guvendemir/E+ via Getty Images

Investment Thesis

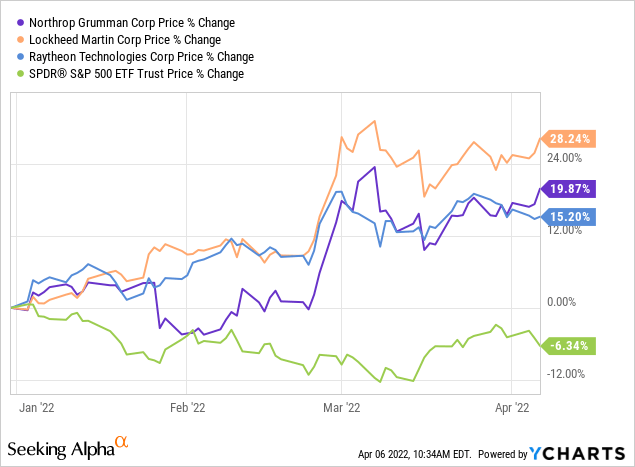

The defense sector has caught a bout of investment from various countries that are boosting their defense spending in light of the recent Russian invasion of Ukraine. Defense stocks such as Raytheon Technologies (NYSE:RTX), Lockheed Martin (NYSE:LMT), and Northrop Grumman (NYSE:NOC) have lifted off through the turmoil, with all three beating the returns of the S&P 500 YTD.

As the chart shows, these stocks have crushed the S&P 500 so far this year. It begs the question, however, how sustainable is the rally? And furthermore, what is the best company of these three leaders. I argue that RTX is a buy, LMT is a hold, and NOC is a sell based on my DCF valuation that will be discussed below. But first, let’s take a look at the business models of these three aerospace and defense giants.

Summary Of Business Models

The mission of these companies is very similar; to provide defense solutions to customers worldwide. This includes advanced aircraft, missile defense systems, advanced weapons with long-range fire capabilities, and even cyber solutions. The majority of sales are to the United States Government (64.84% for LMT, 86.03% for NOC, and 86.71% for RTX) and the rest of sales are spread mostly across countries in the Middle East and Europe. Each company has its own unique product offerings, however, which makes them differ. Lockheed Martin, for example, specializes in its “F-35” Jet which accounted for 27% of total sales in 2021. Below is a picture of the fighter jet.

F-35 Fighter Jet – Lockheed Martin (Theaviationist.com)

Raytheon specializes in air/missile defense, with its most notable product being its “Patriot”, a missile defense system that uses a proprietary GhostEye™ sensor system to detect/eliminate incoming ballistic missiles. Yes, these things exist. Below is a picture to prove it.

The Patriot, made by Raytheon (Army-technology.com)

Lastly, Northrop Grumman, which has its MQ-4C Triton, an unmanned aircraft system (UAS) that provides wide-range surveillance over oceans for the U.S. Navy.

MQ-4C Triton – NOC (northropgrumman.com)

While these companies have hundreds of products and services that cover the defense sector, the few I’ve provided serve as examples of the cutting-edge technology being produced. Given the need for wartime products in the current geopolitical environment, it is no wonder why these stocks have taken off this year.

Rising Geopolitical Tensions

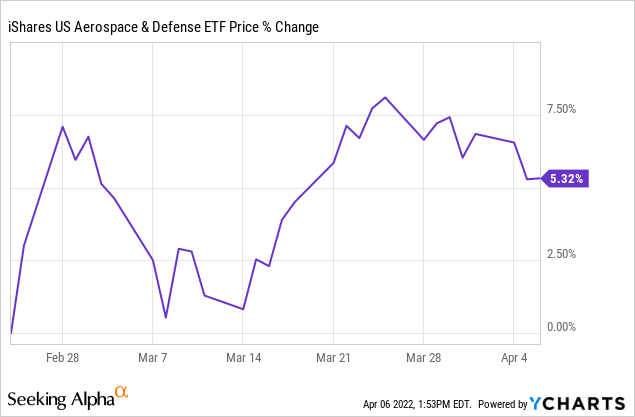

Since the announcement of Russia’s invasion of Ukraine, the defense sector has caught steam. Below is the performance of the iShares U.S. Aerospace & Defense ETF (ITA) since the invasion.

Since then, many nations have gotten involved by imposing sanctions on Russia and providing aid to Ukraine. Additionally, Russia’s invasion is a wake-up call to the rest of the world that a major superpower has now become a major aggressor. This has sparked a flux of budget increases for the defense sector.

Increased Defense Spending

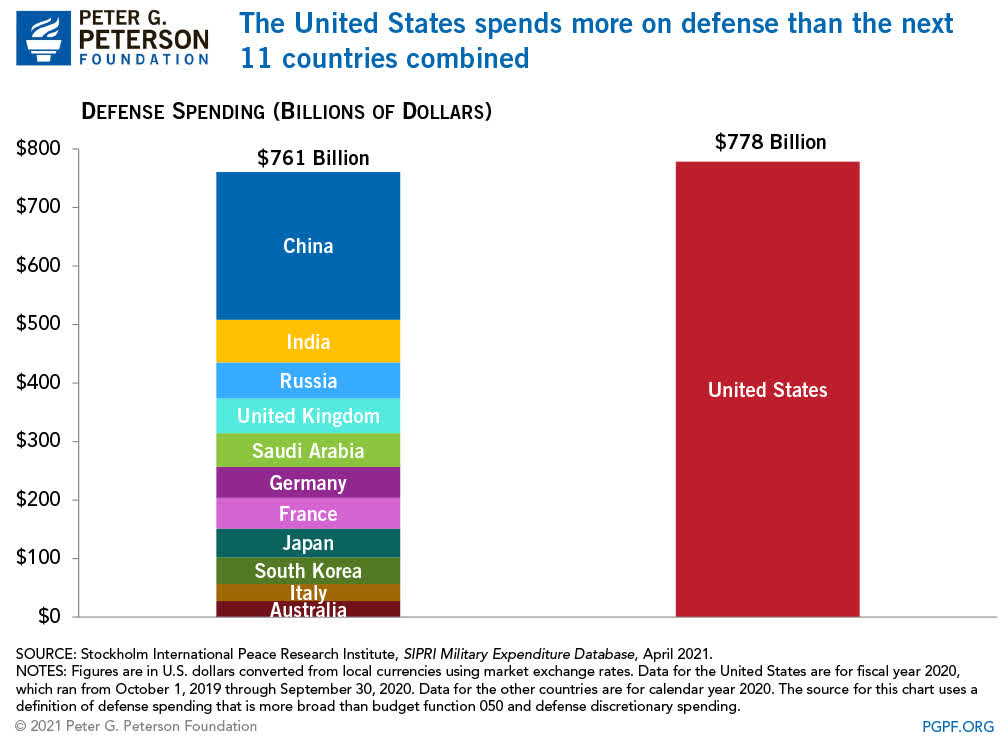

In the past month, seven European nations have increased their defense budget. These nations include Germany (€100B increase) and Belgium (€2.5B). Five other nations vowed to increase defense spending with several now meeting the NATO threshold (2% of total GDP). The United States spends the most on defense, as shown in the chart below.

www.pgpf.org/blog/2021/07/the-united-states-spends-more-on-defense-than-the-next-11-countries-combined

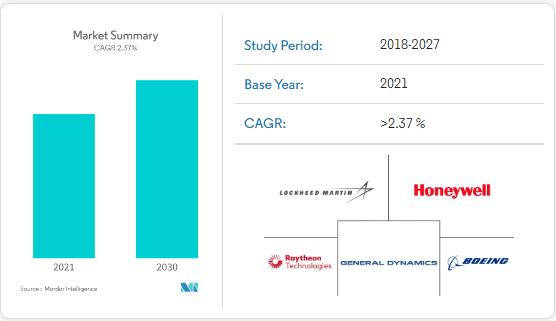

Congress passed a $778B spending bill at the end of last year and now the United States spends more on defense than the 11 countries pictured above. Given most of NOC, LMT, and RTX’s contracts are to the United States, a large amount of spending is positive for their operations. Moving forward, it is anticipated that the defense sector will continue its growth and register a 2.37% CAGR through 2030.

US Aerospace and Defense Market Outlook (Mordon Intelligence)

Much of the recent growth is being priced into LMT RTX, and NOC’s share prices, but are these companies still undervalued? Before assessing the DCF models for each company respectively, let’s first compare their recent growth

Comparing Recent Financial Performance

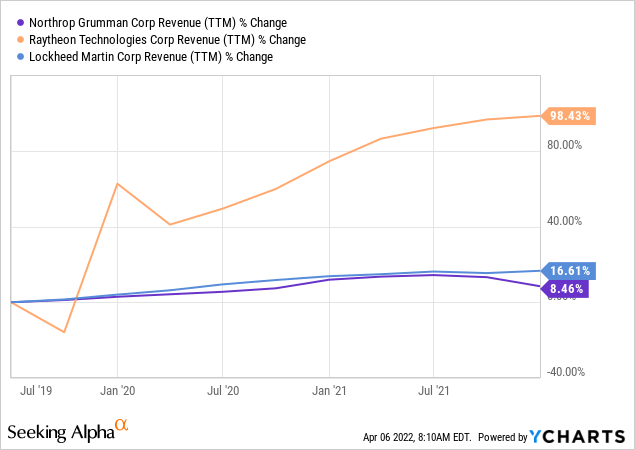

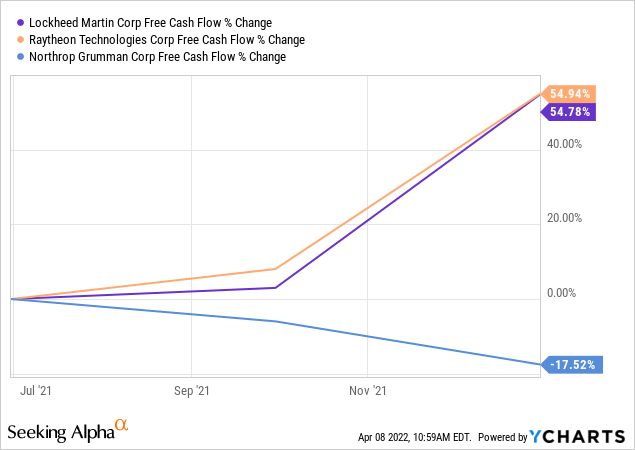

In terms of top-line growth, RTX has grown revenues at the fastest pace over the past three years as shown below.

This was primarily the result of the company’s merger with United Technologies’ Collins Aerospace and Pratt & Whitney, which have supported RTX’s revenues. In terms of free cash flow, on a Y/Y basis LMT and RTX have materially outpaced NOC.

LMT and RTX have increased their free cash flow by ~55% over the past year, while NOC’s has declined by ~17.5%. This is concerning for NOC, given the United State’s increased spending on defense and the companies inability to produce excess free cash flow as a result.

Raytheon Technologies Valuation

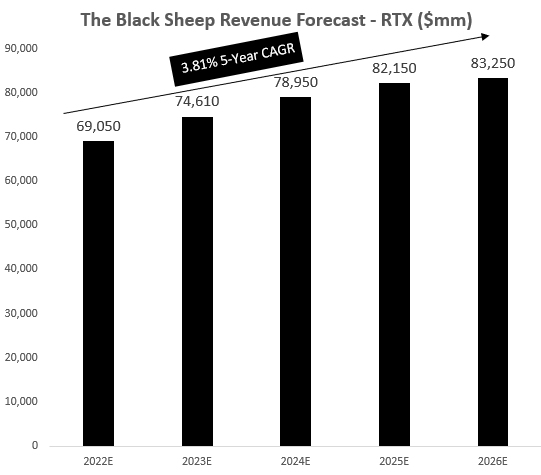

RTX remains my only buy across these three companies due to my optimistic revenue forecast which can be found below.

