Khanchit Khirisutchalual

This article was originally published to members of the CEF/ETF Income Laboratory on September 1st, 2022.

August was a reversal from the strong rebound we saw off of the lows touched in June. The indexes are still up quite significantly from those levels. However, a lot of the gains the market had achieved were given up after Powell spooked the market.

Besides the “some pain” remark, it wasn’t too different from what he had previously said. They intend to continue to be aggressive on inflation and want to see a trend of lowering inflation before making any sort of pivot. The market seemed to get a bit ahead of itself as it seemed to expect some dovishness after we had a cooling inflation report earlier in the month.

Before the Fed meets again to decide the direction of interest rates, we will get some more data. I believe that will provide a catalyst to either push the overall market lower if it is too hot, or it could push the market higher if it is once again showing a decrease in the pace of inflation.

No matter the direction of the market, I continue to put money to work every month as I often do. Generally, when markets are in corrections or bear markets, I’m putting most of my cash position to work. In the latest month, I added to several positions but was still wanting to build up my cash position after unloading it in May and June. So while I was buying, I was a bit less aggressive overall. Each of these five positions I had previously held. This was just adding to these positions.

Aberdeen Standard Global Infrastructure Income Fund (ASGI)

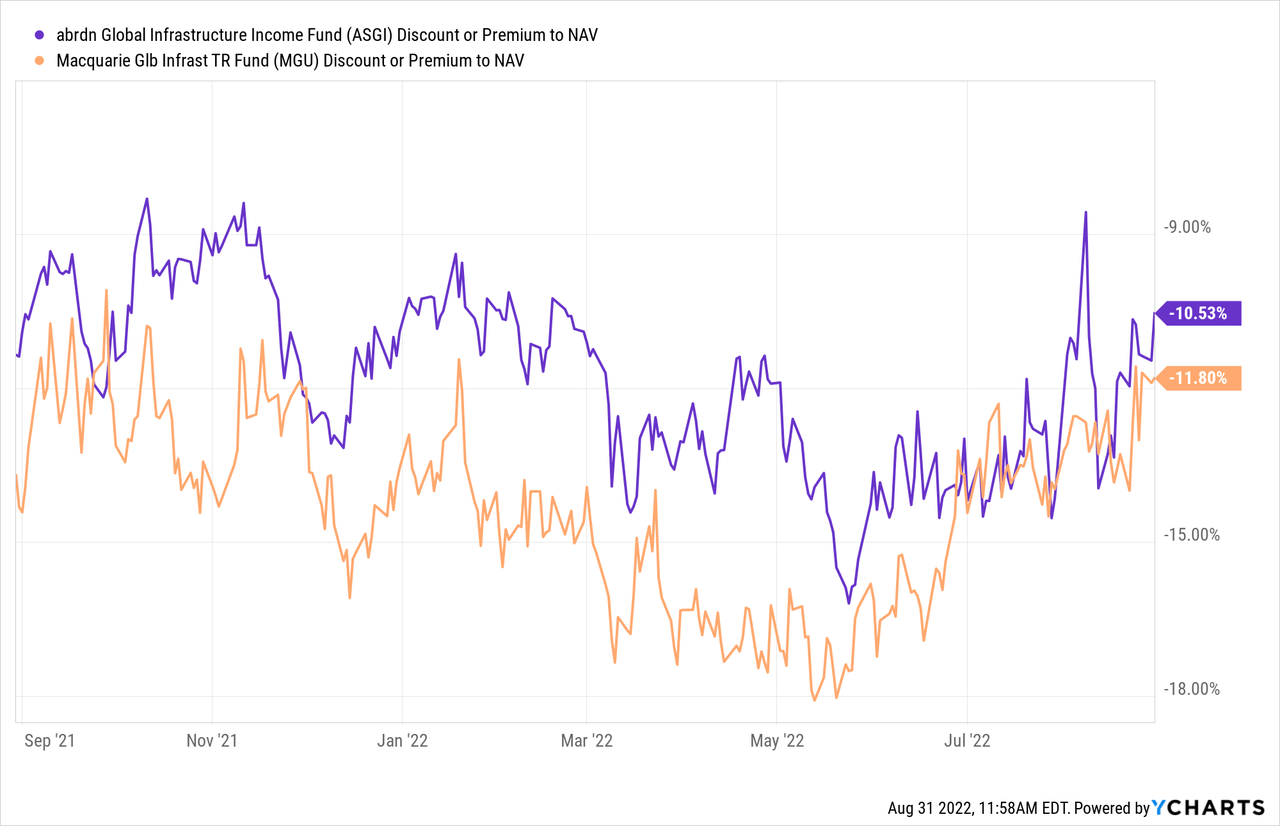

ASGI had some interesting news pop up over the last month. It was related to several Delaware funds being merged into Aberdeen funds. In this case, Macquarie Global Infrastructure Total Return Fund (MGU) is to be merged into ASGI. That will make ASGI a meaningfully larger fund. That could provide more visibility and liquidity to the fund that has otherwise been left to trade at a deep discount.

