JHVEPhoto

The recent destruction in tech stock valuations has not spared e-commerce giant Shopify (NYSE:SHOP), which is down 84% from its peak in November 2021. While the stock could indeed fall lower if macroeconomic conditions worsen, at these levels, a lot of pessimism has already been priced in. In this article we evaluate some products that are likely to be key growth drivers going forward, the value that executive management offer merchants and shareholders, address some key concerns investors have (such as merchant growth slowdown), assess future revenue growth/ profit margin expansion potential and its current valuation.

Product & Strategy

Shopify’s recent corporate moves shed light on the firm’s future product & growth strategies. The new COO Kaz Nejatian’s solid background in building payments technology (see ‘Management Quality’ section for more details) underscores Shopify’s aspirations to continue penetrating the payments solutions market through leveraging its growing merchant base. Additionally, Shopify recently launched Shopify Markets Pro to better capitalize on merchants’ cross-border operations. Below we will dive into each of these products to better understand Shopify’s cross-selling and up-selling strategies and how they help bolster sales turnover. We also explore potential new avenues for revenue growth and profit expansion based on the assets available.

Shopify Payments

Shopify Payments launched in 2013 as an alternative to third-party payment gateways on its platform, and is powered using Stripe’s technology. It is currently the most significant revenue contributor to the merchant solutions segment, as according to their 2021 annual report, they “principally generate merchant solutions revenues from payment processing fees and currency conversion fees from Shopify Payments”. It is currently available in 18 countries, and over two-thirds of Shopify’s merchants offer Shopify Payments to its customers at checkout.

There are several strategies Shopify uses to encourage merchants to adopt Shopify Payments over third-party solutions; mainly by deeply integrating its payments solution with other offerings. For example, the ability to set local payment methods in international markets and shipping insurance services are only available to Shopify Payments users. This encourages merchants to choose Shopify Payments over third-party payment gateways to be able to extract more value out of the Shopify platform.

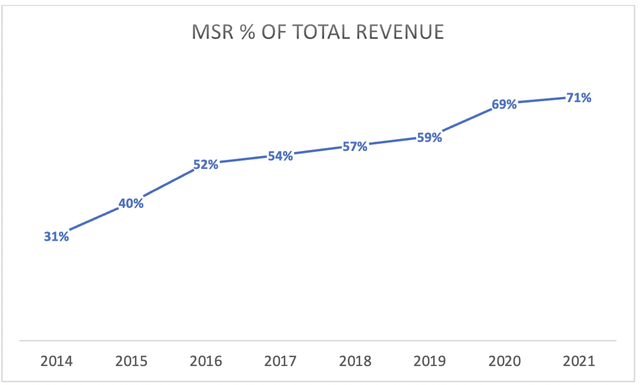

Shopify does not disclose revenue and associated costs of Shopify Payments specifically, though they do reveal that “gross profit margins on Shopify Payments, the biggest driver of merchant solutions revenue, are typically lower than on subscription solutions due to the associated third-party costs of providing this solution”. Due to narrower gross margins on Shopify Payments and merchant solutions, overall gross margins have also narrowed overtime as the segment represents an increasing share of overall revenue.

Note: MSR is Merchant Solutions Revenue (Generated using data from company filings)

Despite low gross margins on Shopify Payments, there are various pathways for Shopify to expand its margins overtime. Firstly, as Shopify’s merchant base and the proportion of merchants using Shopify Payments grows overtime, this merchant base becomes increasingly alluring to third-party payment solutions providers, which are vying to expand their own market shares in the already highly-competitive fintech industry. Hence, Shopify’s bargaining power over third-party partners strengthens as its merchant base grows.

As a result, Shopify could leverage its large merchant base access to renegotiate the costs of the agreement with its current third-party provider, Stripe, or seek an alternative provider, conducive to widening profit margins. While Shopify currently holds a $350 million stake in Stripe, it does not imply any longer-term commitment given it is a minority (non-controlling) stake. In fact, under the Risk Factors section of the 2021 annual report, Shopify states over-reliance on third-party provider Stripe incurs operational risks in case of service disruptions.

Furthermore, new COO Kaz Nejatian’s appointment could potentially be foretelling board members’ ambitions to build in-house payments solutions going forward, given his background in founding and running a fintech company (see ‘Management Quality’ section for more details). While Shopify so far have not publicly expressed any intention of building its own payment solution, Nejatian’s promotion to COO is potentially a step in that direction. Although building in-house solutions would compress operating margins/ widen operating losses over the development period, it would ultimately lead to wider profit margins over the long-term through better cost control as third-party fees are eliminated.

Hence, shareholders should not be discouraged by lower gross margins on Shopify Payments, as the firm has viable pathways to widen margins over the long-term. In fact, if Shopify were indeed to adopt in-house payment solutions, it would be better positioned to capitalize on the growing market size of online payment solutions, allowing Shopify Payments to reap higher margins on payments revenue going forward.

Point-of-Sale [POS] Solutions

Shopify’s POS solutions play a vital role in the company’s post-pandemic growth strategy. Shopify POS enables card payment acceptance and various business management features at physical retail locations. The Shopify POS app for mobile & tablet devices is included in all Shopify plans, hence a free solution for subscribers, and $89/month per location for the Shopify POS Pro offering, granting additional omnichannel and operations management features. POS Pro subscription revenues contribute to the subscription solutions revenue segment.

