RichLegg/E+ via Getty Images

It is my firm belief that 80% of money managers can’t outperform the S&P 500 index over time due primarily to the fees they charge their clients. Each and every individual person intent on having the happiest retirement possible could and should take charge of their retirement portfolios and invest in simple index/mutual funds and/or a balanced portfolio like the one I have set up to maximize returns over decades of performance. My ratios and distributions are based on my book – Investing Better Than A Money Manager: The Rise Of Retail Investing.

Past Performance

Here is briefly how my portfolio evolved from its inception when I became more of an active investor in 2014 in the market until now. Notice, I spent several years before 2014 putting some funds into the market now and then at random as I finished school and got married and started a family etc., which I didn’t really follow or record.

| Year | Welsh Portfolio | S&P 500 |

| 2014 | $77,053 | |

| 2015 | $81,233 | -0.81% |

| 2016 | $91,494 | 9.64% |

| 2017 | $142,363 | 19.38% |

| 2018 | $162,607 | -6.29% |

| 2019 | $230,093 | 29.01% |

| 2020 | $316,104 | 16.28% |

| 2021 | $402,037 | 27.04% |

Contributions

Contributions make up a vital component of your portfolio, especially when you are starting out, as they are the building blocks of tax advantaged savings for retirement. The more money you have, the more concern you should have with taxes. This is why when you start out investing, you should try to add to accounts like IRAs ASAP instead of putting the money into regular taxable investment accounts.

|

Contributions |

HSA |

IRAs |

401(K) |

|

Jan 2022 |

$0 |

$0 |

$0 |

|

Feb 2022 |

$0 |

$0 |

$500 |

|

Mar 2022 |

$0 |

$0 |

$3,760.44 |

|

Apr 2022 |

$0 |

$0 |

$500 |

|

May 2022 |

$10,000 |

$0 |

$2,000 |

|

Jun 2022 |

$0 |

$0 |

5,205.53 |

|

YTD CONTRIBUTIONS |

$10,000 |

$0 |

$11,965.97 |

Here is how my portfolio is performing compared to the SPDR S&P 500 Trust (SPY) over the first half of 2022.

|

Fund |

SPY |

Welsh |

Welsh Minus Contributions |

|

% Gain Jan 2022 |

-5.32% |

-8.12% |

-8.12% |

|

% Gain Feb 2022 |

-3.62% |

-0.88% |

-10.15% |

|

% Gain Mar 2022 |

3.59% |

3.3% |

2.3% |

|

% Gain Apr 2022 |

-9.03% |

-6.2% |

-6.4% |

|

% Gain May 2022 |

0.24% |

1.3% |

-2.09% |

|

% Gain Jun 2022 |

-9.02% |

-6.21% |

-7.66% |

|

YTD GAINS |

-20.46% |

-16.23% |

-21.69% |

Regular contributions to your retirement portfolio help your portfolio to grow even during less than ideal months where you fail to outperform the S&P 500. Not every month will be a winner, but regular contributions can help make anyone’s performance look great over time.

My portfolio is divided up to start 2022 at around 73% stocks and around 27% mutual and index funds with the goal to increase stocks to over 80% of my portfolio over time. My current setup has swayed to 77% domestic exposure and 23% international as I have pushed in a lot of my chips in on Petrobras (PBR). I have about 2.6% of my portfolio in bond mutual funds so that I know how they work and to have at least a little exposure to this sector over time. I plan to have bonds be a very small portion of my portfolio up to right around age 65. Diversification lifts my whole portfolio’s returns over time, so finding the best stocks in every sector is a goal for me each and every year. Here are some of the main changes since my last portfolio article in May of 2022.

|

Welsh Portfolio |

Stocks |

Index/Mutual Funds |

Bonds |

Domestic |

International |

|

Jan 2022 |

73% |

27% |

2.6% |

82% |

18% |

|

Feb 2022 |

74% |

26% |

2.6% |

93% |

7% |

|

Mar 2022 |

74% |

26% |

2.4% |

94% |

6% |

|

Apr 2022 |

75% |

25% |

2.5% |

96% |

4% |

|

May 2022 |

73% |

27% |

2.5% |

62% |

38% |

|

Jun 2022 |

73% |

27% |

2.6% |

77% |

23% |

Here are the details of my personal ~$336K portfolio then, based on values of approximately $40K, $400K, and $4 million broken down by sectors with brief descriptions of each stock in each sector. The best thing about my portfolio setup is that it is scalable so that people interested in following a similar path can set up their portfolios to follow my path no matter how small or large their holdings are. With fee-free trading and the advent of fractional shares, investors are more capable than ever in setting up amazing portfolios even when starting from scratch.

The Information Technology Sector

Aim = 8% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

QCOM |

$800 |

$8,000 |

$80,000 |

|

DELL |

$250 |

$2,500 |

$25,000 |

|

VMW |

$270 |

$2,700 |

$27,000 |

|

AMD |

$380 |

$3,800 |

$38,000 |

|

% Portfolio |

6.9% |

1. QUALCOMM (QCOM) is a major technology solutions provider for companies like Apple (AAPL) and will be an integral part of upcoming transformational secular revolutions like 5G. Its recent victories against Apple in court have boosted its value as Apple can’t shake the company by trying to make its own chips. I always like to have at least one chip company in my portfolio at all times with a couple never a bad idea.

ACPS = $61.92

2. Dell (DELL) is a legacy holding which continues to aggressively seek M&A opportunities like the value acquisition of the $67B EMC deal and the spin-off of the hybrid cloud giant VMware (VMW) at the end of October 2021, which it formerly owned ~80% of the stock of. Michael Dell is a shareholder winner through and through, and following in his stock footpaths I think is a good long-term decision. The VMware spinoff should allow Dell to deleverage significantly while allowing the free cash flow to hit its remaining debt burden opportunistically before Michael Dell moves on to his next future M&A opportunity. The sale of VMware to Broadcom (AVGO) potentially next year in 2023 could open up Michael Dell and Dell itself to lots of new opportunities now that it can officially cut all ties with VMware besides what is truly mutually beneficial to both parties.

ACPS = $21.52

3. VMware I acquired VMware as a spin-off from Dell. Now I get to hopefully enjoy it being acquired by Broadcom for ~$61B. I plan at this time to opt in for receiving all Broadcom stock when the deal closes, but that won’t be until 2023 most likely. When I do my IRAs later this year, I might opt in to beef up this position markedly to take advantage of the arbitrage and for future Broadcom shares.

ACPS = $51.57

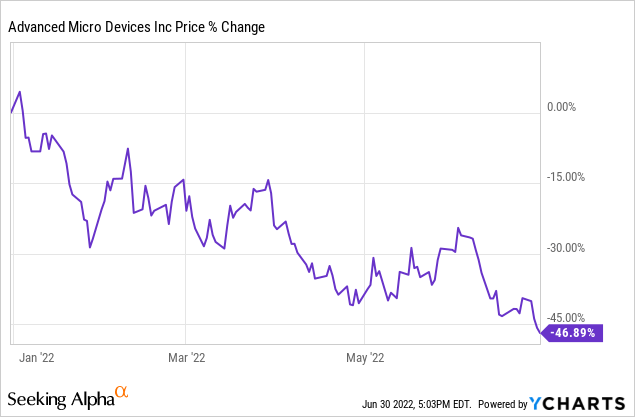

4. Advanced Micro Devices (AMD) Bought back into this stock as one of my favorite chip companies at a tremendous value in my opinion as the stock is about half off of 52-week highs. I love the CEO Lisa Su and also its most recent deal to acquire Xilinx for ~$50B which closed early in 2022. AMD continues to bully incumbents like Intel (INTC) relentlessly and I see AMD continuing to eat Intel’s lunch in the coming years as well.

ACPS = $83.68

The Health Care Sector

Aim = 15% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

ARWR |

$2,460 |

$24,600 |

$246,000 |

|

MDT |

$350 |

$3,500 |

$35,000 |

|

PFE |

$430 |

$4,300 |

$43,000 |

|

SMMT |

$400 |

$4,000 |

$40,000 |

|

NVAX |

$3,340 |

$33,400 |

$334,000 |

|

LLY |

$90 |

$900 |

$9,000 |

|

% Portfolio |

28.7% |

5. Arrowhead Pharmaceuticals (ARWR) is a permanent large stock position in my portfolio as an RNAi juggernaut entering key Phase 2 and 3 trials in 2022. A lovely balance sheet with key partnerships with Johnson & Johnson (JNJ), Amgen (AMGN), Takeda (TAK), Horizon (HZNP), and a new ~$1 Billion licensing deal in November of 2021 with GSK (GSK) significantly de-risks its TRiM platform as it continues to expand into additional cell types. Amgen continues to slowly progress Olpasiran (AMG 890), its collaboration candidate with Arrowhead along with a successful Johnson & Johnson update in November 2021 on JNJ-3989 for hepatitis B virus. Takeda will help co-develop and co-commercialize Arrowhead’s lead candidate ARO-AAT preparing Arrowhead for independent commercialization of its wholly owned candidates while it continues to find partners for new candidates like the recently revealed ARO-XDH with Horizon. Arrowhead partnered with GSK for its NASH candidate ARO-HSD, proving once again its TRiM platform is in big demand as it continues to expand its pipeline so fast that it can’t progress all of its candidates by itself as a smaller sub $5B company.