As a utility/infrastructure play with an overweight exposure to industrials, ASGI is a fund I continue to view positively. Being a larger fund only made it even more appealing, in my opinion. The one thing that I’m hoping happens before the merger takes place is that MGU will deleverage. ASGI has been successful enough without being leveraged. Although, admittedly, it’s only been around a short while.

In this case, both ASGI and MGU trade at relatively similar discounts. There really isn’t a huge opportunity here to play a backdoor move into ASGI opportunistically. They aren’t looking for completion until Q1 of 2023, so it will be something to monitor.

Ycharts

Basically, I continue to like this fund’s exposure and want to continue to add to my position at what I feel are attractive valuations.

BlackRock Health Sciences Trust (BME)

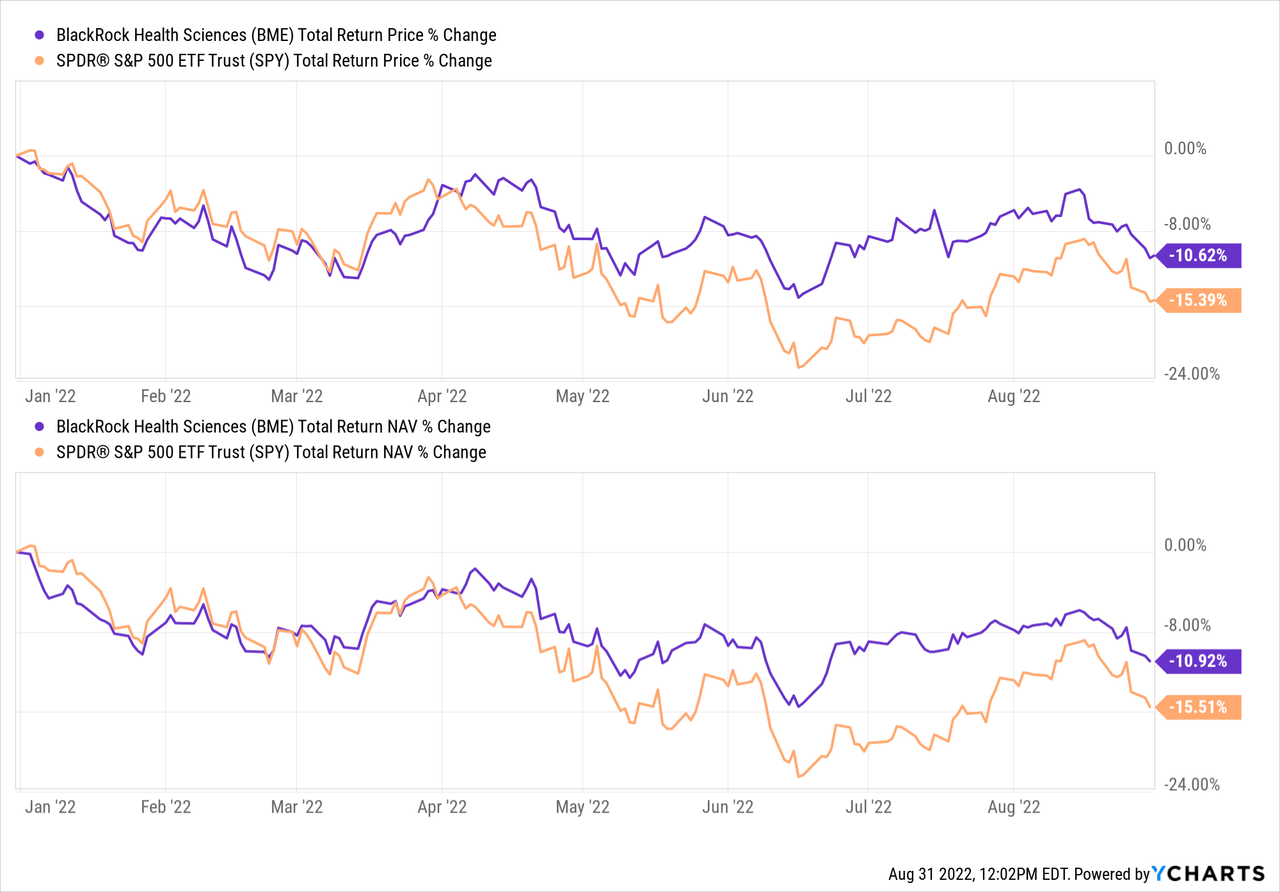

BME is another position that I just find attractive. A true core position that you can set and forget. The last time I added to this position was just back in April. As a fund focused squarely on healthcare, it has provided some protection from the overall downside of the market YTD.

Ycharts

The fund also utilizes an options writing strategy, which has further mitigated some of the downside moves for the year. That contributed over $6 million of the $17.1 million realized capital gains in the first six-month report.

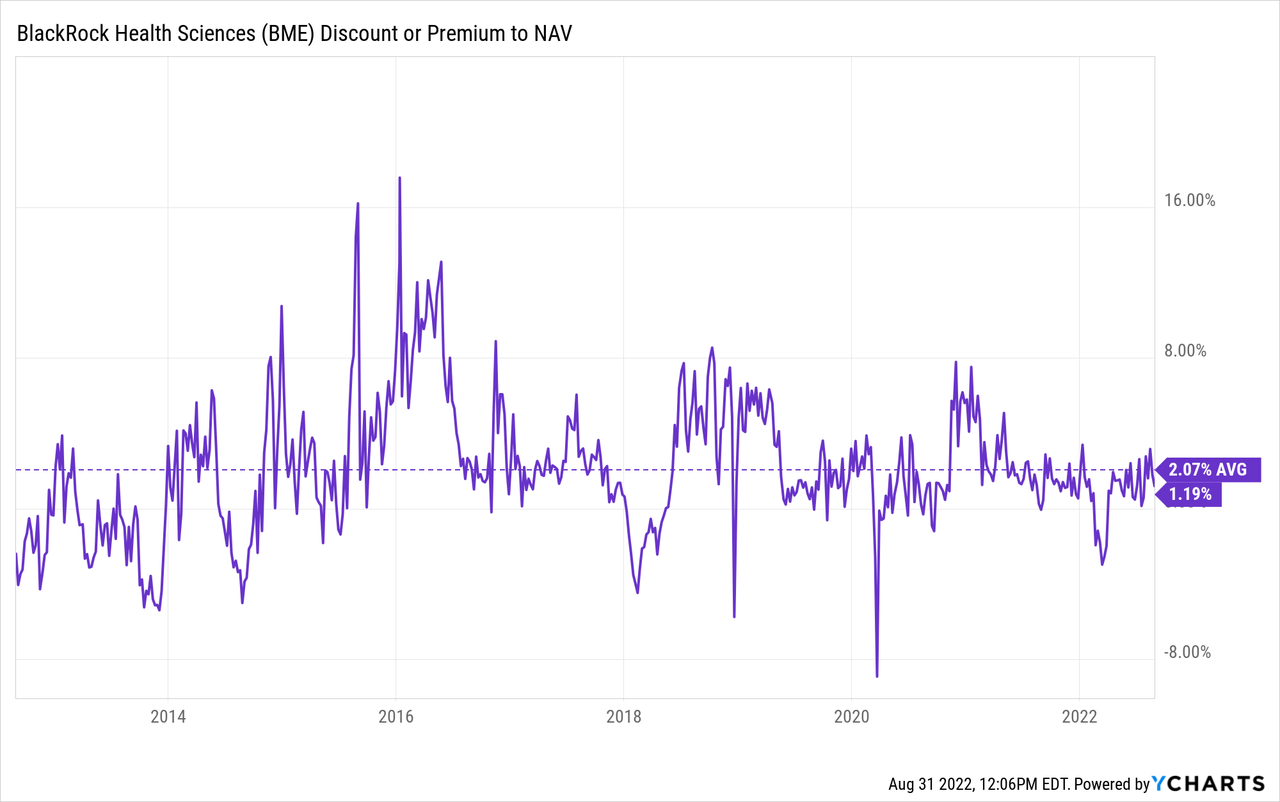

This fund is at a slight premium but has consistently been trading near this level for a while now. Given the fund’s general stability, I’m okay with paying up to a certain degree.

Over time, CEFs tend to revert back to the mean. So while a discount would be more attractive, the last ten years have shown us that now isn’t a terrible time to pick up the name based on the discount/premium. I would also argue that the declines in the underlying portfolio make it a relatively more attractive valuation too.

Ycharts

Ellsworth Fund (ECF)

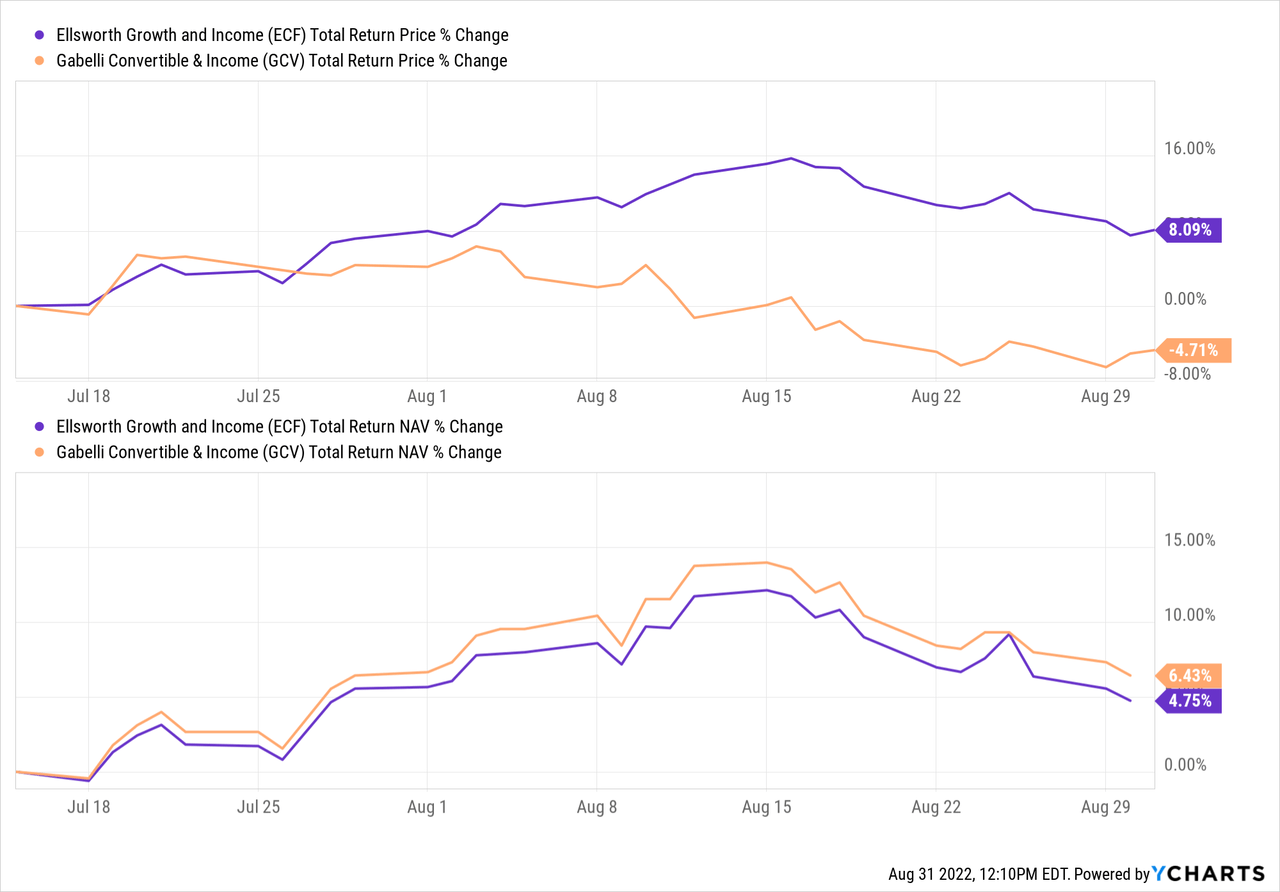

ECF is a rather interesting name that doesn’t always get a lot of attention. Its cousin, the Gabelli Convertible & Income Securities Fund (GCV), gets more praise, at least if the premium is any gauge of popularity. I had rather recently covered both of these funds and said that ECF was a better buy over GCV. I posted that piece publicly on July 17th, 2022.

It has really only been a short time, but since then, that would have been a wise move. Despite GCV’s NAV performing better than ECF, due to valuation contraction, the actual share price performance for ECF has been much better.

Ycharts

While things are looking a little better in terms of valuation for GCV, I think that there continues to be more opportunity in ECF at this time based on valuation.

This isn’t just a move on valuation, though. I also like ECF’s portfolio and the exposure that it has. I had been fairly hesitant to invest in convertible funds previously as I was less familiar with the type of asset. Over the last couple of years, I had warmed up to them. Now, I like including the exposure a bit heavier than I had done before then with holdings funds such as ECF and Calamos Convertible Opportunities and Income Fund (CHI).

ECF remains at an attractive valuation, making it an appropriate name that could be scooped up at this time.

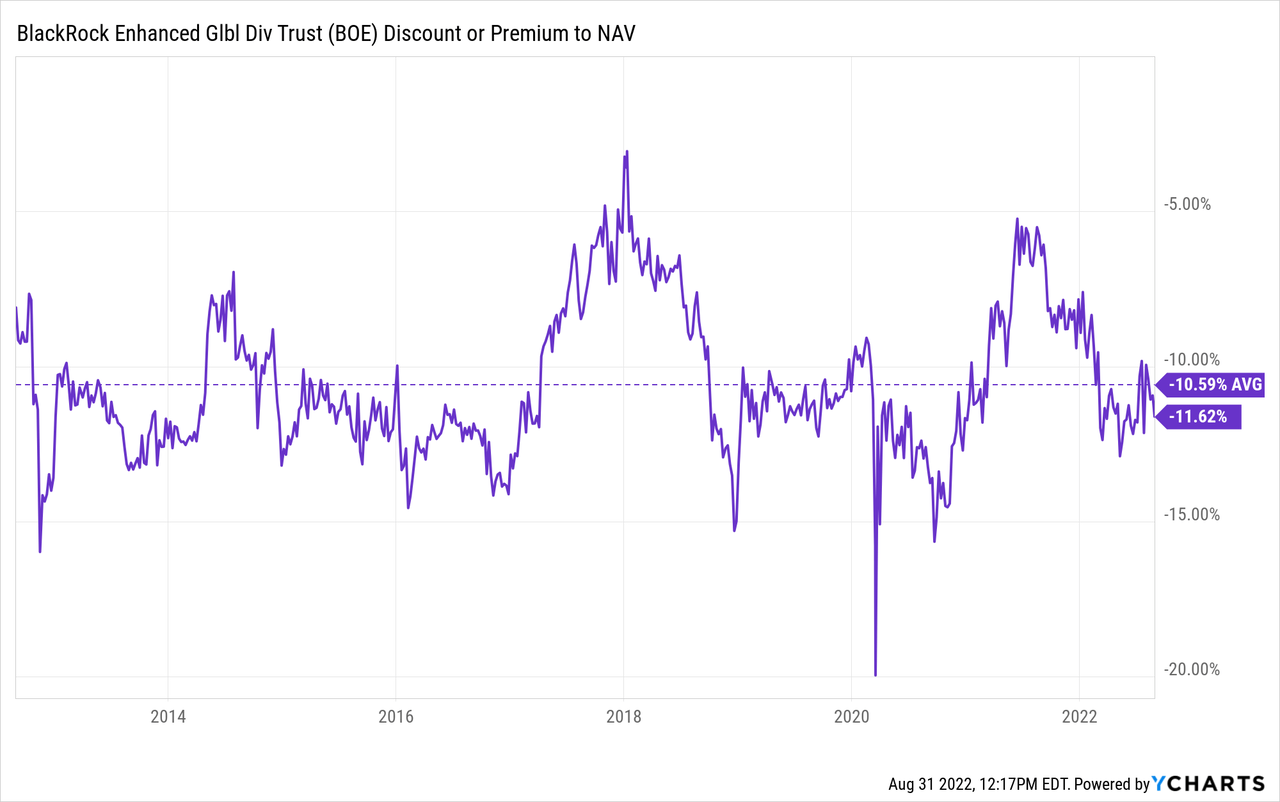

BlackRock Enhanced Global Dividend Trust (BOE)

BOE has caught my attention due to the global diversification it can offer and the attractive discount. Many funds have been reducing their discounts; it would seem, after the June lows for the market. BOE, on the other hand, continues to remain deeply discounted.

Ycharts

I had last covered BOE rather recently. Unfortunately, it was before Powell’s comments that sent the rebound of the overall market reversing lower. However, this is also another name that I continue to add to build up a position over time. The last time I added was in December of 2021.

