Panama7/iStock Editorial via Getty Images

Catalysts for Stability, Rather than Upside

Telecoms are quite the paradox. They offer some of the most stable, slowest moving investments in the market, perfect for dividend growth or yield seekers, but often face the most noise and scrutiny. Therefore, it is important to choose your holdings wisely as stability often turns to volatility during times of chaos. In this article, I present the three major catalysts that support my thesis that one telecom giant is set to outperform its larger peers.

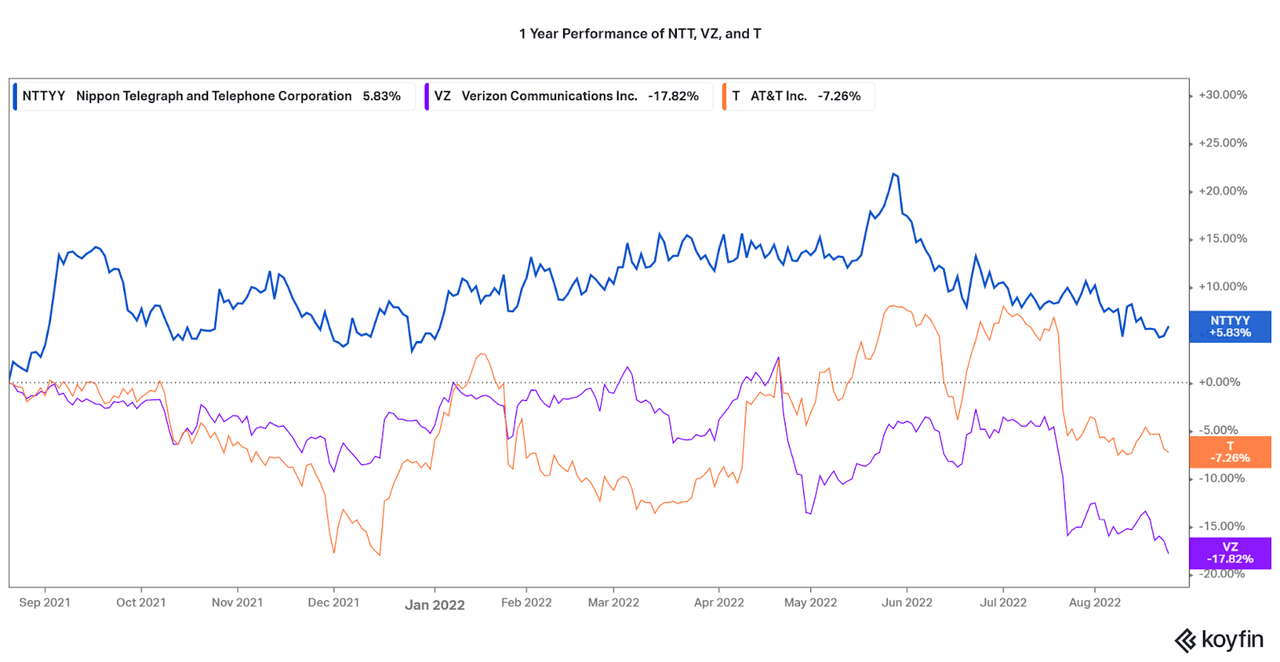

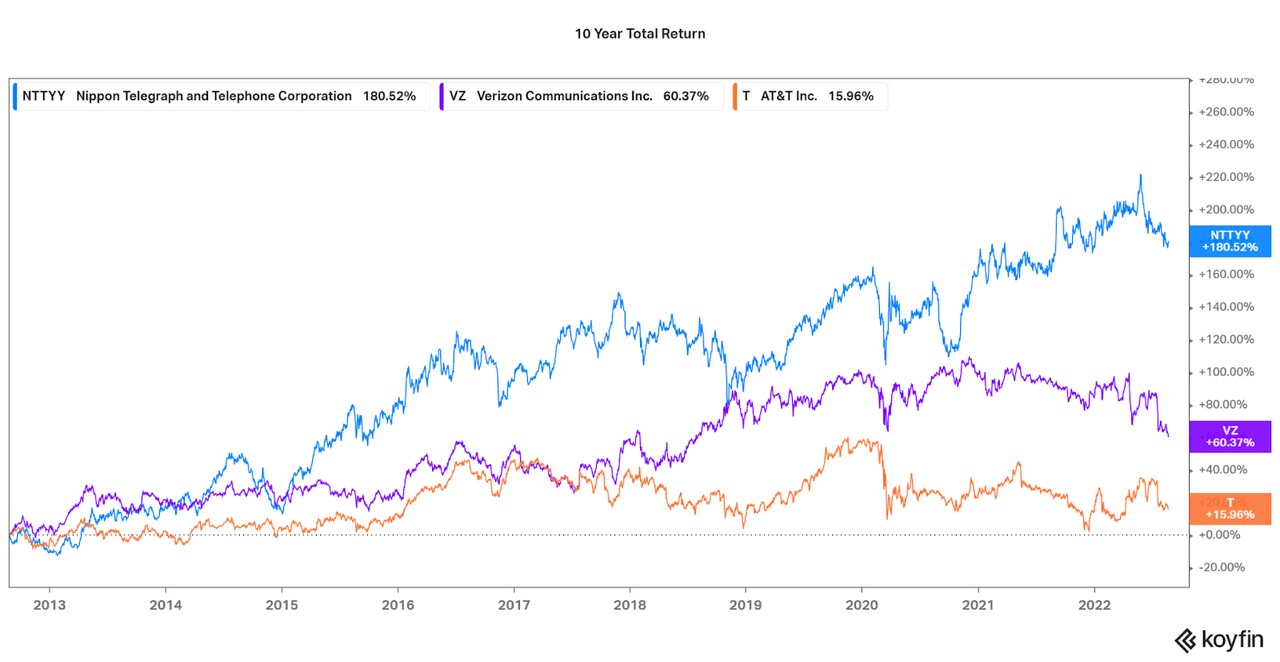

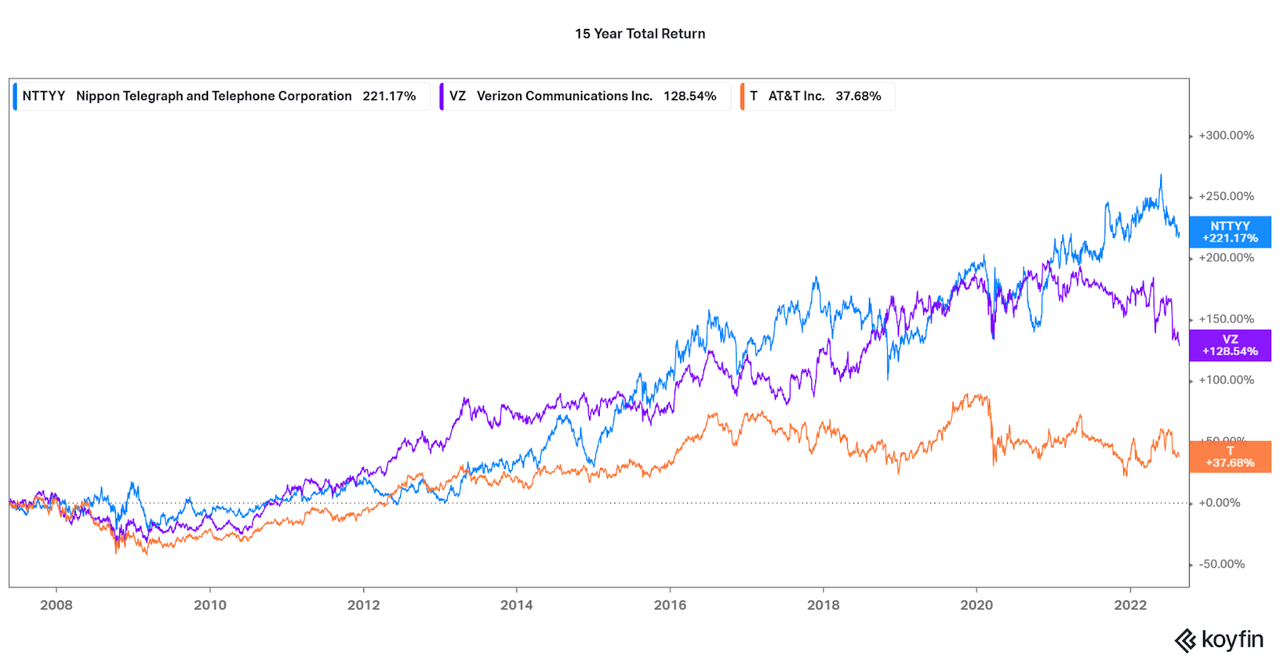

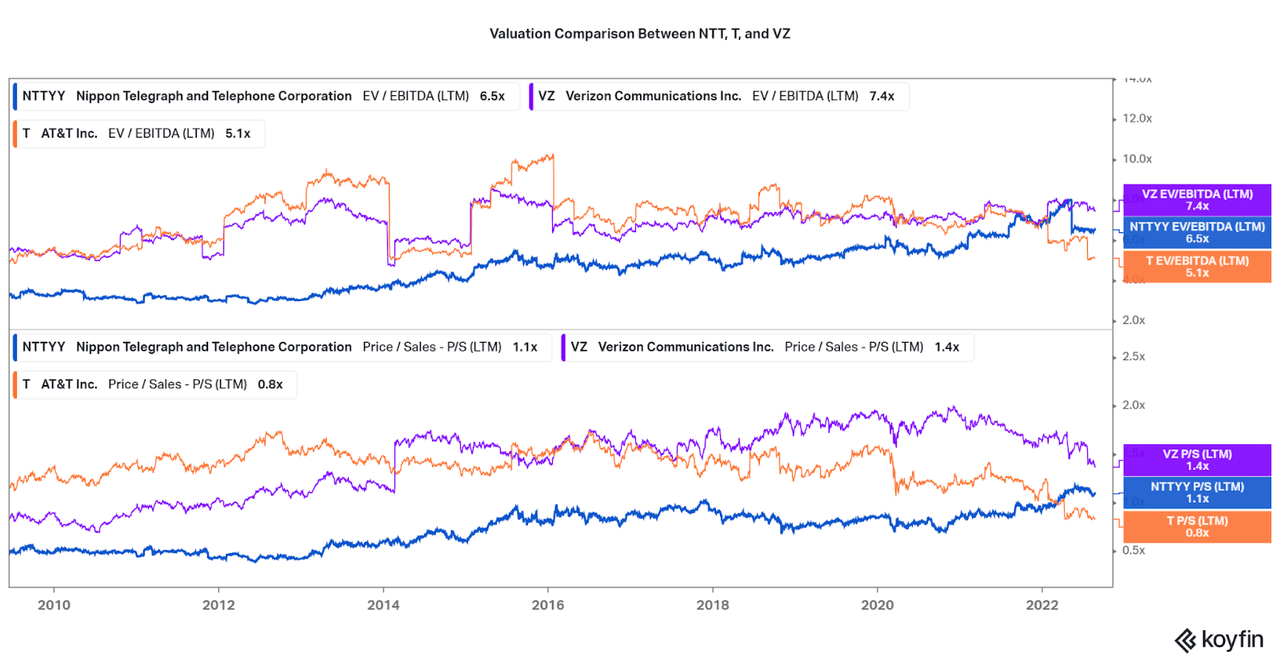

Koyfin

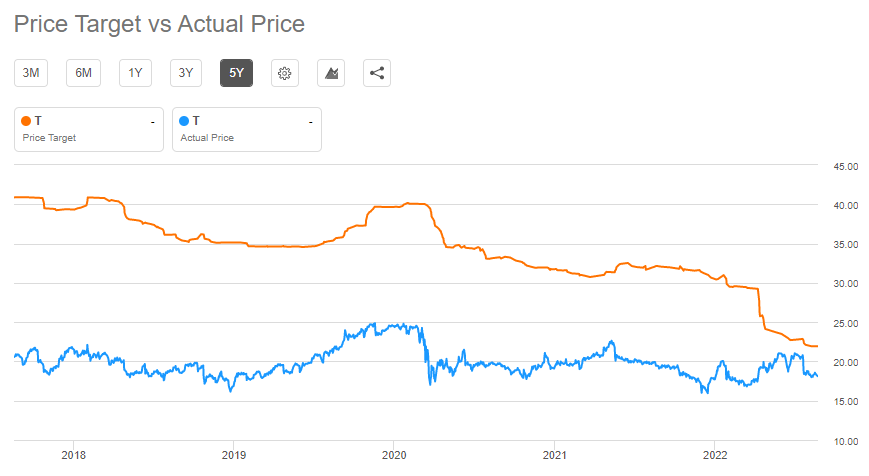

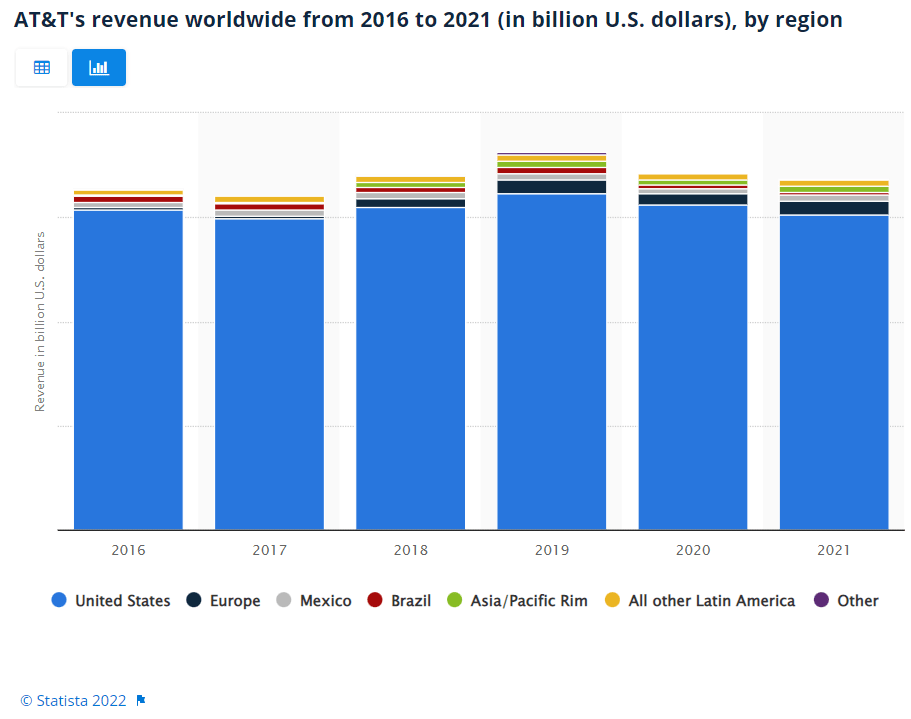

AT&T (T) is a perfect example of the opposite of a reliable company. While financially the company is relatively stable even as the entertainment assets have been let go, the share price has taken a beating over the past year or so. The share price is now down 40% from highs seen in late 2019, making the ticker a poor carrier of capital for long-term investors.