A setback in its ARO-ENaC candidate led to a tremendous buying opportunity in the stock in 2021, which is still in effect in my opinion. ARO-ENaC is neither the company’s lead product nor a very important one in Arrowhead’s ever growing pipeline of candidates. Investors will have gotten an update on Arrowhead’s pulmonary plans at the Pulmonary R&D day on May 26, 2022.

I used the ARO-ENaC debacle to expand my shares of Arrowhead from 410 shares up to 530 shares. I expanded my shares in Arrowhead again in January of 2022 by buying an additional 70 shares to bring my total up to 600 shares. Baby steps on this conviction stock for me as I continue to add shares as the company continues to sit around 52-week lows even as it successfully continues to expand and advance its marvelous pipeline.

ACPS = $45.56

6. Medtronic (MDT): Health care device maker that I think has significant upside from COVID-19 variants for years to come. Hospitals will need the best equipment companies like Medtronic provides as health issues from COVID-19 could and seem poised to persist for years.

ACPS = $83.13

7. Pfizer (PFE): A healthcare behemoth with a big stake in the fight against COVID-19. Seems like a great potential long-term winner at a great value compared to some of its peers. Brand new deals like its latest ~$3.2B deal with the government mean excess cash flows should continue to shower down on stockholders.

ACPS = $35.86

8. Summit Therapeutics (SMMT) did a very suspicious move in August of 2021 by combining its two Phase 3 blinded pivotal trials for its ridinilazole candidate for clostridioides difficile into one study. This was doable as both studies were at ~ 50% enrollment but were apparently not enrolling fast enough for management’s liking. However, in September 2021, investors found out that this change in the study was not pre-approved by the FDA, so the trial results won’t be enough for the FDA moving forward.

On top of all this, Summit investors found out in late December of 2021 that the company’s data results for its ridinilazole candidate didn’t meet all of the hoped for primary endpoints, resulting in another deep drop in the company’s share price.

Did a massive stock buy in January of 2022 as it settled around $2.00 a share. Went from 850 shares up to 2,850 shares as I think the stock’s upside is attractive now again. With its ability to raise cash on will with Rights Offerings backed by company Chairman and CEO billionaire Robert W. Duggan, with a 70+% ownership of the company, downside risk is markedly mitigated in my opinion.

I started to add shares of Summit again in April of 2022 as it headed south of $2 a share again along with the general continued malaise in the biotech sector. Buying shares around $1 a share now with the company’s latest rights offering on tap to bolster its cash reserves as I move up to 4,000 shares.

