peshkov

Recession Fears And Wall Street

Wall Street and many investors believe a recession is near, while many consumers believe the recession is already here. The demand for discretionary items has seen a decline as the economy heads into a slowdown. Consumer savings, especially the middle to lower-income wage earners, are already being punished more than expected. Companies that were once disruptors are experiencing substantial declines and continuing to take a hit.

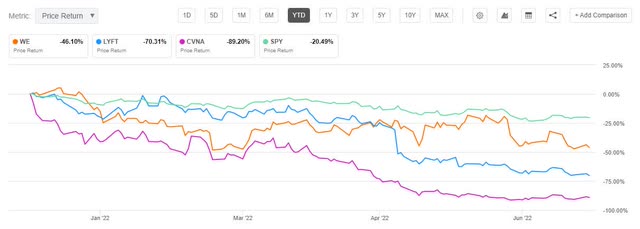

YTD Price Performance WE, LYFT, CVNA vs. SPY

YTD Price Performance WE, LYFT, CVNA vs. SPY (Seeking Alpha Premium)

As we look at my three stock picks, WeWork (NYSE:WE), Lyft, Inc. (NASDAQ:LYFT), and Carvana (NYSE:CVNA), all are strong sells according to Seeking Alpha’s quant ratings. Meanwhile, Wall Street continues to pound the table that these stocks are buys. I feel Wall Street called these wrong because analyst earnings estimate revisions keep coming down. Year-to-date, WE is -46.26%, LYFT is -70.22%, and CVNA is -89.13%. As inflation continues to penetrate households and businesses, people start to budget. Some of the first items cut are discretionary and luxury, including vehicle purchases and discretionary travel. Given the post-pandemic transition from in-office work to work-from-home, WeWork is still reeling from the effects of its fledgling business model. As the Fed continues rate hikes, it is bound to hurt a stock like WE because its costs are tied to long-term leases, and its revenue is generated by short-term leases that could end if the recession does come to fruition. Along with rate hikes, spiking prices from inflation continue to take a toll on consumers, cutting into spending habits for car-sharing and purchasing. Stocks already carrying negative analyst ratings, poor fundamentals, slowing growth, and lagging in their sectors are likely to continue this poor performance, resulting in demand destruction.

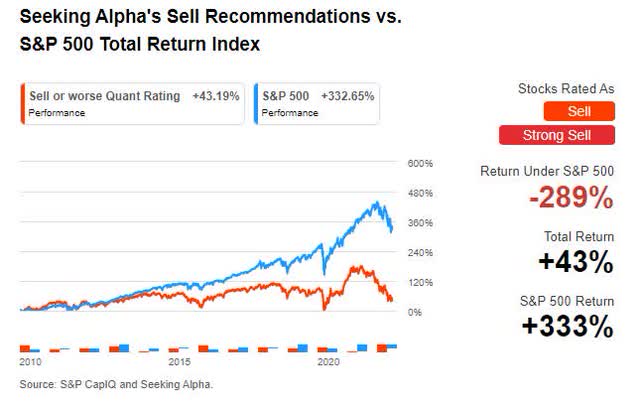

Seeking Alpha’s Quant Ratings’ Sell Recommendations have underperformed the S&P 500 for over a decade using quantitative data. We strive to select stocks that perform well in this volatile environment while highlighting the worst performers.

Seeking Alpha’s Strong Sell Recommendations (Seeking Alpha Premium)

Disruptor Stocks Are Dying

One thing is for sure. There is no inflation in financial assets or disruptor stocks. Disruptor stocks – companies that pioneer and alter existing business models – have been all the craze, especially in tech. The pandemic opened the floodgates for countless disruptor stocks like Peloton (PTON), DocuSign (DOCU), and Shopify (SHOP), known as pandemic darlings, haven’t fared so well post-pandemic. Why? The new normal shifted from speculative technology as the industry is getting crushed along with many smaller-scale techs. And while crypto, technology, and the fear of missing out (FOMO) have captured the eyes of many investors, we all see where that gamble has taken a toll on investor portfolios. The Nasdaq is down nearly 30%YTD in this ‘summer of pain,’ as skyrocketing fuel, energy, food – everything persists as portfolios experience severe declines. With uncertainty around the globe and varying sectors taking a beating, we continue to see outflows from the major equity indexes.

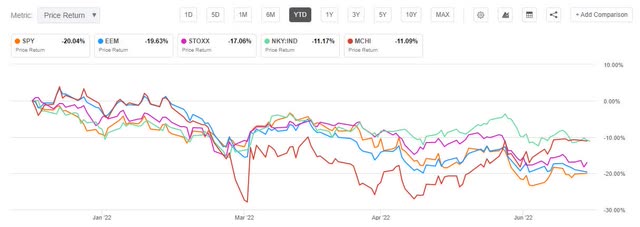

Major Equity Index Outflows YTD

Major Equity Index Outflows YTD (Seeking Alpha Premium)

In April, U.S. stocks experienced $15.5B in outflows in what Bloomberg deemed the Race to the Bottom. But I don’t believe we’ve experienced the bottom quite yet, so investors should avoid catching a falling knife, which describes the three stocks in this article.

3 Stocks to Avoid

We believe investors should avoid adding stocks with questionable performance to their portfolios with severe declines year-to-date and falling. On a downward trend with investment characteristics that have historically indicated poor future performance, each stock comes with a warning banner and is at high risk of performing poorly.

1. WeWork Inc. (WE)

-

Market Capitalization: $3.60B

-

Quant Sector Ranking (as of 7/6): 184 out of 185

-

Quant Rating: Strong Sell

There are several reasons why WeWork hasn’t worked, and based upon its strong sell rating, lack of profits, and massive debt load, I believe it’s unlikely to work soon. While renting flexible workspaces that offered varying amenities was a brilliant idea and should’ve been an instant hit. In practice, it is an awful business model because the pandemic created the perfect storm for companies wanting to downsize rather than rent large commercial spaces.

WeWork CEO Adam Neumann has also played a role in the business’ decline. He is said to be a unique individual with wildly optimistic ideas, including giving out free beer to tenants. Without the right people to ensure a company is polished and meeting objectives in attempts to grow and be profitable, failure can set in, leading to the company’s failed IPO, followed by a later IPO as a SPAC.

While the CEO’s projections for the number of customers renting its flexible workspaces have seemed farfetched to investors, lack of profits and continued falling valuation seem to speak volumes. Notably, WeWork’s business model is less than ideal for the current environment. Where more people are working from home, small businesses and startups are less likely to want to rent space, given higher interest rates, recession fears, and corporations looking to cut costs. Corporate lease renewals and maintaining office spaces could see declines.

WeWork One Year Performance Chart (Seeking Alpha Premium)

Looking at WeWork’s downward trend, you can see this stock is taking a beating. Down more than 56% over the last year, the stock is at a high risk of continuing to perform poorly.

WeWork Valuation & Momentum

WeWork has been trending down since its peak in 2021. Year-to-date, the stock is down 46% with continued bearish momentum. Considered overvalued, the stock currently trades at $4.95/share and possesses a D+ overall valuation grade.

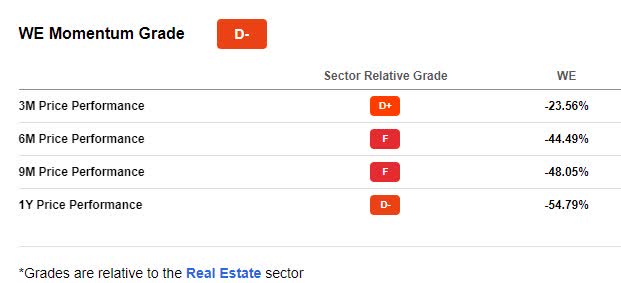

WE Momentum Grade (Seeking Alpha Premium)

Quarterly, WeWork is being outperformed by most of its sector peers. As evidenced in the price-performance figures above, the company lacks momentum and is at a high risk of performing badly given its Return on Total Assets (TTM) of -13.74% compared to the sector’s 2.56%. As we look at the company’s other factors, growth, and profitability, it is clear why this stock is decelerating.

