bedo/iStock via Getty Images

Introduction

High-growth technology stocks have truly fallen from grace over the past year, and the fear of a looming recession is only making matters worse. Yet, I believe there are a handful of companies who will be substantially less affected by a recession, and that is why I bought these three stocks last week.

CrowdStrike

Founded in 2011, CrowdStrike (NASDAQ:CRWD) is a cloud-native cybersecurity business operating a software-as-a-service business model. Due to this cloud-native approach, the CrowdStrike Falcon platform has been able to scale rapidly whilst delivering impressive results that legacy players struggle to compete with.

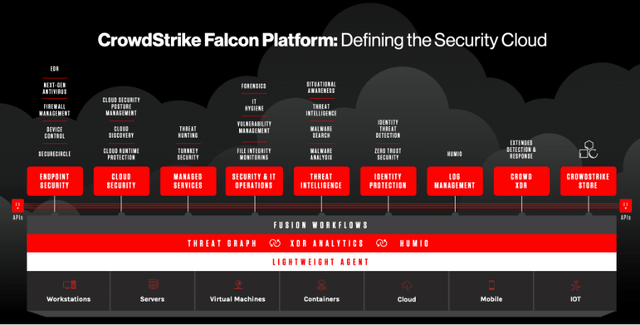

The Falcon platform specialises in endpoint and cloud workload protection, meaning that it can protect endpoint devices (laptops, desktops, mobile phones, IoT devices etc) operating in both on-premise and cloud-based environments. Whilst it may have started out specialising in endpoint devices, the Falcon platform has rapidly expanded its services, and now offers 22 different cloud modules across additional areas such as managed security services, identity protection, corporate workload security, and more.

CrowdStrike Investor Presentation – June 2022

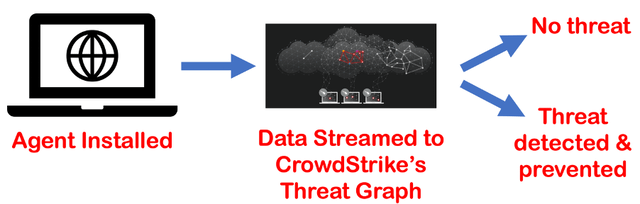

CrowdStrike has one of the most impressive business models that I have seen for a while, but to understand why, we must first look at how their Falcon platform works. The platform has two main components: an ‘agent’ which is installed on the endpoint device such as a laptop, and CrowdStrike’s Threat Graph.

CrowdStrike collects data from the endpoint device via its agent and sends this data to the Threat Graph. The Threat Graph then uses analytics and artificial intelligence to see if there is any abnormal or threatening activity within the data. If the Threat Graph picks up on any potentially threatening activity, then CrowdStrike can detect and prevent the cyber-attack.

The beauty of this model is that every time there is a cyber-attack on an endpoint device within CrowdStrike’s network, CrowdStrike’s AI will then be able to recognise and prevent this attack in the future – not only for that specific endpoint device, but for every single endpoint device across its network – talk about a powerful network effect!

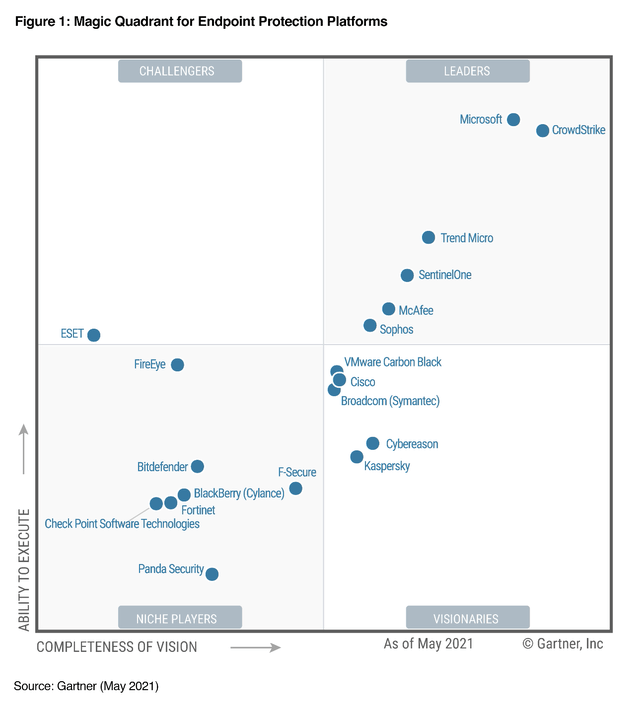

I get both excited and concerned when companies refer to artificial intelligence as a core competence; excited because of the potential that AI has when implemented correctly, but concerned because it’s essentially a black box where the company is saying ‘trust us, it works’. Thankfully, CrowdStrike has the results to show its effectiveness. In the 2021 Gartner Magic Quadrant for Endpoint Protection Platforms, CrowdStrike was way ahead of the pack (excluding Microsoft (MSFT), who it competes with at a similar level).

There is a lot to like about this business, but why have I chosen it as a recession-proof investment?

Cut Cybersecurity Spending? No Chance

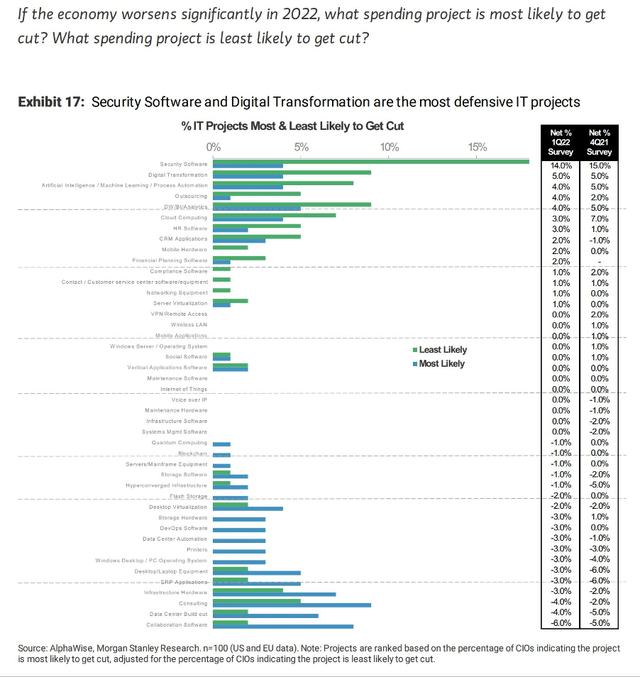

Recently, AlphaWise / Morgan Stanley published a report from their survey of CIOs which posed the following question: “If the economy worsens significantly in 2022, what spending project is most likely to get cut?”.

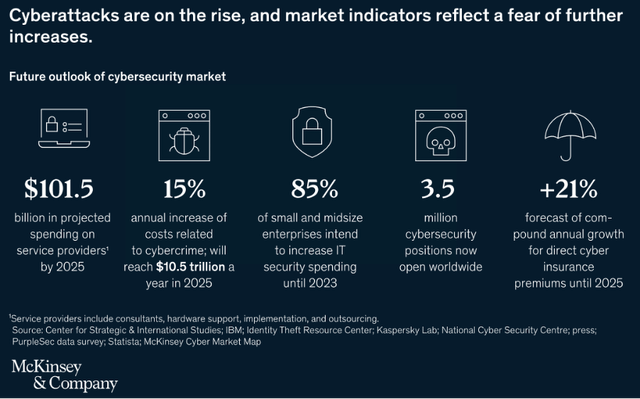

Perhaps unsurprisingly, Security Software was by far the ‘least likely’ to get cut, and that really shouldn’t be a surprise to anyone. This is also supported by McKinsey’s outlook for the cybersecurity market, with an expectation that annual costs related to cybercrime will increase by 15% annually to reach $10.5 trillion by 2025.

Even without these sources, common sense will tell you that the more digital companies become, and the more sophisticated hackers become, the greater the risk of cyberattacks & the more damaging they are. Cyberattacks are capable of being ruinous for a business, so I am led to believe two things:

- Companies will not cut back on cybersecurity spending in a recession

- Companies will always be more inclined to go for the highest quality cybersecurity provider that they can find

CrowdStrike successfully fits the bill for both of these categories.

