josefkubes

3M Company (NYSE:MMM) is what many may consider a “boring dividend stock.” It is one of the 30 stocks in the venerable Dow Jones Industrial Average, and one of the only stocks in the world that can claim 63 consecutive years of annual dividend growth. With MMM shares now selling at a 25% discount from where they were a year ago, I consider now to be a good time to evaluate the future growth and income prospects of this name, and the best ways to harvest returns from its profitable business.

This article consists of two parts. First, I look at the big picture fundamentals of MMM through a rule of thumb framework I refer to by the acronym “GINA”, which stands for Growth, Income, Narrative, and Analyst Estimates. The first two of these checks are more backward looking and objective, while the latter two are more forward looking and subjective. Second, as a continued shareholder in MMM, I consider and compare 3 option strategies and their impact on my overall risk vs reward on this name going forward.

3M’s Growth

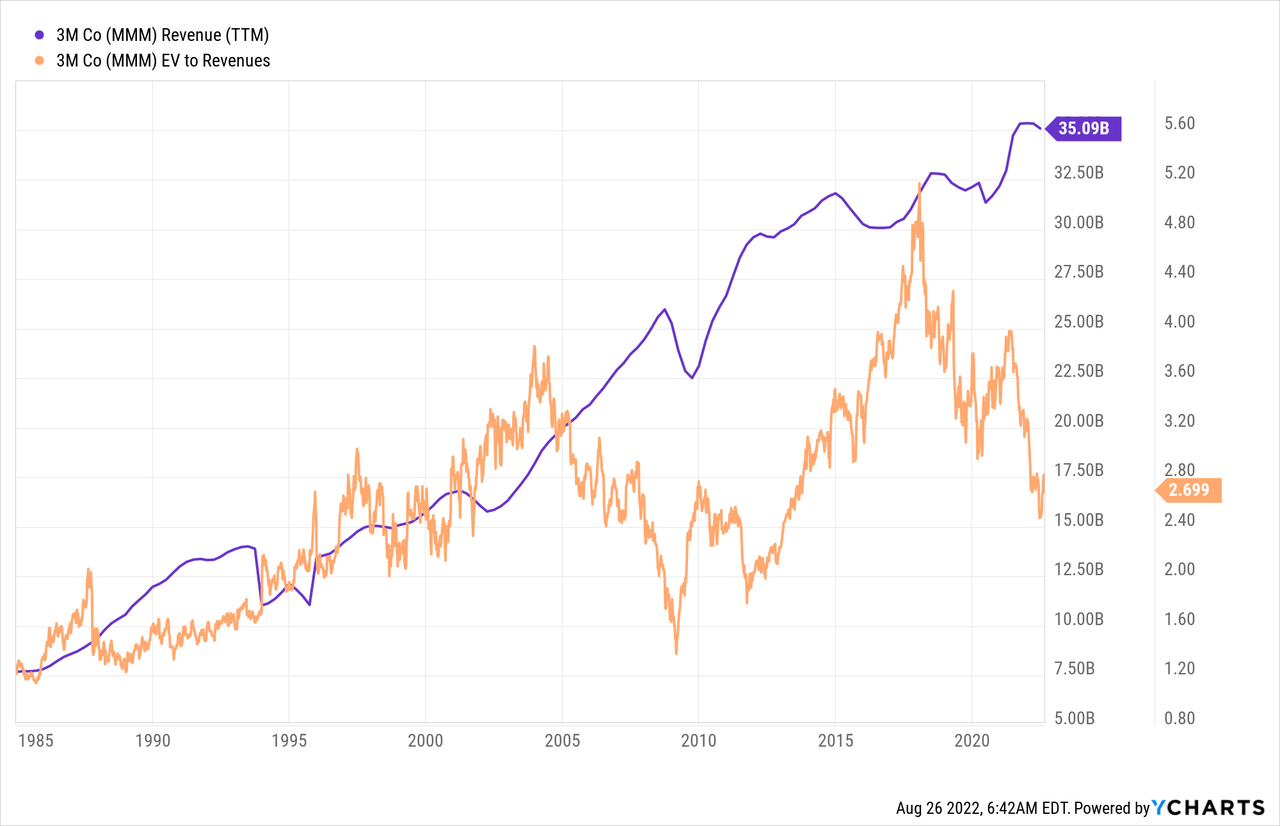

Many readers are unlikely to consider MMM to be a “growth stock,” but at first look, its top-line revenue growth over the past 37 years seems impressive, consistent, and seems to continue to the present day. While MMM’s EV/Sales multiple is not as cheap as it was before 1995 or in the depths of the 2008 financial crisis, MMM does seem to be trading at its cheapest levels since 2013 by this metric.