The omni-channel management feature of Shopify POS, allowing a seamless integration between merchants’ online and offline retail activities positioned the firm well for the post-pandemic reopening, as Shopify’s GMV continued to grow offline channels growth. Shopify’s strategy of making the Shopify POS app freely available to all subscribers positioned it well for when their ecommerce merchants wanted to expand to physical retail locations following the reopening, as the readily available point-of-sale solution as part of their subscriptions would become an obvious choice to allow for seamless integration between their online and offline operations, thereby inducing merchant retention and growth. While the Shopify POS app is not specifically revenue-generating, eventually as these small businesses grow and expand to new locations, they are more likely to upgrade to POS Pro subscriptions and purchase Shopify POS hardware (contributing to merchant solutions revenue), to continue benefitting from Shopify’s deeply integrated functionalities.

While Shopify does not disclose Shopify POS Pro subscriber growth and revenue specifically, Shopify’s CFO Amy Shapero shared on the Q2 2022 earnings call that “POS Pro locations are increasing in the thousands year-over-year, and we expect that to continue to increase into the back half”. Additionally, Shopify’s President Harley Finkelstein mentioned that “June was the best month ever for merchants adding Pro, and our Q2 offline GMV [Gross Merchandise Value] grew 47% year-over-year as we continue to take market share”.

These insights are encouraging signs of effective strategy execution, which incurs market penetration through initial free offerings, subsequent deep integration into merchants’ daily operations and other platform services, and eventual upselling towards POS Pro as successful merchants continue to upgrade and expand to new locations overtime. Shopify’s POS solutions are integral to revenue diversification towards offline retail to enhance post-pandemic sales turnover. Additionally, the newly appointed COO’s solid background in building mobile payments solutions for brick-and-mortar stores (see ‘Management Quality’ section for more details) reinforces Shopify’s POS market penetration and growth potential to become a key revenue growth driver going forward.

Shopify Markets

Last year the firm introduced Shopify Markets, a solution that aims to facilitate international commerce (e.g. enabling merchants to offer tailored shopping experiences as per local customs).

On the Q2 2022 earnings call, President Harley Finkelstein offered some insight into Shopify Markets’ performance so far:

Our own studies indicate that merchants can drive up to 40% higher conversion rates in the international regions by customizing their storefronts for each market to improve the buyer experience for customers.

Given that Shopify Markets is available to merchants of any size with no budget requirements, it essentially democratizes access to international markets for smaller merchants. This enhances Shopify’s ability to attract/ retain more merchants, emboldening market penetration efforts; “more than 175,000 merchants across the world have used Markets to help launch their international businesses”.

While Shopify Markets is available as part of all subscription plans, it does open doors for cross-selling solutions that are revenue-generating. Moreover, the ability to sell in local currencies is only available with Shopify Payments, thereby earning fees on international payment processing. Shopify Payments also generates revenue on duty and import taxes and currency conversions on cross-border transactions through Shopify Markets.

Making international markets more accessible to smaller merchants also enables Shopify to increasingly cross-sell Shopify Shipping services, which according to its annual report is a higher-margin solution. Hence rising shipping volumes through Shopify Markets bolsters revenue generation and widens profit margins. In fact, as Shopify builds out its Shopify Fulfillment Network [SFN] across borders overtime, its ability to capitalize on rising GMV through Shopify Markets should improve.

Shopify has extended its efforts to penetrate the cross-border ecommerce market by launching Shopify Markets Pro last month, offering additional services such as handling international tax and duty compliance on behalf of merchants and fraud protection.

Furthermore, Shopify Markets Pro offers merchants competitive express shipping rates, which are usually only accessible to large corporations, by negotiating on their behalf with DHL. Hence allowing smaller merchants to be able to offer faster delivery to customers more cost-effectively. While passing shipping-related economies of scale onto merchants may compromise margins on this solution, Shopify’s pricing strategy entails offering increasingly favorable rates to higher-end plan subscribers, thereby upselling higher-end subscription models to merchants that seek more cost-effective shipping solutions, ultimately benefitting subscription solutions revenues (its higher-margin revenue segment).

Only Shopify merchants are able to see Markets Pro pricing, however, we do know that Shopify is using a bundled pricing strategy. Markets Pro is likely to follow a pricing strategy similar to Shopify Payments, whereby rates become cheaper for higher subscription plans. Making Shopify Markets freely available paves the way for upselling towards Shopify Markets Pro. As Shopify’s merchants incorporate Shopify Markets into their international expansion initiatives, they become more likely to upgrade to Markets Pro services to further accelerate growth, potentially even upgrading to higher subscription plans altogether to access cheaper Markets Pro fees. Hence, the introduction of Markets Pro and Shopify’s upselling strategy opens opportunities for increasing both merchant solutions revenues as well as subscription revenues.

Leveraging Data

Shopify highlighted its data advantage in the 2021 annual report:

This cloud-based infrastructure… consolidates data generated by the interactions between buyers and a merchant’s products, providing rich data to inform merchant decisions. With a large, rapidly growing and highly qualified team of data personnel, we expect to continue leveraging data for the benefit of our merchants.

Amid the recent slowdown in sales growth, investors are keen to determine how Shopify will bolster revenue growth going forward. Under the Growth Strategy section of Shopify’s latest annual report, there is a particular emphasis put on educating merchants to help them augment revenue growth, including through digital content creation, its online business training platform, Shopify Learn, as well as global events and meetups.

Shopify is currently the only ecommerce platform that offers such a wide range of sales channels, including Facebook/ Instagram, Google Platforms (including YouTube content creator partnerships), TikTok, BuzzFeed, eBay, Walmart and more. As a result, Shopify has the ability to consolidate an immense volume of cross-channel, commercial activity data, allowing it to build customer acquisition intelligence overtime.

How Shopify’s management decide to use its commercial database will be determined overtime, but what is important for shareholders to understand is the potential this rich database offers to fuel future GMV/ revenue growth. Moreover, Shopify’s database offers insights into which sales channels are most effective for different product types, industries and international markets. For example, it could potentially offer a fashion designer insight into which social media platform and marketing strategy offers the optimal sales conversion rate for different geographic regions.