ACPS = $2.90

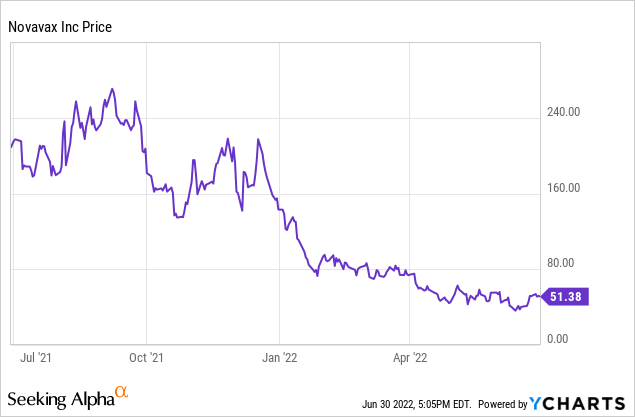

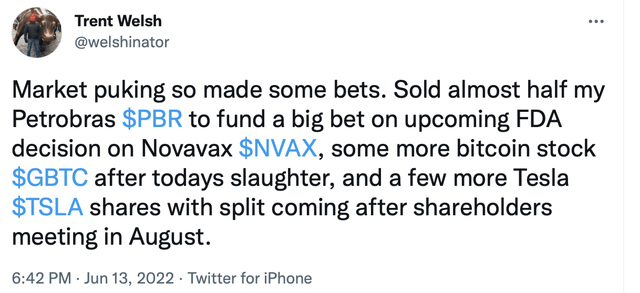

9. Novavax (NVAX) I see Novavax as a tremendous trade opportunity after the FDA’s advisory committee signed off on the drug which included 21 yes votes with 1 person abstaining. Sounds like a pretty good recommendation to me for the first potential U.S. approved vaccine not built on an mRNA platform like Moderna’s (MRNA), Pfizer’s (PFE), and Johnson & Johnson’s (JNJ) are. Despite this recommendation, Novavax still has a manufacturing update to shore up with the FDA meaning that shares were still trading at 52-week lows earlier in June even with a potential FDA approval right around the corner.

A clear upcoming FDA catalyst in July with a decent probability of success, and a beaten down stock sporting a small ~$3 billion market cap earlier in June, prompted me to pull the trigger and make a big bet on it at around 7% of my total retirement portfolio on June 13th.

Trent Welsh’s Twitter Feed (Twitter)

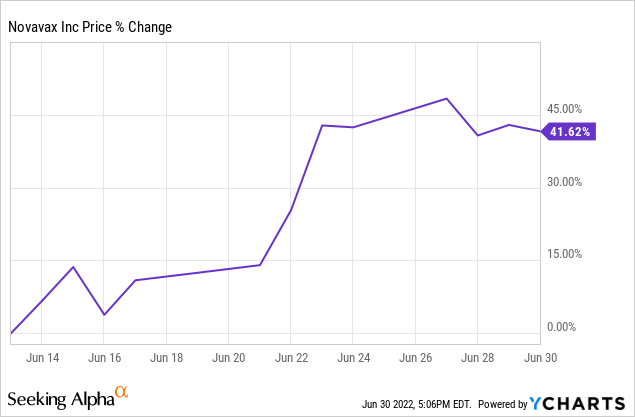

Since then, Novavax stock has rallied nicely along with decent gains for the rest of the market as well.

At this point, even the pain of an FDA’s rejection of the company’s vaccine would be considerably mitigated by the performance of the stock over the back half of the month since the advisory committee signed off on it. The current exit plan is to sell half to all of my shares of Novavax after the FDA’s decision depending on the outcome and the volatility experienced by the decision on the market.

ACPS = $36.45

10. Eli Lilly (LLY) A favorite healthcare stock of mine that I easily jump back into and rarely sell except when I see big opportunities arise for a short-term trade. Great collection of commercialized drugs and a great developmental pipeline of possibilities including Alzheimer’s candidate donanedab.

ACPS = $322.51

The Communication Services Sector

Aim = 10% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

DIS |

$1,210 |

$12,100 |

$121,000 |

|

GOOGL |

$680 |

$6,800 |

$68,000 |

|

TWTR |

$1,960 |

$19,600 |

$196,000 |

|

% Portfolio |

14.8% |

11. Disney (DIS) will crush Netflix (NFLX) in growth over the coming decades in my opinion as its streaming platform continues to grow by leaps and bounds. It is getting pummeled currently along with other streaming names like Netflix as inflation is starting to show effects in markets such as these, and winners and losers are starting to emerge as consumers pick and choose instead of owning everything. Definitely would like to buy more shares at these levels but other stocks are my focus right now.

ACPS = $171.78

12. Alphabet (GOOGL) (GOOG) One of the FAANG names producing amazing results as always even in a bear market. I have a decent amount of exposure to the FAANG names with my mutual funds, but it is hard to have too much of these juggernauts.

ACPS = $2,335.36

13. Twitter (TWTR) I bought Twitter stock again because of Musk playing his games with shareholders and the world with his tweets. The newest sell signal was Musk putting the Twitter deal “on hold” as he tries to determine how many bots the site has and if this is a good enough reason to try and potentially axe the deal or to try and negotiate a lower purchase price. I believe the deal will go through later on in the year at the deal’s $54.20 price point, making shares at a near 40% discount an incredible value if the current deal does go through. Even if the deal gets axed or renegotiated, I think the drop in share price at this time already reflects a lot of the potential harm that would cause limiting the downside at this time as most of the damage to share price is already reflected in the shares.

