection with the Lion manufacturing campus.

Verdict:

February Company Presentation

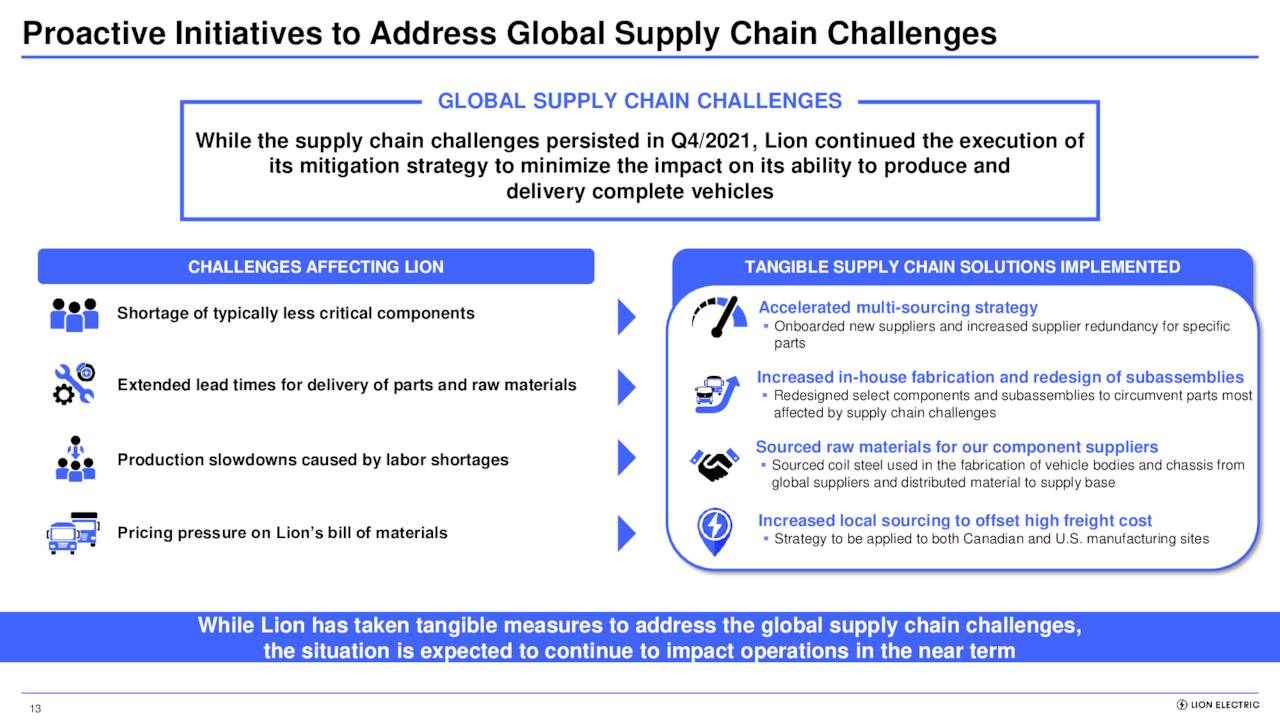

The Lion Electric Group is an interesting story worth watching. Like the entire EV sector, it is contending with significant supply chain issues, which are likely to last until year-end if not longer. The soaring cost of lithium is another headwind to the battery space. In addition, the company is in the process of launching two key manufacturing facilities and has more than doubled its workforce since the end of 2020. Cost inflation has pushed up cost estimates for completion of its facilities. The initial cost of the Lion Campus was $145 million, which currently stands at $180 million as one example of this.

February Company Presentation

That is a lot of challenges to manage simultaneously. This is also happening within a market environment where the economy of the U.S is clearly slowing. There is also a decent chance of the U.S. economy heading toward recession over the next year as the Federal Reserve is embarking on an aggressive monetary tightening journey to cool inflation, which is at four-decade highs.

The company’s balance sheet is in decent shape. Lion had negative cash flow of $59 million in the fourth quarter, but that will ebb as manufacturing facilities are completed and production ramps up. There are definitive positives around the firm, but with a valuation of nearly two and a half times its order book and profitability likely years off in the distance, I am passing on any investment recommendation on this stock. However, this is the name we will likely revisit again after key milestones are completed.

“We are woven from the fabric of which our dreams are made.”― William Shakespeare

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment