golero

A few days ago, I wrote an article titled “Life Is Too Short When…” in which I explained some of my failures in life that resulted in some significant wins. In that article I explained that,

These days, I have a greater understanding of investing: how monetary success is gained by playing good offense (earning money) and defense (spending as little as possible).

I’ll admit, in my early days as an investor, I never really understood the concept of money, but over the last three decades I have developed a serious concern for it (money) and a desire to work hard to achieve success.

It’s not just my experience that differentiates me from other Wall Street writers, but my extreme conservatism that provides me with a gigantic edge.

When I was younger, I never grasped the concept of losing money, I was more of an “easy come, easy go” type, however, my mental mindset was significantly modified as a result of the “Great Recession”.

When I lost large sums, I was the first to blame others.

I blamed the bankers, the appraisers, and my business partner, and while they did have a hand in some of the losses I incurred, I had to learn to look myself in the mirror.

It’s hard to accept defeat, and perhaps it’s simply human nature to pin the loss on somebody else.

Yet there’s a point in which everyone on this earth experiences a mishap at some point in their lives, but what matters is how they handle it, what they do next, and how they let it shape them in the end.

The victim mentality feeds on negative thoughts, while the victor mindset is focused on resolution.

As a young investor, I had to grasp the concept of hard work, recognizing that another differentiator for me was to outwork anyone on the planet.

As my track record on Seeking Alpha attests, I have more articles published than anyone (3,378 currently) and it’s no surprise that I have the most followers too (over 102,000).

I learned very quickly when I started writing (on Seeking Alpha) that my greatest attribute is perseverance in the face of adversity.

More so, I decided that even though I had my fair share of failures before 2010, I had to keep my head up and play the role of victor and rise above.

Perhaps the greatest outcome from my failures, and the true “rising from the ashes” moment was when I decided to shift my focus to that of a value investor, with a primary objective to preserve capital.

In other words, the old Brad Thomas was focused on how much money he could make and not on how much he could lose, but in 2010 he transformed into a value investor who’s focused on risk as well as return.

Just call me “Brad Thomas 2.0” because I am a completely different investor than I was around 12 years ago. My mantra is to “always protect principal at all costs”, and of course that includes not to overpay for anything.

My failures in life taught me some valuable lessons, and they shaped be to become a more intelligent investor.

As a victor, I now have an instinctive appreciation for value that only those who have experience can completely grasp.

The Margin of Safety Applied

Benjamin Graham (Security Analysis) explained:

In security analysis the prime stress is laid upon protection against untoward (unfortunate) events.

As Graham wrote in The Intelligent Investor, the value investor’s purpose is to capitalize upon “a favorable difference between price on the one hand and indicated or appraised value on the other.”

As a hard-core value investor (like Graham and Buffett) I spend most of my time analyzing dividend growth stocks that can be purchased at a margin of safety, and of course this involves consideration of the prospective company’s moat that helps preserve long-term profits.

In this article today I would like to highlight three Equity REITs that can be purchased at bargain prices.

A Bargain in the Retail Aisle

CTO Realty (CTO) is a shopping center that owns a portfolio of high-quality properties in high growth markets while also holding a 15% interest in net lease REIT Alpine Income Property Trust (PINE) – worth around $40 million.

Year-to-date CTO has acquired $177.0 million at a weighted average cap rate of 7.2% bringing its total portfolio to 22 properties and approximately 3 million square feet (94% leased).

CTO commenced (in 19021) as a large landowner (in Daytona Beach) and over the years the company utilized the 1031 exchange vehicle to invest in income-producing properties. During the pandemic however, Consolidated Tomoka Land Co. converted into its now high-return diversified REIT, CTO.

Since then, CTO has proven its new strategy is paying off. With positive income and multiple cash flow growth prospects created in the short time as a REIT, dividend growth is expected, and upside potential is obvious.

CTO recently acquired a 162,500 sq. ft. property known as Madison Yards, located in the Inman Park/Reynoldstown submarket along the Memorial Drive corridor of Atlanta, Georgia for $80.2 million. The property was purchased through a 1031 like-kind exchange using $17.5 million of restricted cash generated from the company’s previously completed property dispositions.

CTO’s total revenues Q2-22 increased by 36% to $19.5 million and year-to-date total revenues have increased by 26% to $36.7 million. Year-over-year same-property NOI growth was 24% for Q2 or 13% and same-property NOI increased 20%.