Revenue Forecast RTX (Image made by author using own forecasts)

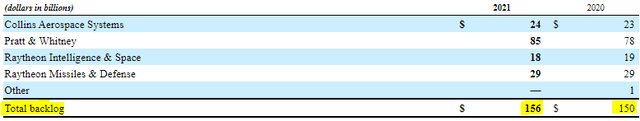

RTX recently won a missile & defense contract for next-gen US Navy Ships that totals $2.5B over the next four years. Layer this revenue boost with a backlog that increased $6B Y/Y to $156B at the end of 2021, and I see a company with secure revenue streams that will be recognized in the coming periods.

Backlog RTX (SEC 2021 10-K Filing )

For these reasons, I am optimistic the company will deliver a 3.81% 5-year revenue CAGR. The rest of my assumptions for my DCF model can be found below.

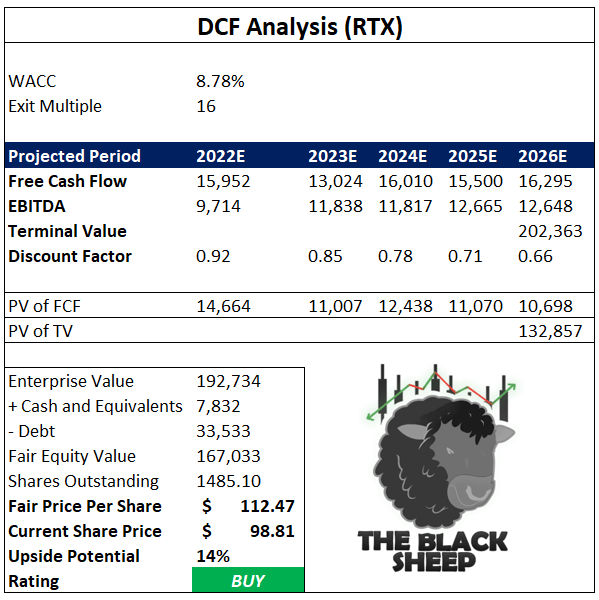

DCF – RTX (DCF made by author using own forecasts)

Assumed in the model is a 8.78% WACC, exit multiple of 16 on year five EBITDA in which I receive a terminal value of $202.36B. After discounting all cash flows, the terminal value, subtracting net debt and dividing by shares outstanding I derive a fair share price of $112.47. This is ~14% above where the stock is currently trading and therefore represents a buying opportunity for investors.

Lockheed Martin Valuation

I maintain a hold on LMT shares as my top-line growth assumption and subsequent free cash flow metrics maintain that the stock is fairly valued. My revenue assumptions can be found below.

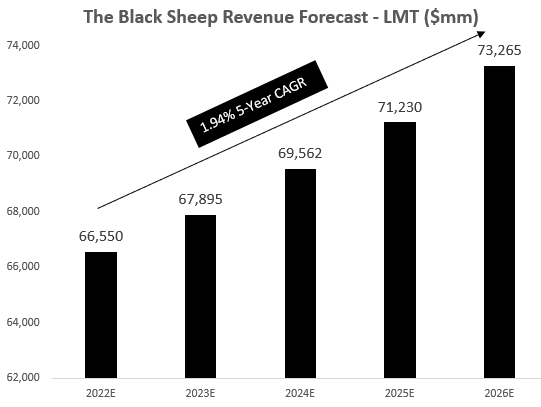

LMT Revenue Forecast (Image made by author using own forecasts )

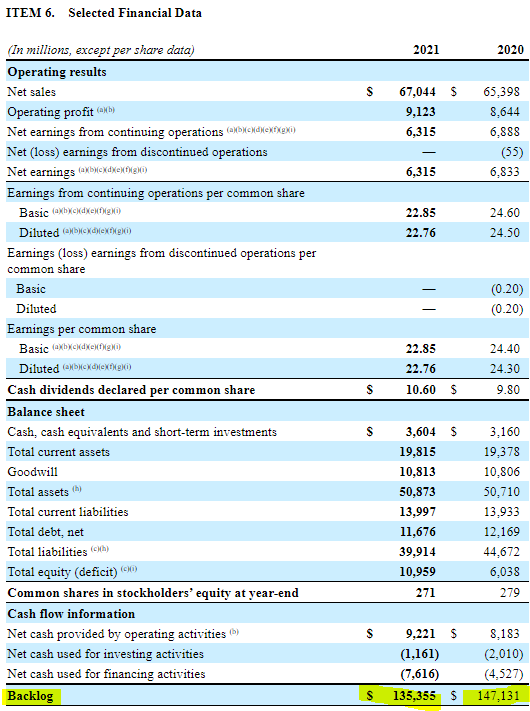

My revenue outlook is driven by the company’s backlog of $135.35B, which it will recognize over the coming years. Comparably, The companies backlog is ~$20B less than RTX and shrank ~$12B Y/Y.

LMT Backlog (2021 10-K SEC Document)

Because the company continues to have a demand buffer in its backlog, I revenues should continue to be resilient. My overall forecast is a 5-year revenue CAGR of 1.94%. The DCF model for LMT can be found below.

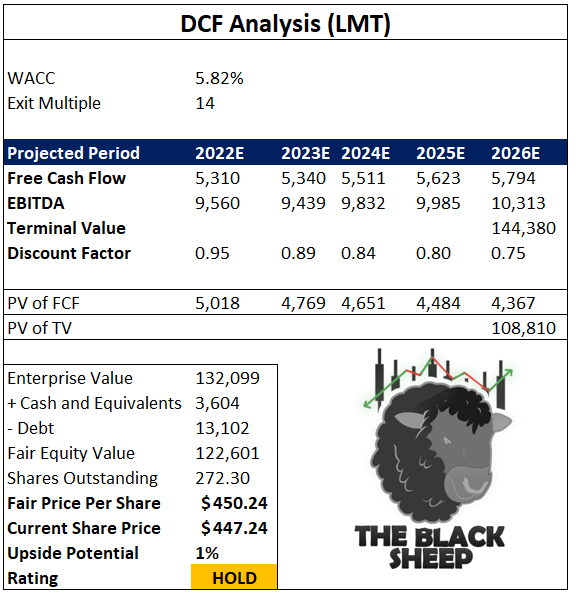

LMT DCF Model (DCF made by author using own calculations and forecasts)

I assume a WACC of 5.82% and exit multiple of 14 on year-5 EBITDA of $10.313B to achieve a terminal value of $144.38B (before discounting). After discounting all cash flows and the TV, subtracting net debt, and dividing by shares outstanding my projected fair value of the company is $450.24. This is roughly where the stock is trading and offers limited upside for investors. For this reason, the stock is a hold.

NOC Valuation

I maintain a sell on NOC, not based on a lackluster revenue growth rate (which can be found below), but its current valuation being too expensive.

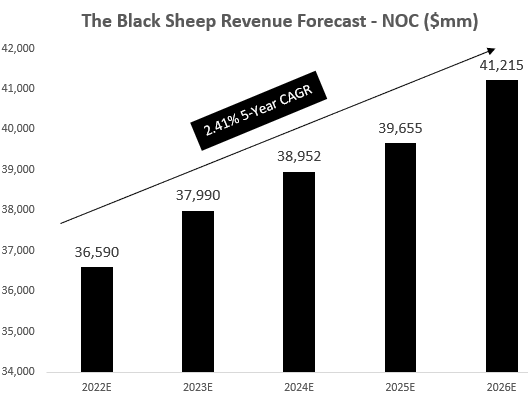

NOC Revenue Forecast (Image made by author using own forecasts )

I forecast a 2.41% revenue CAGR for the next five years, which is slightly below the industry growth rate of 2.47%.