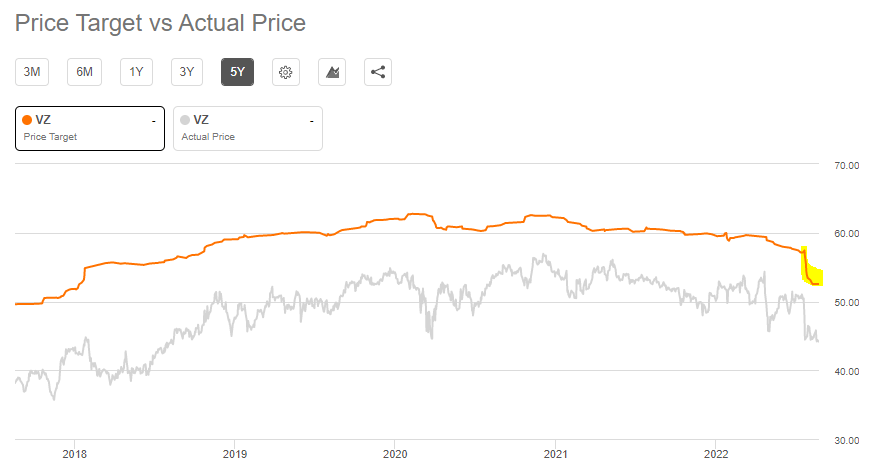

At the same time, Verizon (VZ) has been impacted by downgrades as analysts believe AT&T’s recent wave of advertising will damage the growth opportunity. However, these occurrences have been perpetual for the industry over the past 30 years or more, and the share price does not usually reflect financial performance. This is why Verizon is also down 30% from highs in late 2019.

Although, it is probably best to skip out on those over-analyzed names, and stick to a more stable option in Nippon Telegraph and Telephone (OTCPK:NTTYY). While Verizon and AT&T are down, NTT is up 10% over the same period, even though the growth of telecoms have essentially all been equal.

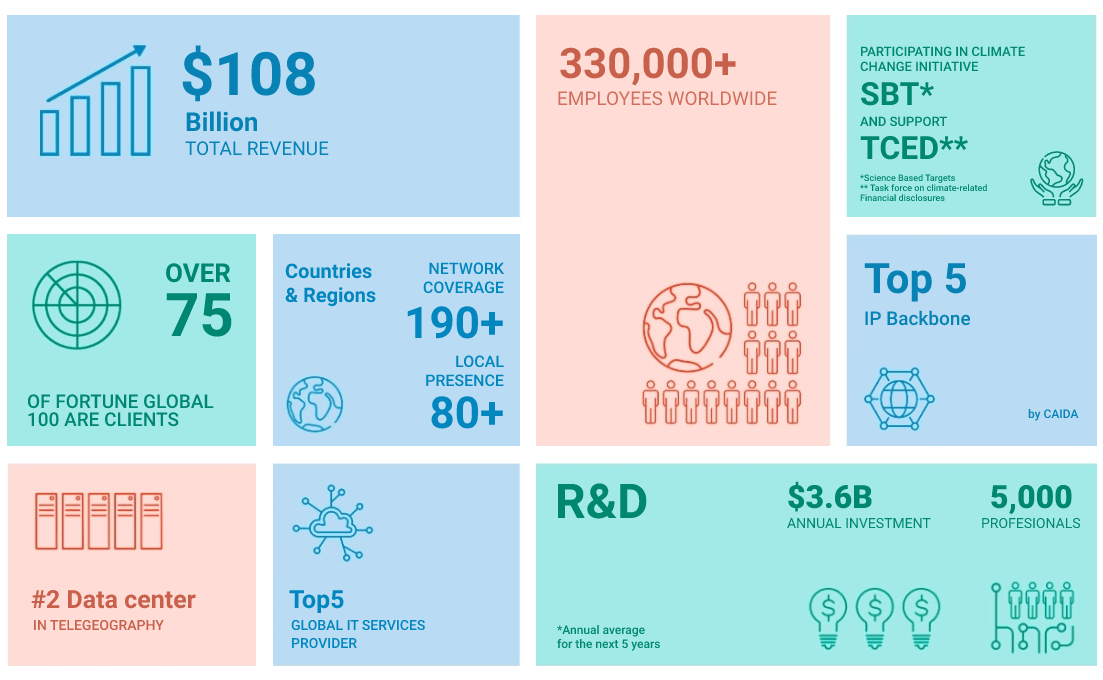

NTT is not a specialized competitor with undue advantage, and in fact, has very similar business segments to VZ and T. However, NTT has risen to over a $100 billion market cap just this year, and is set to continue the advancement of value. With $100 billion in revenues thanks to globalized operations, there are multiple reasons why NTT may end up outperforming. In particular, it is the diversification of their business structure, unlike VZ and T, that will be the main driver of the following catalysts.