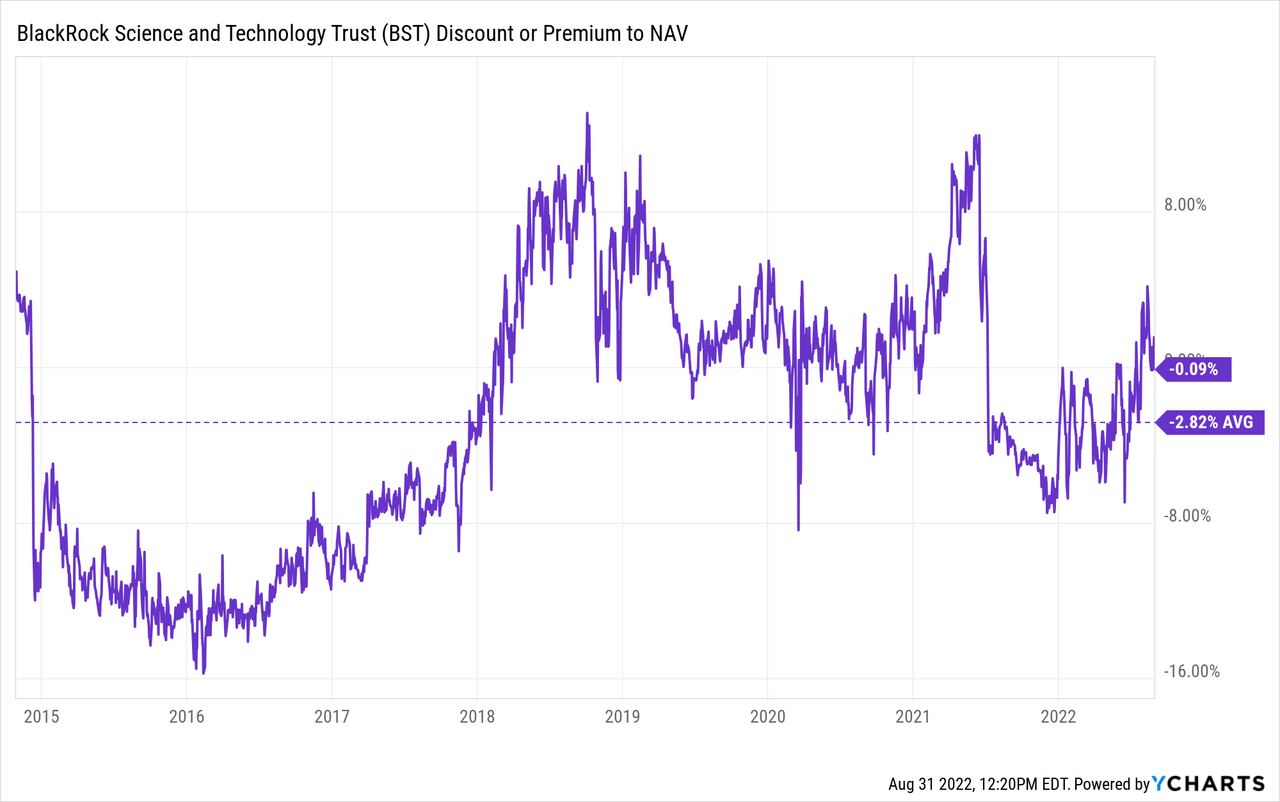

BlackRock Science and Technology Trust (BST)

BST certainly isn’t having a strong year. The tech fund has been doing about what we would expect, with the Nasdaq 100 being the weakest performing benchmark, and that is going lower and lower. Interestingly, the fund hasn’t been able to shake too far away from its NAV per share, even with the volatility the market has been experiencing.

Over the last ten years, the fund’s discount/premium has been quite volatile. Through 2018 and 2021, it regularly enjoyed premium pricing. That was before the fund launched a rights offering that saw the valuation collapse, as we typically see. It hadn’t touched a premium again until this year, which shockingly is when this fund’s underlying holdings have done so poorly.

Ycharts

For me, it was an opportunity to average down, even though the discount/premium here isn’t overly attractive. The bear market that tech is in was the more appealing factor. I don’t necessarily expect this fund to really reverse anytime soon, though, or even come close to its all-time highs again.

What I do expect is that tech won’t disappear anytime soon, either. I look forward to the regular monthly distributions this fund pays while having a high amount of tech exposure. At a NAV distribution rate of 8.61%, I think they are comfortable paying the same distribution for the time being.