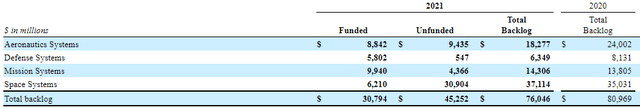

NOC Backlog (10-K SEC Filing NOC )

The company has a backlog of $76B which decreased ~$4B Y/Y. This revenue will be recognized in the coming years as performance obligations are satisfied.

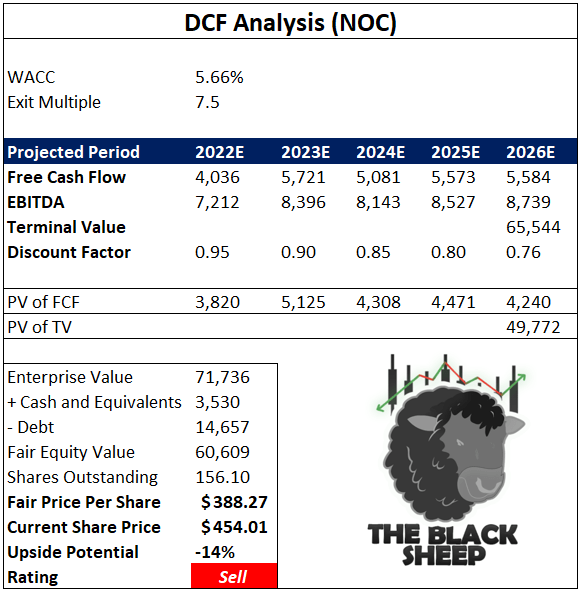

NOC DCF Model (DCF made by author using own forecasts and assumptions)

In terms of my DCF model, I assume a 5.66% WACC, 7.5x exit multiple on year-5 EBITDA and arrive at a terminal value of $65.54B. After discounting all cash flows and the terminal value, subtracting net debt, and dividing by shares outstanding I get to a fair share price of $388.27. This is 14% below where the stock is trading at and therefore represents a selling opportunity.

Balance Sheet Comparison

LMT, NOC, and RTX all maintain strong financial standing. A summary of their balance sheets can be found below.

| Important Balance Sheet Metrics | LMT | RTX | NOC |

| Total Cash |

3.60B |

7.83B |

3.53B |

| Total Cash Per Share |

13.23 |

5.28 |

22.67 |

| Total Debt |

13.10B |

33.55B |

14.66B |

| Net Debt |

9.50B |

25.72B |

10.71B |

| Total Debt to Equity |

119.55% |

44.92% |

113.39% |

| Short Term Debt |

– |

134.00M |

– |

| Long Term Debt |

11.67B |

31.23B |

12.78B |

| Current Ratio |

1.42 |

1.19 |

1.3 |

| Quick Ratio |

1.15 |

0.81 |

1.16 |

| Covered Ratio |

13.75 |

5.02 |

13.48 |

| Book Value Per Share |

-12.31 |

-13.38 |

-33.06 |

| Debt/Free Cash Flow |

8.24 |

12.83 |

4.59 |

| Long Term Debt/Total Capital |

53.08% |

30.47% |

52.09% |

(Source: Seeking Alpha Peer Analysis Tool)

The companies are able to take on long-term debt due to their predictability in revenues as a result of their contracts with the U.S. Government. All three companies maintain a current ratio of >1.19 showing they have ample liquidity in the near-term to cover short-term financial obligations. One might find RTX’s quick ratio (0.81) slightly concerning, but due to ~96% of its debt being long-term and having $7.83B of cash on the balance sheet, I am confident it is no issue.

Final Thoughts

Given the defense sector is set to grow at a 2.37% CAGR through 2030 and geopolitical tensions are escalating, investors are eyeing potential names to deploy capital into in the defense space. While NOC, LMT, and RTX will all benefit from the expected increase in defense spending, the valuation is only “cheap” for RTX (with 14% upside). Valuation matters and at least for now, my DCF-models show that NOC is overvalued (14% downside to fair value), and LMT is perfectly priced (~1% upside). As a result, I maintain a sell on NOC, hold on LMT, and buy on RTX.

Be the first to comment