As Shopify is currently the only platform that offers such a wide range of sales channels, the customer acquisition database it builds allows Shopify to further distinguish itself from competitors, thereby widening its moat. That being said, there is certainly the possibility of competitors offering a similar range of sales channels overtime, which would undermine Shopify’s moat. However, Shopify would still benefit from a first-mover advantage, as it holds data over a longer time-range, hence is able to offer more extensive insights on evolving consumer trends and through different stages of the business cycle. For example, as of now, they are the only e-commerce firm to hold data on the effectiveness of the various sales channels throughout the pandemic and how economic reopening influenced the efficacy of such channels. This data could be used to help merchants navigate future epidemics/ pandemics, or other comparable events.

Therefore, Shopify’s growing customer acquisition database allows for more actionable digital content creation and insightful learning material under Shopify Learn, such as more specific guidance on navigating industry-specific and region-specific trends, enhancing its ability to attract and retain merchants. The firm’s rich database could also potentially lead to new revenue-generating avenues, such as in-house consultancy or advisory services for merchants, whether it be a service included in subscription fees (subsequently improving pricing power) or an entirely new business division. Furthermore, such services could open more cross-selling opportunities by encouraging merchants to adopt Shopify’s merchant solutions as part of strategies to navigate various digital marketing trends. Regardless of how Shopify decide to use its growing customer acquisition intelligence to offer new products/services to its merchants, it creates great opportunities to help merchants improve sales conversion rates, thereupon advancing the platform’s GMV processing and sales turnover, as well as widening Shopify’s moat.

Management Quality

Executive team members play a vital role in determining the direction and ultimate success of the company. Below we examine some key personnel (other than the well-covered CEO Tobias Lütke), including the two new executive team appointments, by assessing the relevance of their skills and experiences, and what value they offer to Shopify’s merchants and shareholders.

COO Kaz Nejatian

Kaz Nejatian extended his role as VP of Product to also become the COO in September, replacing Toby Shannan, who will be joining the Board of Directors. In addition to overseeing product solutions, such as payment solutions, Shopify Capital and Shopify Balance, his division as COO will now also include Shopify Plus, Shipping & Fulfilment and Merchant Services.

Nejatian co-founded a payment technology company called Kash, which he also ran as CEO between 2012 through 2017. “Kash was one of the early players in giving small businesses access to mobile payments technology for brick-and-mortar stores”. Evidently, he has always had the mindset of making innovative solutions accessible for smaller players, which he continued to demonstrate as VP of Product through solutions such as Shopify POS and Shop Pay, as well as integrations with leading social media platforms.

Following Kash’s acquisition by an undisclosed, large fintech corporation in 2017, he joined Facebook/Meta (META) as Product Lead for Payments and Billing, “building payment products for WhatsApp, Instagram, [and] Marketplace”. Moreover, he played an integral role in “reducing the barriers for businesses in cash-dependent markets to purchase digital ads without a credit card”. His profound problem-solving skills, combined with his academic and professional background in law, are eminently vital as Shopify expands internationally, to help the firm navigate through various regional regulatory hurdles and customs.

Given the importance of mobile commerce for Shopify’s growth (66% of orders were placed from mobile devices in 2021), Nejatian’s innovative background in mobile payment solutions fosters Shopify’s mobile ecommerce efforts. Additionally, his experience in supporting brick-and-mortar stores also reinforces Shopify’s push to penetrate the offline retail market, particularly through advancing its POS solutions.

CFO Jeff Hoffmeister

Jeff Hoffmeister replaced Amy Shapero as CFO in September. Hoffmeister joins after serving at Morgan Stanley for almost 23 years (16 years of which he led Tech Banking teams). He has extensive experience in helping tech companies raise capital through equity and debt financing. In fact, he helped lead the IPO for Shopify, hence not alien to Shopify’s operations.

He also holds valuable experience in evaluating and executing M&A opportunities in the technology space, which is vital to Shopify at this stage given the importance M&A plays in its growth strategy, highlighted by its acquisitions of 6 River Systems and Deliverr to build out SFN. Hoffmeister’s international banking experience across the Americas and Europe should help Shopify capitalize on lucrative M&A opportunities as it expands globally.

While Hoffmeister’s performance as CFO of Shopify can only be evaluated overtime, the Board’s last CFO appointment, Amy Shapero, was a sound decision. She played a vital role in laying the groundwork for driving future growth, particularly regarding fortifying Shopify’s balance sheet. She had been an investment banker helping tech companies raise capital between 1992 and 2001, hence was well-acquainted with the nature of equity markets during the dotcom bubble and burst. Her experience proved invaluable to Shopify, as she wisely took advantage of the sky-rocketing stock price over the last few years to conduct 5 follow-on equity offerings during her time as CFO since April 2018, raising $5.2 billion (calculated using company reports). In hindsight now that the recent tech bubble has burst, these equity offerings were prudent and timely to fund future growth. Such strategies have helped keep Shopify’s debt to equity ratio relatively low (0.13x in Q2 2022) compared to other growth stocks, thereby making it better prepared to weather the rising interest rate environment amid high inflation, and freeing up more cash flow to invest in growth going forward, rather than debt servicing.

Conversely, Hoffmeister has experienced the post- dotcom capital market conditions as an investment banker (had joined Morgan Stanley in 2000), which should prove more relevant given the current state of affairs. While present capital market conditions might not be exactly the same as the 2000s despite the recent stock market woes, his experience in helping companies raise finance and engage in M&As throughout two significant periods (post-dotcom burst and the 2007-09 financial crisis) should help Shopify better navigate the looming recession/ economic hardships ahead through pragmatic investment decision-making and balance sheet management.