WeWork Growth & Profitability

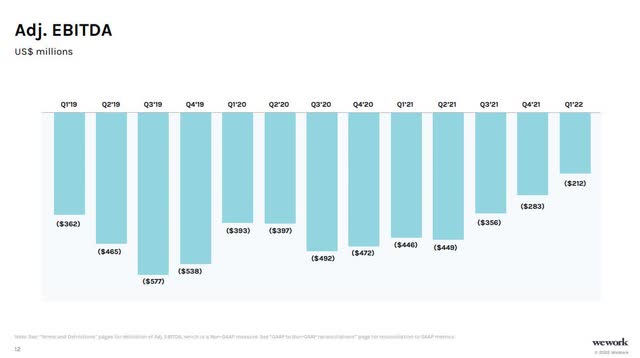

WeWork faces many challenges, including macroeconomic headwinds, liquidity issues, heavy debt, and troubled history. Although WE generated $765M in revenue in Q1 2022, the company’s operating loss was $358M, net loss was $504M, and WE’s cash flow is -$412M. As you look at WE’s adjusted EBITDA over the last several earnings periods, there’s a reason our quant ratings give this stock a strong sell.

WeWork Adjusted EBITDA (WE’s Q1 Investor Presentation 2022)

WeWork is currently trading at $4.97/share, and as Marketplace Author Ranjit Thomas, CFA writes in WeWork Could Soon Be Wee Work,

The most valuable asset here may be the net operating losses (NOLs) of $14.5 billion that could shield $2.9 billion of income taxes at a 20% rate…I believe bankruptcy is the most likely outcome here, possibly as soon as next year as the company exhausts its cash balance and draws down its credit lines to fund its negative free cash flow over the next year.

While it’s unclear the path forward for this stock or whether they will see bankruptcy, one thing is for sure, whatever the company is doing is not working. Many real estate stocks are in a far better fundamental position and are listed in the SA Quant Top Real Estate Stocks rankings. Let’s consider our next stock to avoid, whose profits could also use a lift.

2. Lyft Inc. (LYFT)

-

Market Capitalization: $4.69B

-

Quant Sector Ranking (as of 7/6): 594 out of 614

-

Analysts’ Downward Earnings Estimates Revisions: 21

-

Quant Rating: Strong Sell

Lyft is the popular on-demand ridesharing mode of transportation, giving riders personalized access to various mobility options, including chaperoned trips, car rentals, bikes and scooters, and more. A consumer discretionary purchase, Lyft has experienced a 78% decline in share price over the last year, compared to the Consumer Discretionary Sector (XLY) as a whole, experiencing a fall of 21%. As consumers scale back on discretionary purchases in this inflationary environment to meet the demands of essential purchases like food, personal hygiene, and shelter, fewer paying customers are likely to reflect in Lyft’s declining revenue.

Lyft 1yr Price Performance Chart (Seeking Alpha Premium)

What is more, the shortage of Lyft drivers coupled with its competition from Uber and current drivers having to pay astronomical fuel prices, if inflation doesn’t come down, the future of this company could use a lift, especially when reviewing its valuation and current momentum.

Lyft Valuation & Momentum

Lyft is trading near its 52-week low of $12.81 and down 70% YTD. With a forward P/E ratio of 42.59x, 184.67% higher than its sector, and a D- forward EV/EBITDA of 15.81x more than 63% higher than its sector peers, Lyft still comes at quite a premium. Somehow, Wall Street analysts still do not realize this stock is expensive relative to the sector, as seen in the consensus Wall Street Buy recommendation. Looking at the quarterly price performance below and F Momentum Grade, it’s no surprise that investors continue to actively sell shares of this stock, which is driving the price lower.

