Yoshiyoshi Hirokawa/DigitalVision via Getty Images

Guardant

Be fearful when others are greedy. Be greedy when others are fearful. – Warren Buffett

In a bearish market cycle, most investors tend to stay away from stocks. Nevertheless, this is the best time for you to purchase more shares. After all, you can pick up the same companies for dimes on the dollar. Now, you can imagine that investors are fleeing from stocks because fear runs pervasively when stocks are tumbling. Given that fear is the most powerful emotion, a highly intelligent investor like yourself would make an imprudent decision of selling prematurely.

As I continue to review more stocks for you to consider averaging down, I want to feature an analysis on a powerful growth stock coined Guardant Health, Inc. (NASDAQ:GH). Despite the sharp downturn like other biotech stocks, Guardant is embarking on extremely robust fundamental developments. As such, there is a huge mismatch between the stock price and its intrinsic value. By holding a stock like Guardant into the next bullish cycle, you can potentially make substantial gains on your investment.

About The Company

As usual, I’ll deliver a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. Headquartered in Redwood City, California, Guardant Health dedicates its efforts to the innovation and commercialization of novel medical diagnostics. In unlocking the power of precision medicine, the company offers genetic profiling to enhance the treatment outcomes of various cancers.

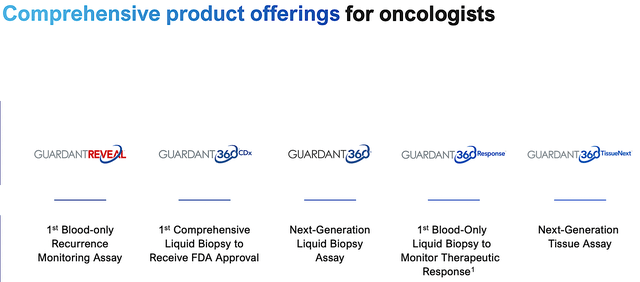

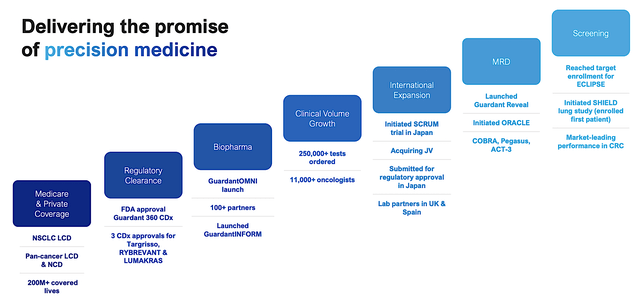

Through its Guardant Health Oncology platform, the company successfully launched various liquid biopsy tests like Guardant360 to catch all stages of cancers. Being a company that follows through, Guardant has successfully executed different milestones to enhance shareholder’s value while delivering hope to countless patients over the years.

Precision Medicine Liquid Biopsy Is Revolutionary

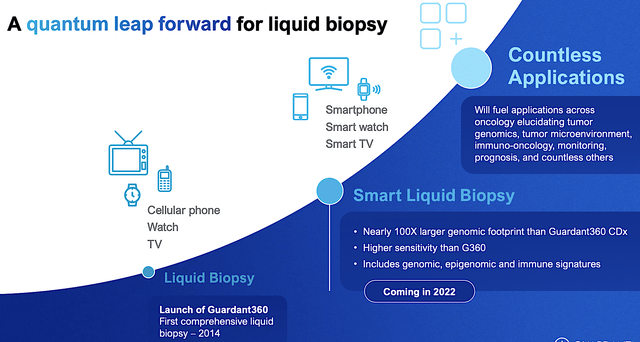

Shifting gears, let us discuss Guardant’s technology because it’s the platform that catapulted growth. As you can see, patients afflicted by cancers rely on conventional tumor biopsy for diagnosis. Riding Guardant’s liquid biopsy analysis (i.e., from a simple blood draw that is routinely done in the hospital or clinic), you can get a vast amount of information about different cancers.

Being precisely cognizant of the tumor’s profile, the doc can deliver a tailored treatment that leads to enhanced efficacy. Importantly, the liquid biopsy gives you early detection which improves survival odds. As you often heard, certain types of cancer (says, testicular cancer) are easily treated with early detection. Interestingly, there is also a multitude of applications from a smartphone, etc., for patients to follow which boost utility and compliance. In the future, you can expect that a liquid biopsy would become mainstream. Being an early investor in this technology, you’re positioned to benefit from upcoming developments.

