f11photo/iStock via Getty Images

Introduction

In this article, I want to cover what I consider to be the best office REIT. Cousins Properties (NYSE:CUZ) owns high-quality assets in sought-after states where it enjoys high rental income and high occupancy rates. However, the industry as a whole is in trouble. Vacancy rates are sky-high, interest rates are rising, and the pandemic has done a number on the “new” work environment. For now, Cousins mainly struggles with high-interest rates, yet even in strong years, the stock did not deliver what some investors may have hoped. In other words, in this article, I will walk you through an industry that I wouldn’t invest in right now, but also explain why CUZ is one of the best stocks in the industry. As I don’t like writing bearish articles, I will give readers a game plan that explains how I would deal with a good company in a tricky industry and uncomfortable market environment.

So, bear with me!

A Lot Of Supply & Underperformance

Over the past 2 years, we have discussed pretty much every shortage imaginable. One “thing” that hasn’t seen a shortage is office space. If anything, supply increased as companies started to implement long-term (partial) work-from-home options for employees. Especially in Europe, some companies have completely ended a 5-day office workweek and reduced it to 3 days of work from home. This obviously differs per country and company, but you get the point.

The other day, The Wall Street Journal published an article highlighting the issues facing this industry, which started well before the pandemic and are much worse than I previously assumed – to be completely honest.

Essentially, America’s office glut has been in the making for decades as a result of federal tax breaks, low-interest rates, and high demand from (often unprofitable) startups.

It was made worse as a lot of landlords were unable or not allowed to turn older, vacant properties into properties for other uses.

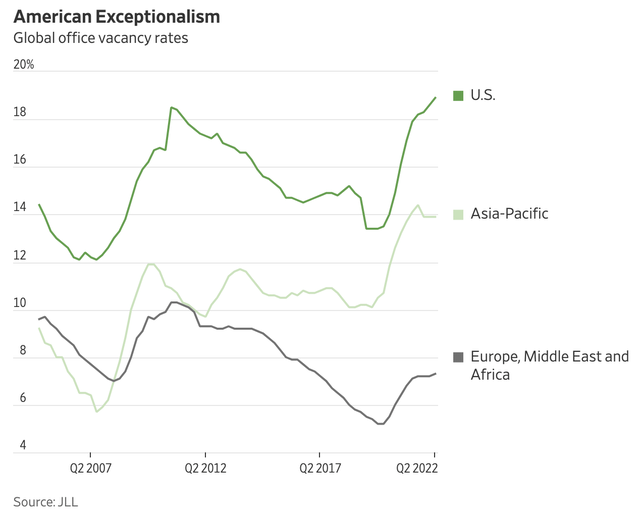

This has now resulted in an office surplus that is far worse than the situation overseas. According to The Wall Street Journal:

About 19% of U.S. office space was vacant in the second quarter, compared with 14% in the Asia-Pacific region and 7% in Europe, the Middle East and Africa, according to brokerage JLL. Analysts expect that share to grow as more leases expire and more companies cut down on their real estate.

A trend that was fueled by a change in the tax code in 1981 that allowed investors to depreciate commercial real estate more quickly is now threatening tax income from major cities that rely on so-called “cubicle farms”.

In 2008, the first wave of the meltdown started as companies cut costs given low economic growth. Yet, demand kept rising due to substantial tax breaks and subsidies that went into projects like New York’s Hudson Yards and the new World Trade Center.