President Harley Finkelstein

Finkelstein has been at Shopify since 2010, and served as COO prior to becoming President. “He oversees Shopify’s commercial teams, growth, and external affairs”. More specifically, he oversees areas like brand marketing, ecosystems (including app and marketplaces) and merchant services.

Finkelstein holds entrepreneurial experience through founding various start-ups, and in fact recently launched a start-up called Firebelly Tea through Shopify to be able to step into the shoes of Shopify’s merchants, to experience first-hand the services offered by the company he helps run. Thereby allowing him to gain a better perspective on how to continuously advance the platform to enable optimum merchant success, particularly the commercial aspects which he oversees as President.

In a LinkedIn post earlier this month, Finkelstein shared:

As the President of Shopify, the best way for me to understand what our merchants are experiencing today as they build their businesses is to be an entrepreneur alongside them.

Furthermore, Finkelstein is also an Angel investor and an advisor to Felicis Ventures for almost 8 years, which gives him exposure to trends across start-ups and the venture capital industry, augmenting his awareness of entrepreneurial essentials, his ability to foresee future merchant requirements, and how to advance Shopify’s offerings to allow its merchants to stay competitive.

Finkelstein’s dedication towards improving merchant solutions through powering his own businesses using Shopify, and continuous venture capital exposure should bolster his ability to deliver solutions that allow Shopify’s merchants to flourish, and ultimately grow shareholder value.

Business & Financial Metrics

Revenue & Merchant Growth

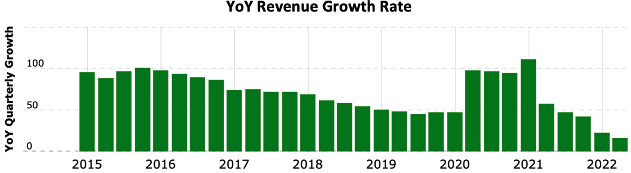

macrotrends

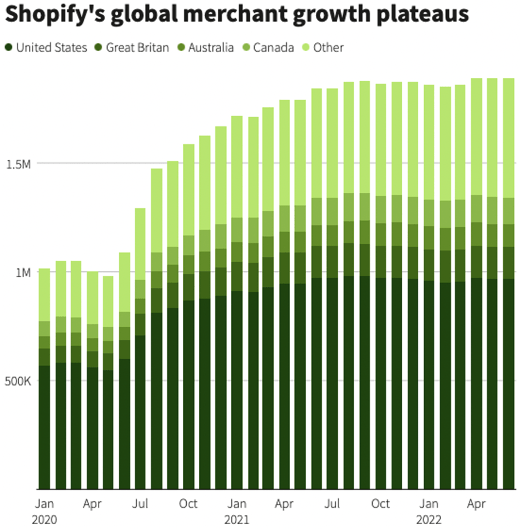

The deceleration in revenue growth has been a key factor behind Shopify stock’s plummet this year. The slowdown in ecommerce spending following economic reopening, higher inflation, and fears of recession has unsurprisingly hit the ecommerce platform’s revenues. While these temporary macro factors do not undermine long-term revenue growth potential, the recent slowdown in merchant growth is particularly concerning to investors as they try to determine whether it is a reflection of a return to post-pandemic normality and/or something more company-specific.

YipitData, Reuters

Shopify do not specifically disclose the number of merchants lost during reporting periods. Nevertheless, it would be unsurprising to see a certain number of unsuccessful digital businesses that had attempted to build online stores during the pandemic give up their subscriptions, now that the economy has opened up again. More generally it is unsurprising to see lower ecommerce merchant growth following the pandemic as business owners, as well as their customers, want to embrace more outdoor activities after being trapped at home during the pandemic. Such shifts in merchant/ consumer sentiment should not shake investors’ confidence in Shopify’s long-term growth potential, as ecommerce will still continue to grow (likely at a more normal pre-covid rate). In fact, the seamless integration of online and offline retail that Shopify’s POS solutions offers enables its merchants as well as the Shopify platform to become more agile to shifts in such consumer spending trends. While online retail still makes up majority of Shopify’s revenue base, Shopify continues to penetrate the offline retail market (as discussed under the ‘Product & Strategy’ section), which should enhance Shopify’s resilience to shifting shopping habits overtime.

That being said, merchant growth slowing as a result of rising competition is also a key concern among investors. Especially from cheaper alternatives, as these tend to be able to attract new merchants that want to lower their upfront costs for starting/ running new businesses, particularly during high inflationary times. Advanced features are not as important as cost-effectiveness for these price-sensitive merchants as they are still exploring their earnings potential.

In fact, under the Risk Factors section of the 2021 annual report, Shopify state that:

SMBs, which comprise the majority of merchants using our platform, may be quite sensitive to price increases or prices offered by competitors. As a result, in the future we may be required to reduce our prices

This could present a genuine and enduring threat to revenue growth, as Shopify may be forced to engage in price wars to maintain and grow its SMB market share. As a result, this may slow future revenue growth, undermining the price to sales ratio the stock is able to command. That being said, Shopify’s size enables it to benefit from various economies of scale. On the Q2 2022 earnings call, CFO Amy Shapero twice highlighted Shopify’s ability to pass “economies of scale onto merchants to help them make every dollar count” in high inflation/ recession environments. Shopify has already been proving its ability to scale the platform by serving larger merchants and widening merchant solutions gross margins (discussed later on), and should continue to see improvements in economies of scale as it builds out SFN. Hence, Shopify’s widening economies of scale should offset any negative impacts on profit margins amid price wars, as it allows them to absorb any price reductions through corresponding cost structure efficiencies.