Early Cancer Detection Is Key To Survival

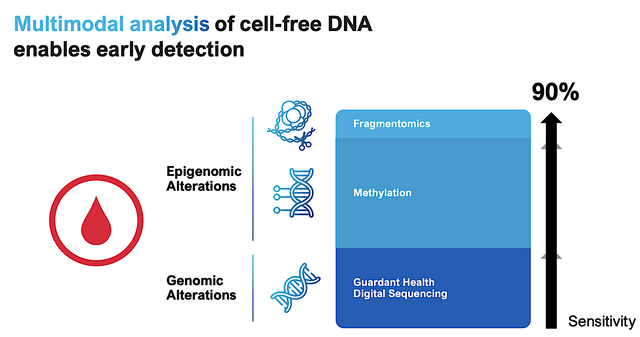

Just because Guardant has a liquid biopsy doesn’t mean it’ll become the wave of the future. There have to be some special characteristics to power that growth. On this front, Guardant is a pioneer of this technology with the application of multimodal analysis. That is to say, its technology is able to pick up both genomic (i.e., genetic materials) changes as well as epigenomic modifications (i.e., external factors that affect the expression of your genes, says smoking).

Viewing the figure below, you can appreciate that the “sensitivity” of the Guardant test exceeds 90%. That’s how good the test is able to pick up a diagnosis. As a general rule-of-thumb, you want a diagnostic test to be over 90% sensitive. Else, it won’t have much utility. While the specificity (i.e., accuracy) does not have to be that high, the higher the better.

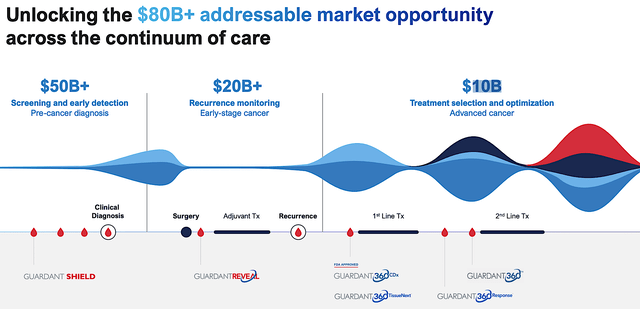

Total Addressable Market

Since it takes tremendous capital to innovate a diagnostic test, you should see if there is a large total address market (i.e., TAM). A substantial TAM gives you the most bang for your bucks in terms of development and commercialization. From the figure below, you can appreciate that Guardant is poised to reap the benefit from a plus $80B market. And, the TAM is expanding due to the industry tailwind that is favoring liquid biopsy and precision medicine.

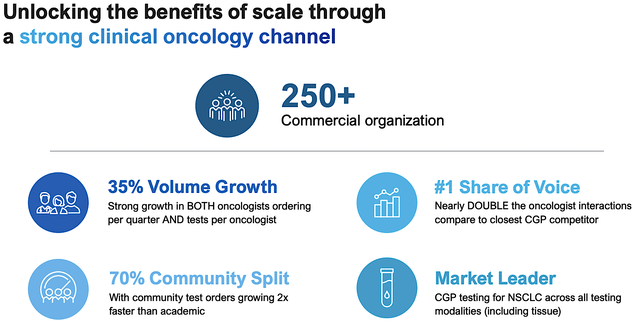

Betting On A Market Leader Is Prudent

When you evaluate new technology, make sure it’s one of the industry leaders. Over the years, I have noticed that investing in an industry leader usually paid off handsomely. On this metric, Guardant is definitely a leader in the precision-medicine diagnostic niche. The company also has vast clinical channels of over 250+ commercial organizations. Among many in the community, Guardant is the number one shared voice.

Epic Deal To Reach More Patients

As a sign of its market leadership, Guardant was able to ink a deal with the premier electronic medical record (i.e., EMR) platform coined Epic. Except in rare instances like in the rural areas, no longer is the day when physicians are shuffling through paper records. Nowadays, treatment and diagnostic tests are ordered electronically through an EMR. Back in my clinical medicine days, we already used EMR. I can imagine that nowadays, it’s much more prominent. Asides from Epic, the other dominant one is Cerner. I personally prefer Epic over Cerner.

As disclosed on April 04, the Epic deal (no pun intended here) will give Guardant access to over 250M patients. After integration in several months, you can expect docs to log into Epic to order cancer tests along with a blood draw. Backed by a vast number of patients, you can anticipate huge revenues increase for Guardant in the coming quarters. It won’t occur immediately. Give it some time for the integration, and you’d be impressed by the sales growth. Commenting on the fundamentally satisfying development, the co-CEO (Helmy Eltoukhy, Ph.D.) remarked,

This partnership will allow us to provide a best-in-class customer experience for healthcare providers to easily order Guardant Health tests and access results quickly, giving them more time to focus on their patients. We are committed to providing the highest quality service to healthcare professionals, and the integration of our tests with Epic, which will include Guardant SHIELD, our blood test to screen for early signs of colorectal cancer, will help to increase the scale and adoption of our offerings in both community practices and large health systems.

Competitor Landscape

Regarding competition, Guardant faces the traditional tissue biopsy. Though liquid biopsy is becoming mainstream, it still takes time for clinicians to shift course. That aside, there are other companies that develop and launch their liquid biopsy-powered precision medicine diagnostics.

Some of them include the following: Personal Genome Diagnostics which is acquired by LabCorp (LH), Pathway Genomics, RainDance Technologies – a Bio-Rad Laboratories (BIO) acquisition, Cardiff Oncology (CRDF), and LungLife AI. In spite of the competition, I believe that Guardant is the most dominant player here. Even if it is not, there is plenty of space in this niche for many competing innovators.

Financial Assessment

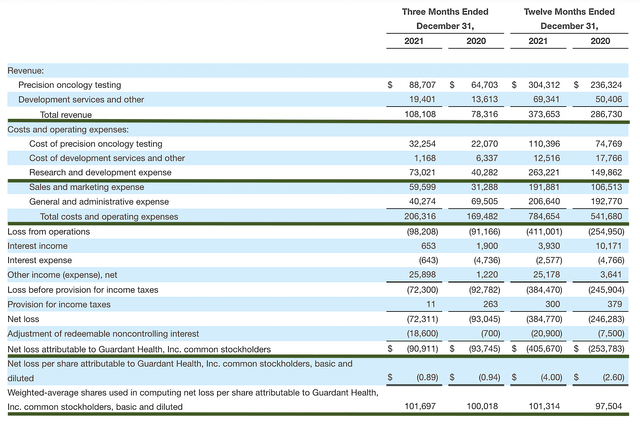

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll assess the 4Q2021 earnings report for the period that ended on December 31.

As follows, Guardant procured $108.1M in revenues compared to $78.3M for the same period a year prior. As such, the year-over-year (YOY) quarterly growth came in at 38%. On a fiscal basis, the 2021 revenues tallied at $373.6M, thus signifying a 38% increase from the $286.7M for the prior year. Underlining the strong revenues increase are the 25.6K reported tests to patients and 6.6K tests to biopharma companies. Noting the year’s achievement, the Chief enthused,

2021 was a transformative year for Guardant and our team continued to push the boundaries to deliver a new paradigm of cancer care. Our commercial team continued to deliver strong growth during Q4 with clinical volumes increasing 48% YOY. This growth was particularly strong in the community setting where Guardant360 CDx grew twice as fast as in the academic centers. Looking ahead to 2022, we are bringing to fruition our vision for providing clinically differentiated offerings that will span the entire continuum of cancer care, including treatment selection, response monitoring, MRD and screening.

That aside, the research and development (i.e., R&D) for the respective quarters registered at $73.0M and $40.2M. I view the 81.5% R&D increase positively because the capital invested today can turn into billions of dollars in sales in the future. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $90.9M (i.e., $0.89 per share) net loss compared to $93.7M (i.e., $0.94 per share) decline for the same comparison. On a per-share basis, the bottom line improved by 5.6%. I like the bottom-line improvement because that tells you the management is mindful of corporate spending.

On the balance sheet, there were $1.6B in cash, equivalents, and investments. Against the $206.3M quarterly OpEx, there should be adequate capital to fund operations into yearend 2023. Simply put, the cash position is extremely robust.

While on the balance sheet, you should check to see if Guardant is a “serial diluter.” A company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 100.0M to 101.0M, my math reveals a 1% annual dilution. At this rate, Guardant cleared my 30% cut-off for a profitable investment. Keep in mind, that this is only a one-year snapshot. The longer trend is more dilutive than I’d like.

Valuation Analysis

It’s important that you appraise Guardant to determine how much your shares are truly worth. Before running our figure, I liked to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. For a medical diagnostic device, I focus on market penetration and sales. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 101.0M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

Guardant diagnostic platform |

$6B (estimated based overall $80B market) | $1.5B | $148.51 | $133.66 (10% discount because uncertainty in market penetration) |

| Others | N/A | N/A | N/A | N/ |

|

The Sum of The Parts |

$133.66 |

Figure 10: Valuation analysis (Source: Dr. Tran BioSci)

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for Guardant is whether the company can boost revenues.

The other risk is that future trial results won’t be positive. Moreover, the competitors and additional lawsuits can cut down on the market shares as well as profit margin. The integration of Guardant’s diagnostic into Epic might not prove as successful as you believe. As a growth company, Guardant might expand too aggressively and thereby run into a potential cash flow constraint.

Conclusion

In all, I maintain my buy recommendation on Guardant Health with a 4.8 out of five stars rating. There is no better time than now for Guardant Health to be in. There is no better niche than precision medicine diagnostic. With the leading company Guardant (riding this industry tailwind of precision medicine), you can anticipate that it’ll continue to bank profits for shareholders while delivering hope for the patients. Just a few years ago, there were only Guardant360 and Guardant CDx. Today, the firm launched Guardant360 Next, and Guardant360 Tissue. You also have Guardant Reveal and Guardant SHIELD baking in the oven.

With its technology rapidly advancing (and delivering to a vast number of patients), it’s not surprising that last year’s revenues are already nearly half of a billion dollars. By integrating with Epic for 250M additional patients, you can project revenues to jump to nearly $1B in the coming years. Since Guardant already has a $7.2B market cap as of this writing, this stock is considered a “stalwart” that will give you less than 100% upsides. Though a modest upside, it’s still quite significant.

Be the first to comment