LYFT Momentum Grade (Seeking Alpha Premium)

In an ominous message delivered by Uber CEO Dara Khosrowshahi that spilled over into shares of Lyft dropping more than 9% in May, he discussed a “seismic shift” in the industry, indicating that costs and expenses are being heavily weighted in ensuring profitability.

Lyft Growth & Profitability

Although Lyft’s financials and balance sheet need a facelift, despite recent earnings beating both top-and bottom-line results. With an EPS of $0.07 that beat by $0.14 and revenue of $875.58M, up more than 43% year-over-year, analysts are still not optimistic about this company.

LYFT Revisions Grade (Seeking Alpha Premium)

As showcased in the D+ revision grade, there have only been two FY1 Upward revisions in the last 90 days and 21 downward revisions. According to Elaine Paul, Lyft CFO, some headwinds are limiting the company’s growth and profits.

COVID and other macro factors like geopolitical dynamics and inflation are impossible for us to predict with any certainty…Over the past two years, evolving COVID conditions have made near-term demand trends highly variable. Federal stimulants and other pandemic-related dynamics have served as headwinds to driver supply. Together, these factors create rapid shifts in demand and in supply that make it more difficult to achieve a healthy balance when compared to a more typical environment. Coming out of Omicron, we want to invest more in driver supply in Q2 to move our marketplace further into balance. This will set us up for the long term and ensure we’re doing everything we can to take care of drivers and riders with the best possible experience.

With rate hikes on the horizon and inflation taking its toll, the future is uncertain for Lyft and many stocks. Lyft is classified as a stock in the Trucking industry. According to SA Quant ratings, many other Top Trucking stocks have greater potential.

3. Carvana (CVNA)

-

Market Capitalization: $4.18B

-

Quant Sector Ranking (as of 7/6): 525 out of 526

-

Analysts’ Downward Earnings Estimates Revisions: 19

-

Quant Rating: Strong Sell

Declining margins, a bear market, and the Fed raising rates make this company an easy pick at risk of performing badly. Carvana is a unique e-commerce platform that allows customers to buy and sell cars in the U.S. Following online purchases, customers can either pick up or have the vehicle delivered to your door. And while this disruptor’s unique business model worked well during the pandemic, post-pandemic buying patterns have changed, especially amid chip shortages. As Seeking Alpha Marketplace author Robert Castellano writes,

A semiconductor shortage has been impacting the automobile industry for more than a year with no end in sight, and various “experts” have prognosticated that the end will come in 2022, or maybe 2023…There’s no sign the prolonged automotive semiconductor shortage will abate this year.

Carvana was already lacking profits before the risky environment we are seeing. Attempting to raise capital now.

Carvana 1yr Price Chart (Seeking Alpha Premium)

Carvana Valuation & Momentum

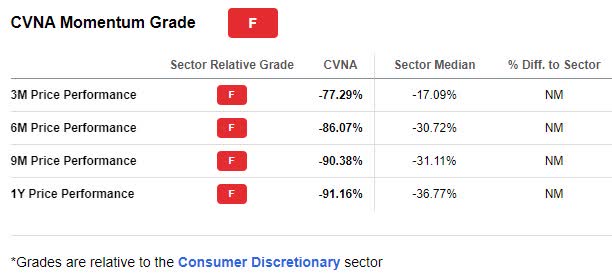

Carvana has a C+ valuation grade and is trading at a discount, which should be no surprise given the stock has been down more than 90% over the last year. With a current share price of just under $30 from its 52-week high of $376.83, this stock is approaching zombie territory.

Carvana Momentum Grade (Seeking Alpha Premium)

On a downward trend, CVNA’s Momentum grade is an F, and its shares remain below its 200-day moving average. As we look above at the dismal quarterly price performance, Carvana is significantly underperforming its sector median, making its way into a danger zone.

