Rich Polk/Getty Images Entertainment

Investment Thesis

Pinterest (NYSE:PINS) is a leading global social media platform with a mission to ‘bring everyone the inspiration to create a life they love’. Its platform is used by ‘Pinners’ to discover ideas and be inspired, whether that’s looking for your next favourite outfit or deciding how to remodel your kitchen.

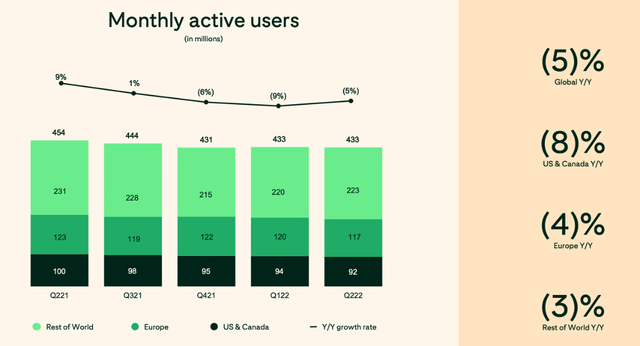

It’s been a difficult year for Pinterest shareholders, with the stock down 60% over the past 12 months and down 75% from its all-time highs. This has been down to a combination of factors, but the primary concern driving the stock downwards has been Pinterest’s haemorrhaging of MAUs (monthly active users).

Pinterest Q2’22 Earnings Presentation

Yet, my personal investment thesis for Pinterest does not rely too much on user growth, although I can’t overlook falling MAUs.

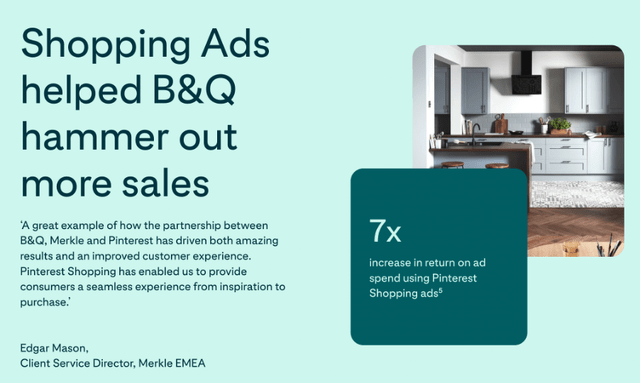

I believe that Pinterest is a highly monetizable, shoppable platform and that it has the potential to grow ARPU to the levels of Meta Platforms (META) and beyond. Advertisements are usually a distraction to the experience on social media, but with Pinterest, I believe they can, in fact, enhance the experience. If I need design inspiration for my new kitchen, then perhaps I’ll find a kitchen on Pinterest that I like, following which I can click on individual pieces of the design (kettles, counters, fridges etc.) and be taken to the retailer in order to purchase these products. I think this is a highly attractive way of doing ecommerce, and it explains why I think Pinterest is well positioned for long-term success.

But shares were under pressure once again last week, following yet another disappointing earnings report from social media platform Snap (SNAP). I for one find it absolutely hilarious how Snap’s regular poor results have a habit of dragging down higher quality advertising businesses, such as The Trade Desk (TTD). It would appear that the market can’t help but extrapolate Snap’s results over every advertising or social media business, and Pinterest was swept up in this negativity.

The big question now for Pinterest shareholders is whether or not Q3 results will be as bad as Snap’s, or if the company can take another step in the right direction as it hopes to turn its fortunes around.

Latest Expectations

Pinterest is set to report its Q3’22 earnings on Thursday, October 27, after the market closes, and there are several key items that investors should keep their eyes on.

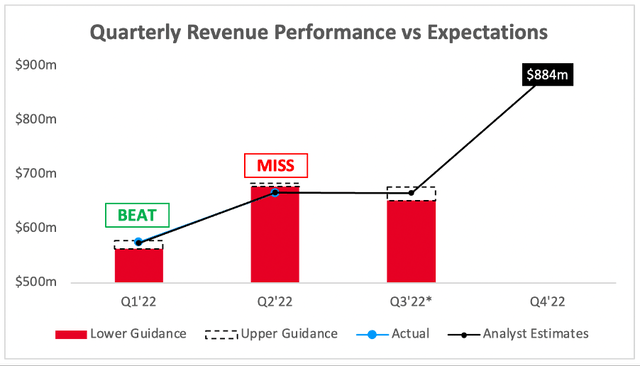

Starting with the headline numbers, analysts are expecting Q3’22 revenue of $665.5m, representing YoY growth of 5.2%. This was revised downwards from $721m back in August, following management’s Q3 guidance of ‘mid-single digit revenue growth’.

Q2 results were a perfect demonstration of just how low the market’s expectations were for Pinterest; a huge miss on revenue guidance, and yet shares popped 20% after the results were announced.

Investing.com / Pinterest / Excel

Clearly, mid-single-digit revenue growth is way below expectations from a ‘growth’ company like Pinterest, but there are two things to remember.

Firstly, I don’t think Pinterest is currently priced for the hyper-growth that it saw during the pandemic, where annual revenue growth was 48% and 52% in 2020 and 2021 respectively.

Secondly, I think the market is aware that Pinterest is going through something of a reset – it saw a huge post-pandemic slowdown and has recently hired a new CEO in place of the founder (who moved to the Board of Directors), so this is a company that needs a bit of time. In my view, the current share price certainly shows that the market isn’t expecting an awful lot from Pinterest right now.

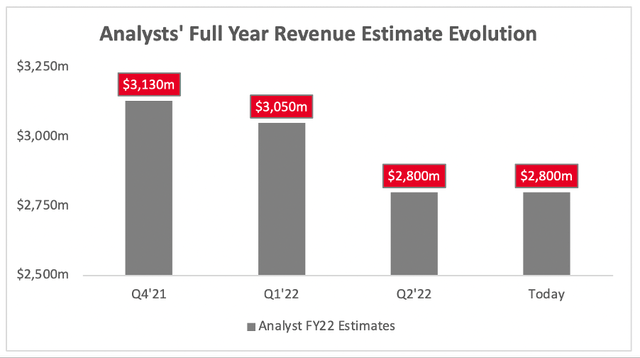

The lower expectations can clearly be seen in the below graph, as analysts have cut their 2022 full-year revenue expectations for Pinterest from $3.13B to $2.80B in just a couple of quarters.

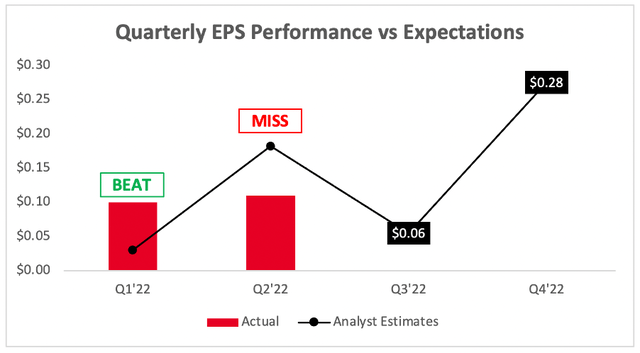

Moving down to the bottom line, and Pinterest also saw earnings in Q2 fall below expectations. Analysts are now expecting EPS of $0.06 in Q3 and $0.28 in Q4 – with the latter being Pinterest’s strongest quarter historically, thanks to holiday shopping.

Investing.com / Pinterest / Excel

When looking at the Q2 results above, investors might be surprised that shares jumped 20% on the last earnings release – but there are key reasons for this share price rebound beyond just the financials, so what else should investors be looking at when Q3 earnings are released?

2 Key Metrics To Watch In Pinterest’s Q3 Earnings

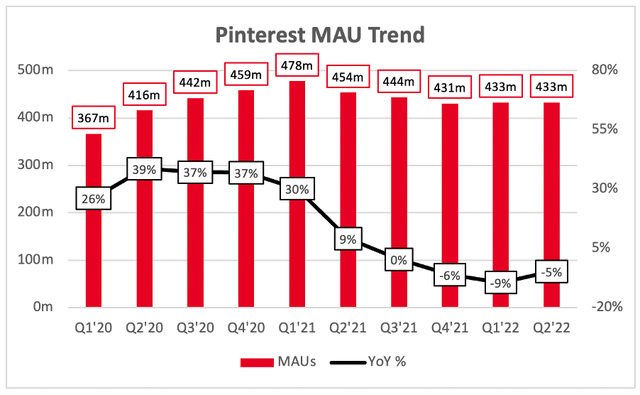

As mentioned, one of the most substantial downward pressures on Pinterest’s shares over the past 18 months has been its monthly active users. The company had a big boost in MAUs during the pandemic, particularly as people stuck at home turned to Pinterest for inspiration on redecorating, baking, and more.

The below graph shows that Pinterest’s MAUs peaked in Q1’21, and then went on a fairly rapid downward spiral throughout 2021 as the world opened up once more. A reopening world meant there was less demand for the ‘at home’ inspiration, which is where Pinterest excels.

Yet, 2022 appears to have stemmed the outflow of MAUs, as Q1’22 saw the first sequential rise in MAUs for a year – and Q2’22 continued to show a stabilisation in MAUs.

Perhaps most interesting was the reversal in YoY growth rates; Pinterest may have still seen a MAU decline of (5%) YoY in Q2, but as seen in the above graph, this was the first sequential improvement in YoY growth rates since Q2’20. If Pinterest can continue this improvement and see MAUs increase from that 433m figure, I imagine the market will react extremely positively.

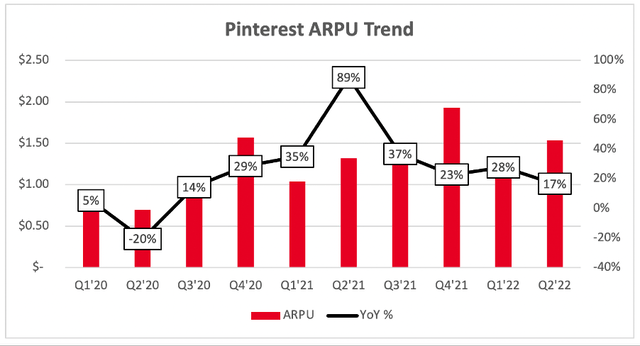

But what about the financials? This is the fun thing about Pinterest – its financials have remained fairly strong despite losing so many MAUs. In fact, Pinterest’s ARPU in Q2 grew 17% YoY, and the trend of strong ARPU growth has been a bright spot for Pinterest throughout these difficult 18 months.

My personal investment thesis for Pinterest is, in short, the fact that I think its platform is built better than any other social media company for user monetisation, and growing ARPU is the clearest indication that this thesis is playing out.

Furthermore, new CEO Bill Ready is an ecommerce specialist, having been CEO of Venmo and a PayPal (PYPL) executive prior to his recent role as President of Commerce at Google (GOOGL). On the face of it, he is the perfect CEO to take Pinterest to its next level of monetisation. It may take time for him to put his stamp on the company, but I’ll be excited to take a look at Pinterest’s Q3 earnings to see what plans he has to boost Pinterest’s monetisation & ecommerce presence – and, perhaps some of those will already start to play out in the ARPU trend.

PINS Stock Valuation Remains Attractive

As with all innovative, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Pinterest is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

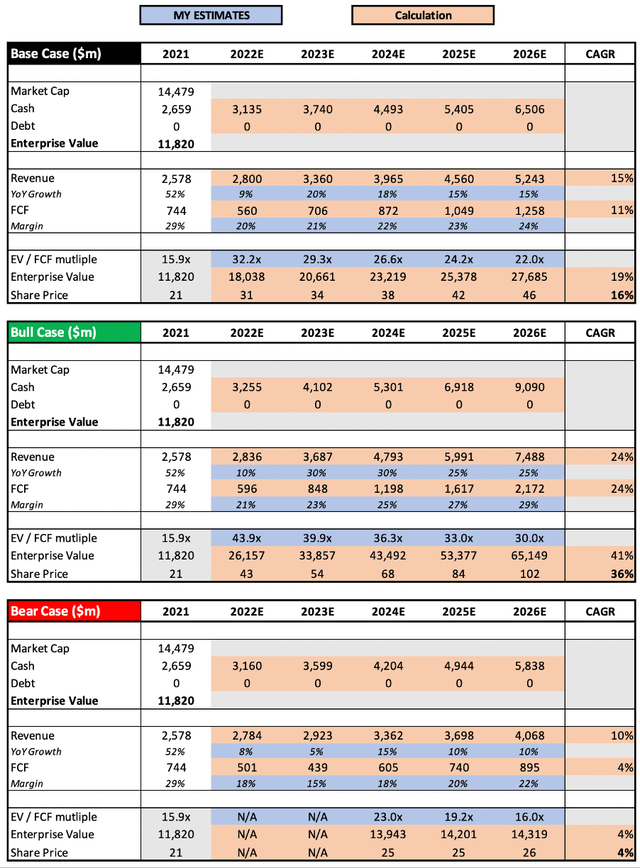

I have changed the valuation model slightly from my previous article, in order to better demonstrate the potential upside and downside in my bear and bull case scenarios. The base-case scenario has remained fairly similar to the base-case scenario in my previous model; the main change is that I have been more prudent with growth rates and the final EV/FCF multiple used, as expectations do remain muted for Pinterest.

My bull-case scenario assumes that Pinterest manages to start growing MAUs again at a decent rate, but, more importantly, the company accelerates its growth of ARPU through improved monetisation initiatives. I believe they have the platform and the CEO to achieve this, so it’s all about execution right now.

The bear-case scenario essentially assumes that the recent downward spiral for Pinterest continues, and the company just doesn’t manage to get itself out of the rut it currently finds itself in.

Put all that together, and I can see Pinterest shares achieving a CAGR through to 2026 of 4%, 16%, and 36% in my bear, base, and bull case scenarios. Given that I have taken a relatively conservative view in this model, I think that Pinterest’s current share price represents an attractive opportunity for long-term investors.

Bottom Line

Whilst Snap may have crumbed in Q3 earnings, the market has been shown time and time again that it’s best not to use Snap as a barometer for other advertising businesses. Given that Pinterest is such a different type of social media platform, I think investors should not be too concerned with the noise coming out of Snap – remember, Snap plunged 20% after Q2 earnings, and Pinterest jumped 20% when it was reported a couple of weeks later.

The number one thing that Wall Street likes to watch with Pinterest is its monthly active users, so if that MAU figure comes in above 433m, I think the shares could react very positively. Expectations currently remain muted for Pinterest, but it remains a platform with a huge amount of potential, and I believe it is set up for long-term success if it can improve on its execution.

Given the current attractive risk/reward setup, I will reiterate my previous ‘Buy’ rating on Pinterest shares.

Be the first to comment