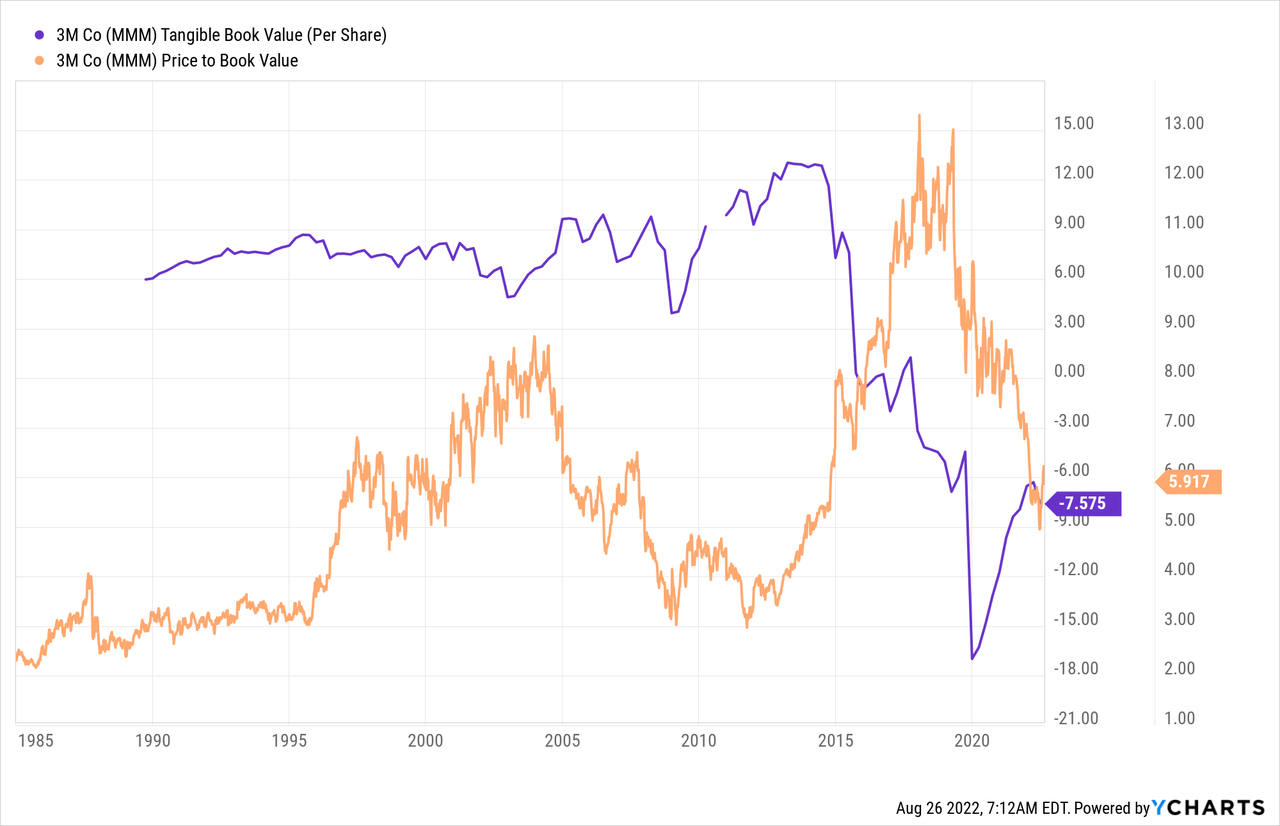

In my book, a more important and often under-appreciated metric for evaluating growth quality is growth in tangible book value. While there are several reasons a company’s book value per share may decline from year to year, a long-term decline in book value per share, especially one which keeps this number negative for many years, is one I often see as a warning sign that future growth is slowing. As I have explained previously, using McDonald’s (MCD) as an example, this pattern of declining and negative tangible book value can be seen as a sign that a company is using borrowing and buybacks to prop up returns while internal reinvestment opportunities are drying up.

3M’s Income

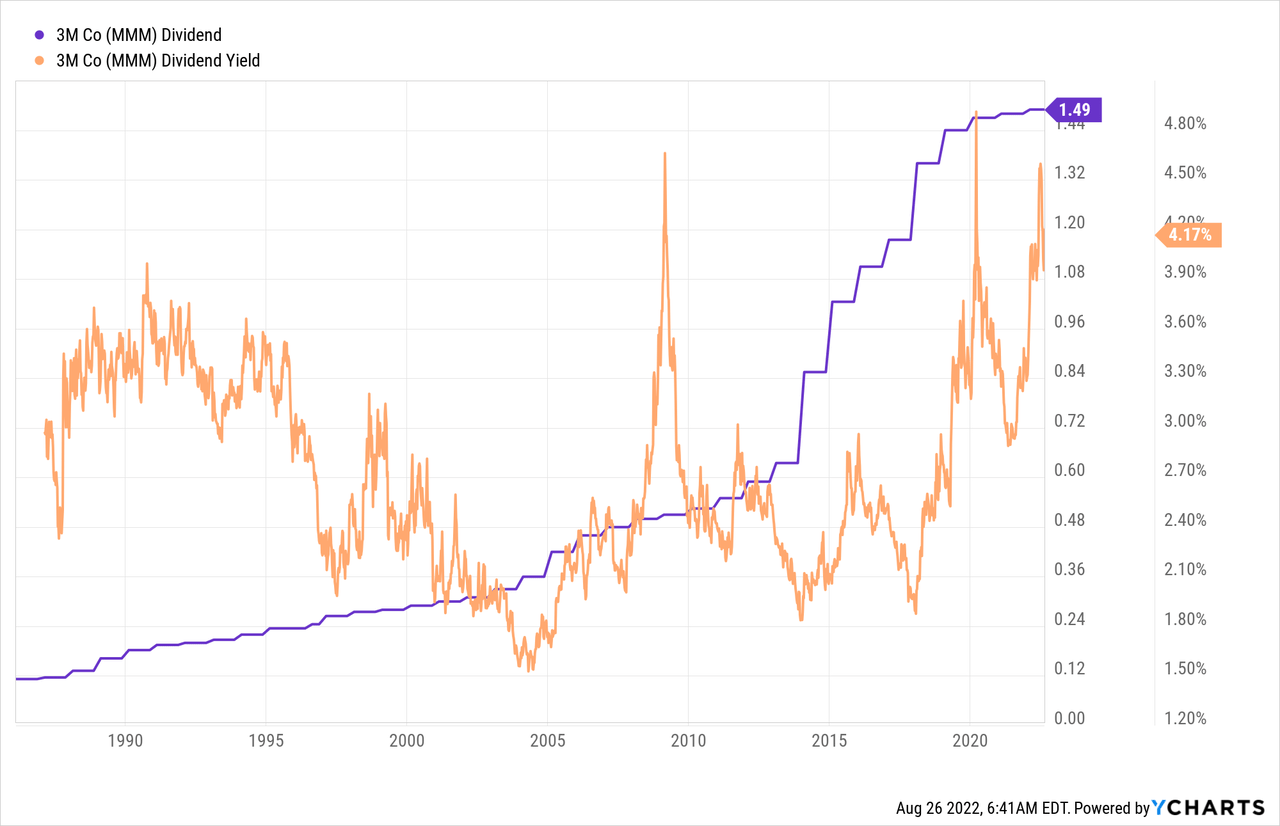

As a long time dividend payer and dividend grower, MMM would seem like a stock best suited to the “Income” portion of my “GINA” checklist. Yes, past dividend growth has been impressive, but I have recently become especially wary of companies that hike their quarterly dividend by one penny per year or less, as MMM has done for the past three years. This pattern tells me that MMM clearly wants to signal to the market its intent to remain “in the club” of stocks that increase their dividend each year, but it is no longer able or willing to do so at the rate it did from 2014-2018. That MMM’s yield is now back above 4%, a level only seen two previous times in this chart, may be a sign that investors feel that 4% yield is most of what they’re going to get, with only a token amount of dividend growth compensating for inflation, if even that.

This is why I compare MMM to a bond or preferred stock yielding 4-5%, whose coupons or dividends are guaranteed not to increase. The penny increases can be seen as the last remaining compensation for the higher risk of owning MMM equity over a bond or preferred stock.

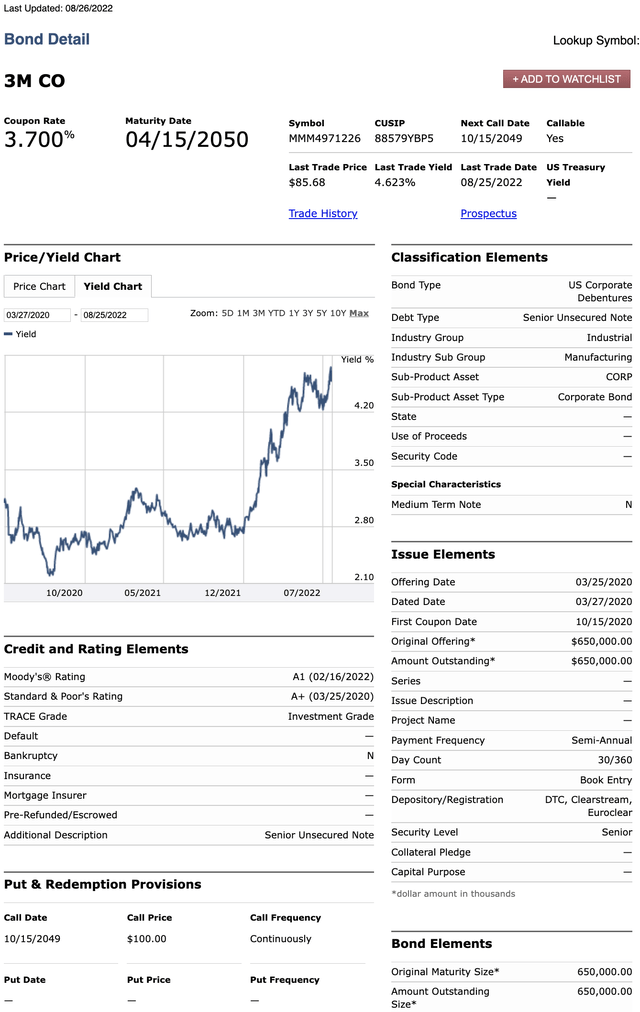

The longest-dated 3M bond I found was the below MMM 3.7% of 2050, issued as a 30 year bond back in 2020, and now trading at a 4.6% yield to maturity for the next 27.5 years. You’d have to be both pretty pessimistic about 3M’s future dividend growth, but also confident enough that 3M will not go bankrupt, to think that this 2050 bond yielding just 0.5%/year more than the stock is a better investment than MMM stock.

