peepo

I like the old adage, “everything in moderation.” Extremes on either side of anything are never sustainable as per the picture above of the woman holding onto the side of a mountain with one hand. With respect to interest rates in the economy, the very same can be said.

Investors have to appreciate the extent of interest rates in the cost of servicing debt, especially to the extent of the size of the economy.

The US economy and the world for that matter, has an inflation problem. The problem is specifically that the cost of living is exceeding rise in wages creating what’s called stagflation. The inflation rate in the US is running at 7.76% in October of 2022. Wages in October were up just 4.72%.

A major driver of inflation is the rate of overall credit growth. The Federal Reserve bank aims to raise interest rates, or the cost of borrowing new money higher with the goal of slowing credit growth. This will in turn have a strong impact on the rate of inflation from the monetary side.

The Fed has been raising rates very fast and the US Prime interest rate is now 7.00%. This is the rate that banks will charge their best customers for the cost to borrow money. It’s this rate that makes for a good exercise of the extent of the rate of interest on money relative to the overall debt and the size of our economy.

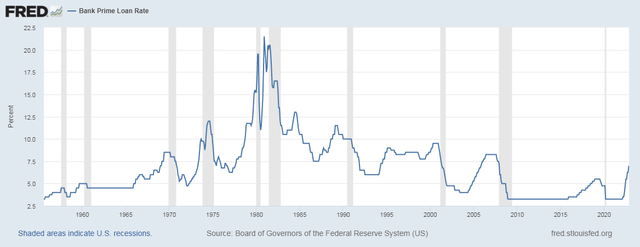

Prime Rate

Prime Loan Rate (St. Louise Fed FRED)

In December of 1980, the Prime Loan rate peaked at 21.50%! One year later, it would be 15.75% and a year after that, by December of 1982, it would be 11.50% or a full 10% lower than just 2 years prior. At nearly every peak in the prime rate, the prime rate 1 – 2 years out would be substantially lower.

Looking at the Prime Rate longer term, since 1980, the Prime bank loan rate has had consistently lower highs and lower lows. Today, the rate is 7% and that is higher than the last high at 5.50% in 2019. So we have now broken out from these levels of lower highs. This is certainly creating a new paradigm of what’s to come I think.

There is a substantial difference this time however and that has to do with the amount of debt relative to the overall economy as I will try to elaborate upon.

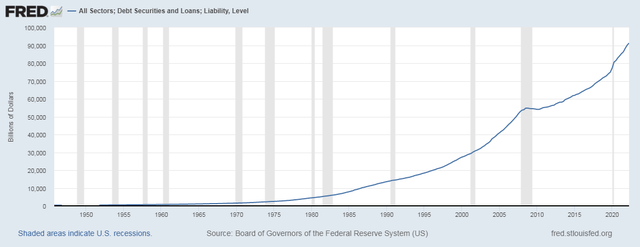

Debt

When we look at debt we have to look at overall debt in the US economy. Mortgage debt, business debt, Federal Government debt as well as State and Local debt. Student loan debt, car loan debt and credit card debt. Add it all up and we have what’s called “All Sectors Debt Securities And Loans.” The chart of it looks like this:

All Sectors Debt Securities and Loans (St. Louis Fed FRED)

As of the 2nd Quarter of 2022, it was at $91.225 Trillion. At a minimum, it’s probably grown about 2% since then as of the 4th Quarter of 2022. To make a guess as to the current level of overall debt in the US economy, I would estimate it at about $93.05 Trillion.

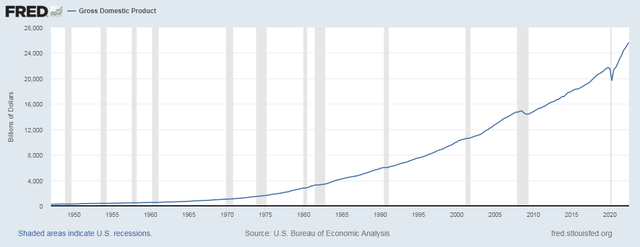

US Economy – GDP

US GDP was running at an annualized rate of $25.663 Trillion as of the 3rd Quarter of 2022. I would estimate that in the 4th quarter, the US economy would grow 1.4% over the 3rd quarter putting the GDP at $26.02 Trillion in the 4th quarter.

Prime Rate to Debt to GDP

A good exercise to perform is to see how Prime Rate cost of money interest expense would compare to the overall economy or the GDP.

I’m simply taking the Prime Rate and multiplying that against the overall debt in the US economy and comparing that as a percent of GDP.

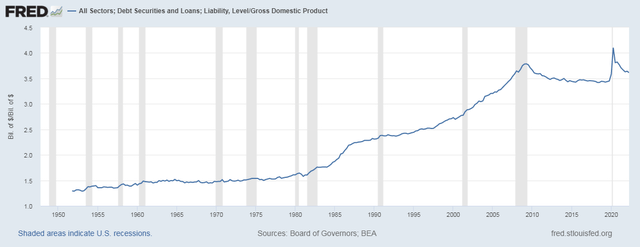

First, I’d like to show the extent of US debt relative to the US economy as that plays a substantial role in the rate of interest to which it can withstand.

Debt To GDP (St, Louis Fed FRED)

US Debt was running at about 3.61x its GDP as of the 2nd Quarter of 2022. This compares to 1980 when it was about 1.6x GDP. Today, the US economy is very leveraged and its ability to service debt at high interest rates is not only not sustainable but impossible if rates become too high.

Everything is relative so this exercise helps put the Prime Rate of interest relative to the level of debt and the economy in perspective.

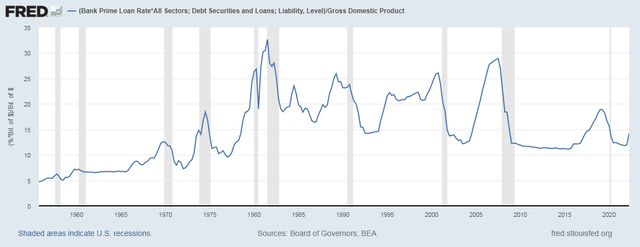

Prime Rate To Debt To GDP (St, Louis Fed FRED)

This is in effect, the carrying cost of the debt relative to the economy. It’s been, frankly, well managed over the years. It’s ranged between 11% and as high as 32.56% in the 3rd quarter of 1981. It reached 26% in 1989 and again in 2000. In 2007, it reached nearly 29%. In 2019, it peaked just under 19%.

As of the 2nd quarter of 2022, it was at 14.20%. In the 2nd quarter, the prime rate averaged just 3.93% as the Fed was only just beginning to raise rates substantially and fast. We’re now in the 4th quarter of 2022 and the rate is 7.00%.

The Bank Prime Rate at 7.00% today with $93.05 Trillion in debt is about $6.51 Trillion. With a GDP estimated to be about $26.02 Trillion in the 4th quarter of 2022, that makes the $6.51 Trillion debt service at about 25% of GDP per my exercise.

Conclusion

History suggests that such a high rate of interest relative to the debt of an economy is simply unsustainable. Perhaps interest rates peak in the 1st quarter of 2023, but once they do, as has always happened in the past, rates will drop hard to ultimately alleviate the heavy burden of the cost of money.

Inflation could very well by all means drop to 2% easily. It does appear inflation is beginning to fall, although wages are falling as well. Both will fall in tandem, although wages could very well fall faster than inflation. What matters will be wages and household incomes and their ability to keep up with the rate of increase in the cost of living. That’s a horse of a different color.

In markets, what goes up very fast, goes down very fast. Interest rates have gone up very fast and we could very well find ourselves soon enough, where interest rates will be falling very fast as soon as 6 -12 months out and into the following year. The Prime Rate would need to get back to a level where the debt service is between 12% – 15% of GDP, which would put the Prime Rate between around 3.5% – 4% again Vs. 7% today I would think.

This is more or less what has to occur to keep the economy sustained given its leverage in debt. A slowing economy and demand destruction will certainly prove to be a deflationary force that will help lower rates. Same goes for lower real wages that will help contribute to lower inflation as demand will be forced to subside. This implies lower living standards relative to recent years.

Of course, anything is possible and policies can change. Rates could stay sky high and defaults could become the answer to bringing down leverage and inflation too but cause tremendous economic hardship in the process.

It should come down to what’s in the best interest for humanity and in that case, everything in moderation always.

Be the first to comment