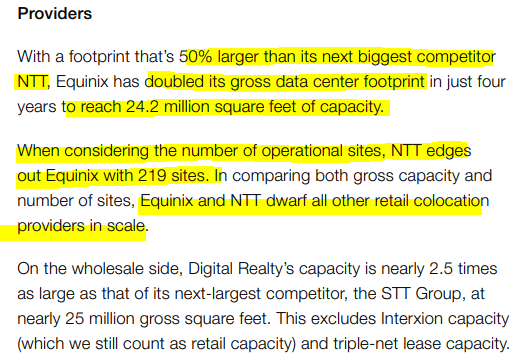

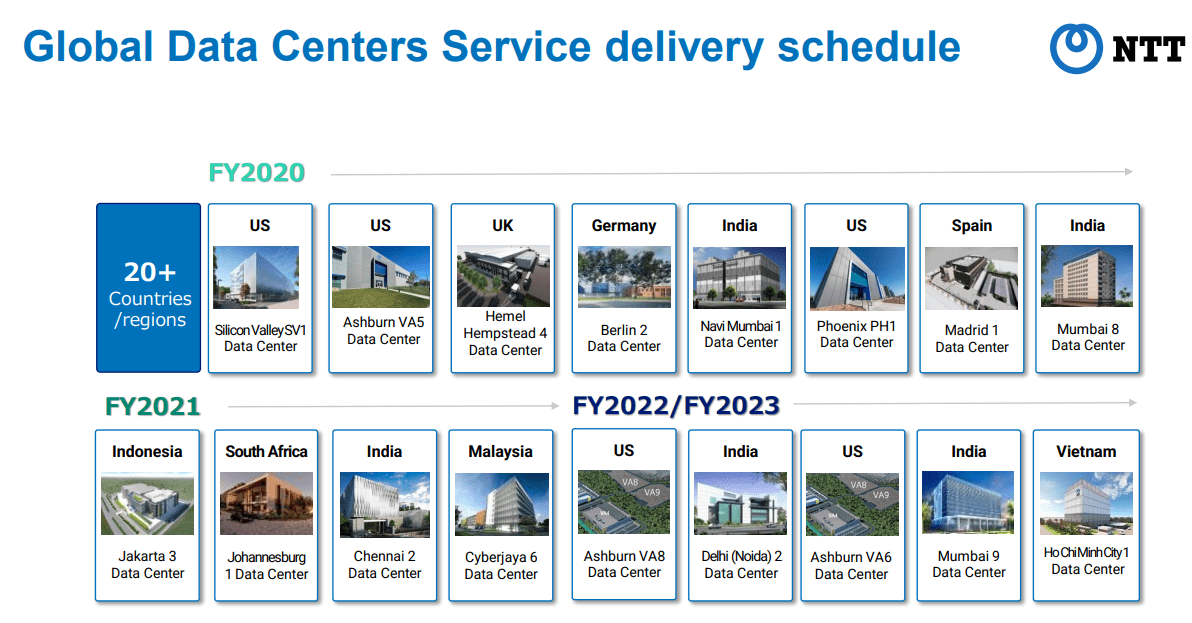

The unique diversification includes consulting and business service revenues, along with being rated #2 in the provision of data centers by TeleGeography (total square footage, behind Equinix (EQIX)). Exposure to data centers seems to be frowned upon by the US peers, as Verizon and AT&T sold their assets to Equinix and Brookfield Infrastructure (BIP), respectively, over the past few years. Perhaps this was to NTT’s advantage, so read on to find out!

NTT Website TeleGeography

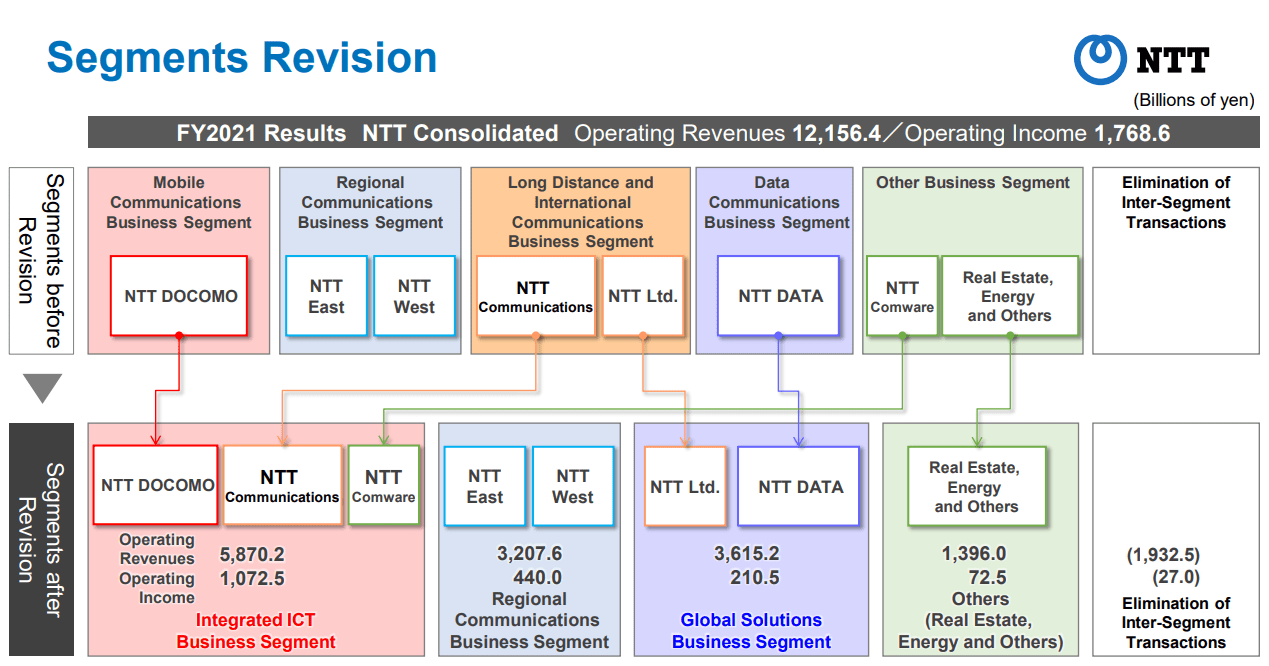

While Verizon and AT&T are focused on the provision of communications services, now 5G and Fiber Optic connectivity, I find that NTT is slightly more diversified. When considering an investment in terms of safety, diversification is one way to survive through a wide range of economic conditions. As the company undergoes reorganization to increase profitability, NTT will have four drivers of growth across communications and IT services, along with approximately 10% of revenues from real estate, utility, and other subsidiaries. However, all three companies offer a significant moat and will maintain their leadership in each field they pursue. Let’s focus on some major glaring issues that there are with the US peers.

NTT August Investor Presentation NTT

1.) Needless Noise and Volatility

AT&T and Verizon’s major issues are that while they are boring companies, they suffer from endless discussion and scrutiny. Every day, new reports, analysis, or new releases highlight risks, issues, or competition between the two names, along with other telecoms peers, and this does not bode well for the share price. Not to mention managerial risks as both companies have had issues with M&A and operations (i.e. Warner Bros. Discovery (WBD)). Just last week, a Seeking Alpha news story highlighted frequent negative commentary on Verizon as an analyst downgrade struck again. Across the industry, nothing looks bright for any company.

AT&T has managed to accelerate its subscriber growth, but it’s come at the expense of its free cash flow and dividend coverage, with Moffett noting the company has an “arguably lower quality, customer base whose preservation is more dependent than ever on lucrative giveaways.”

And with the wireless industry growth now showing signs of moderation and T-Mobile (NASDAQ:TMUS) continuing to extend its “competitive advantage” in 5G due to download and upload speeds, coverage and availability, Verizon “appears particularly vulnerable,” Moffett opined.

Moffett also noted that the cable industry has continued to add wireless subscribers, leaving incumbents such as Verizon to respond with lower priced alternatives.

Wall St. sentiment remains influential on the market, and this has very strong impacts for investors. Due to the industry weakness, even though telecom is so entrenched in our society, shares have reached multi-year lows across the board and sentiment has fallen to record lows. Verizon now has an average Wall St. price target that is less than in 2018. At the same time, AT&T has been downgraded for the past five years and more, with the current price target only reaching $22 per share.

Wall St Price Targets for Verizon (Seeking Alpha) AT&T Wall St Price Targets (Seeking Alpha)

Even if an investor is in for the long-run, short-term volatility plays a role in lowering confidence, hurting morale, and may even have economic downsides if one must sell for capital purposes. As investors become dissuaded from investing due to the volatility, they will keep the holdings at a low valuation, even if the finances improve. The charts below show the total return of all three companies over 10- and 15-year time periods, highlighting how recent issues have allowed NTT to outperform.