Furthermore, not a single competitor is currently able to offer the multiple sales channel exposure integrated with advanced functionalities that Shopify provides. While cheaper pricing may be lucrative to nascent, price-sensitive merchants, Shopify’s more advanced product offering is strongly positioned to take market share across more well-established businesses, particularly at the Shopify Plus level (Shopify’s premium solution for large enterprises at $2000/month). While Shopify do not disclose the total number of merchants it has acquired from its competitors, its website does offer a list of case studies detailing how large merchants benefitted from shifting to Shopify Plus after leaving their legacy providers. The sample list of merchants acquired includes 30 from Magento/ Adobe (ADBE) , 8 from OpenCart, 6 from WooCommerce, 4 from Salesforce (CRM), 3 from WordPress, and 1 from Oracle (ORCL).

Shopify’s ability to seize such large merchants away from competitors is particularly commendable given the high switching costs incurred in the ecommerce platform industry, and testament to Shopify’s easy migrating process, which is essential for optimum market-penetration in an industry that provides relatively sticky services. While we don’t know industry-wide statistics on platform switching activities for better cross-firm comparisons, larger merchants leaving their legacy service providers, as well as multinationals like Netflix and Heinz adopting Shopify Plus, is testament to the firm’s more valuable platform offerings.

The point is, while competitors offering cheaper alternatives may be able attract nascent, price-sensitive merchants (which may include temporary hobbyists), Shopify’s premium product offerings may be better placed to attract more serious merchants once they are more established. Therefore, weak pricing power at lower end subscription plans (due to cheaper alternatives) could be countered by better pricing power for higher-end subscriptions, as more professional merchants, especially those that re-platform to Shopify, will be more appreciative of Shopify’s advanced functionalities, and hence willing to pay a higher price to access superior business-advancing tools. The effectiveness of this type of business model and pricing strategy will ultimately depend on Shopify’s ability to maintain unmatched, superior functionalities over its competitors through market-leading Research & Development. Shopify have already been proving their superior ecommerce functionalities and ease of migration by attracting large enterprises at the Shopify Plus level. If they can show similar success at acquiring medium-sized businesses at scale, then slower SMB merchant growth in the short-run should be offset by merchants re-platforming to Shopify over the medium and long-run.

The ecommerce market is still a rapidly growing industry, expected to reach a market size of $8.1 trillion by 2026, and Shopify is strongly positioned to continue penetrating this high-growth market to drive future revenue growth despite rising competition.

Merchant Solutions Revenue/GMV

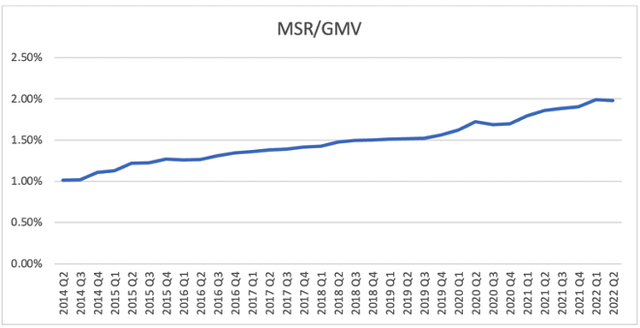

Considerable attention is given to the level Gross Merchandise Volume (GMV) processed through the Shopify platform in company filings and analyst commentary, but rising GMV is meaningless without considering how well Shopify is able to capitalize on it through its solutions offerings.

In the Q2 2022 earnings call, President Harley Finkelstein shared that “we talk a lot about this sort of product usage metric, which is Merchant Solutions revenue [MSR] divided by GMV”. This is a useful metric to assess how effectively Shopify are able to monetize on the growing GMV processed through its platform by offering numerous merchant solutions (e.g. Shopify Payments, Shopify Capital, Shopify Shipping etc.). While Shopify does not disclose this metric publicly (rather use it internally), the quarterly MSR/GMV metric since 2014 Q2 has been produced in the chart below:

Generated using data from company filings

At first glance the small percentage values may seem negligible (MSR is unsurprisingly a miniscule proportion of Gross Merchandise Value given that merchant solutions mostly incur fees in the form of few percentage points of the order value). Though measuring it overtime does offer insight into product usage across the merchant base, and whether Shopify has been successful at offering useful and relevant solutions for merchants.

Shopify’s MSR/GMV has essentially doubled since 2014 Q2, reflecting the fact that Merchant Solutions Revenue has grown faster than GMV, and that merchants are increasingly adopting Shopify’s broadening set of merchant solutions. The increase in MSR/GMV indicates Shopify’s product innovation success; its R&D efforts are resulting in relevant merchant solutions, allowing Shopify to better monetize its growing merchant base.

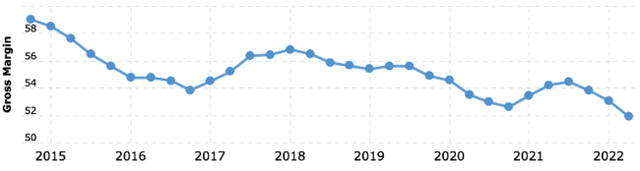

Gross Profit Margin

The firm-wide gross margin has been narrowing over the last several years. In its 2022 Q2 MD&A, management highlighted that “the lower margins on merchant solutions compared to subscription solutions means that the continued growth of merchant solutions may cause a decline in our overall gross margin percentage”.

While a narrowing gross margin trend is dissuasive to investors, closer inspection into the Merchant Solutions gross margin trend over the last decade reveals reasons to be optimistic for overall gross margin stabilization/ expansion over the long-term.