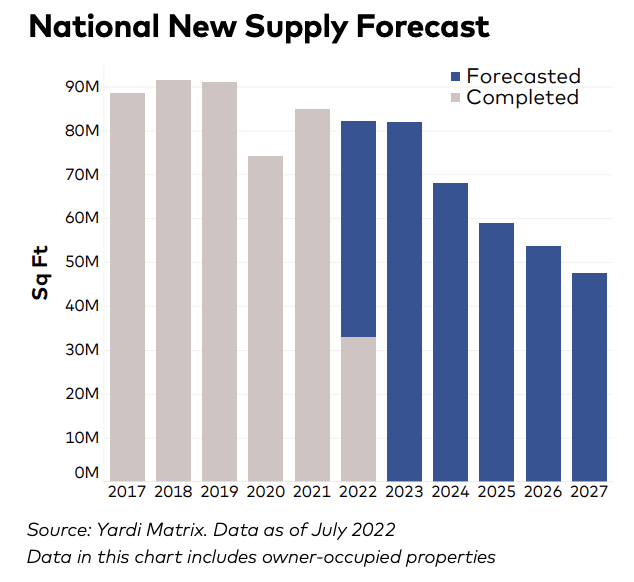

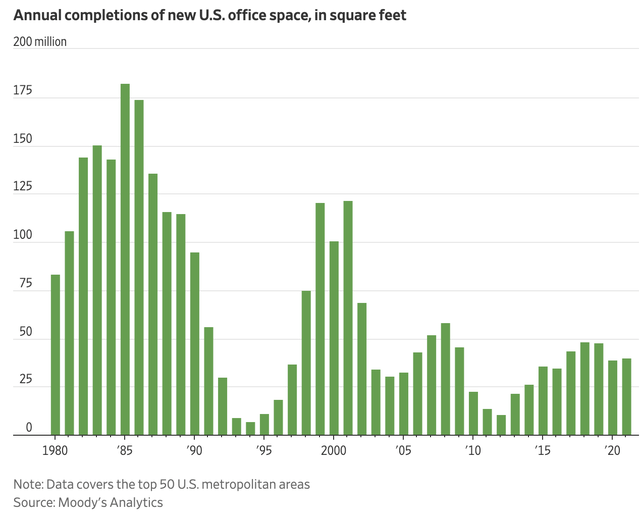

New supply is well-below levels witnessed in the 1980s, but still at high levels given that the pandemic added a new layer of problems.

The bottom line is that demand could fall by another 20% over the next few years, although expectations vary tremendously.

Supply, on the other hand, could rise by another 6.5% over the next few years with 2.2% being currently under construction according to CommercialEdge.

CommercialEdge (Via Yardi Matrix)

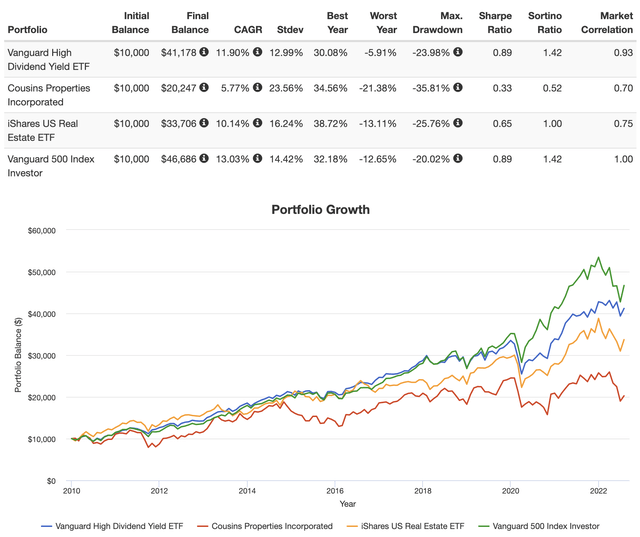

Now, with that said, office real estate hasn’t been a good investment. Below, I’m backtesting a number of investments starting at the bottom of the Great Financial Crisis, to give real estate a benefit. Since 2010, the S&P 500 has returned 13.0% per year with a standard deviation of 14.4%. That’s a terrific performance.

High-yield stocks have returned 11.9% per year with a lower standard deviation, achieving an equal volatility-adjusted return (Sharpe/Sortino ratios). Real estate stocks have returned 10.1%, which isn’t bad either. Unfortunately, Cousins Properties – like its office peers – has underperformed. Even starting at the bottom of the recession, the stock has returned just 5.8% per year with a standard deviation of 23.6%. That’s weak and results in a disappointing volatility-adjusted return.

With that said, Cousins isn’t a worthless investment, as I believe that it’s one of the best office REITs around – if you want to buy exposure in the industry.