ACPS = $37.73

The Financial Sector

Aim = 15% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

GBTC |

$2,170 |

$21,700 |

$217,000 |

|

HSBC |

$250 |

$2,500 |

$25,000 |

|

% Portfolio |

9.8% |

14. Bitcoin (BTC-USD) is digital gold in my opinion and the future of finance as a potential bedfellow to or eventual replacement of not only the U.S. dollar, but to all fiat money in the coming decades. I plan on holding Bitcoin stock for the next 20+ years and to very rarely if ever sell shares, so month to month performance means little to me at this point. I plan on it being a long-term top 3 stock position in my portfolio at all times and will consider adding significant shares to my position if the coin drops below the $15K level as I just added more shares of Grayscale Bitcoin Trust (OTC:GBTC) stock in June of 2022 as it hovers around $20k a coin. I hope to be buying some Bitcoin shares every month now that prices are hovering at ~$20k a coin.

ACPS = $27.95

15. HSBC Bank (HSBC) is a legacy holding that might finally see some upside if the United Kingdom can ever get Brexit resolved and new trade opportunities sorted out. That, of course, might be a big if. Looks to be a stock on the chopping block when I do my IRA contributions for 2022.

ACPS = $48.91

The Consumer Discretionary Sector

Aim = 8% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

TSCO |

$580 |

$5,800 |

$58,000 |

|

TSLA |

$670 |

$6,700 |

$67,000 |

|

% Portfolio |

5.1% |

16. Tractor Supply Company (TSCO) quietly continues to perform as one of the best companies in retail, mostly immune to Amazon’s dominance. Its acquisition of Petsense makes a lot of sense now, especially with the explosive growth of everything pet in the wake of COVID-19.

ACPS = $79.76

17. Tesla (TSLA) is a newer position again for me after selling the proceeds from my Twitter trades. It was originally not on my buy list but Elon Musk selling ~$8.4B of Tesla stock to help fund his upcoming purchase of Twitter allowed the high-flying Tesla stock to trade under $900 a share. After a phenomenal earnings report, I’m more than happy to buy back into Tesla’s story as I have made great money on it in the past and see good opportunity again here around $700-$800 a share. This could be a landing spot for future Petrobras dividends as I still love Tesla’s long-term story even with Twitter’s deal overhang currently weighting shares down.

ACPS = $796.70

The Consumer Staples Sector

Aim = 6% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

PG |

$550 |

$5,500 |

$55,000 |

|

PEP |

$530 |

$5,300 |

$53,000 |

|

% Portfolio |

4.4% |

18. Procter & Gamble (PG) is a legacy holding that sports a decent growing dividend along with many best-in-class brands like Olay, Head & Shoulders, Dawn, and Charmin. Always nice to have some stalwarts for the upcoming recessions and depressions.

ACPS = $92.59

19. PepsiCo (PEP) is a phenomenal drink company with brands like Pepsi-Cola, Gatorade and Tropicana, along with amazing growth in the snack category with Frito-Lay that, in my mind, sets it apart from competitors like Coca-Cola (KO).

ACPS = $106.77

The Industrials Sector

Aim = 6% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

|

J |

$1,140 |

$11,400 |

$114,000 |

|

|

SPCE |

$220 |

$2,200 |

$22,000 |

|

|

% Portfolio |

5.5% |

20. Jacobs Engineering (NYSE:J) is a legacy holding I have loved for years. A long-time no-debt company that makes super-smart acquisitions. It now has very low-debt and initiated a small dividend which it should be able to grow annually over the coming years like it did in January of 2022 by 10%. Its focus on carbon neutrality and diversity in its workforce makes it a prime target for the younger generation. Jacobs could also experience sustained tailwinds for years due to Biden’s infrastructure and spending bills.

ACPS = $68.41

21. Virgin Galactic (SPCE) looks ripe and tasty for another re-entrance at its current price. I love Virgin Galactic’s volatility as I have made good money in the past buying low and selling high. Commercial space flight for Virgin Galactic looks probable for the beginning of 2023, so it is a long buy-and-hold scenario but one I’m willing to wait on.