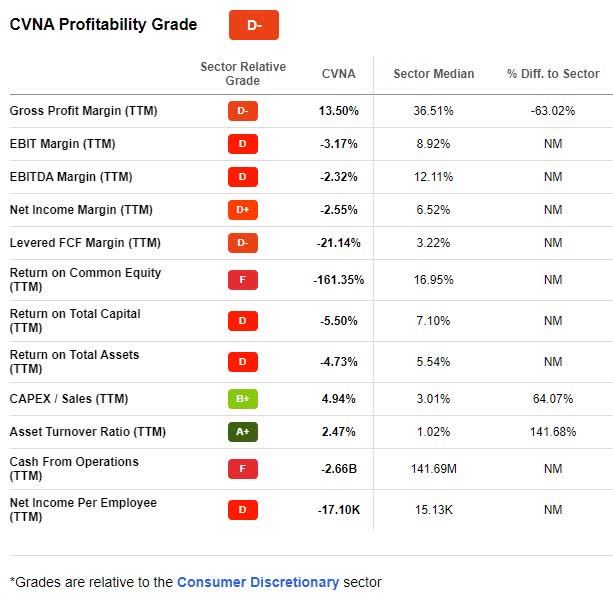

Carvana Growth & Profitability

Since going public in 2017, Carvana has yet to generate positive free cash flow. Q1 2022 earnings resulted in an EPS of -$2.89, which missed by $1.31, and despite revenue of $3.50B beating by nearly 56%, this company has rapidly declined and has minimal cash on its balance sheet. As Seeking Alpha Marketplace Author David Trainer writes,

Since 2016, Carvana has burned through $8.3 billion in FCF, (AND) the cash bonfire at Carvana is roaring as the company burned through $4.0 billion in FCF over the TTM ended 1Q22. With just $247 million in cash and cash equivalents on the balance sheet at the end of 1Q22, Carvana’s cash balance could only have sustained its cash burn for less than one month after 1Q22. Not surprisingly, Carvana issued $3.3 billion in senior unsecured notes in April 2022, which bear an interest rate of 10.25%. The interest rate on the debt is substantially higher than the 4.875% rate on senior unsecured notes issued in August 2021. However, most of this capital is already accounted for, as Carvana is using the proceeds to fund the $2.2 billion acquisition of ADESA’s U.S. auction business.

CVNA Profitability Grade (Seeking Alpha Premium)

While some investors think this stock is a perfect buy-the-dip option, others are speculating if Carvana is going to zero. Will Carvana need to raise more equity or debt to survive? Or is this stock heading for its official demise? With Carvana among the buyer-beware stocks, disruptors like CVNA, WE, and LYFT are names that should be avoided, according to Seeking Alpha quant ratings. For a list of automotive retailers with quant strong buy recommendations and greater stock price appreciation potential, please refer to Top Automotive Retail Stocks.

Conclusion

In an inflationary environment and times of market volatility, investors should seek investments with strong metrics and collective characteristics to perform well while attempting to avoid those that may fall. Because the economic outlook is uncertain and the market has been shifting, investors fear losing money, so a focus on stocks that are profitable and have indicators of profits and growth with an established track record is a better consideration based on my quant ratings and factor grades compared to WE, LYFT, and CVNA. Consider purchasing stocks with strong investment fundamentals. Each of these stocks lacks growth and profitability and has a past trend of downward analysts’ earnings revisions. Some are overvalued, and all roads lead to a strong sell in the current landscape.

Check out the Grades on your stocks or consider our investment research tools to help ensure you are furnished with the best resources to make informed investment decisions. Alternatively to the stocks in this article with Quant Strong Sell recommendations, here is a list of SA Top Stocks By Quant. Finding knowledgeable investment resources is also a great way to be a successful investor in volatile or rallying markets.

Be the first to comment