ismagilov

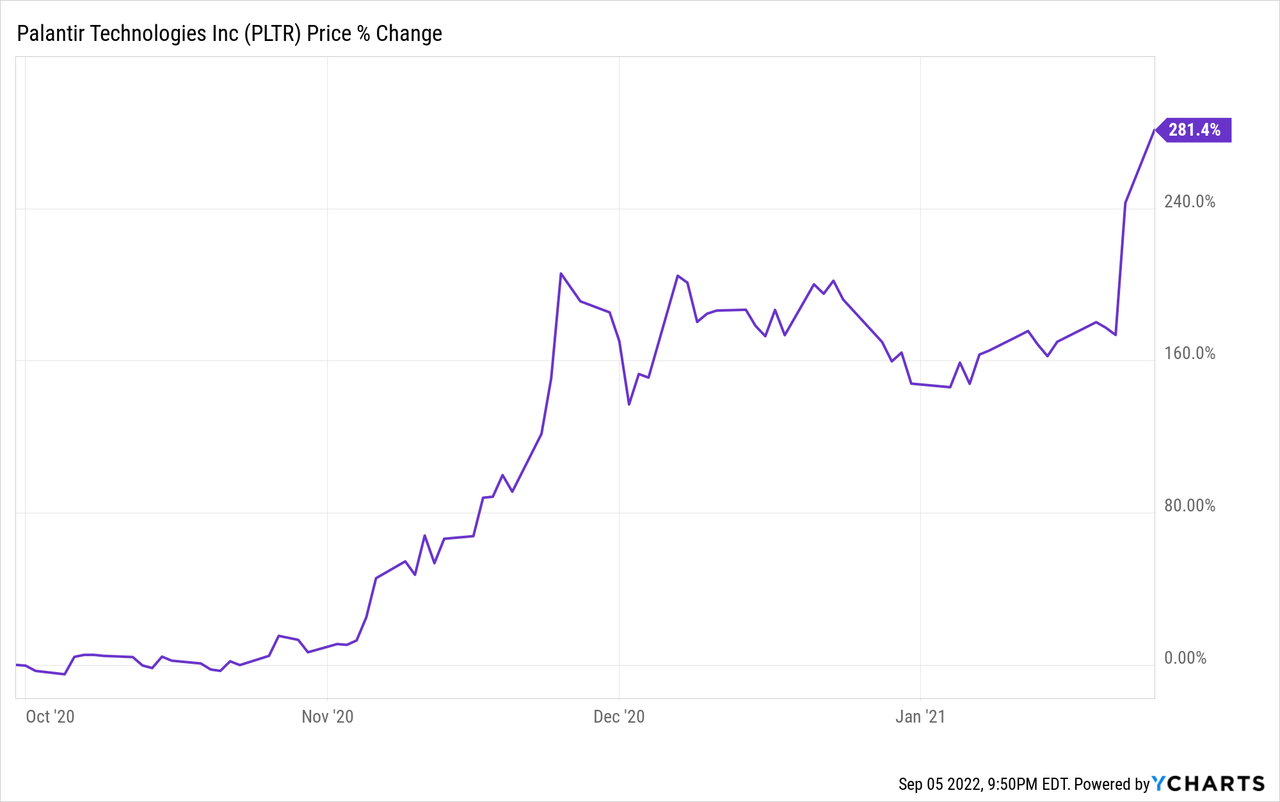

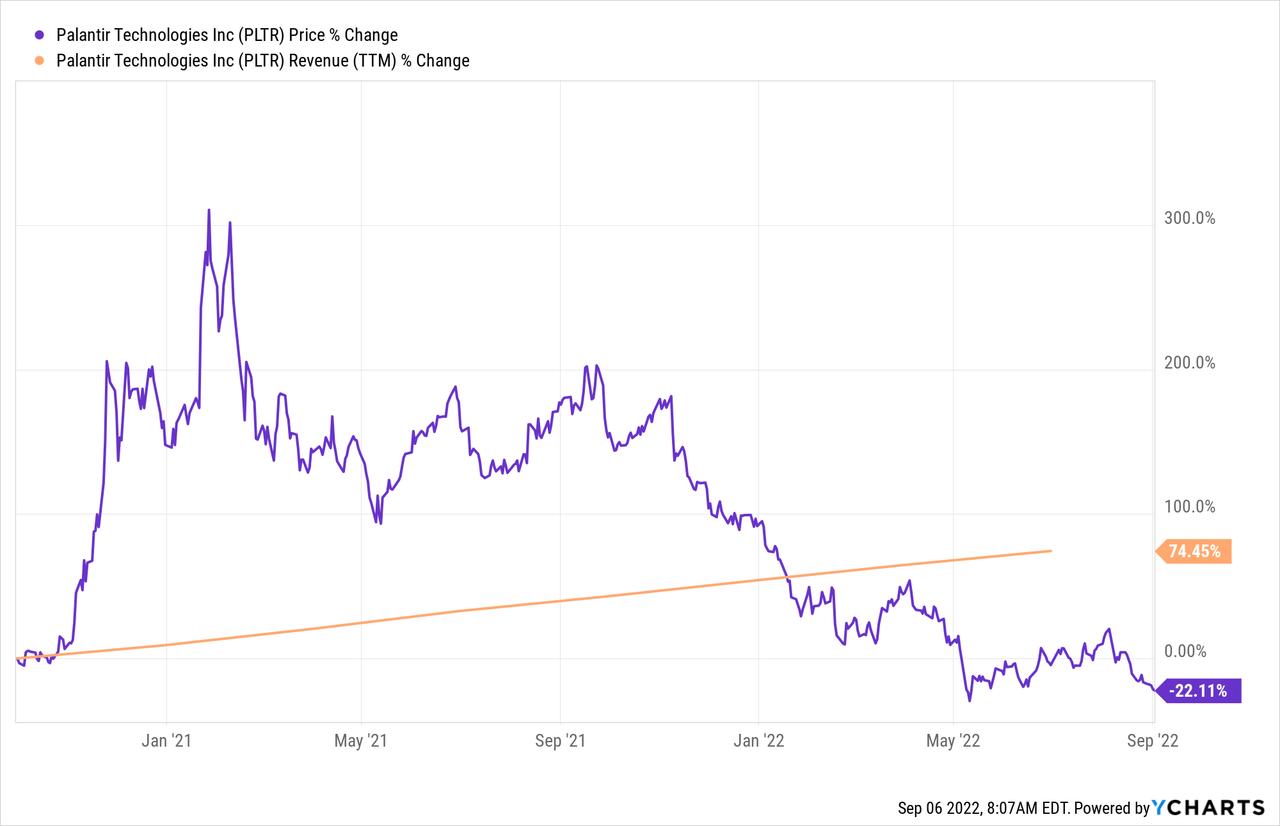

Palantir Technologies (NYSE:PLTR) stock shot up like a rocket after its direct listing, becoming one of the hottest and most popular stocks on Wall Street at the time, even developing a cult-like following with numerous YouTube channels and blogs dedicated to following the company:

