lisafx

This article was co-produced with Cappuccino Finance.

What was your first thought when you read this title?

Was it one that stemmed from greed, complete with Scrooge McDuck-like money signs in your eyes?

Or did you immediately feel some fear?

If you’re one of my regular readers, it may very well have been a combination of the two.

On the one hand, you’ve got your natural investor instincts to make money. And real estate investment trusts (REITs) – or any other kind of dividend-paying stock – that delivers 9% yields are very attractive at first glance.

At second glance too.

On closer inspection though, the higher the yield, the more your alarm bells should be going off. That’s what I preach, and that’s what I put into practice.

As I wrote for April Fool’s this year:

“Oftentimes, the demise of a company can be traced to a long-lasting change in the cash-generating power of the business model…

“When the earnings stream is in a consistent state of decline, we can determine whether or not the business is sustainable.

“Another way we can define a value trap is based on the dividend yield.

“Many of you are familiar with the term ‘sucker yield,’ which simply means that the high yield is too good to be true.

“We always recommend looking at other metrics beside just the yield. And one of the best ways to evaluate the safety of the dividend is to consider the payout ratio.”

I stand by all that today. Just like I stood by all that before. However…

A 9% Dividend Yield Isn’t an Automatic Apocalyptic Indication

High yields and sucker yields are not automatically the same thing.

It’s probably safe to say that sucker yields are always high. But there are companies that, for varying reasons, actually can sustain increased percentages.

Even the 9% variety.

Dividend Sensei, who operates iREIT on Alpha’s sister service, Dividend Kings, wrote about one such pick in October. Here’s a part of “Magellan Midstream Is a 9% Yield You Can Trust in These Crazy Times” that I especially want to highlight:

“… it’s precisely in dark times like this when investor fear of missing out has turned to despair that safe ultra-yield becomes most valuable. Why?

“Because when you can earn almost 10% safe yield from day one, you never have to worry about what share prices do in the short term.

“When you can live richly off safe yield, then only fundamentals determine your standard of living over time, and fundamentals are much more stable than stock prices.”

Or here’s another way to look at it:

“… during bear markets, speculation gives way to sound long-term investing, and that’s when rich retirement fortunes are made.”

In the case of Magellan, its yield was so high because its share price was unfairly devalued.

Why do I – and Dividend Sensei – call it “unfairly devalued?” You’ll have to read the whole article for the full explanation, of course. But I do think this one line does a good job of summarizing up the situation:

“Magellan has one of the industry’s most consistent payout track records, a 20-year streak that is expected to reach 25 years by 2027.”

In short, as of Oct. 6, it had successfully balanced its operations for 20 years to offer a reliable dividend. Moreover, analysts don’t expect those capabilities to change from here.

That’s the very opposite of a sucker yield.

Perfection Isn’t Available, but These Imperfections Seem Acceptable

This isn’t to say the three REITs below or the master limited partnership (‘MLP’) above are perfectly safe. No investment ever is.

There are always risks involved – even with a company that keeps paying its dividends year after year no matter the market’s moves.

What I am saying is that there’s a lot to like in the businesses I’m about to delve into. Which is rarely the case with sucker-yield-style stocks.

Often, with sucker-yield-style stocks, there’s only one thing to like: The high yield.

That’s why I commend all my readers – regardless of whether they’ve been with me for a decade or just clicked on their first Brad Thomas article today – who looked at the title of this piece and thought twice.

Yes, sure, it would be nice to get some extra cash for Christmas, as it were. But will you regret it come January… or February… or even by next December?

Now is not the time to play fast and loose with your money considering how unreliable the larger markets are. There’s a lot to lose these days.

Then again, there always is.

So, as always, read the information provided carefully below. Review it. Research it further. Evaluate it according to your own personal situation, plans, and capabilities.

I can’t promise you what will happen tomorrow in any of the following businesses. All I can do is tell you that, come what may, these aren’t sucker yields on display right now.

In which case, what they do offer really could make for stocking stuffers you can enjoy Christmas in and Christmas out.

Starwood Property Trust (STWD)

Starwood Property Trust focuses on originating, acquiring, and financing mortgage loans and other real estate investments in the U.S., Europe, and Australia. They have four business segments: Real estate commercial and residential lending, infrastructure lending, real estate property, and real estate investing and servicing.