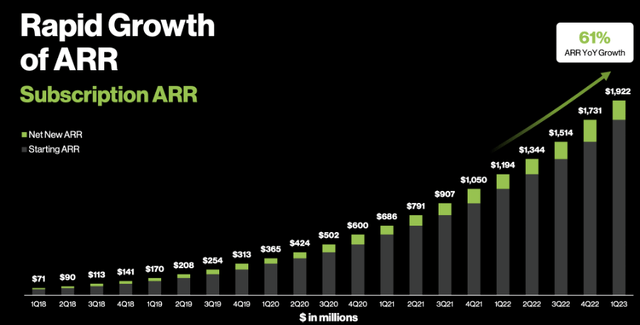

The future may hold a potential slowdown in growth, but I think CrowdStrike should be relatively immune to a recession. Perhaps this is why co-founder & CEO George Kurtz recently issued full year 2023 guidance implying 51%-52% YoY growth in revenue to ~$2.198B – this is not a company that is too concerned with the macro picture, and I have no doubt that it will continue to see strong growth where other companies will struggle.

CrowdStrike Investor Presentation – June 2022

UiPath

UiPath (NYSE:PATH) makes software robots so people don’t have to be robots.

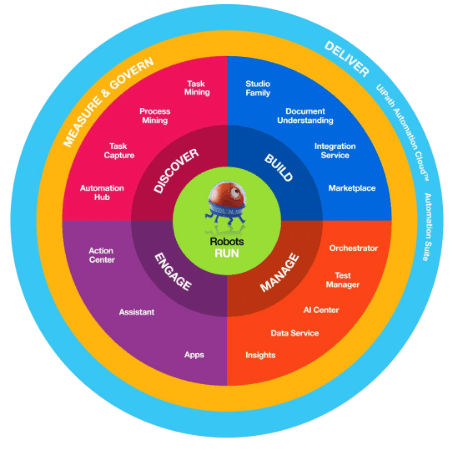

At least that’s what we can see displayed on the first slide of their Q1 FY23 results, but I do think it summarises what UiPath aim to achieve pretty well. They specialise in robotic process automation, or RPA for short, which is defined by UiPath as follows:

Robotic process automation (RPA) is a software technology that makes it easy to build, deploy, and manage software robots that emulate humans actions interacting with digital systems and software. Just like people, software robots can do things like understand what’s on a screen, complete the right keystrokes, navigate systems, identify and extract data, and perform a wide range of defined actions. But software robots can do it faster and more consistently than people, without the need to get up and stretch or take a coffee break.

UiPath provides businesses with the ability to use its software ‘robots’ to perform a wide range of human-like business process actions such as logging into applications, extracting information from documents, moving folders, filling in forms, updating information fields and databases, and many more. This allows companies to improve their operational efficiencies whilst reducing the amount of repetitive, mind-numbing, robotic work that employees need to perform.

UiPath Q1’23 Investor Presentation

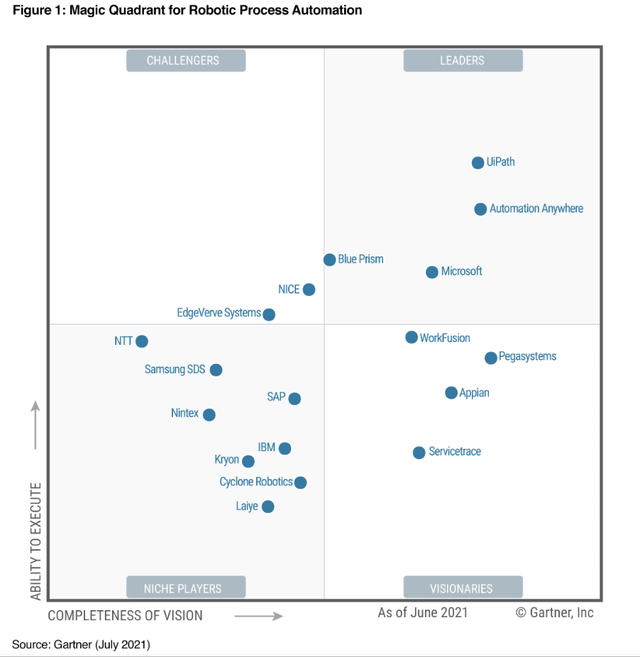

Like CrowdStrike, UiPath is a leader in the Gartner Magic Quadrant in its respective field (Robotic Process Automation) – and it is even further ahead in comparison to the competition than CrowdStrike was. Again, I get scared when I have to rely on artificial intelligence or machine learning, but UiPath is another example of a company with best-in-class technology.