During select periods, the US-based companies do see stronger returns, but recent issues inhibit the long-term thesis. If there was less noise, I imagine that both Verizon and AT&T would have better returns over both time periods, as revenue growth is quite similar between all three (flat across the board).

Koyfin Koyfin

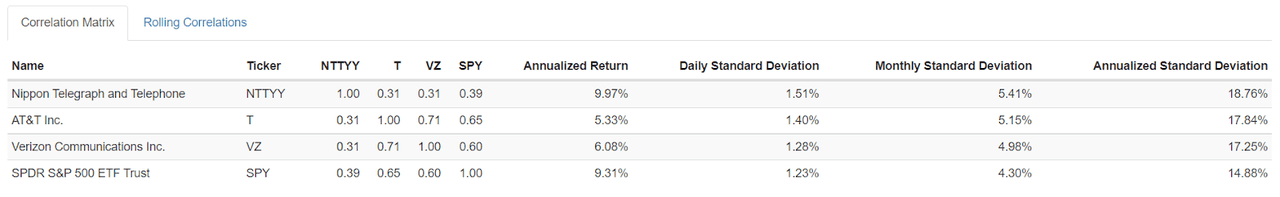

A lack of publicity is just one reason why NTT may have outperformed, and this is also reflected when comparing the correlation between all three holdings. Similar to determining the beta of an asset, a correlation matrix is a simple way to compare various tickers. As shown below, NTT trades differently than both T and VZ, along with the broader market as defined by SPY. This means that on any given day, NTT is unlikely to have the same ups or downs as the other names. This is unlike VZ and T who both have similar correlation, removing any reason to own both. Also notice that NTT has performance in line with the broader S&P 500, returning almost 10% per year on the 2005-2022 timeline examined below.

Portfolio Visualizer

2.) Foreign Exchange Benefits

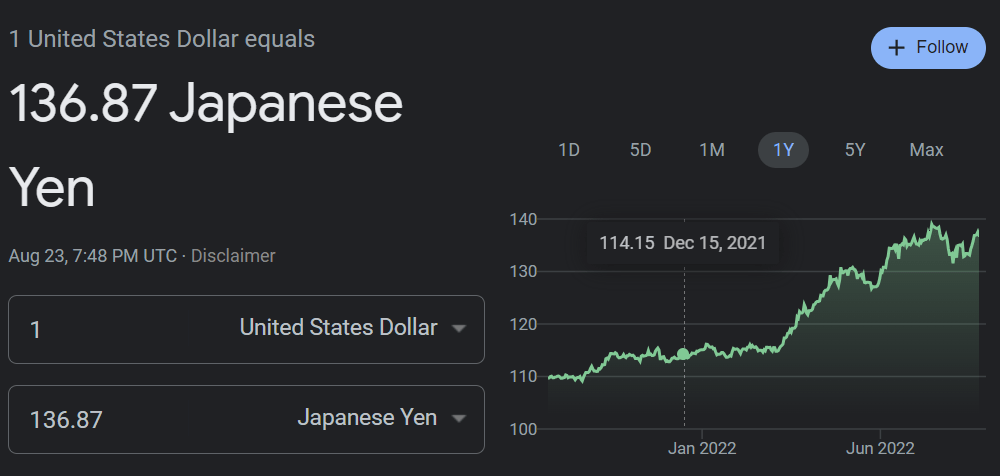

While long-term publicity issues may lead to underperformance, one short-term factor may benefit NTT: foreign exchange benefits. While T and VZ are mostly based in the US (approximately >90% of revenues from US), NTT has significant global operations. This is one of the major reasons why the financials are on the same magnitude as the US giants. Due to the current situation of weak Yen compared to a strong Dollar (and most major currencies), any international sales are converted to at least a 10% or more gain compared to years prior.

Therefore, foreign earnings can be turned into stronger investments in the home country of Japan. Considering much of their research and administrative costs are in the country, it should be expected to see profitability increase solely from the benefits of international operations. Also, there is no end in sight to the 30% or more difference between the Yen and USD, so NTT has significant leeway to drive either investments, debt reduction, or shareholder benefits (buybacks, dividends, etc).

Google

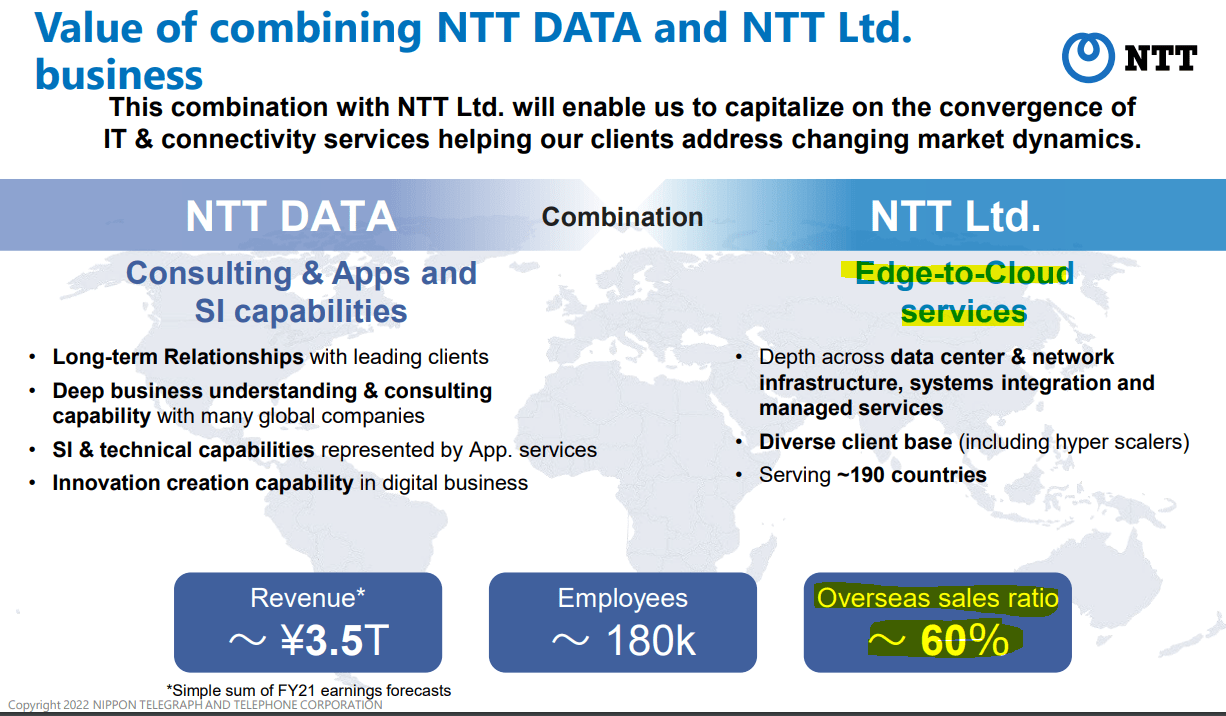

Why is NTT a global business? Well, it all comes down to the company’s NTT DATA and NTT Ltd segments, providers of internet services across the world. These segments are less VZ or T, and more Lumen (LUMN) or Cogent (CCOI) thanks to the significant internet infrastructure development. In fact, according to CAIDA, NTT is the world’s fourth largest organizer of Autonomous Systems, part of the backbone of our internet. Verizon and AT&T are 22nd and 24th, respectively.