Also, in Q2-22 core FFO grew 60% to $1.41 per share and AFFO grew 38% to $1.48 per share (these per share results are before the effects of the recent 3-for-1 stock split). CTO also paid a regular cash dividend of $1.12 per share, which is a 12% year-over-year increase over the Q2-21 cash dividend and a 4% increase over the Q1-22 quarterly dividend and a current stock split adjusted annualized yield of approximately 7%.

The quarterly dividend represents a cash payout ratio of 76% of Q2-22 AFFO per share, which continues to improve.

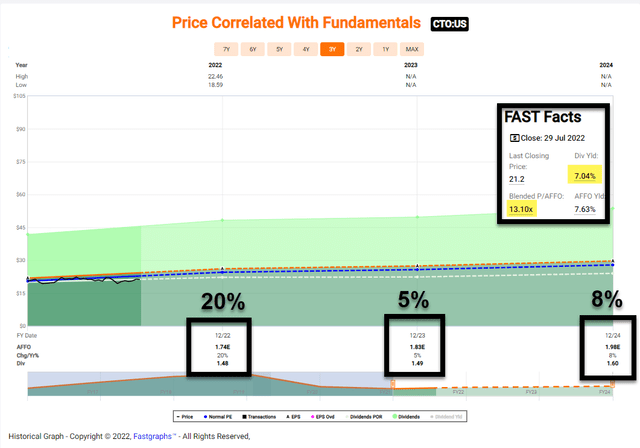

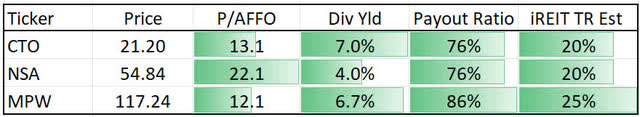

As seen above, CTO sports a juicy 7.0% dividend yield with growth estimates (analyst consensus) of 20% in 2022, 5% in 2023, and 8% in 2024. More telling is CTO’s P/AFFO multiple is suggests a bargain at 13.1x. Compare that with other shopping center REITs like Kimco Realty (KIM) – trading at 19.1x, Regency Centers (REG), trading at 19.5x, and Federal Realty (FRT), trading at 23.3x.

Conclusively, CTO is trading at a wide margin of safety, and as a result, we’re recommending the shopping center as a Buy with a forecasted 12-month total return target of 20%.

A Self Storage Gem

National Storage (NSA) is a self-storage REIT that owns 1,061 properties (884 wholly owned) and over 68.4 million square feet. A key component of NSA’s strategy is to capitalize on the local market expertise and knowledge of regional self-storage operators by maintaining the continuity of their roles as property managers.

In Q1-22 NSA acquired 12 stores valued at approximately $93 million with cap rates averaging 5.3%. Subsequent to Q1 the company closed with one of its JV partners on the acquisition of a high-quality 7 property portfolio, strategically located in the Houston MSA and valued at $208 million.

NSA’s balance sheet is strongly positioned: subsequent to quarter end, Kroll Bond Rating Agency upgraded NSA’s credit rating of its operating partnership to BBB+ from BBB flat, reflective of the conservative balance sheet, multiple options for capital and strength of the self-storage sector.

At the end of Q1-22 leverage was 5.7x net debt-to-EBITDA (towards the low end of the targeted range of 5.5x to 6.5x) with no debt maturities through 2022. In addition, NSA has just 18% of principal debt subject to variable rate exposure and $185 million of availability on the revolver.

NSA has seen 163% growth in its quarterly dividend since the IPO. More recently the company declared its $0.55/share quarterly dividend, a 10% increase from prior dividend of $0.50. What’s more, NSA’s dividend is well-covered with a payout ratio (using AFFO per share) of 76%.

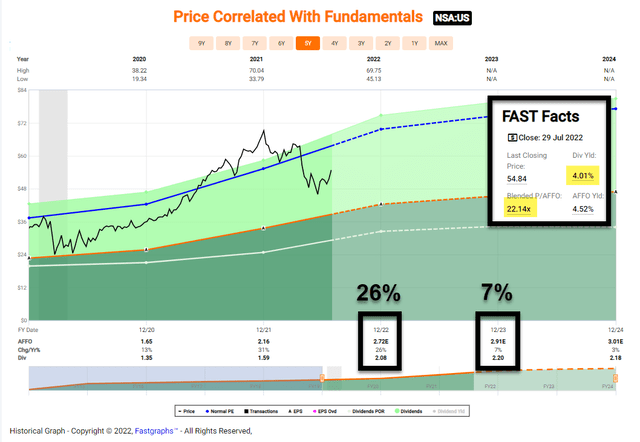

As a result of the strong performance, we increased NSA’s Buy Below target and we recently added shares to one of our iREIT on Alpha portfolios. Analysts are forecasting NSA to grow AFFO per share by 26% in 2022 and by 7% in 2023.

As the FAST Graphs illustrates (above), shares are trading at 22.1x (using AFFO metrics) below the normal multiple of 25.7x. Furthermore, NSA is cheaper than the peers like Extra Space (EXR) – trading at 25.7x and Public Storage (PSA) – trading at 25.3x.

NSA’s dividend yield is 4.0% (and well-covered as I mentioned above). We like the pricing power we see here with NSA (and other self-storage REITs) and we maintain a BUY with a 12-month total return forecast of 20%.

A Pure Play Hospital REIT Pick

Medical Properties (MPW) is a healthcare REIT that owns 440 hospitals in the US (60%) and other markets including the U.K. (20%), Switzerland (6%), Germany (6%), Australia (4%), Spain (1%), and other Countries.

MPW’s core competency is in owning and investing in mission critical hospitals where the REIT is the second largest owner of hospital beds in the U.S., with approximately 46,000 and a U.S. portfolio of $13.3 billion.

Recognizing that hospital investments are not bullet proof, MPW has managed to diversify its business model to mitigate operator-specific risks such that, even in event of bankruptcy: rents get paid, value is protected, and new tenants are available.

MPW utilizes multiple master lease structures that guarantees the company the right to “take back” all properties upon default.

MPW’s leases safeguard immediate control of properties in the rare event of parent-level distress. In 2021, property-level earnings before interest, depreciation, amortization, rent, and management fees (EBITDARM) rent coverage was 2.8x… demonstrating the properties are profitable.

Over the years, we have watched MPW improves its payout ratio (currently 86% based on AFFO per share, according to REIT/BASE), while also growing its dividend. In the early innings, I was not a fan of the MPW business model, recognizing that the company was not growing the dividend.

However, MPW has proven it can manage properties globally and create value – since 2012 the company has paid out $3.2 billion in cash dividends and its capital has appreciated by $5.1 billion (2012-2021). In February the company boosted its dividend by 3.6% from $.28/sh to $.29/sh.

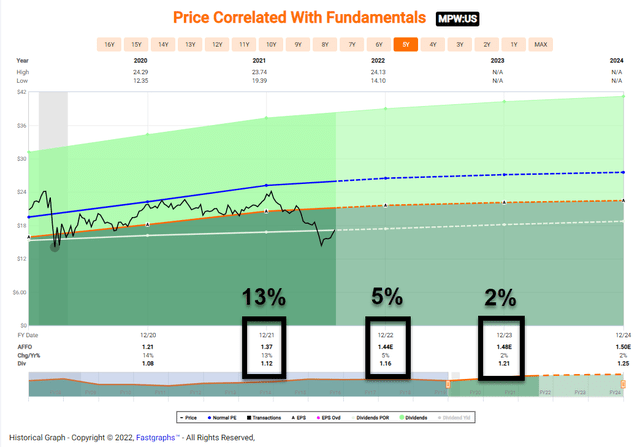

As viewed below, MPW had solid earnings (AFFO per share) growth in 2021 of 13% and analysts are forecasting more modest growth of 5% in 2022 and 2% in 2023 (all based on AFFO per share).

MPW has seen strong momentum over the last 30 days (+13%) and we’re anxiously awaiting earnings (when markets open August 3rd). We will be interviewing management shortly after the earnings call for iREIT on Alpha members. We’re maintaining a Strong Buy with a 12-month total return forecast of 25%+.

Be the Victor!

My final advice to become victorious in your investment portfolio is to stop trying to predict the market, as Warren Buffett explains.

“I never have the faintest idea what the stock market is going to do in the next six months, or the next year, or the next two.”

Larry Swedroe among the first authors to publish a book that explained the science of investing in layman’s terms, “The Only Guide to a Winning Investment Strategy You’ll Ever Need” said that,

There is an overwhelming body of evidence to support the view that believing in the ability of market timers is the equivalent of believing astrologers can predict the future.

Swedroe added,

It’s a staple of personal finance advice: Buy-and-hold, because trading the stock market is a sucker’s bet.

Don’t become the victim of a sucker’s bet…

Stay the course. It is the most important single piece of investment wisdom I can give to you. – Jack Bogle

Be the first to comment