Cousins Properties Has Value

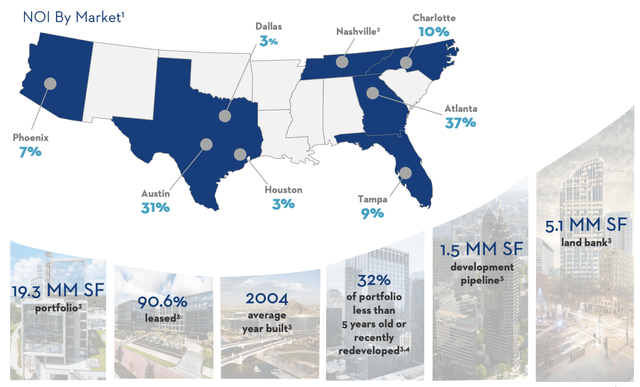

Cousins is the 6th-largest office REIT in the United States, with a $4.5 billion market cap. The company has 100% of its assets in the Sun Belt, where it enjoys Class A locations for all of its assets. Atlanta and Austin alone account for 68% of net operating income. The company has relatively young assets as 2004 is the average year its properties were built. Roughly a third is younger than five years old.

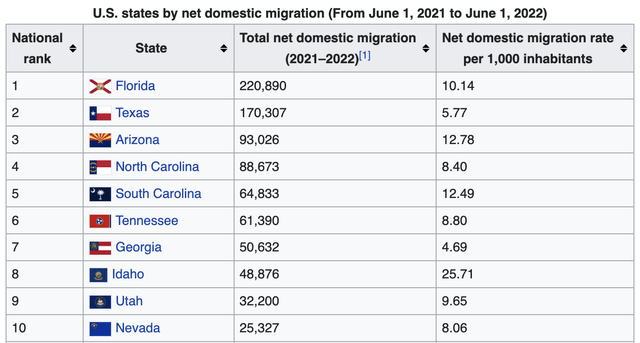

Thanks to its geographic location and office assets, the company benefits from the flight to never, highly-amenitized assets as well as the migration to Sun Belt states, which started to accelerate after the pandemic.

Using the latest data, the company’s core markets were all top migration destinations.

www.census.gov (Via Wikipedia)

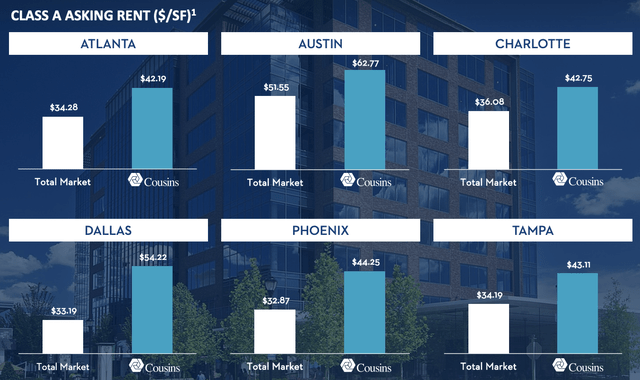

The good thing is the company’s assets don’t just make sense on paper, but also in reality. The company’s asking rents are 9% higher than pre-pandemic levels and 25% higher than its Class A average peers.

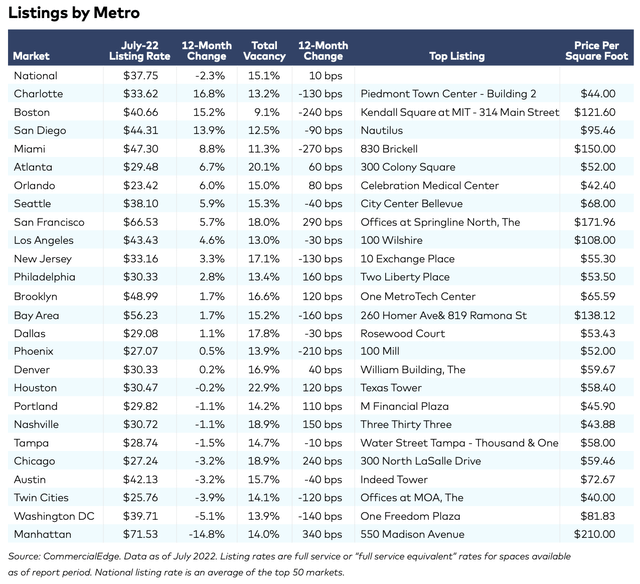

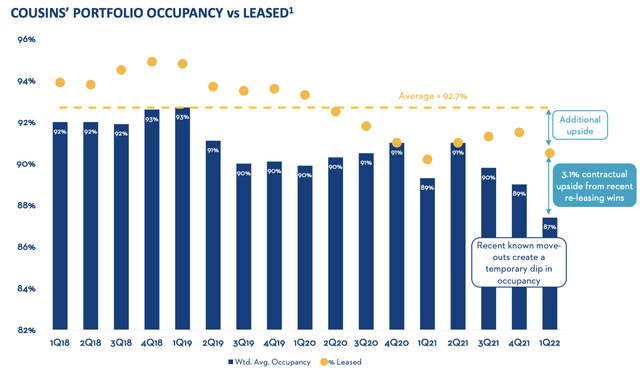

Moreover, 90.6% of the company’s assets are leased. This includes 310 basis points of recent re-leasing wins. On paper, the current occupancy rate is 87%. This means the company’s average vacancy is below 10%. That’s a fantastic number as Boston is the only metro area with a number better than that. Even go-to markets have higher vacancy rates according to a recent report from CommercialEdge.

CommercialEdge (Via Yardi Matrix)

On top of that, only 17% of leases expire over the next 2 years (until 2024), which is well below the industry average of 27%.

Organic growth plans are mainly based on getting the occupancy rate back to 93%, which is the company’s longer-term average.

While the company’s downtrend in occupancy isn’t as bad as the chart suggests given the recent re-leasing wins, there is a downtrend, and I hope the company can turn it around. If industry fundamentals are any indication, downside pressure is high.

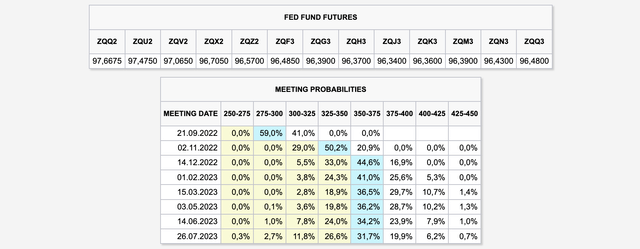

Adding to the list of bad news, the Federal Reserve is aggressively hiking rates. The market expects the central bank to hike rates to at least 350 basis points going into next year. More on this in the “valuation” part of this article.

This is impacting Cousins’ fundamentals. According to the company:

[…], the Federal Reserve has begun tightening financial conditions. The result is higher interest rates and a slowing economy. Not surprisingly, many companies are announcing plans to slow hiring and in some cases, layoffs.

The company isn’t worried as it owns top-tier real estate in strong markets and its $566 million development pipeline is 70% pre-leased. Moreover, the company’s net debt ratio is just 4.9x (EBITDA), which is well below the sector average of 7.3x.

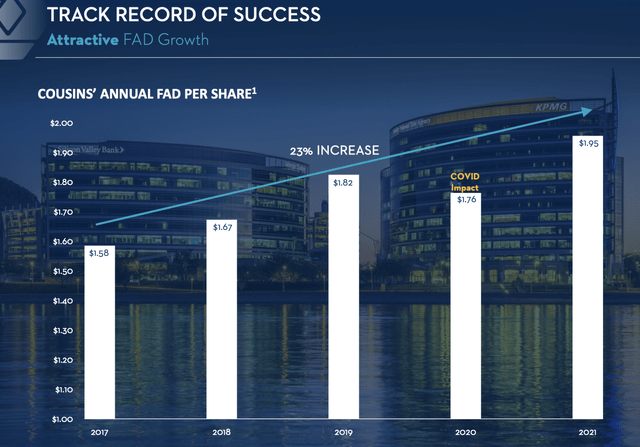

This also means that the company is in a good spot to protect its dividend. As of Q2 22, the company’s FAD (funds available for distribution) payout ratio was 70.6%. Since 2017, FAD has grown by 23% with constant growth if we exclude the COVID impact in 2020.