While it is hard to find the exact global revenue information, from just NTT DATA and NTT Ltd. alone, over 15% of revenues are global in nature (20% according to Moody’s). The global revenues also have other benefits, especially in regards to providing revenue growth when based in a stagnant economy.

NTT Statista

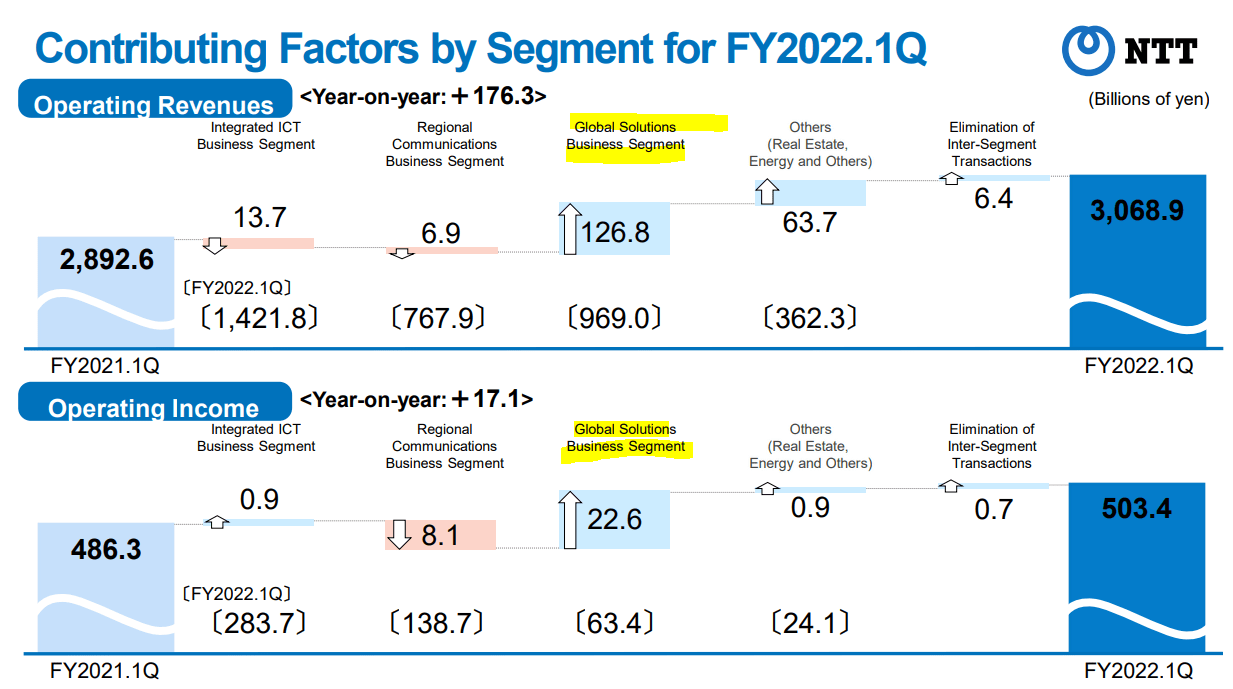

We can already see the effects of the global revenues on earnings as both revenues and operating income are increased for the first quarter of 2022 (reported in August). This is as normal communications, particularly regional ones, are seeing negative growth YoY. Thanks to strong performance of non-local telecom segments, NTT is able to see upward growth YoY, and expects this to continue for the full year. This continues to highlight the benefits of diversification as AT&T and Verizon expect a slowdown. At least AT&T only face issues with inflation, rather than weak exchange rates!

NTT

3.) Credit Ratings and Balance Sheet

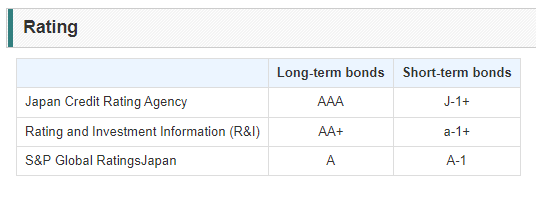

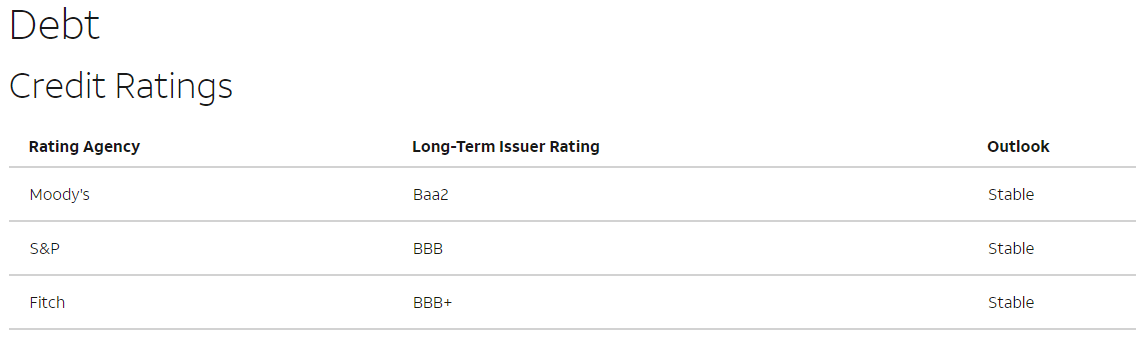

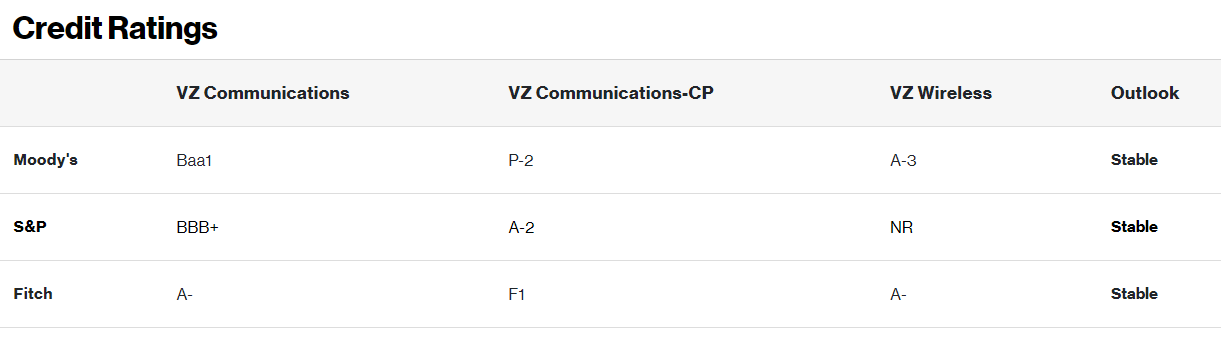

If you don’t care to take my word for things, I will also present some raw fundamentals that highlight NTT’s better position. Mostly, due to the fact that NTT holds higher credit ratings than the US-peers. According to the JCR, NTT is AAA rated, one of only a few public companies (such as Toyota) to be rated accordingly. Internationally, S&P Global rates the company as an A. This contrasts with AT&T and VZ who hold S&P ratings of BBB and BBB+, respectively. While some may believe these are minor differences in rating, the fundamental differences are quite important to understand and are another indicator of volatility.

NTT Credit Ratings (NTT Website) Credit Ratings of AT&T (AT&T Website) Credit Ratings of Verizon (Verizon Website)

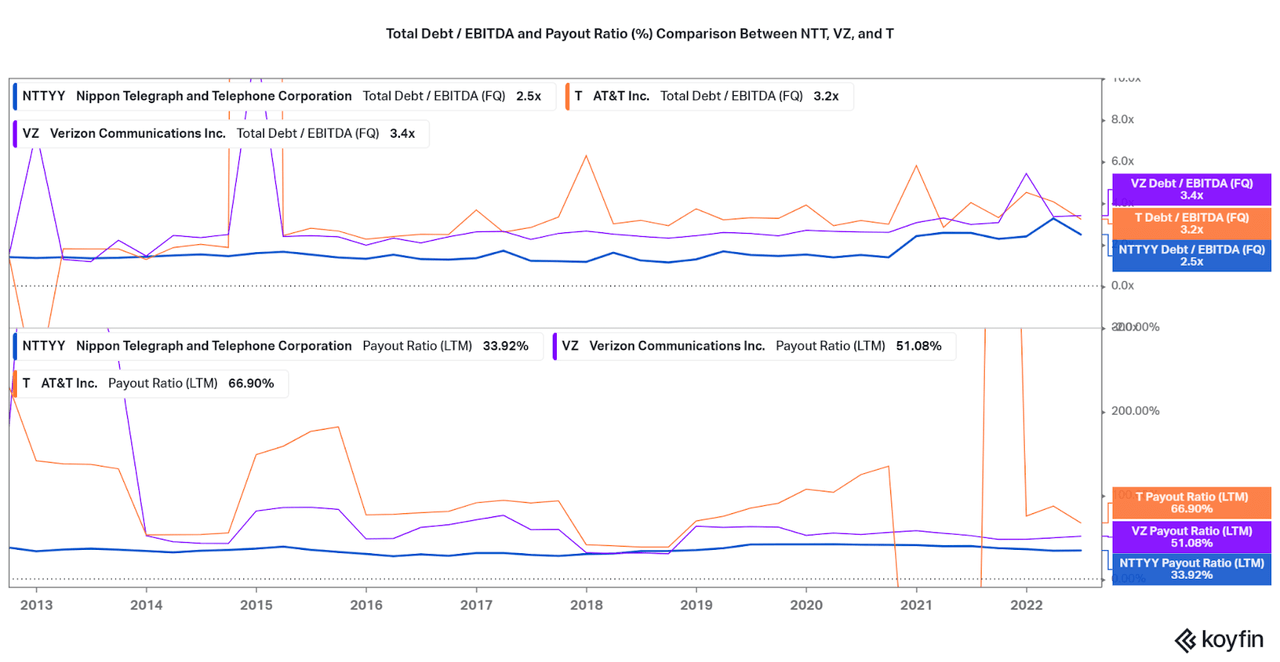

The strong ratings performance is driven by two major factors. On the surface, it may seem that NTT suffers from profitability issues, which is partially true in terms of gross and net margins, conservative management allows for stable EBITDA generation. Combined with a smaller debt load-that has risen in recent years- NTT has a leverage ratio of 2.5x, compared to over 3x with VZ and T. NTT also has a pattern of maintaining stable leverage at a lower level while T and VZ are more volatile per quarter.

Then beyond just earnings and leverage, we can see that NTT’s payout ratio is far safer at less than 30%, with VZ close behind at ~50%. T, meanwhile, remains extremely volatile with their high yield dividend that rarely reaches a safe payout ratio. The drawback of a lower yield is balanced by the fact that there is stable growth and safety. Combined with the other factors I have discussed, ranging from better forward outlook to better historical total returns, I see NTT as the clear favorite.

Koyfin

The Three Catalysts in Action

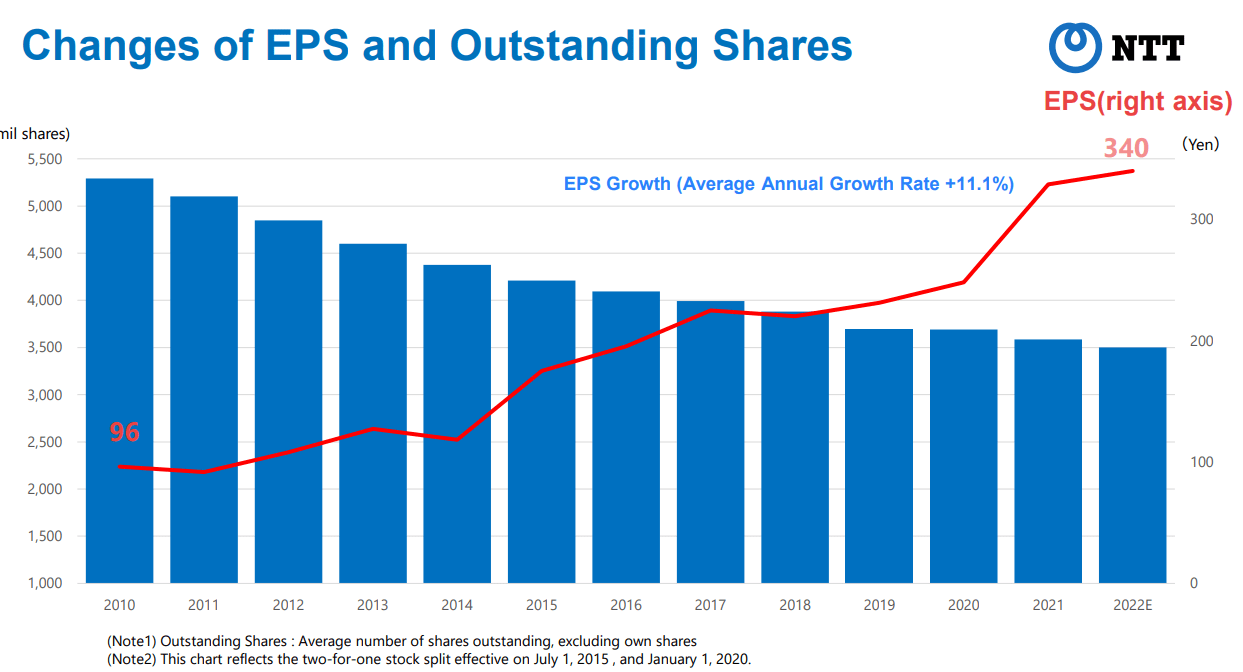

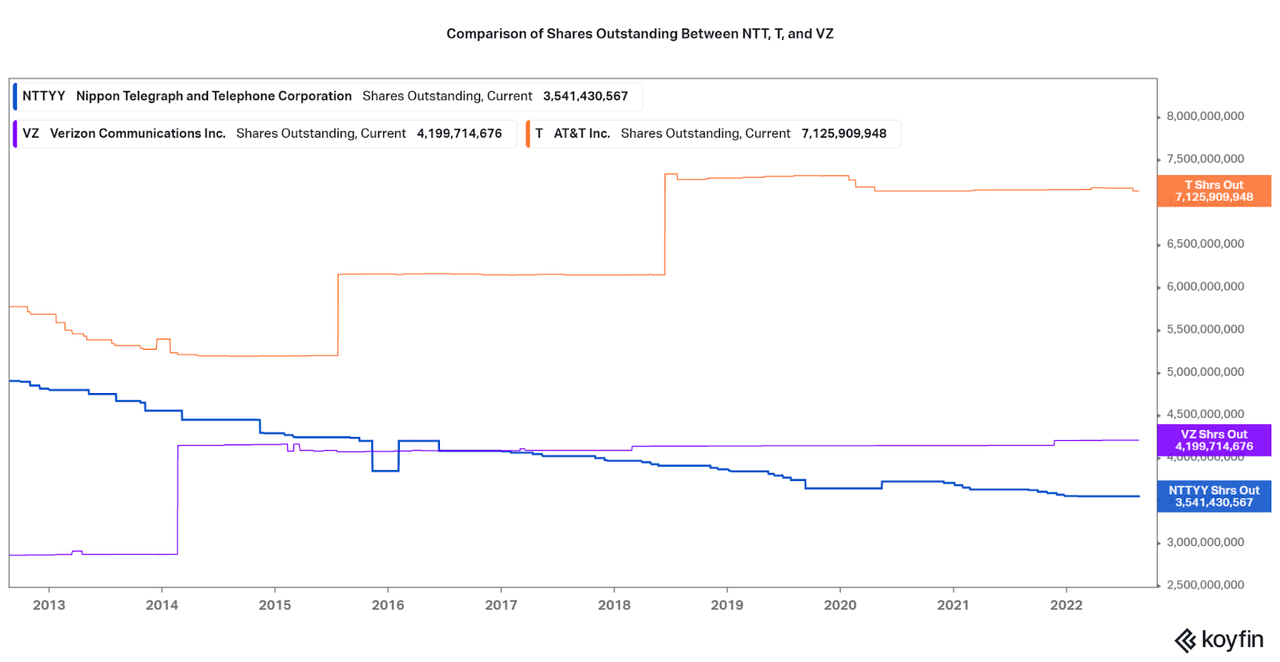

To find the results of NTT’s benefits, look directly at EPS data. While growth may be meager, returns can be found thanks to steadily increasing EPS. This is partially thanks to a meaningful reduction in shares outstanding, and more than makes up for the lack of growth out of Japan. This pattern of share buybacks is a sight for sore eyes when compared to Verizon or AT&T. Look for NTT to continue growth abroad, as evident by their rise in sports sponsorships in the west (see image below), and NTT should maintain the advantage.

NTT Koyfin The big sports that have NTT as a major sponsor. (NTT Website)

Catalysts Not Valued in Yet

As presented, I find NTT to be far superior thanks to the three factors. However, I also find that these factors seem to be missed by the market, and NTT’s valuation adds to the bullish thesis. Much of NTT’s recent return can be attributed to multiple expansion as the company has typically traded far below the two peers. Now as data continues to suggest outperformance, I expect NTT to gain a value greater than the two peers. This would currently imply upside of at least 14%.

Over the past year or so, investors have caught on to the narrative a bit, but the valuation remains in line with the two weaker peers. Considering that Verizon, the stronger of the two US peers, holds a higher valuation than NTT, I expect that NTT will hold up far better in the coming tight economic conditions. Therefore, lower magnitude drawdowns, less volatility, and even the potential for further upside. The valuations also reflect the issue with AT&T: don’t fall for the value trap.

Koyfin

Conclusion

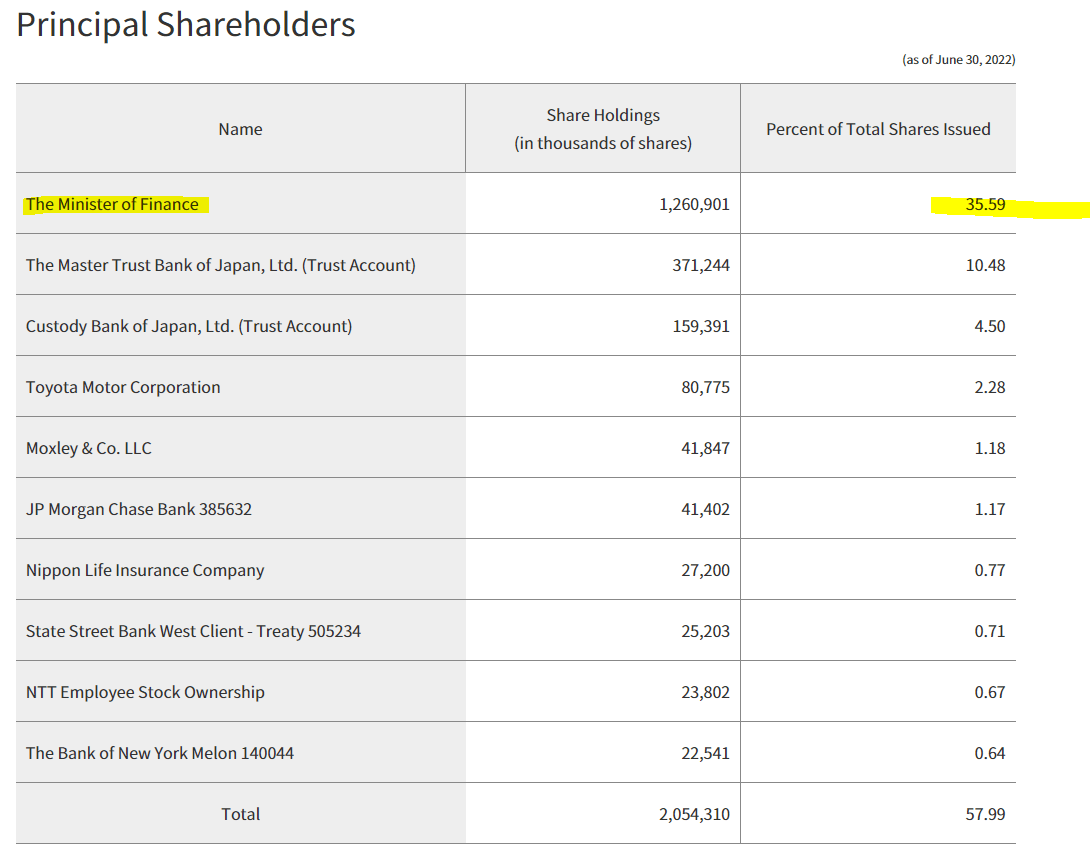

Sometimes a few simple catalysts are the primary reason why a stock outperforms peers. As is the case with NTT, sometimes it is best to remain out of the limelight and diversify away from risk. With the investment in NTT comes the backing of the Government of Japan (perpetual 30%+ owners), and the seriousness of the investment will play to any shareholders benefit. Is this not the reason to even invest in a telecom to begin with? I know many long-term AT&T investors who are quite unhappy with their investments, especially if they have not followed recent events.

NTT Website

While this is not a direct bear case for either Verizon or AT&T, I will continue to believe NTT will outperform for some time. At least the holding will meet the target of providing a low-risk, dividend growth investment to not have to worry about on a constant basis. I also hope this article highlights the importance of small catalysts that may be the hidden reason why particular holdings outperform, often unexpectedly. Please feel free to share your thoughts on the thesis below.

Thanks for reading.

Be the first to comment