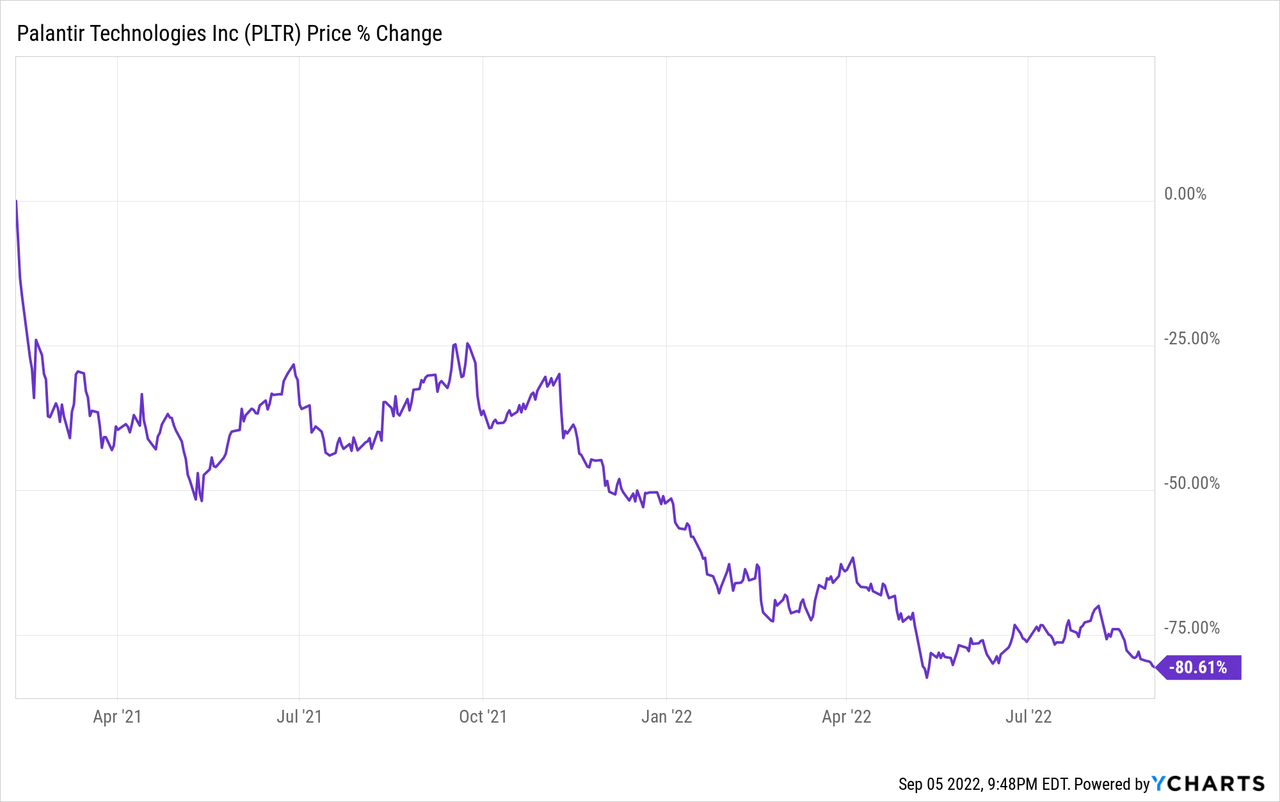

Since then, however, the stock has dropped like a rock, now trading below its direct listing price.

Between general market bearishness, an epic collapse in high-growth speculative tech stocks, exceedingly high stock-based compensation for company insiders, and disappointing recent quarterly numbers from PLTR, the market’s obsession with PLTR stock has seemingly vanished.

That said, the core investment thesis for the company remains intact, and the long-term potential remains enormous. It is when market pessimism is at its peak that the best buys are made. In this article, we will discuss three reasons why we still believe that PLTR could generate significant alpha for investors over the long term, especially from the currently suppressed share price.

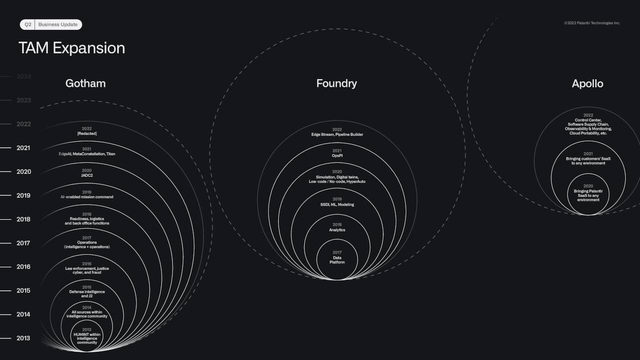

#1. PLTR’s total addressable market is very large and continues to grow rapidly

When it went public, PLTR estimated that its total addressable market was ~$120 billion, and since then it has continued to grow both organically and inorganically. This provides the company with a very long growth runway, which means it could potentially compound shareholder wealth over a long period of time as it continues to innovate and create new products to meet the insatiable government and corporate demand for data analytics and artificial intelligence software.

PLTR’s organic total addressable market growth is simply the result of the rapid growth in the global big data industry, a segment of the economy that is expected to grow at a ~20% CAGR through 2030. Analysts expect PLTR’s total addressable market to reach $230 billion by 2025 and a 20% CAGR in global big data would put PLTR’s total addressable market at ~$600 billion by the end of 2030.