Starwood Property has a diversified portfolio and investment strategy. In addition to their business diversification across the four segments, the portfolio is geographically very well diversified. For example, the commercial portfolio’s breakdown by U.S. geographical region is 17%, 16%, 16%, and 13% for the Southeast, Northeast, Southwest, and West, respectively.

Their diversified business segments reduce investment risk. Their real estate commercial and residential lending engages primarily in originating, acquiring, financing, and managing commercial first mortgages, non-agency residential mortgages, subordinated mortgages, mezzanine loans, and preferred equity.

The infrastructure lending engages primarily in infrastructure debt investments.

The real estate property segment acquires and manages equity interest in stable commercial real estate properties, including multifamily properties and commercial properties subject to net lease.

Finally, the real estate investing and servicing segment provides i) a servicing business that manages and works out problematic assets, ii) an investment business that acquires and manages non-investment grade commercial mortgage-backed securities, iii) a mortgage loan business that originates conduit loans, and iv) an investment business that acquires commercial real estate assets.

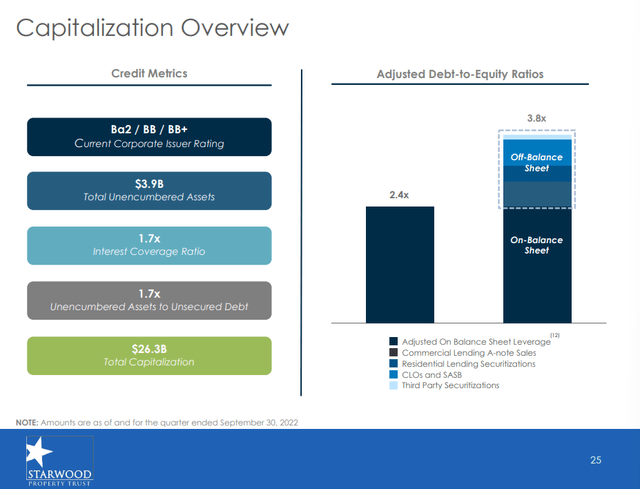

The capital structure of Starwood is favorable. The interest coverage ratio is 1.7x, and adjusted debt-to-equity ratio is 2.4x (on a balance sheet basis). Also, they have $8.5 B available capacity on financing facilities.

Investor Relations

The dividend yield is currently a whopping 9.6%. The company has steadily made these dividend payouts every quarter for the past 12 consecutive years.

The current valuation metric (P/FFO) shows that Starwood is undervalued. P/AFFO of 9.20x is significantly lower than their historical average.

Blackstone Mortgage Trust (BXMT)

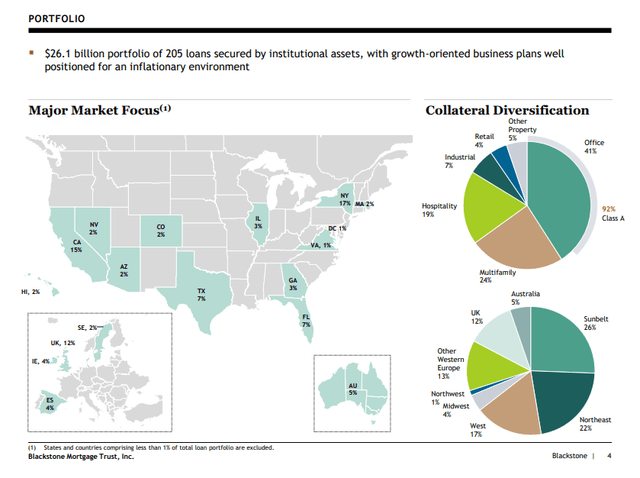

Blackstone Mortgage Trust originates senior loans that are collateralized by commercial real estate in North America, Europe, and Australia. Their portfolio consists of loans secured by high-quality, institutional assets in major markets, sponsored by experienced, well-capitalized real estate investment owners and operators.

Their $26.1 B portfolio of 205 loans are geographically very well diversified. It’s not concentrated in one region but spread out over several different states within the U.S., as well as Europe and Australia.

Also, the portfolio is well diversified by the business segments as well. Top segments include multifamily (24%), hospitality (19%), and industrial (7%).

Investor Relations

Throughout 2022, Blackstone’s business has been flourishing and growing. The higher interest rate environment and strong loan performance resulted in strong earnings growth for Blackstone’s. The EPS grew from $0.62 in 1Q 2022 to $0.71 in 3Q 2022, which was 15% growth in two quarters.