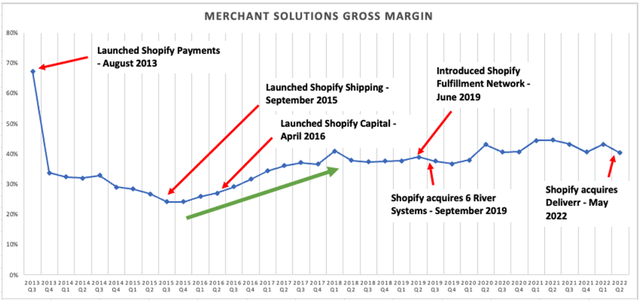

The chart below exhibits the Merchant Solutions gross margin trend between 2013 and 2022, including key events to better understand how certain product offerings impact gross margins.

Generated using data from company filings

As discussed under the ‘Product & Strategy’ section, Shopify Payments is a lower margin solution, hence dragging Merchant Solutions gross margins lower from 67% to the 20-30% range following its launch in 2013. Nevertheless, as discussed earlier, Shopify is expected to be able expand Shopify Payments margins overtime, especially if it were to build an in-house payments solution.

The launch of higher-margin solutions like Shopify Shipping (September 2015) and Shopify Capital (April 2016) helped Shopify expand its Merchant Solutions gross margin. As the chart exhibits, the narrowing gross margin trend started reversing in early 2016 before stabilizing around 40% since early 2018. In its 2021 annual report, the firm said “higher-margin solutions such as Shopify Capital and Shopify Shipping will continue to grow through increased adoption and international expansion”. Shopify’s proven ability to introduce higher-margin solutions and increased adoption of such offerings, including cross-selling through Shopify Markets (as discussed under the ‘Product & Strategy’ section), should further bolster gross margins overtime.

Gross margin growth has slowed in the past few years, as Shopify builds out the Shopify Fulfillment Network, which includes the acquisitions of 6 River Systems and Deliverr, to broaden its control over the ecommerce value chain. Management have said that “we expect the development of Shopify Fulfillment Network, 6RS, and Deliverr to be dilutive to the gross margin percentage for merchant solutions in the short term”. Over the longer-term, developing SFN is essential to gain better cost control and should allow Shopify to increasingly benefit from economies of scale as order processing capacity grows, thereby allowing for gross margin expansion overtime.

In fact, the pandemic-induced boom revealed Shopify’s ability to scale. The development of Shopify Fulfillment Network and the 6RS acquisition in 2019 allowed Shopify to be well-positioned for processing higher delivery volumes during the pandemic. While we don’t know the exact contribution of these new SFN developments towards MSR, Merchant Solutions gross margins did slightly widen during the pandemic (touching 45% in Q2 2021), indicative of Shopify’s collective set of merchant solutions benefitting from economies of scale (despite SFN not being fully built out and integrated yet). This bolsters confidence in Shopify’s ability to scale the business and expand gross margins over the long-term.

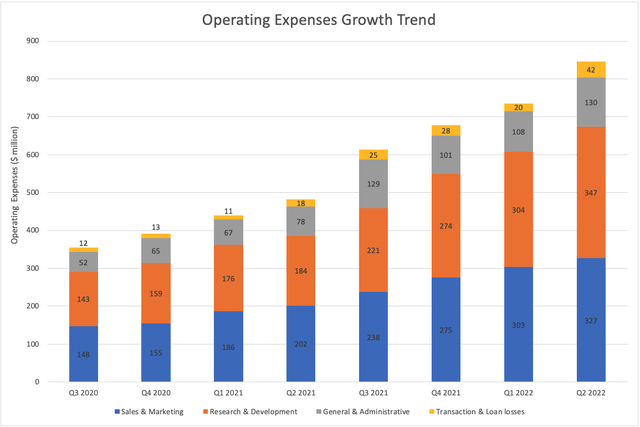

Operating Margin/Losses

A key concern for investors this year has been the fact that Shopify was not able to maintain its profitability post economic reopening, which has been another key reason behind the stock’s plummet over the last year. Net profit margins are impacted by non-core activities such as gains/losses on equity investments, such as its stake in Affirm (AFRM), hence net margins tend to cloud the operational efficiency picture. Therefore, it is more worthwhile to analyze the core operating activities section of the income statement to effectively assess management performance.

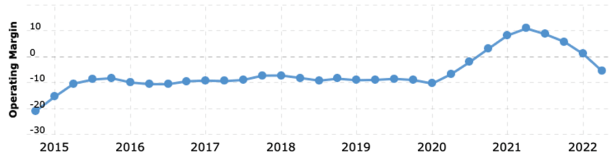

macrotrends

Shopify’s operating margin peaked at 10.95% in Q2 2021, before reversing back into unprofitability amid economic reopening. It is not unusual for a growth company to have large, growing operating expenses, as long as the resources are being used effectively to ultimately benefit the top and bottom line. In Q2 2022, 80% of Shopify’s operating expenses consisted of R&D and Sales & Marketing, two vital operating activities to drive growth going forward.

R&D expenses surpassed Sales & Marketing expenses in 2022 to become the largest contributor to overall operating expenses (41%). While rising operating expenses (accompanied with declining gross profits) have subsequently been widening operating losses, it is encouraging to see that the largest proportion of these expenses is being allocated towards operational scaling efforts and producing new innovations that could become future sources of revenue and/or offer moat-widening opportunities to fend off competition.

Furthermore, the rise in MSR/GMV ratio (as discussed earlier) reflects that R&D budgets are being used effectively to offer new, relevant solutions for merchants. R&D expenditure is also being used effectively to produce scalable merchant solutions (e.g. Shopify developed “warehouse management software…to improve quality, operational performance, and variable cost per unit”), as evidenced by widening gross margins and subsequent operating profits during the pandemic-boom. Hence Shopify has proven its ability to scale and run profitably as ecommerce demand grows (albeit at pre-covid growth rates).