This fund also utilizes a covered call-writing strategy. For the first six months, it contributed $43.629 million in realized capital gains. That was almost the entire $48.365 million in realized capital gains for the first six months of the year. They paid out $48.129 million in the period. Therefore, a meaningful portion of the payout was covered via these options written.

The shortfall came in from the net investment income that was negative $5,439,889 due to expenses being more than the dividends received. That isn’t unusual for BST or other heavily tech-focused funds.

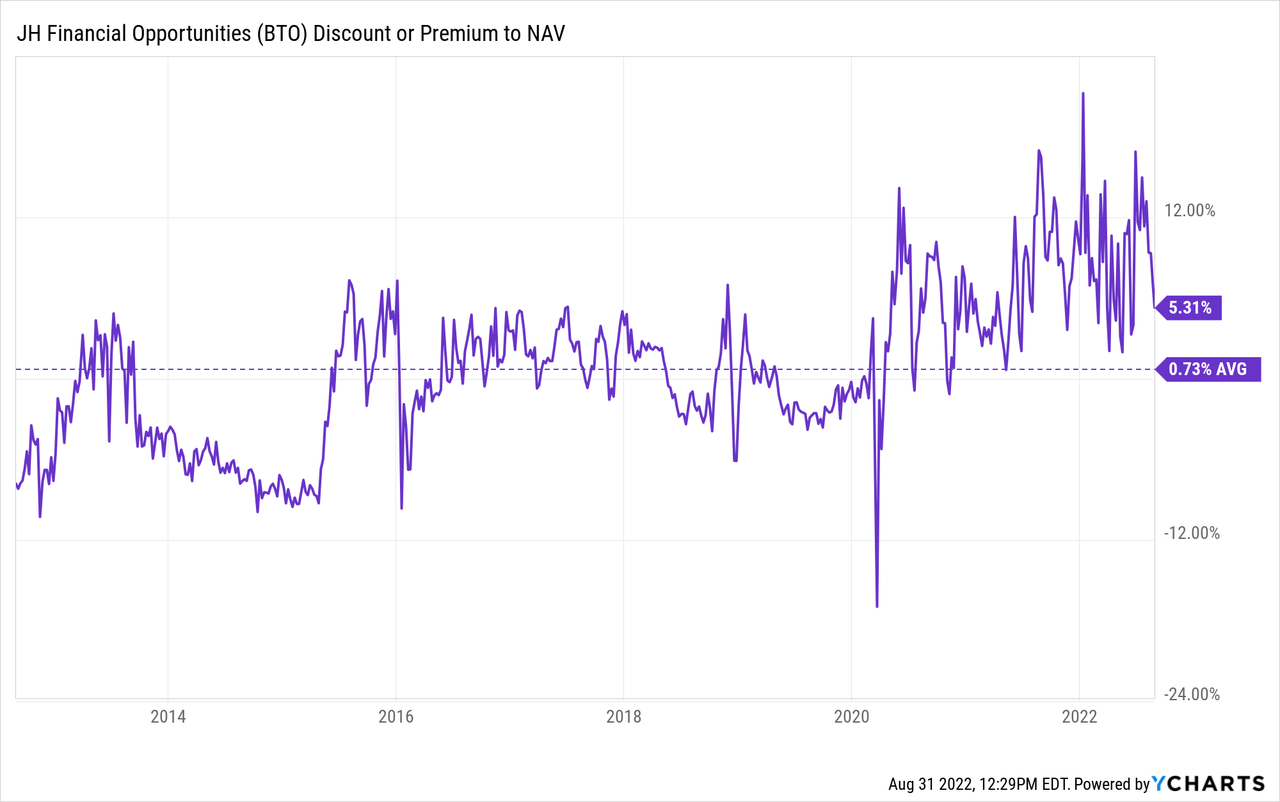

John Hancock Financial Opportunities Fund (BTO)

This was a bit more unusual for me to add to because the fund is still at a fairly large premium. It is down substantially from where it was, but I was still buying it at around a 6% premium. I don’t do that too often when it means the valuation is meaningfully above its longer-run average.

Ycharts

In this case, I’ve made an exception due to the current environment of rising rates. Generally, we should see financial institutions benefit strongly from higher rates as their net interest income can increase. On the other hand, the big bank stocks that this fund holds also have to grapple with higher expenses and economic uncertainty going forward. Higher rates are beneficial, but if we slip into an actual recession that sees demand for loans drop, then it doesn’t benefit them anyway.

