Nikada

SHK Properties – logo (SHK Properties home page)

Investment thesis

Sun Hung Kai Properties (OTCPK:SUHJY) is one of Asia’s largest property companies with income from the development and sales of new homes and a large staple of investment properties. Its property activities are mainly in Hong Kong and in mainland China.

Its market capitalization is HKD 276.7 billion which equated to about USD 35 billion.

Its fundamentals are very attractive from a value investors point of view.

SHK Properties fundamentals (Quamnet)

In my last article on SUHJY, I argued that this company was a “sleep well at night” stock.

SHKP just came out on the 8th of September with their 2022 Full Year financial results with the accounting period ending 30th of June 2022.

Therefore, it is a good time to look at how they are doing.

2022 Full Year results

Total underlying profit attributable to the Company’s shareholders for the year, excluding the effect of fair-value changes on investment properties, amounted to HKD 28.7 billion. This is weaker than the HKD 29,9 billion it reported last year.

The underlying earnings per share were HKD 9.91, compared to HKD 10.31 last year.

It is useful to separate the profits into two segments. One for property development and the other for the investment properties.

Property Development

Their net profit generated from property sales amounted to HKD 15.8 billion, as compared to HKD 21 billion the year before. The pandemic has had an impact on sales activities.

Things are starting to look better. Since July 2022, contracted sales of over HKD 12 billion in attributable terms have been recorded. However, it might slow down in the event of a higher cost of borrowing. See risks to the thesis in this article.

Investment Properties

Despite the impact of the pandemic, the good news is that their net rental income from their investment properties rose by 1% year-on-year to HKD 19.2 billion.

Their office portfolio of about 10 million square feet was able to register an overall average occupancy rate of about 92%.

One example of this is the International Finance Center, which sits right on top of the high-speed train station to Hong Kong International Airport. IFC, as it is referred to, is still a very popular choice for many international corporations on the back of its prime location and modern specification.

They also hold a portfolio of investment properties in China.

These generated a gross rental income, including contributions from joint-venture and associate projects, of RMB 5.4 billion during the year. That was 4% higher year on year.

An example of their investment properties in China, we can look at their property called “ITC” in Shanghai. It covers about 6.7 million square feet of gross floor area and is developed in stages. Presently, it includes two grade-A office towers, a 2.5-million-square-foot mega mall, and the Andaz Shanghai ITC hotel.

ITC Shanghai (SHK Properties 2022 FY Presentation)

Its construction work has resumed in an orderly manner. The 220-meter tall office tower was completed in mid-2022 and has been handed over to tenants.

Another office and retail tower reaching up 370 meters into the skies is under construction and is expected to be ready in 2024.

The group also holds investments in telecom and infrastructure.

Balance sheet

Not all Chinese property companies are heavily indebted, as some who just listen to the media might think. I understand that news on China Evergrande Group (OTCPK:EGRNF), and their dire fortunes, sell more than “boring news” about companies that have no financial problems.

One reason I would sleep well at night is their very low gearing ratio of just 17.4%.

Their interest rate coverage, which is defined as a ratio between operating profit to net interest expenses, is a comfortable 12.8x.

As a result of this, SUHJY holds the highest credit ratings among Hong Kong property companies. Moody’s and S&P have awarded A1 and A+ ratings respectively with a stable outlook for the Group.

Returning capital to shareholders

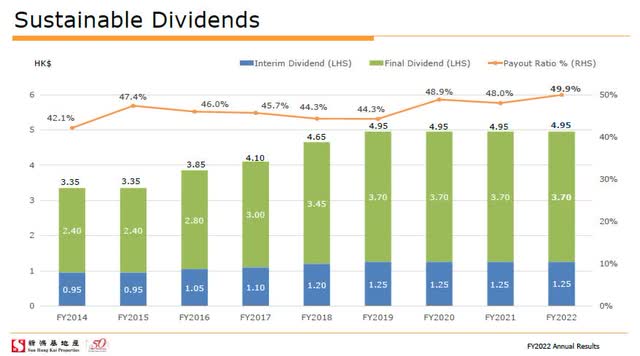

The dividend that SUHJY has distributed to its shareholders over the years has been growing.

SHK Properties growing dividends (SHK Properties – 2022 FY Results Presentation)

From 2014 to 2022 it grew by 47.8%, which is a CAGR of 5.31%.

Their current yield is quite acceptable at 5.18%.

Business development

Hong Kong’s economy slipped into a recession in the second quarter, contracting by 1.4% from a year ago.

They have been slow to ease up on COVID-19 restrictions. However, they are gradually opening, allowing resumption of full dining services and reopening of entertainment venues. The biggest obstacle and what keeps tourists away is that they still have a quarantine period required for international arrivals. As I have pointed out in earlier articles on the Hong Kong economy, tourism is a big pull factor as it caters to many of the jobs in Hong Kong. Quarantine periods have to go completely before we will see Hong Kong getting back to pre-COVID levels.

But there is no lack of new projects for SUHJY in the pipeline for years to come.

Development at West Kowloon in HK (SHK Properties 2022 FY Financial Results Presentation)

A mega landmark project is being built on top of the High-Speed Rail West Kowloon Terminus, which is the train station that connects Hong Kong with mainland China.

It will provide about 2.6 million square feet of office premises and some 600,000 square feet of retail space. SUHJY will hold the entire retail portion and about 1.2 million square feet of office floor area for long-term investment purposes. Two long-term strategic investors will hold the remaining office space.

When you are a property developer, you need a land bank.

The Group added a combined gross floor area of about 1.1 million square feet to its land bank through two lease modifications. This allows them to continue to build more residential units to meet the city’s housing demands.

As of 30 June 2022, the Group’s attributable land bank in Hong Kong amounted to about 57.1 million square feet. This comprised about 22.4 million square feet of properties under development, which should support their needs over the next 5 years.

In addition to this land bank, they also have a total attributable land bank of 70.6 million square feet in mainland China.

About 53.0 million square feet were properties under development, of which over 40% will be developed into residences for sale. The majority of the remaining 17.6 million square feet were completed properties in key cities held for rental and long-term investment purposes.

Risks to the thesis

Their sales from property development in Hong Kong could slow down as a result of higher interest rates.

A widening interest-rate gap between Hong Kong and the US has contributed to a flight of capital out of the Hong Kong dollar market and has increased funding costs at banks in the city.

According to a recent article in SCMP, a customer with a 30-year loan of HKD 5 million would have to pay HKD 1,324 more following a 75 basis points increase. Should the prime rate rise a full percentage point, this homeowner will see monthly repayments increase by HKD 2,004.

Banks will raise their prime rates by 25 basis points this month, followed by another 25 basis points by the end of 2022.

The improved buying interest we have seen could stall.

There are always risks that what may look like a great value proposition could potentially be a value trap. It could be “cheap” for a valid reason. A reason that is unknown to me. I have many stocks in my value portfolio that now are extremely undervalued. A large dose of patience is required. Nevertheless, the value may never be unlocked. It is a risk.

Conclusion

Judging from the company’s low beta of just 0.37 we can deduce that the share fluctuates less than the market in which its shares are listed.

SHK Properties share price versus HSI (Yahoo Finance)

That is also the case.

The share price has gone down 21.8% since my last article in June 2021.

I would still argue that it is a SWAN stock. It is now even more attractive, as it is priced even lower.

My stance is still a Buy.

Be the first to comment