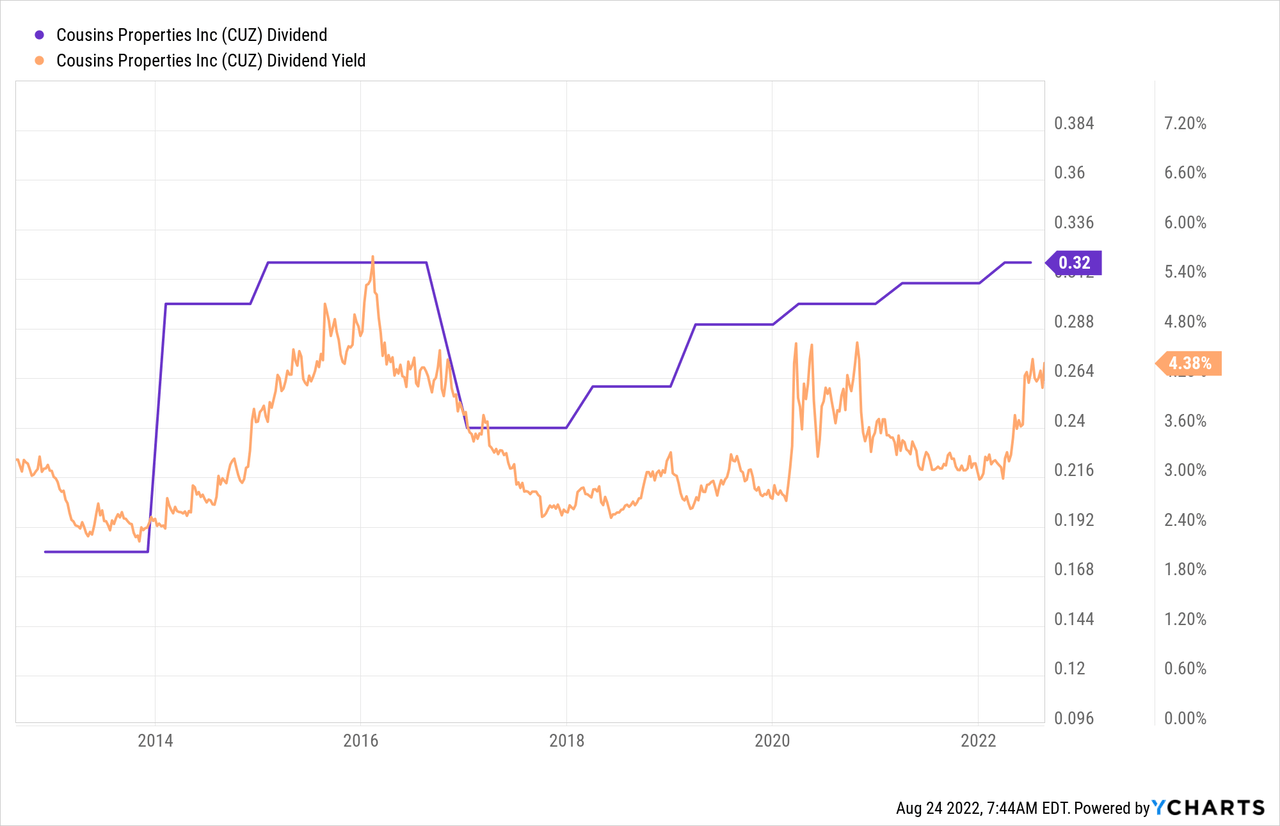

Now, with that said, the CUZ dividend isn’t that bad.

The company currently pays a $0.32 per share per quarter dividend. That’s $1.28 per year and translates to a 4.5% yield. That’s one of the highest yields in recent history. Note that the 2017 dividend cut was the result of a spin-off, which did not change the distribution policy.

The most recent hike was announced in March when the company hiked by 3.2%. In March 2021, CUZ hiked by 3.3% after a 3.4% hike in March 2020. In March 2019, the company hiked by 11.5%.

Going forward, I think investors should continue to expect low single-digit hikes as the industry isn’t getting more favorable – especially given higher rates.

Valuation

The valuation is exactly what one would expect given industry headwinds. This year, the company expects full-year FFO (funds from operations) between $2.67 and $2.73 with $2.70 being the midpoint. These expectations are down $0.04, or 1.5% from prior guidance. According to the company:

This $0.04 adjustment is driven by a negative variance of $0.08 due to higher interest rates, partially offset by $0.03 from the Victory land I discussed earlier, as well as $0.01 of improved property NOI.

This puts the valuation between 10.5x and 10.8x FFO.

