MarsBars

Office REITs have been hit hard this year, as concerns around return to office linger, despite many employers requesting their employees return to in-person work. The silver lining in this, of course, is that office REITs can now be had at bargain basement prices.

This includes City Office REIT (NYSE:CIO), whose share price is now just several points shy of its 52-week low, and is more than half off its high of $21.70 achieved earlier this year. This article highlights why CIO and its high yield presents an attractive buy at the current price, so let’s get started.

Why CIO?

City Office REIT is an internally-managed REIT that specializes in owning and leasing majority Class A Office properties in secondary markets. Rather than focusing on highly competitive prime markets, CIO follows a differentiated strategy by focusing on what it calls “18-hour” cities. These cities have vibrant and growing populations, yet are not as congested as the Tier-1 cities.

This strategy is beneficial as CIO encounters less competition for deals in these markets from larger players such as Boston Properties (BXP), thereby resulting in higher cap rates. CIO’s 60 properties are geographically diversified across the growing Sunbelt and West Coast regions of the U.S., whose population growth has been accelerated by the pandemic.

On average, CIO’s rent has grown by 26% over the past 5 years, and management expects this outperformance to continue, and importantly, CIO has seen over 99% rent collection throughout the pandemic.

Meanwhile, CIO’s portfolio remains overall healthy, with in-place occupancy of 86% as of the end of the third quarter. This contributed to Core FFO per share of $0.39 during Q3, an increase of $0.07 over the prior year period. This more than covers the $0.20 quarterly dividend. CIO is also modestly leveraged, with a net debt to EBITDA ratio of 6.3x, with no debt maturities for the remainder of the year, and two small maturities in the fall of next year. CIO’s debt is also primarily fixed rate, thereby shielding it from the recent rise in interest rates this year.

This is not to say that CIO doesn’t have headwinds, however, as same-store NOI trended down by 4.3% YoY, in line with expectations. This was driven by lower YoY occupancy and free rent periods associated with new leases. However, before running for the hills, it’s important to note that $500K of the total $800K reduction in same-store NOI is due to one property, in which a new tenant will not begin paying rent until February 2023. As management noted, the new tenant’s 8 year leases increases the value of the property.

Moreover, management highlighted the challenges of return to office, but noted that highly amenitized properties are well-positioned in the marketplace in terms of their appeal to tenants and their employees, as noted below during the recent conference call:

To accelerate a return to the office and increase employee retention in a tight labor market, employers are looking for highly amenitized office buildings that have outdoor spaces, fitness centers, lounges, food and beverage options and updated finishes. Likewise, there’s heightened demand for ready-to-lease space with desirable buildings.

Our property, The Quad in Phoenix is an excellent case study in this. The property has high end amenities, including a fitness center, outdoor tenant and common space, event and conference areas and a great on-site restaurant.

The property is 100% leased today with a waiting list and we are continuing to achieve new high watermark lease rates with minimal tenant improvements. Fortunately, we have assembled a quality portfolio and a high percentage of the value of our company is invested in properties that are very well positioned for these trends.

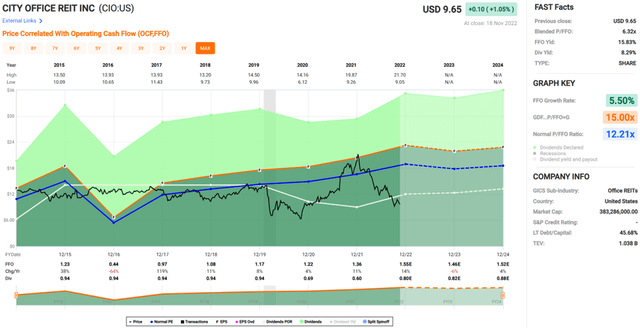

Turning to valuation, I find CIO to be rather cheap at the current price of $9.65 with a forward P/FFO of just 6.2, sitting at about half of CIO’s normal P/FFO of 12.2.

Management apparently thinks the stock is too cheap, as it is rare for a REIT to execute a share buyback program. CIO did just that in the second and third quarters of this year, by buying back $50 million worth of common stock, at an average price of $12.48. Analysts have a consensus Buy rating on CIO with an average price target of $12.50, translating to potentially strong double-digit annual returns.

Investor Takeaway

CIO is a well-diversified Office REIT that has seen strong rent collections throughout the pandemic. The company’s core FFO per share continues to cover its dividend, and management keeps leverage in check. While return to office poses a challenge for the entire office sector, CIO’s modern and well-amenitized properties should continue to attract top tenants. With potential for double-digit returns, CIO looks to be an attractive option for investors looking for income and capital gain potential.

Be the first to comment