Meanwhile, PLTR’s inorganic total addressable market growth is being fueled by its innovations to bring new products to market and make its existing platforms affordable and usable by a greater audience of potential clients. This expansion was clearly illustrated in PLTR’s Q2 investor presentation:

PLTR TAM Growth (Q2 Investor Presentation)

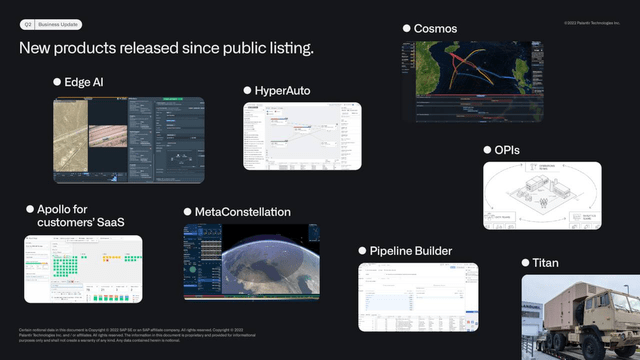

This has resulted in numerous new innovations since going public, including Edge AI, HyperAuto, Cosmos, MetaConstellation, and Apollo for customers’ SaaS.

PLTR Innovations (Q2 Investor Presentation)

Given that the current expectation is that PLTR will generate $4.1 billion in 2025 (less than 2% of its expected total addressable market), the vastness of PLTR’s growth runway is clear. Given its aggressive innovative pace and ability to attract top industry talent, there is good reason to be bullish on its ability to sustain high revenue growth rates for many years to come.

#2. PLTR’s Gotham business has a wide moat and has a major long-term growth catalyst

PLTR’s Gotham (i.e., government) business is another reason we really like PLTR. There are two main reasons why we believe this business truly has a wonderful long-term outlook:

1. It is positioned to become the sixth prime defense contractor with the U.S. government and its first software prime contractor. As management stated on a recent earnings call:

Our ambition is to be the sixth prime contractor for the U.S. Federal Government, a trusted partner to deliver complex end-to-end integrated hardware and software solutions, building on the legacy of programs that we prime today. But we seek to be the first company to do this as a software prime, using software innovation and our unmatched expertise to deliver new integrated hardware software capabilities faster than the pace of conflict.

This highlights the wide moat that they have built in their U.S. government business, establishing themselves as the go-to firm for data analytics and artificial intelligence software expertise whenever a department has a no-fail mission and/or platform that they are looking to execute/enhance. This reputation has come about as a combination of decades of successful relationship building and collaboration on previous high-stakes missions and Gotham’s proven capabilities. Furthermore, PLTR’s strong commitment to continuous innovation gives the U.S. Government confidence that they are betting on a winning horse that will be able to help them stay a step ahead of current and potential future adversaries in the new A.I.-powered defense applications arms race.

2. This leads us to another reason why we are highly bullish on Gotham’s long-term outlook: it has a very strong demand catalyst in China’s rise and, in particular, its obsession with winning the artificial intelligence race with the United States. The reason why this is such a lucrative catalyst for PLTR is because – as history has proven for other defense contractor primes like General Dynamics (GD) and Raytheon (RTX) – government contracts for mission-critical platforms and systems are budget-driven, not profit-driven. In other words, the higher priority of a system, the more the government will be happy to pay for it, even if it leads to wildly high profit margins for the defense contractor. Given the increasing prominence of A.I.-powered defense technologies in national security and PLTR’s increasingly dominant position among potential vendors, this bodes very well not only for continued revenue growth for Gotham, but also profit margin growth.

Some bears point to the fact that this theory is already springing leaks and taking on considerable water given that the U.S. Government business saw its growth decelerate to a 27% revenue growth rate in Q2. If government growth continues to decelerate (as it has for the past four quarters), PLTR’s long-term intrinsic value will likely be quite disappointing.

However, the reality is that PLTR still only has a small percentage of its U.S. government’s total addressable market and management remains highly bullish on its long-term growth trajectory. As it pointed out on the earnings call: PLTR believes that the heightened geopolitical tensions today relative to other times in its history mean that demand should accelerate moving forward. Furthermore, CEO Alex Karp elaborated on the nature of contract winning and revenue growth in the government business on the Q2 earnings call, stating:

I think we shared in one of our earnings calls was that our government U.S. business has a CAGR over a decade or more of 35%. During that time, we’ve had a number of years that were flat, and this is frustrating. Believe me, it’s more frustrating for us than anyone else because we would prefer an even lower CAGR, but having more certainty.

And so nevertheless, you can ask yourself the question, does it appear that the last 10 years were less dangerous or the next 10 years are going to be more or less dangerous than the last 10 years? So, it’s just a very basic view that we have. The next 10 years, the next 2 years are clearly more dangerous. America’s engaged on multiple fronts. And then there’s a question, does Palantir have the product market fit and access to the market?

Our product, we’re looking at the U.S. business that’s going to cross the $1 billion mark next year as well. This is like so you have a $1 billion software business as of next year with positioning that has never been as good. So both our micro positioning and obviously, the macro position, it’s so sublime. It’s hard to talk about without sounding like we’re kind of warmongering.

And that’s why I am positing internally and externally the growth in U.S. government over a multiyear period will be at least as good in the future as it was in the past. However, that 35% CAGR included a number of years where it was flat or even negative, and that’s just the frustrating part about contracting at our level. The contracts are so big and meaty that you got to kind of wait.

#3. The stock price looks very cheap right now.

Finally, PLTR’s stock price has pretty much never been cheaper since it went public. Not only is the stock trading near all-time lows, but revenue has grown considerably since PLTR went public:

Furthermore, as has already been mentioned, PLTR’s total addressable market and lineup of successfully adopted products have already increased meaningfully, with significant continued growth in TAM and innovations likely to come for the foreseeable future. In short, the fundamentals remain incredibly robust, and the company – and the world situation – has only continued to strengthen the investment thesis.

The only major issue in our view is the continued aggressive issuance of stock-based compensation to insiders. However, we expect this headwind to gradually decline on a relative basis as the company continues to scale.

Furthermore, it is important to note that PLTR’s business model is such that the company generally is not profitable in the early years of its dealings with a new client, as it spends heavily on labor to effectively serve as a data analytics consulting firm, getting to know the client and tailor the product to their needs. However, once it has an established working relationship and the company begins to expand its use of and demand for PLTR’s products, PLTR’s profitability increases substantially. The numbers are already showing that PLTR’s clients are doing exactly this. For example, in Q2 the average revenue from its 20 largest customers saw 17% year-over-year growth.

Meanwhile, the stock currently trades at 31.4x on an EV/EBITDA basis and 57.9x on a price-to-forward normalized earnings basis. Analysts expect revenue to grow at a 29.1% CAGR through 2026, but for EBITDA to experience a 45.3% CAGR and normalized earnings per share to achieve an 82.3% CAGR through 2026 as its profit margins are expected to increase tremendously due to economies of scale. At an expected normalized earnings per share of $0.60 in 2026 along with 27.7% expected normalized earnings per share growth that year, we think a P/E ratio of at least 30x will be justified. This would result in a stock price of $18, translating to a 2.8% total return CAGR between now and the end of 2026. Given that these assumptions are predicated on a 29.1% revenue CAGR over that span, we think it is very achievable. Furthermore, it gives the company a significant margin of safety to still deliver attractive total returns even if it were to underperform that level of growth.

Investor Takeaway

PLTR has experienced a horrific decline in its stock price ever since reaching highs in early 2021. However, its underlying business continues to hum along, especially in its commercial Foundry business which is currently experiencing accelerating growth. Meanwhile, its government business remains as strongly positioned as ever, and – given the long-term catalyst from A.I. competition with China – is likely to continue growing at an impressive clip over the long term.

With the stock price looking very cheap and the total addressable market continuing to grow at a rapid pace, the sky appears to be the limit to what PLTR can achieve for its clients and the wealth it can compound for shareholders over the long term. We rate it a Strong Buy.

Be the first to comment