ACPS = $13.21

The Materials Sector

Aim = 12% of my Stock holdings

| Stock | $40K | $400k | $4M |

| CLF | $300 | ||

| % Portfolio | 0% |

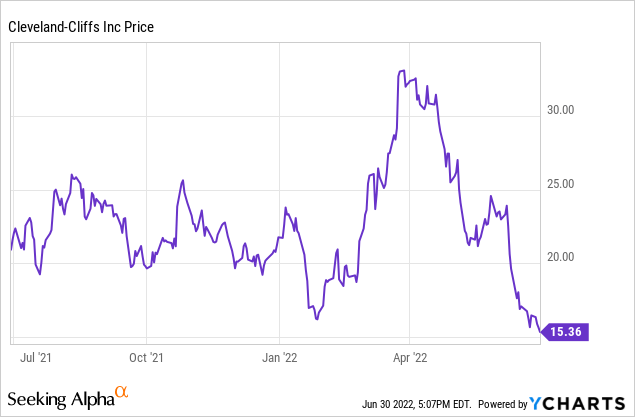

22. Cleveland-Cliffs (CLF) is a favorite material stock for me and is a good value again trading about half off of its recent 52-week highs. It is still making money hand-over-fist and has fixed its former debt problems means it can handle the upcoming potential recession easily enough. Just a teeny tiny position to start as I think it could easily drop more as I slowly build this position back up. I am still hugely overweight in energy and oil so no big hurry to get my materials sector up to previous levels again means I see oil itself as a material as well.

ACPS = $16.25

The Energy Sector

Aim = 12% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

HAL |

$640 |

$6,400 |

$64,000 |

|

PBR |

$4,670 |

$46,700 |

$467,000 |

|

% Portfolio |

21% |

23. Halliburton (HAL) is a U.S.-based oil service company that dominates services in the North American market. Small position with no real plans to expand even though it has been on fire to start 2022 but has cooled off lately.

ACPS = $36.48

24. Petrobras (PBR) With oil prices potentially peaking here around Memorial Day or over the course of the summer, switching over from a price-based oil stock to a safer oil value play with a massive dividend that can make money even under $60 a barrel makes sense to me now at this time. This could work out well even in a global recession as oil would have to fall quite far for this company to feel revenue pressure now that it has fixed its legacy debt issues. Achieving its proper debt level means its dividend should be safe in upcoming years barring political interference, which is an issue for a company like Petrobras. Elections are coming up in October I believe, which might cause some volatility in the stock. But Petrobras in its current scenario makes so much money every quarter that even worst case scenarios still include Petrobras making tons and tons of money for shareholders. Brazil might even try to privatize Petrobras, which can have several different outcomes for shareholders, but privatization most likely wouldn’t happen for a decade or more if it ever does happen.

I used my first massive June dividend to expand my positions in beaten down stocks and sold a chunk of my Petrobras stock to fund my Novavax (NVAX) bet for the month of June. Depending on how the Novavax trade works out in July, I might build my Petrobras holding up again or simply stick to building back the new positions I started in June some more.

ACPS= $13.58

The Utility Sector

Aim = 3% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

| DUK | $1,000 | ||

|

% Portfolio |

0% |

25. Duke Energy (DUK) A small start to my utilities again as I am putting most of my excess cash towards opportunities I see in this volatile market but I’m always looking to build my utilities sector again so I have an easy stock to sell for upcoming opportunities I need cash for. Duke Energy is my go to utility as it’s a large company with a good dividend which is what I’m looking for in a simple utility I sell just as often as I buy.

ACPS = $106.62

The Real Estate Sector

Aim = 3% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

AMT |

$800 |

$8,000 |

$80,000 |

|

% Portfolio |

3.3% |

26. American Tower (AMT) is a premier U.S. cell phone tower company aggressively expanding globally across a few more continents. 5G evolution could be a lucrative tailwind for years to come. Can’t think of a reason to add another real estate play, so I just plan to keep adding to this holding over time.

ACPS = $111.38

Bonds (2% of my Stock holdings)

This asset class is currently satisfied by my mutual fund holdings.

My top 10 Holdings and Percentage of my Portfolio

|

Stock |

Sector |

% Portfolio |

|

Petrobras |

Energy |

13.7% |

|

Novavax |

Health Care |

9.8% |

|

Arrowhead |

Health Care |

7.1% |

|

Bitcoin |

Financials |

6.2% |

|

|

Communication Services |

5.7% |

| Jacobs Engineering |

Industrials |

3.3% |

|

Disney |

Communications Services |

3.0% |

|

American Tower |

REIT |

2.4% |

|

QUALCOMM |

Info Tech |

2.4% |

| Tesla |

REIT |

2.0% |

|

Total % of Portfolio |

~55.6% |

Stock Watch List:

Stocks I am looking to add to my portfolio or add shares to in the coming months potentially especially with Petrobras dividends.

Bitcoin, Tesla, Twitter, Boil, and VMware.

Best of luck :).

Be the first to comment