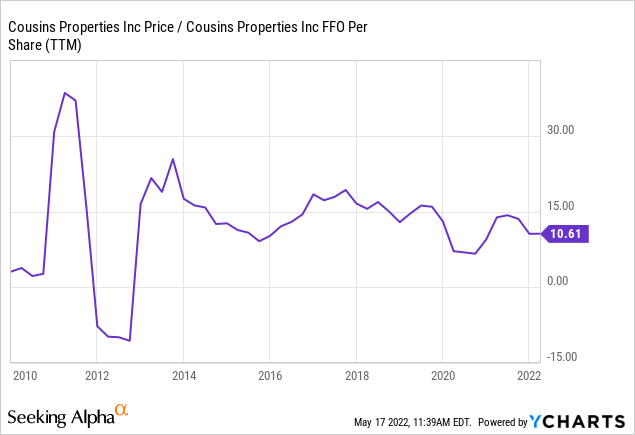

Seeking Alpha (Data by YCharts)

In good years, when rates are in a downtrend and demand is stable, the company is trading at roughly 15x FFO.

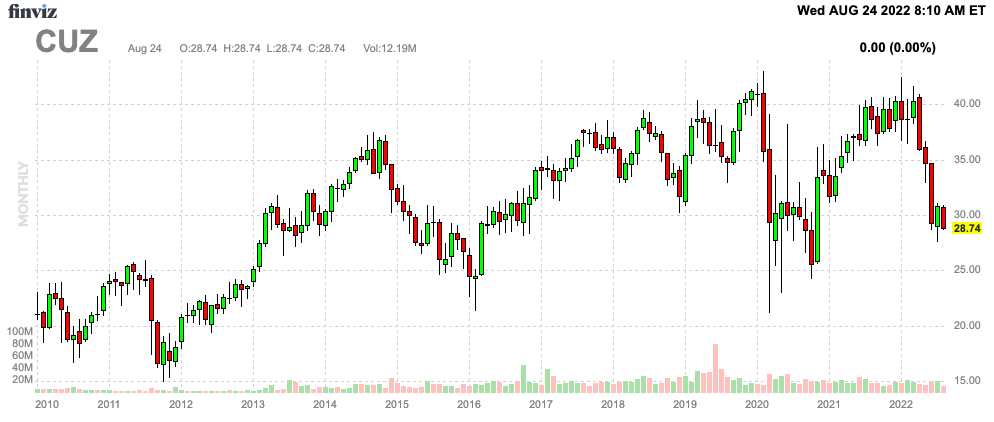

This would put the fair value close to $40, a price that has functioned as a hard ceiling since pre-pandemic 2020.

FINVIZ

Also, getting to the fair value will be tough and a slow uptrend. After all, I do not expect the Fed to quit its aggressive hiking cycle anytime soon. According to Wells Fargo:

Past inflation cycles have required the Fed to raise the federal funds rate above the prevailing inflation rate in order to break inflation’s upward momentum. That will prove problematic today, given the still-low nominal interest rate and a core PCE deflator in the 5% range. The bottom line is that market participants should be on guard for higher short-term interest rates than the current consensus forecast. One only has to look back to where interest rate forecasts were one year ago to gauge the extent of how much higher rates can rise in the coming year.

Wells Fargo

Takeaway

The office real estate market isn’t in a good spot. Supply is high and further rising while vacancy rates have accelerated. This trend is made worse by rising rates and a Fed that is desperate to get inflation under control – in a time of weakening economic growth.

However, there is good news. Cousins Properties investors have priced in a lot of weakness, lowering the valuation to less than 11x FFO. This includes lower guidance, incorporating the aforementioned economic headwinds.

It also helps that Cousins has a high occupancy rates, a 70% pre-booked real estate pipeline, a healthy balance sheet, and a footprint in the best real estate markets in the US.

However, even though CUZ shares are trading below (what I consider to be) fair value, I don’t think there’s a strong bull case here. Yes, the dividend yield has become attractive, but I don’t see CUZ shares offering high total returns on a long-term basis.

So, if you want a high-yielding REIT, CUZ may be interesting, but if you have a long investment horizon, CUZ may not be the best place to put your money.

Hence, I remain neutral for the time being, which includes my view on the industry as a whole.

(Dis)agree? Let me know in the comments!

Be the first to comment