Blackstone is very well funded and has a strong capital structure. The balance sheet will provide stability even during highly volatile market conditions. Also, they just closed a new $1.1 B credit facility in 3Q 2022, increasing liquidity to $1.7 B.

They’re well positioned on debt and do not have any significant corporate debt maturities until 2026.

Blackstone’s dividend yield is 10.7% and the company has paid dividends for the past 7 years.

Sabra Health Care REIT (SBRA)

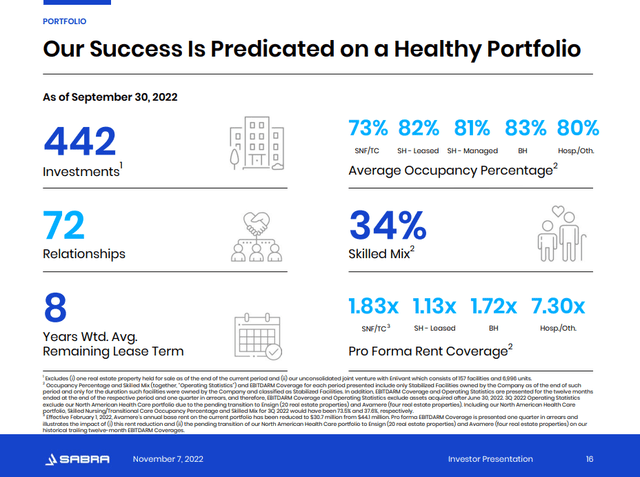

Sabra Health Care owns and invests in real estate serving the healthcare industry. Their investment portfolio primarily consists of skilled nursing/transitional care facilities, senior housing, and specialty hospitals.

They have a robust portfolio (442 investments) with long-term leases in place (eight-year weighted average remaining lease term). Also, their properties are well occupied.

Investor Relations

Sabra Health Care has a solid balance sheet with ample liquidity. Their net debt to adjusted EBITDA is 5.50x, and their interest coverage ratio is 4.71x. Additionally, they have $900 M liquidity available to them.

With the solid balance sheet and available liquidity, Sabra Health Care should be able to navigate through any economic cycle and support their growth plan in the future.

The valuation metrics show that they are currently undervalued. The P/AFFO of 8.29x and P/FFO of 8.80x are lower than their historical average. An investor who is interested in a growing healthcare REIT should take advantage of such a good opportunity. The iREIT rating tracker shows a very comfortable 28% margin of safety for Sabra Health Care at the moment.

Their 9.3% dividend payment is safe at this point, shown by cash dividend payout ratio of 79.9% and FFO payout ratio of 80.5%.

Risk

While I believe all three companies hold a strong balance sheet, solid capitalization, and great operation, these companies are rated below investment grade by the credit agency. This means that the interest rate spread might be much higher for them, and that may reduce their capacity to acquire and expand their portfolio and business.

The market has been volatile pretty much the whole year, and I don’t expect that to change anytime soon. At this point, uncertainty surrounding the inflation rate, interest rate, energy cost, and supply chain remain high, so continued volatility is likely until we have clearer picture on these main factors.

Reflecting the high uncertainty about major economic indicators, CEOs from top companies are forecasting a wide range of outlooks for the U.S. economy. Some are staying positive, expecting a mild recession or even no upcoming recession, while others are warning about the possibility of a severe recession in the short term.

However, the consensus is that we will experience a recession in 2023, but are not sure about the magnitude.

Given the general negativity and uncertainty, a bull market wouldn’t get any footing in the near future. I like these stocks for their attractive dividend yields. But recognize that they are a little more speculative than many of the other blue chip REITs that we like to cover.

Conclusion

Dividend stocks are one of the best ways to grow your investment portfolio steadily. Collecting a dividend from a strong company and reinvesting the dividend has been a bread-and-butter strategy for the long-term investor.

Especially in a volatile market with great uncertainty, investing in high yield companies looks even more attractive. These certainly look like a safer bet right now than chasing growth stocks given all the uncertainty surrounding the overall economic outlook.

These high-yielding divided REITs have a solid balance sheet, strong operation, and ample liquidity. They are a great idea for collecting dividend payouts while the rest of the market is moving sideways.

Sleep well at night, knowing that your investment is hard at work making you money.

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment