FatCamera

Cases of Monkeypox have been growing significantly during the last few months

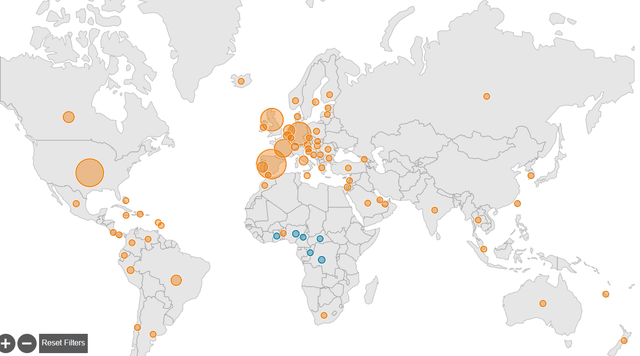

CDC – Monkeypox epidemic (CDC)

We have seen exponential growth in monkeypox cases during the last few months, the case number reached 16k cases in July, and the disease is spreading across the world.

Monkeypox virus was first documented in the 1970s, and the outbreak has been reported in many countries, with most cases restricted to endemic areas during previous outbreaks. However, we believe the 2022 monkeypox outbreak may be more severe than the previous outbreaks based on the pattern of geographical dispersal, which is significantly larger compared to past outbreaks. Unlike previous outbreaks where cases occurred more in under-resourced communities, the 2022 outbreaks are more concentrated in developed nations such as Europe and North America as shown in the chart above, and the clusters are growing each day exponentially. We believe the rapid spread could be linked ta high travel during the summer holiday.

Within the first week of the initial report, 24 countries reported suspected and confirmed cases of monkeypox virus, some of which had known travel links to the UK, Spain, Canada, and western Europe. As of June 5, 2022, there have been 920 confirmed and 70 suspected cases. Of 64 confirmed cases with known travel history, 32 were associated with travel from Europe, three from west Africa, two from Canada, and one from Australia.” Source: The lancet – Tracking the 2022 monkeypox outbreak with epidemiological data in real-time

During July 23, WHO declared the Monkeypox spread as a “global health emergency” highlighting the agency’s heightened concern around the severity of the disease and its speed of spread. We further highlight that there is a high degree of uncertainty around identifying the mild-moderate stage cases due to the conspecific side-effects of early symptoms with other conditions, and the actual cases could be significantly higher. In regards to severity, WHO has indicated that there were several cases of hospitalizations and even deaths from an immunocompromised individual. On July 25, the US white house indicated that they have the capacity to test 80k tests per day and awareness around Monkeypox. We believe the diagnosed case will grow even more with readily accessible testing.

We are buyers of monkeypox companies

With the rising cases and awareness around Monkeypox, we expect a windfall of government funds to flow into select companies with reliable/approved vaccines with manufacturing capacity that they can scale.

Currently, we view the fastest horse in the race for a vaccine for Monkeypox to be Jynneos, which is a 3rd generation vaccine developed by Barvarian Nordic (OTCPK:BVNKF) that is approved for smallpox and Monkeypox in the U.S., Canada, and EU. We note that Emergent BioSolutions (EBS) has ACAM2000, which is the second-generation vaccine that is also approved for smallpox, but we believe it will work for Monkeypox as well.

The monkeypox vaccine has a more straightforward approval pathway

The monkeypox vaccine follows the animal rule, where animal trials lead to approval without human trials. This is because human trials are impossible and unethical. As such, proving the superiority of one vaccine over another could be difficult as head-to-head trials are not possible.

There are a few vaccines in pre-clinical development, for example, i) an mRNA vaccine by Moderna (MRNA) and ii) Tonix Pharmaceuticals’ (TNXP) live virus vaccine (horsebox virus); however, we build a higher degree of confidence in Jynneos as it is already approved in the US, EU, and Canada.

Three companies that we are investing in:

Barvarian Nordics

Three reasons why we believe Barvarian Nordics is a buy, i) the company is already selling their monkeypox vaccine and the management previously mentioned that they already have USD 2M doses that can be delivered in 2022 and has the capacity to produce 30M doses annually, ii) the management has indicated that manufacturing facility upgraded with an anticipated reopening in august 22, even though it is possible there could be delays in delivery as we have seen during the COVID19 pandemic, and iii) we like the pricing of the vaccine, the company previously indicated that the current price for Jynneos in the US market to be USD40-100 per dose, which is significantly higher than the covid19 vaccine offering the more attractive market opportunity. Barvarian Nordics seem like they have already signed supply agreements with the US and Canada. Furthermore, the management has noted that there are a million doses of Jynneos in the company’s own stockpile, which they are supplying to the EU.