Why UiPath?

So clearly another business with plenty of tailwinds and industry-leading technology, but why do I believe it to be recession-proof?

If I go back to the AlphaWise & Morgan Stanley research, the 3rd ;least likely’ item of expenditure to get cut related to artificial intelligence / machine learning / process automation software, and this is exactly where UiPath sits.

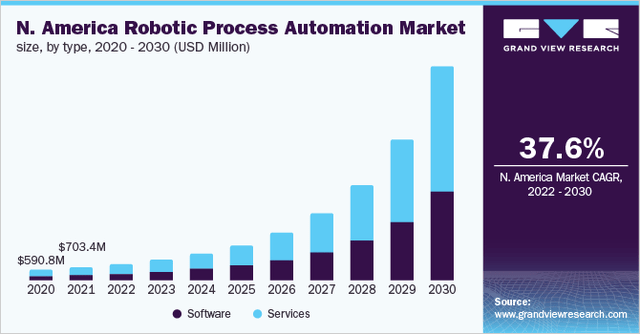

In fact, according to Grand View Research, the RPA market in North America is expected to absolutely skyrocket over the upcoming decade, growing at an almost unfathomable 37.6% CAGR – it will take more than a recession to stop this trend!

The most appealing aspect of UiPath to businesses in a recessionary environment is the potential efficiency it could bring. Not only are companies looking to fill the gaps currently left by ‘The Great Resignation’, but there is the additional opportunity to streamline certain areas of their business – and have UiPath’s robots take over roles that were previously filled by salaried staff, but execute the processes with greater speed and accuracy whilst being less expensive.

So CIOs have the opportunity to accelerate their digital transformation whilst also cutting costs? It feels like a no brainer, especially in a recessionary environment.

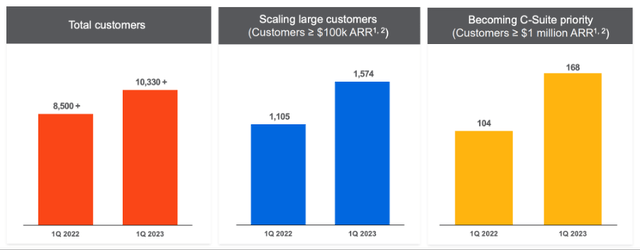

UiPath has also seen strong momentum recently with its business customers, with impressive YoY growth in large customers & even faster growth in enterprise-level businesses. With RPA clearly becoming more of a priority, I don’t think companies will be looking to ease up on these investments any time soon.

UiPath Q1’23 Investor Presentation

Lemonade

Lemonade (NYSE:LMND) is an AI-driven insurance company, with a mission to “Harness technology and social impact to be the world’s most loved insurance company.”

Lemonade initially focused on renters’ insurance, but now it also offers homeowners, pet, life, and recently moved into the lucrative car insurance market. It has grown rapidly, going from just over 729,000 customers two years ago to just over 1.5 million today. Using its AI chatbots, Lemonade is able to approve insurance claims in minutes and grant insurance policies in seconds.

It also has a different business model to classic insurance companies; Lemonade takes a fixed fee of 25% of premiums and passes the remaining 75% passed on to reinsurers. The at the end of each year, whatever is left over from that 75% is donated to charities chosen by Lemonade customers.

The company is attempting to disrupt a multi-trillion dollar industry that hasn’t seen too much evolution over the past century, and with a current market capitalisation of ~$1 billion, it’s clear to see why I’m excited. Yet, why does a company with such a huge opportunity ahead have such a small market cap? Well…

Despite my continued complaining about artificial intelligence being difficult to analyse as an investor, I do seem to invest in a lot of these ‘black box’ companies. Both CrowdStrike and UiPath have the results and industry recognition to back up their claims of effective AI, but Lemonade… not so much.