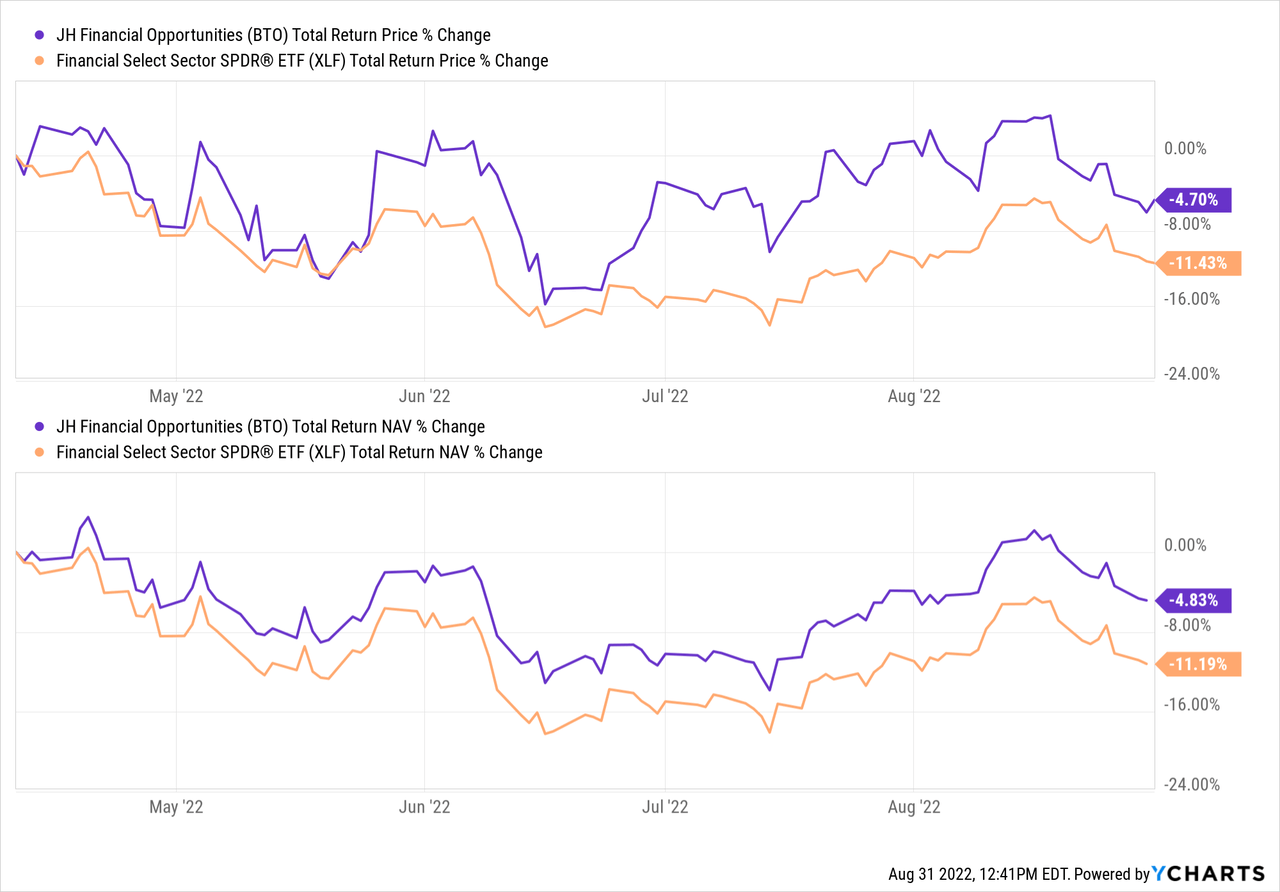

I had added to this position in April too. At that time, it was actually reentering the position after selling out of it in favor of the Financial Select Sector SPDR (XLF). The specific day was April 11th.

Ycharts

Since then, it has still worked out in my favor to have swapped out of XLF. That was against the odds as BTO employs leverage, but it still held up better. Albeit still producing a negative return during the period.

Conclusion

I’m not entirely sure where the market will head next. My first assumption would be that a further cooling in the pace of inflation could see the market head higher. The opposite could happen if inflation ticks up higher in the next report. All that being said, I continue to add or initiate positions every month. That sees my income grow month after month and quarter after quarter. In the end, that’s more of what I’m focused on. Lower prices in the market just help that goal. That is the case barring any sort of major collapse that would send equity fund distributions meaningfully lower.

Be the first to comment