SIGA Technologies, Inc. (SIGA)

SIGA Technology’s TPOXX is an oral small molecule drug that showed efficacy across all orthodox viruses; the drug works by blocking the virus from exiting infected cells. The drug was approved in 2018 for the oral formulation, and IV formulation received approval in May 2022. We highlight that SIGA’s TPOXX is indicated to be used 3 capsules twice daily for 14 days after patients start having lesions, and it is not indicated to be used as a vaccination before symptom onset. In practice, infected patients would take the drug rather than being vaccinated before patients travel to an area where Monkeypox is endemic. We note that the company is going through a trial for post-exposure prophylaxis (PEP).

We like SIGA because i) the drug addresses a different patient population than BVNKF, ii) the drug does not have clinical risk considering that it is already approved, and the US gov has been stockpiling the drug since 2013, and the company signed a USD 629M 5 year contract during 2020, and iii) management has indicated that they can scale up the production of TPOXX to meet the increasing demand. For example, we highlight that the company has successfully delivered a 360k course of drug during the past 2-3 years for a total of USD112M. Furthermore, the company has disclosed that the price per treatment of TPOXX is USD310 in the US and USD930 in Canada showing a high degree of pricing power.

Emergent BioSolutions

Emergent Bioscience currently manufactures and delivers around 18-20M doses of ACAM2000 to the US government each year at a price of USD9-10 per dose. The company signed a contract with the US Government, and if the government exercises additional options over the 9 years, the contract will bring in approximately USD2B. Even though the USD2Bn potential revenue looks juicy, we believe the risk remains as BARDA may decide to buy more Jynneos and fewer ACAM2000. However, we do own a small option size position of EBS.

Valuations

It is hard to project the correct valuation for an infectious disease vaccine company as government stockpiling and subsidies can be unpredictable, as we have seen with the case of Moderna and BioNTech (BNTX) during the COVID19 pandemic. We believe we are early into the monkeypox vaccine trade, and there is still a high degree of upside from here, depending on government policy and subsidies. We look forward to updating the readers as we get more information on vaccine contracts and government stockpiling orders.

Risks

Biotechnology investment comes with a high degree of risk, and we believe investors who do not have a high degree of risk appetite should avoid investing in biotechnology opportunities. We list a few risks that can take place below.

- Monkeypox abates faster than we expect.

- The government decided not to fund the vaccine companies.

- Clinical risk: vaccine companies fail clinical trials, or rare adverse events show up during the RWE trials.

- The companies listed above fail to manufacture or deliver the vaccines due to a lack of manufacturing capacity or supply chain hurdles.

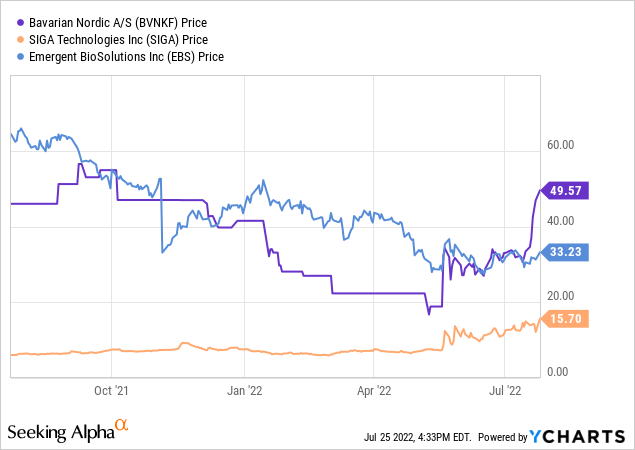

Conclusion: We are accumulating SIGA, BVNKF, EBS

We expect Monkeypox to spread exponentially and awareness around the disease to rise during the foreseeable future, coupled with the summer holiday season. As a result, we expect governments across the world to start stockpiling vaccines and post-exposure treatments. We believe there is a limited manufacturing capacity for the companies that are listed above, and we envisage governments will start funding the vaccine companies at a large scale in order to aid companies to scale up manufacturing, similar to operation-warp-speed during the 2020 covid19 pandemic. We expect a cash windfall for a few companies with approved vaccines during 2H 22, and we expect the stock price of the aforementioned SMID cap biotech stocks to jump multiple times to the price that they are trading at the moment. Even though SIGA, BVNKF, and EBS have rallied more than 100% already, we believe there is significantly more upside from here, and we remain a buyer.

Be the first to comment