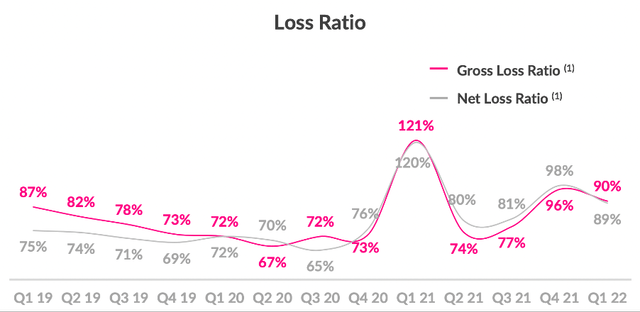

Fortunately, it is possible to track the effectiveness of their AI by looking at the loss ratio trends. Unfortunately, the trend looks as follows:

Lemonade Q1’22 Shareholder Letter

The gross loss ratio refers to the total claims paid divided by the total premiums, and Lemonade have a goal to achieve loss ratios below a target of 75%. The left-hand side of this chart looks ideal; gross loss ratios trending down (indicating that Lemonade’s AI is getting smarter & learning how to underwrite more accurate insurance policies), but then it all goes a bit pear shaped. There is a spike in Q1 21 due to the Texas Freeze, so I can’t blame Lemonade for that, but in Q4 21 and Q1 22 the gross loss ratios were 96% and 90% respectively – that is a huge step backwards!

It’s worth noting that the higher loss ratios in Q1 were in part a result of higher inflation, which makes sense – the premiums received from Lemonade cover the year ahead, but if prices rise due to inflation then the cost of claims rise for Lemonade, but the price of premium won’t rise until they get renewed the following year.

In general, the line from Lemonade is that higher gross loss ratios are a result of launching more products; this makes sense, new products = new data for AI to learn from, and the AI is going to be less effective when the product first launches. As an investor, I am willing to give them the benefit of the doubt for now, as I believe they do have a very compelling value proposition.

It’s also worth highlighting the following quote from Co-founder and COO Shai Wininger, where he talks about the fact that they are expecting a substantial gross loss ratio improvement soon:

We’re now using our fifth generation of machine-learning LTV prediction models, and these provide an ever-improving estimate of the loss ratio of each new customer, as well as their likelihood to churn or cross-sell. The combination of these factors supports our real-time view of customer lifetime value. Despite a 90% gross loss ratio for the quarter, these efforts show that the business we generated in Q1 is expected to have a lifetime loss ratio comfortably within our 75% gross loss ratio target. As we’ve spoken about before, loss ratios are lagging indicators, and changes in pricing, underwriting and segmentation take time to develop and then get approved through regulatory filings and yet more time to earn in.

My eyes are very much open to the risks surrounding Lemonade – the AI is unproven, it recently acquired MetroMile for Lemonade Car Insurance and there’s no knowing how effective the integration will be (although it was a bargain of an acquisition), and the company is and will continue to be unprofitable in the short-to-medium-term.

With that said, the company has shown an impressive ability to upsell products to its customers, and Lemonade was actually able to bundle all four policies together (renters’, car, pet, life) for the first time in the states of Illinois and Tennessee. The result?

- Customers with 2 Lemonade products outspent the average single product customer by 3:1

- Customers with 3 Lemonade products outspent the average single product customer by 7:1

- Customers with all 4 Lemonade products outspent the average single product customer by 9:1

This is a company with a strong brand and a compelling customer offering, I’m just looking for more evidence that the AI itself is capable of outperforming the incumbents.

Why Lemonade?

Despite Lemonade being the riskiest investment of the three (in my view), explaining why it’s made this article about recession-proof stocks is simple.

People will always need insurance.

Summary

Whilst high-growth technology stocks have been battered over the past 12 months (with good reason, given some of the wild valuations), I think there are companies out there that will continue to thrive despite the wider macroeconomic difficulties. These three companies have always impressed me, although I do think CrowdStrike in particular is in a league of its own.

And, as always, I put my money where my mouth is.

Be the first to comment