BrianAJackson/iStock via Getty Images

The photo shows a house on shaking foundations. Housing markets world wide are one of the dangers I mentioned in A Crash Is Becoming Certain. That article had nearly 340,000 reads indicating that many others share my worries.

Nothing has been done to rectify the housing problem and central banks are going make it worse in their eagerness to raise interest rates. They will thus pull out the last major support for that key economic sector.

There has been a SPACS crash. This CNBC report tells more about that.

Liquidity problems are also now showing in another very important sector that had not arisen when I wrote that earlier article.

While superficially little has shown that justifies labelling market declines so far a crash, a deeper look shows that has happened in some sectors.

Taking US house builders as one example. Soon after I wrote that article I decided they would be among the earliest affected so in early December, 2021, I sold my holdings in Lennar (LEN) and LGI Homes (LGIH). I was reluctant to do so because both had been good long term holds but I am glad I did as LEN is down 33% since and LGIH down 42%. That means a crash to me. I also sold out of 2 house builders in the UK and the result has been the same there.

One can probably find similar examples in the S&P 500 in other sectors but they are masked by the overweighting techs have in that index, so it is down less than 5%. Those mighty techs are another danger and I shall now go into more detail on the real dangers, as I see them.

Taken together they point to big problems for investors…

Confused Market

In a recent Financial article headed Confused market leaves investors groping for answers the Bank of America’s April monthly survey is reported as showing that some 71 percent of investors are expecting a weaker economy over the next 12 months. That being the most pessimistic reading ever on data going back to 1995 – not even March 2020 and the financial crisis of 2008 match it. Fund managers in the survey now expect to see an average of 7.4 rate rises from the US Federal Reserve this year, up from 4.4 in March. Some expect as many as 12 rate rises in this cycle, or even more. Despite that, as the BofA survey points out, “the disconnect between global growth and equity allocation remains staggering”. Over the month “investors got slightly more bullish on equities” with the proportion of fund managers saying they are overweight stocks edging higher.

Unfortunately, there seems to be no sense of direction as investors are flipping almost weekly between value and supposedly growth tech stocks.

Housing

This is a worldwide problem. On the other side of the world, we see this in Australia. There the economy is founded on housing and commodities. The housing part consists of residents buying and selling property from and to each other for ever-higher prices using borrowed money in a surreal pyramid of paper wealth creation, which hit A$9tn (more than 4 times GDP) in 2021.

Sky high prices mask moribund wages and living standards but exacerbate housing unaffordability. House prices across the country surged 22.1 percent last year, according to CoreLogic figures, while wages rose just 2.3 percent, as the latest Australian Bureau of Statistics figures show.

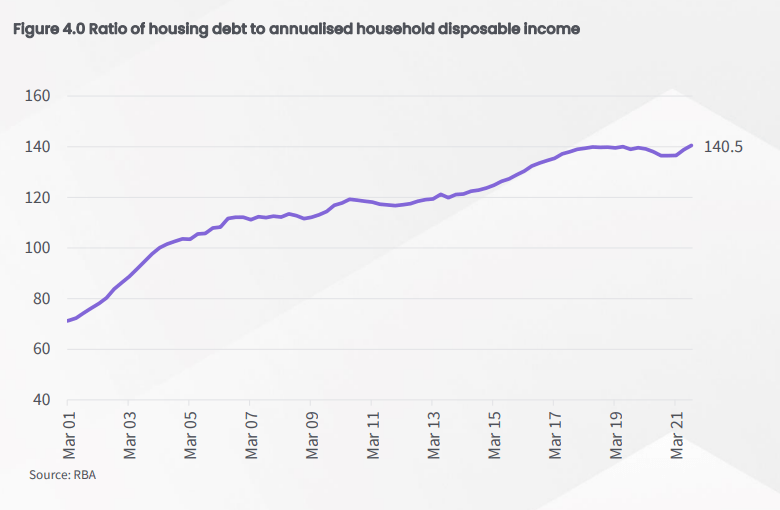

In many cases home owners have used home equity to borrow more to buy cars and support a lifestyle higher than their incomes would otherwise permit. Thus, mortgages have put household debt at 140% of GDP, one of the highest levels globally. This chart shows the trend…

RBA

According to the OECD that means household debt is at 203% times disposable income. Australian banks are heavily exposed to house prices with residential mortgages constituting over 60 percent of total loans, one of the highest levels in the world. We all know from 2007 lessons what happens when banks panic and pull the rug when house prices go lower than the security they have in a property.

Australia maybe a long way away and small in global terms but it is an indicator of similar problems elsewhere.

In Britain – still the world’s 5th largest economy – there has long been a housing crisis as that linked Big Issue report shows. Now rising prices will cause a “historic shock” to Briton’s incomes according to a recent warning by Andrew Bailey, governor of the Bank of England, the UK’s central bank. He has a solution – raise interest rates!

Globally this UBS report tells more: Global house price boom amplifies bubble risks

The Tesla/Tech Worshippers

Tesla is a car maker but one dare not say that to the members of the cult that Elon Musk has created around himself. To them Tesla is a unique form of tech company and he can do no wrong. Of the near 1,300 comments on my recent article Tesla’s Battery Is Running Flat I guess that around 95% were by people who can only be described as fans of Elon Musk and my suggestions that Tesla (TSLA) is hugely over valued was scorned by them. With a PE of 200 it remains so if compared with any other car maker including the world’s largest one; Toyota with a PE of 9.5, yet they believe Tesla’s stock market price has nowhere to go but up.

If that form of worship is extended to others such as Jeff Bezos of Amazon (AMZN) and at the top of other leading tech companies then the world of investing in rational terms has ended. If and when those rational ways return we will see an enormous panic by many that will ripple across markets generally.

College Debt

We have heard little about this recently but it is a very real risk to the real economy. For two years, there has been a pandemic moratorium on US college debt repayments for 41m people, but now most of them are facing a May 1 deadline to start paying again. The freeze may well be extended but even that would only delay the inevitable.

According to four decades worth of data analyzed by Georgetown University’s Center on Education and the Workforce, 60 percent of college students earn more than a high school graduate after 10 years – but that means 40 percent do not. And at a third of those institutions, more than half of students earn less than high school graduates after a decade. Total US student loan debt at the end of last year was $1.75tn and 30 percent of US adults incurred some debt for their education. Millions face repayments into later life, according to AARP, the retirement experts.

The debt is spread over around 46 million borrowers meaning around 18% of the adult (over 18 years old) population.

That debt prevent many from buying homes or living lives that were once considered normal because many have low incomes. They were told by society before they entered college at age 18 that a university degree would guarantee life long prosperity.

Maybe they enjoyed some form of normal life during the pandemic moratorium and that would have added to the health of the US economy but that will soon end for them and the economy.

Systemic Risk With Commodity Traders’ Liquidity Problems

This is not something we hear about normally but the risk could be huge as commodity margin calls pose a macroeconomic risk. Maybe not another Lehman Brothers but potentially very dangerous. This Bloomberg article by Javier Blas tells more: Too Big to Fail Risk Looms Over Commodities

Central Banks, Inflation And The Disconnect

Central banks remain mired in another age and – like the upper echelons of law, public service and media – they fail to reflect the diversity and reality of life in the western world in 2022.

I mentioned above that the Bank of England’s “solution” to house price and other inflation problems is raising interest rates.

In the eurozone Eurostat reported that in the final quarter of 2021 hourly wages rose at an annual rate of 1.5% while inflation surged by 4.6% resulting in a fall in real wages of 3%. Since then, Putin’s invasion of Ukraine has made matters worse by forcing food and energy prices up drastically to the point that consumer prices rose 7.5% in March.

If the ECB raises rates it worsens the risks inside the real economy and risks causing another eurozone debt crisis due to the unsustainable level of public debt in Italy. The last crisis was caused by the public debt levels of Greece. Italy’s economy is some 10 times that of Greece!

In the US we see much complacency about the state of the economy but a closer look inside the real economy shows an awful picture for many. One example recently reported was that of about 14% of Con Edison’s 3.4 million residential and commercial customers in New York are more than two months behind on their electricity bill payments, an increase of 42% since before the pandemic and worsening rapidly now due to inflation. More than 175,000 customers received “final termination” or disconnection notices in February according to the New York Public Service Commission. No doubt similar is happening in other parts of the US as people almost certainly prioritize paying their mortgage or rent first and those payments will increase when the Fed raises interest rates.

Overall, total U.S. household debt increased by $333 billion during the fourth quarter to $15.58 trillion, according to the New York Fed. Throughout 2021, debt balances-including mortgage, credit card, auto, and student loans-grew by $1 trillion, largely driven by mortgage balances. United States credit-card balances increased every quarter in 2021, with the fourth quarter gain the largest in figures dating back 22 years, data shows. U.S. credit-card bills jumped sharply last quarter as Americans returned to pre-pandemic spending habits. It will have jumped again in recent weeks as people try to maintain living standards while faced with paying for higher food and energy costs with low pay.

“The total increase in nominal debt during 2021 was the largest we have seen since 2007,” Wilbert Van Der Klaauw, senior vice president at the New York Fed, said in a statement.

We all know what happened in 2007 and he is a member of the Fed that is itching to raise interest rates almost guaranteeing a repeat of that history!

I will leave the last word on that to Bill Gross – the former bond king and founder of Pimco – who recently said in this interview with the Financial Times “I suspect you can’t get above 2.5 to 3 percent before you crack the economy again”. “We’ve just gotten used to lower and lower rates and anything much higher will break the housing market.”

Breaking the housing market will break the US economy and take much of the world down with it. As of 2020, spending on housing services was about $2.8 trillion, accounting for 13.3% of GDP. Taken together, spending within the housing market accounted for 17.5% of GDP in 2020. Source.

The great disconnect will worsen with ESG mandates. The solution to the inflation problem central banks want to control is more supply. Higher interest rates deter investment in more supply but that fact does not suit their siloed way of thinking. More restrictions to supply will come from ESG investing being added to their mandates. ESG criteria by many financial sources have already prevented some new copper mines from being developed and more oil wells being drilled causing prices for those and other commodities to surge so central banks want to put up interest rates to stop that. Adding ESG to their mandates guarantees more of the same because copper mining is a polluting activity but vast amounts of copper are needed for wind turbines, solar power, electric vehicles, etc. One’s head spins! I prefer to think of more rational things such as…

China As Threat And Crash Savior

Threat. I covered the threat China poses in The Coming China Led Crash on Oct 14, 2021. Many of the points in there remain and especially the property sector problems. About 29% of China’s GDP and 40% of bank assets are tied to the property market and estimates of default rates are very high. I saw a recent report saying lenders do not know which big borrowers will survive and that could cause credit markets to freeze. Total debt is now nearly 300% of GDP.

On top of that the government’s Covid Zero policy has locked down over 80 of China’s 100 most productive cities. That has had an immediate effect on already stressed supply chains worldwide plus is pushing China closest to something resembling a recession – say only 3-4% annual growth – than at any time in the past three decades; almost an implosion in a country that has sometimes grown over 10% per year. Year on year growth was 4% in the last quarter of 2021 and Covid lockdowns have slowed things further since.

Chinese leaders have a choice – Covid led politics or growth – and that choice will be a key driver of the global economy this year.

Crash Saviour. My bet is that growth needs will mean a face saving gradual exit from the Covid Zero policies and partly because those are causing protests among a mostly subservient population during a year when Emperor Xi seeks reappointment.

Signs supporting this include both fiscal and monetary boosts to the economy. On the monetary side and unlike western central banks the Chinese RBOC is starting to push through lower interest rates and encourage banks to lend more to business on less stringent terms.

On the fiscal side, the state will build 20,000 kms of high speed rail in the next 12 years. It already has more than the rest of the world combined. That is good for productivity and the economy. As far as I know the US still has not one inch of high speed rail in service! Other big infrastructure investments are being planned. It also leads the world with high speed internet. Only 2.4% of connections in Europe are 5G and 15% in the US. China has 30% and is growing that fast.

China’s combined trade with the EU and the US was $1.4tn in 2021. That is around ten times the trade with Russia so it is unlikely China will risk that by openly supporting Russia.

That leaves us with a question needing an answer…

How To Beat The Next Leg Down

Compliance with SEC rules could keep some Chinese companies listed in the US so Chinese companies may therefore be one place to invest avoid the crash! Also the Chinese regulators that cracked down on big Chinese companies last year have just approved new online games for the first time in nine months, including one from search giant Baidu. That suggests the government is easing its crackdown in order to get stock markets moving again.

I do not follow Chinese companies so cannot recommend any. Readers might share their favourites in comments on this article so that we can all learn more.

My beat the crash bets are in commodities and specifically in natural gas and related companies, mostly in the US. I put that in my conclusions to earlier crash articles and it has paid off well. I mentioned the ESG disconnect above. The result of the ESG movement is that there’s been massive compression in oil and gas stocks and that has just started to change as it becomes realised that a balance is needed between ESG and reliable energy supply. Putin’s awful invasion of Ukraine has focused minds in a way that few other things could. Political/ESG mood change in the US will speed natural gas drilling and facility approvals.

I have already done very well with natgas driller Antero Resources (AR) being up 73% since my article A Crash is Becoming Certain was published on Nov 1, 2021, and up 270% in the past 12 months.

US LNG is among the cheapest in the world and the world needs more. The EU needs it to reduce its dependence on Russia for natural gas and India and China need it to replace filthy coal for power generation.

I have Cheniere Energy (LNG) to take advantage of that and am up 32% since that article and 87% in the past year. My other main LNG bet is Tellurian, up 48% and 224% respectively.

I do not see any reason for that progress not to continue given the growing demand in world markets and mostly higher prices from other sources. A look at history also gives some idea of where they can go. In 2014 AR peaked at $65.67. Today the price is $35.28 and today AR is in better shape than then.

TELL peaked at $14.40. As I write the last price was $6.91 yet today it is much further advanced with its plans to build an LNG export facility.

Only Cheniere is higher today than then due to its being much further advanced with its LNG export facilities then, but I still expect it to go higher as expansions to those come on stream and natgas prices get pushed up.

One other advantage with these is they are US stock exchange listed, priced in USD and – even if misguided for other things – the Fed raising interest rates will keep the USD strong.

I and others would welcome learning about readers picks in comments on my article below.

Best of investing luck in the potentially risky times ahead.

Be the first to comment