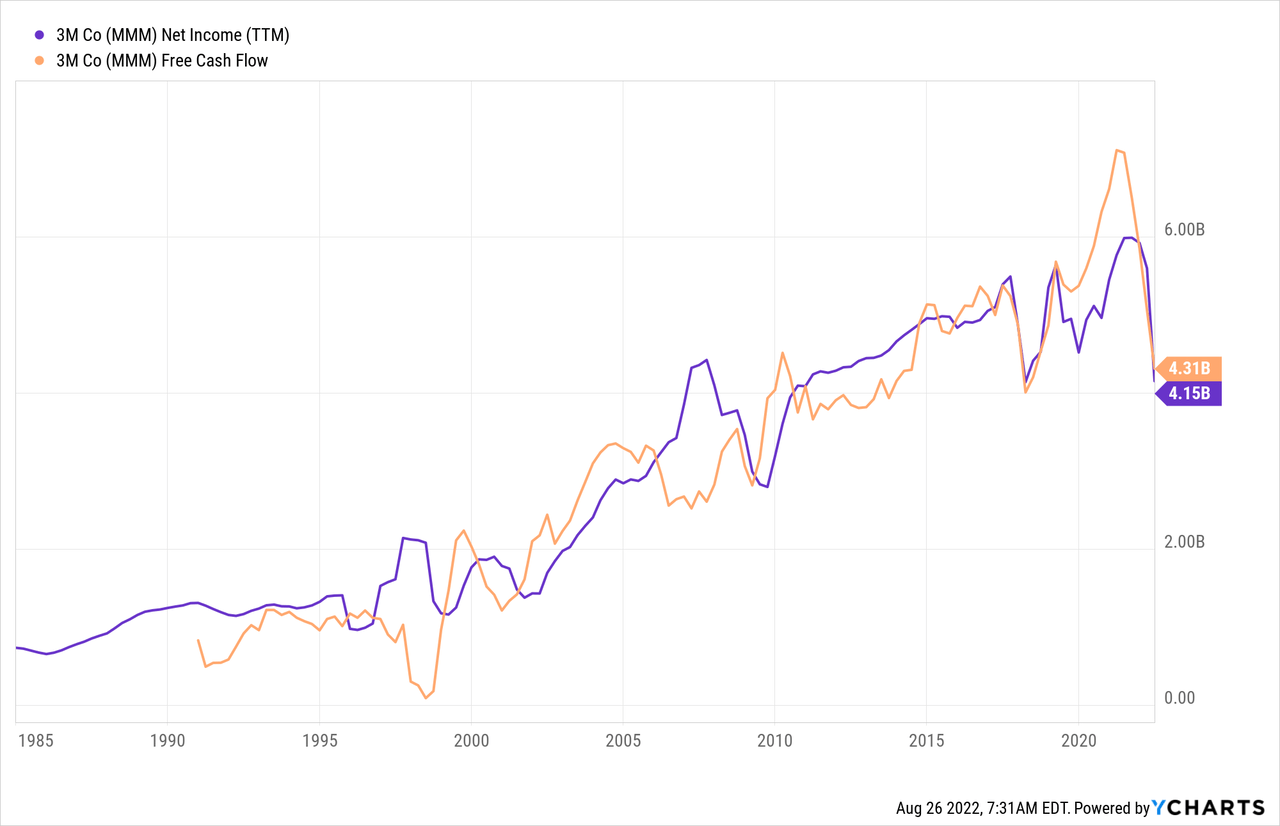

If we look at the earnings and cash flows supporting the above dividend (and after the interest payments on the above bonds), we see a similarly impressive level of growth, but with a very recent dip. I’d have to take a closer look to know why this dip happened and it, like the book value decline observed above, it may be a sign that dividend growth may be at risk of halting or even reversing.

3M’s Narrative

3M’s “narrative” may not be an exciting one, but here I focus on the company’s diversification across businesses and geographies. Just as I compared MMM stock to a bond in the previous section, here I compare it to an index fund, whose exposure we can break down by sector and country. No, MMM stock is not as diversified as the S&P 500, but it’s probably no less diversified than smaller total market index funds like those of Canada, Australia, or Singapore.

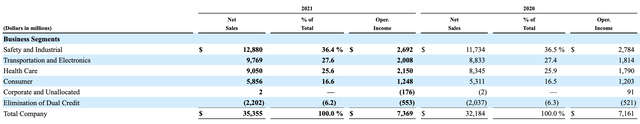

This first table is from MMM’s 2021 Form 10-K, and shows how their revenues are primarily diversified across four business segments: Safety and Industrial, Transportation and Electronics, Health Care, and Consumer.

3M Form 10-K for 2021, page 21

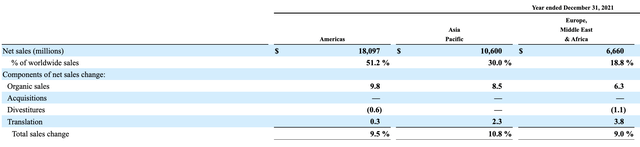

This second table is from page 22 of the same 10-K, showing how, not too differently from a globally diversified index fund, only about 50% of MMM’s revenues are from the Americas, 30% are from the Asia-Pacific region, and the remaining 20% from that region in between.

3M Form 10-K for 2021, page 22

While some may not consider the above two tables to be much of a “narrative,” my point is that this isn’t a name many dividend investors need to get too deep into to decide whether a 1-5% position provides them a diversified enough source of yield.

3M’s Analyst Estimates

3M earnings are fairly well watched and monitored by 19 analysts out to 2023, and 2 analysts out to 2026, all of whom I’m sure know more about this company than I ever will. The consensus seems to be for continued mid single digit growth in revenues and earnings per share for the foreseeable future, but revision trends seem to be negative as of this writing. Together, these signs tell me that MMM stock is probably about fairly priced, not deeply undervalued, but not the most likely stock to decline by another 50% over the next 5 years either.

3 Option Strategies On 3M

MMM is primarily a stock I see worth buying for its income, not for its growth, and so naturally I find it worth looking at yield enhancement or risk reduction strategies on this stock. Below are three options strategies I’m evaluating, all using Seeking Alpha option chain data.

Option Strategy #1: Covered Call

The first option strategy many “beginning” investors learn is covered call writing. In this strategy, I receive an up-front premium in exchange for giving up the upside of the stock above a certain strike price on an agreed expiration date. In this case, the option tenor I’m looking at January 2023, partly because the prices look good, but also because if my shares get called away, I can defer my capital gains taxes to next year for shares held in a taxable account.

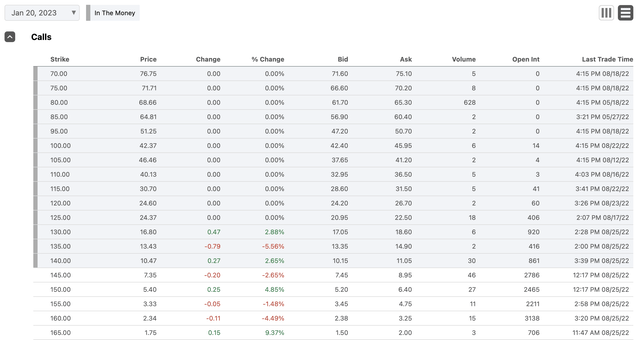

Of the below strikes, my choice would be to write the 150 strike call, because 150 happens to be about where the yield on MMM would fall below 4%. My current view on MMM is that it’s worth buying at yields well above 4%, and start taking profits as the yield falls below 4%.

If I can receive a 5.50 premium for the call expiring in 147 days, my return comes in two parts:

- The 5.50/share premium is cash I get up front that supplements my dividend. On an annualized basis, this covered call premium along provides a yield enhancement of (5.50 premium / 150 strike)*(365 days in a year/147 days to expiry) = 9.1% per year, plus

- I could still enjoy any appreciation of MMM stock from its current level around 142.75 to 150. This is another 5% I would enjoy over the next 147 days if the stock rises to 150 or higher, but I’m writing to call to get paid to wait for it to reach that level, if it does at all.

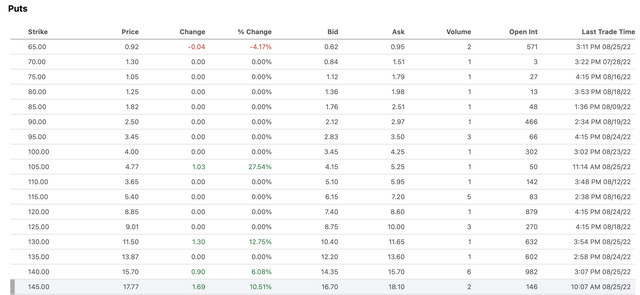

Option Strategy #2: Buy Longer-Dated Put Spread

A second, and very different, option strategy I am considering is one where I buy downside protection against a significant decline in MMM’s share price. I would do this by buying a put option, and like any insurance, it costs more the more protection I need. The below put option chain is of those expiring January 2024, since I’m looking to protect against a longer-term big decline, and the strikes that stand out to me here are the round numbers of 125 and 100. If I buy the 125 strike put and sell the 100 strike put (aka, I buy the “125-100 put spread”) I continue to take the risk of my shares declining from current levels to 125 over the next year and half, but I am protected from declines from 125 to 100, which I see as a significant portion of what would be a “really bad” drawdown for MMM. I would aim to pay around 5.50 for this put spread, which would either be funded with my dividends from MMM between now and then, or by selling the covered call option described above.

Seeking Alpha, Jan 2024 Options

Option Strategy #3: 1×2 Put Spread

One somewhat more aggressive strategy would be to try and do this “costless” by buying one 125 or 120 put, and then selling two 100 strike puts, so that the two puts I sell cover the cost of one I buy. This means I don’t need to pay for the protection up front, but it also means that if MMM falls below 100 over the next year and a half, I’m not only exposed to the decline in my own shares, but I’ll also need to buy more shares at 100. I would consider this more aggressive version as I would be happy to buy more MMM at 100, and see that risk as an acceptable cost in exchange for a modest amount of bear market protection.

Conclusion

Despite its recent declines, MMM stock looks more “fairly valued” than “cheap,” and so presents shareholders with many of the challenges of owning a good stock with a decent yield, but not much in the way of expected growth. The three option strategies presented above are just a few of many ways MMM shareholders like me might try and enhance returns and fine-tune risk exposure.

Be the first to comment