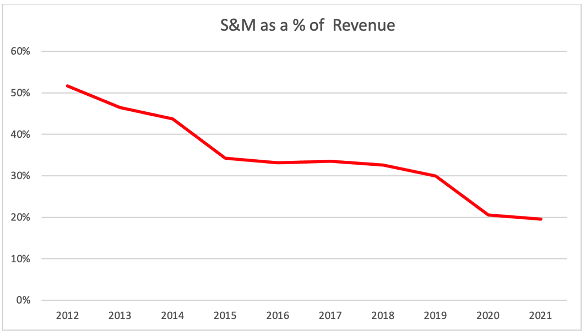

Sales & Marketing (S&M) made up 39% of Shopify’s operating expenses in Q2 2022. Over the past decade, revenue has grown faster than S&M expenses; 10-Year CAGR of 113% vs. 93%, respectively.

Generated using data from company filings

S&M has been declining as share of revenue over the last decade, exhibiting management’s ability to increase revenue while improving S&M cost efficiency; augmenting return on every dollar spent.

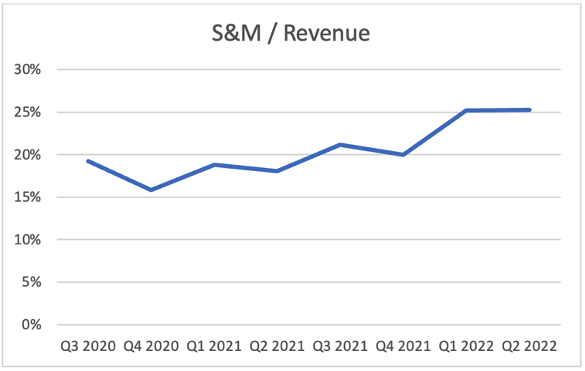

More recently though, S&M as a share of revenue has been increasing over the last few quarters (as per chart below), as management “significantly step up…marketing efforts internationally and initiate a new off-line performance marketing program”.

Generated using data from company filings

S&M expenses are expected to continue to increase over the near-term as Shopify strives to better penetrate international and in-person retail markets, which is likely to continue pressuring operating margins. However, given Shopify’s decade-long track record of driving revenue higher while improving S&M cost efficiencies, investors should be willing to bear near-term operating margin pressure in return for healthy revenue growth over the long-term.

Shopify’s recent return to unprofitability has raised concerns around its ability to turn sustainably profitable over the long-term. However, long-term investors should not be concerned about its operating losses at this growth phase, and in fact should embrace increased investments in the company’s core activities, given the firm’s effective R&D efforts and proven track record of sales & marketing efficiency, which should result in stronger revenue and profit growth over the long-term.

Risks

While Shopify promises long-term growth potential, the company also faces some key risks which investors should consider when making investment decisions.

Credit Risk Exposure

As mentioned earlier, Shopify Capital is a high-margin solution which has played a pivotal role in expanding Shopify’s gross margins. However, amid increasing chances of a recession ahead, offering working capital loans to merchants exposes Shopify to elevated credit risk, as business failure rates increase during economic downturns. In fact, while Transaction & Loan losses is Shopify’s smallest operating expense, it is also the fastest growing.

Generated using data from company filings

A recession is likely to augment Transaction & Loan losses, and consequently widen operating losses over the near-term.

Over-Reliance on Strategic Partnerships

Shopify’s unmatched sales channel offerings are key to building its moat against competing ecommerce website builders, as well as challenging Amazon’s well-established marketplace. However, being overly dependent on strategic partnerships with large tech/ social media platforms for online sales channels raises risks as these firms could decide to offer their own competing services to take advantage of their existing large user bases.

As Shopify states under its Risks section of the 2021 annual report:

Established companies in other market segments or geographic markets expand into our market segments or geographic markets. For instance, certain competitors could use strong or dominant positions in one or more markets to gain a competitive advantage against us in areas where we operate by, among other things, integrating competing platforms, applications, or features into products they control such as search engines, web browsers, mobile device operating systems or social networks

Shopify are implicitly referring to potential threats from Google and Facebook introducing competing services while leveraging their control over key underlying technology to facilitate digital services (e.g. search engines) and integrating them with their existing products/ services as a direct challenge to Shopify’s integrated solutions suite. If these platforms did indeed begin offering competing services, it would diminish the value of Shopify’s sales channel exposure and raise the risk of losing merchants to these big tech platforms with more well-established network effects and high website traffic.

To reduce reliance on third-party sales channels, Shopify is striving to build its own shopping marketplace through the Shop app (introduced in April 2020). However, Shopify acknowledges the risk of competitors “making access to… [the] platform more difficult including by changing the terms of service related to their products”, which includes the risk of Alphabet yielding its control over the Google Play Store and Android Operating System; though this potential risk could be overcome through antitrust litigation. Nevertheless, Shopify will likely have to invest heavily in Sales & Marketing (hence pressuring profitability) to build brand awareness and subsequently a marketplace that can copiously challenge big tech’s website traffic and thereby reduce reliance on third-party sales channels.

Intensifying Competition May Undermine Profitability

Shopify’s Sales & Marketing, R&D and M&A expenditure could stay high or increase further to continue fending off intensifying competition in the ecommerce platform industry, which may delay/ undermine profitability going forward. Shopify not only needs to continue maintaining/widening its moat against ecommerce website builders, but also needs to invest heavily to capably challenge Amazon’s seller program. Amazon’s well-established platform not only offers sellers access to an already entrenched shopping marketplace, but also offers access to high website traffic through other services as part of Amazon Prime benefits, including Prime Video and Music. Hence, Amazon’s large Prime subscriber base offers a loyal customer base that frequently visit the Amazon website. Additionally, Amazon has been building its fulfillment network for over 25 years, offering extensive international fulfillment capabilities. While it may not necessarily take Shopify over a quarter century to challenge Amazon’s fulfillment services, investors can expect a long-lasting development cycle, as SFN’s current capabilities are still “a subset of a subset” in terms of management’s development plans, as guided by CFO Amy Shapero on the Q2 earnings call.

Therefore, Shopify will have to invest heavily in its marketplace building initiatives (primarily through its Shop App) and fulfillment network over the coming years to competently challenge Amazon’s seller program, as well as other rising competitors. This may undermine chances of profitability going forward.

Valuation & Macro Backdrop

Given the current macro backdrop of high inflation, rising interest rates and a potential recession on the horizon, growth stocks are likely to remain out of favor until the economic storm settles. Understandably, investors are unwilling to trust cheap valuation multiples as buying signals at times when the denominator (e.g. Earnings, Sales, etc.) could fall even lower amid worsening economic conditions, which subsequently could cause the numerator (stock price) to further decline.

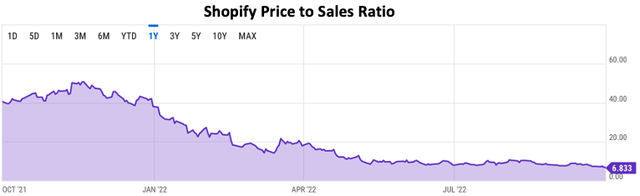

Price to Sales Ratio

The most prevalent valuation multiple to consider for loss-making growth stocks is the Price to Sales (P/S) ratio.

Currently, Shopify stock is trading at a P/S ratio of around 6.83x. The compressed sales multiple relative to historical levels reflects not just the unfavorable economic backdrop, but also the slowing pace of revenue and merchant growth, as investors try to determine whether this is a temporary slowdown or a sign of something more enduring. As discussed earlier, Shopify is well-positioned to counter a slowdown in merchant growth amid rising competition through competitive pricing capabilities (capitalizing on economies of scale) and merchant acquisition strategies at higher-end subscriptions. Hence the compressing P/S ratio amid investors’ fear of intensifying competition presents a buying opportunity for long-term investors seeking exposure to the rapidly ecommerce market through a firm with strong market-penetrating potential.

That being said, the market is still unclear on how long elevated inflation, the consequent rate hiking cycle and a potential recession will last. While the slowdown in revenue growth amid economic reopening (post-pandemic) and high inflation is priced in now, potential declines in revenue amid the increasing likelihood of a recession is still being priced into the stock as investors try to gauge the length and depth of the potential recession. Though given how much economic and company-specific bad news has already been priced into the stock, investors should consider an averaging down investment strategy to start building a long-term position in the stock, while keeping some dry powder to buy more stocks at cheaper levels if chances of a severe recession increase.

Dotcom Comparisons

The ongoing slump in tech growth stocks is frequently compared to the bursting of the dotcom bubble, and used as a guide to determine whether stocks can trade at even cheaper multiples. While Amazon (AMZN) is frequently used as a comparison, Shopify is one of the few stocks for which Amazon is actually a suitable comparison, given they are both ecommerce platforms (albeit with different business models). Shopify is currently trading at a P/S ratio of 6.83x. According to data from YCHARTS, Amazon reached a P/S ratio of 0.716x in the midst of the dotcom unwinding (September 2001). Consequently, bears believe that Shopify stock has further to fall before it bottoms. While there is indeed the possibility that the stock could get cheaper and reach P/S levels similar to where Amazon was trading in the dotcom aftermath, investors should caution such direct comparisons, as there are a few key differences between the 2000-02 era and present day for these e-commerce players.

E-commerce is a much more established industry today than it was in early the 2000s. Investors today are a lot more knowledgeable about ecommerce industry dynamics, have witnessed how the industry performs during different economic cycles, and more importantly, are convinced that ecommerce can be sustainably profitable. Back then, Amazon had yet to prove sustainable profitability, at a time when conducting business activities over the internet was a relatively new concept, and investors had no relevant historical comparisons to back up their investment thesis. As a result, the unwinding of the dotcom bubble resulted in extreme fear and led to investors dumping stocks of unproven business models. Fast forward to today, investors enjoy the luxury of hindsight and access to relevant historical comparisons to know that ecommerce platforms can be profitable. Indeed, Shopify has actually proven to be profitable, albeit for a short period of time so far. Despite not having proven long-term profitability yet, investors may not necessarily treat Shopify with the same level of fear-driven adversity as they treated tech stocks during the dotcom burst, as they are much better-informed today about ecommerce industry potential.

Hence, if you have a long-term investment horizon, it is advisable to start averaging down, rather than waiting to invest all at once in hope of Shopify stock following Amazon’s trajectory and reaching similar P/S levels. Once again, while there is certainly a possibility for Shopify to reach those lower P/S ratios, a comparison with Amazon should not be your sole guide.

Summary

Shopify’s product offerings, accompanied with unmatched sales channels exposure, are well-positioned for effective market-penetration in the high-growth ecommerce industry. Its deepening integration into merchants’ operations offers great cross-selling and upselling opportunities to drive future revenue growth and profit margin expansion, conceivably fortified by its growing customer acquisitions intelligence to support merchants’ sales and further bolster GMV/ sales turnover. The new executive management appointments hold valuable experience to execute the company’s growth strategies, including the new COO Kaz Nejatian’s remarkable background in payment solutions/ mobile commerce. Further bearishness among investors amid an uncertain/ worsening macro backdrop is understandable, though stock-watchers should at least start buying the stock following the considerable drawdown while leaving some dry power, in order to avoid being jolted by head-fake rallies and gradually build a long-term position during new market legs down.

Be the first to comment