cemagraphics

The path of equity markets going forward is likely to be largely determined by commodity prices, labor markets and consumer spending. If consumer spending can remain robust while inflation rapidly declines and financial conditions loosen, equity markets could continue to move higher.

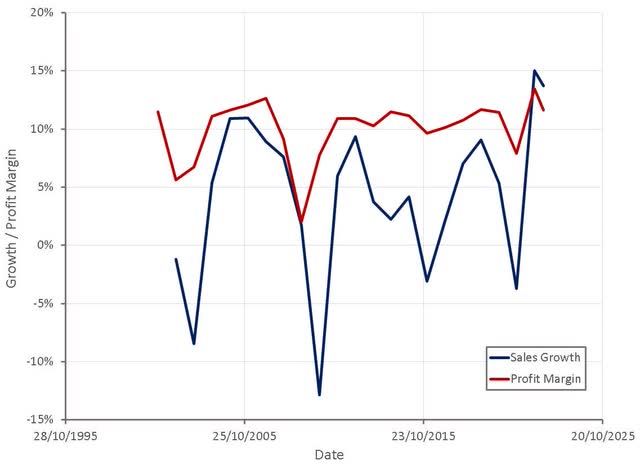

Equity market multiples are in line with recent averages for many stocks but revenue and profit margins are above trend levels. As a result, it would be reasonable to assume margin compression and a decline in revenue (or at least an extended period of weak growth) for many stocks. In addition, investors have turned to quality, profitable value stocks in the face of high inflation and macro uncertainty. This has caused many stocks to trade on multiples that do not reflect the current higher interest rate environment.

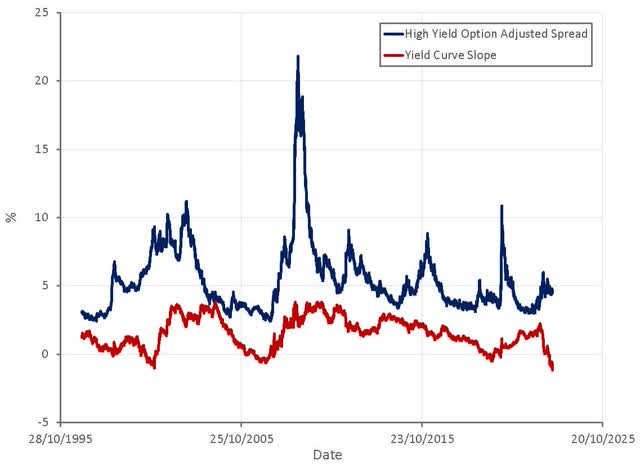

Bond markets appear to be pricing in a soft landing, with the yield curve now significantly inverted and spreads remaining modest. The Fed will likely need to see a deterioration in labor markets before they pivot though and access to financing has become more restrictive, which could lead to increased financial distress down the road.

Inflation

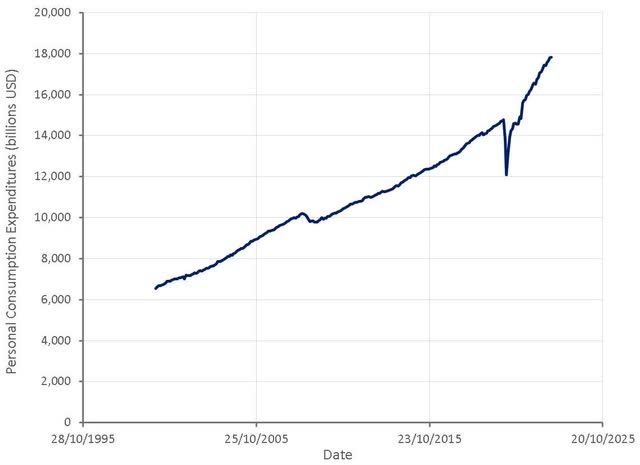

Inflation over the past 2 years has been driven by a combination of excess demand for certain items and supply chain disruptions. For example, household formation accelerated through the pandemic and spending on goods (electronics, home office and home gym equipment, etc.) rose sharply. Spending has now largely rotated into services as people have made up for things like missed holidays. Excess demand is likely to moderate going forward though as excess savings are exhausted and spending patterns normalize. This will ease pressure on supply chains and lead to disinflation / deflation, as already seen in areas like lumber, used car prices and shipping costs.

Figure 1: Personal Consumption Expenditures (source: Created by author using data from The Federal Reserve)

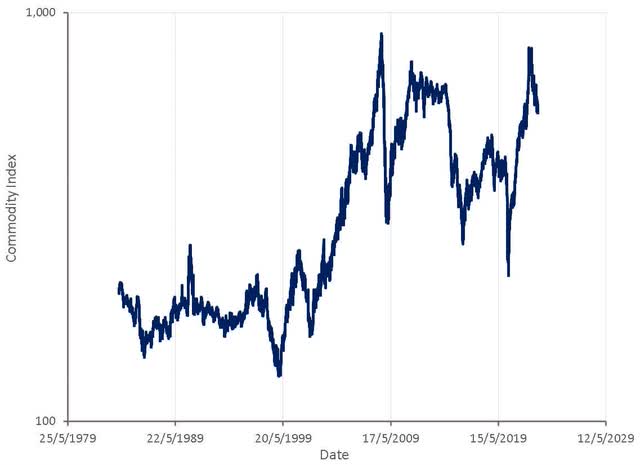

Supply chain disruptions have also been an important contributor to inflationary pressures with the combination of the pandemic, closely followed by Russia’s invasion of Ukraine, preventing supply chains from responding to demand. Commodities have been an important contributor to inflation, with a recent period of weak commodity prices leading to under investment in some areas, which has been exacerbated by the war in Ukraine.

A shortage of energy in general (oil, gas, coal, nuclear, renewables) due to the war in Ukraine has fed through to the rest of the economy. While energy prices may remain high while the war is ongoing, it is not clear that they will continue to increase and contribute to further inflation.

Figure 2: GSCI (source: Created by author using data from Yahoo Finance)

Labor Markets

While the impact of tight labor markets on inflation is likely being vastly overestimated, labor markets will be an important determinant of Fed policy, independent of inflation. Even if inflation rapidly declines in 2023, it is difficult to see the Fed significantly changing policy without a meaningful deterioration in labor markets.

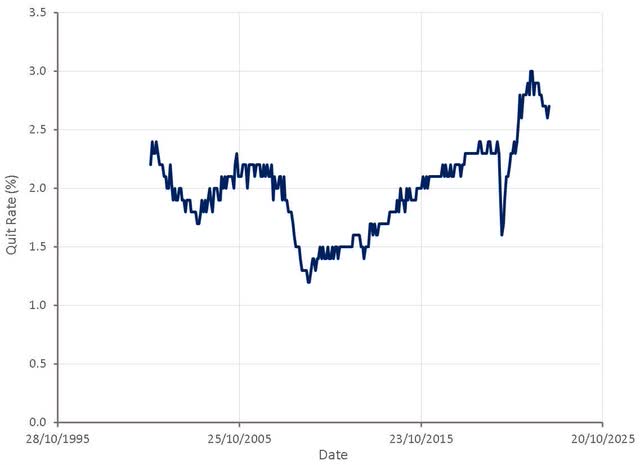

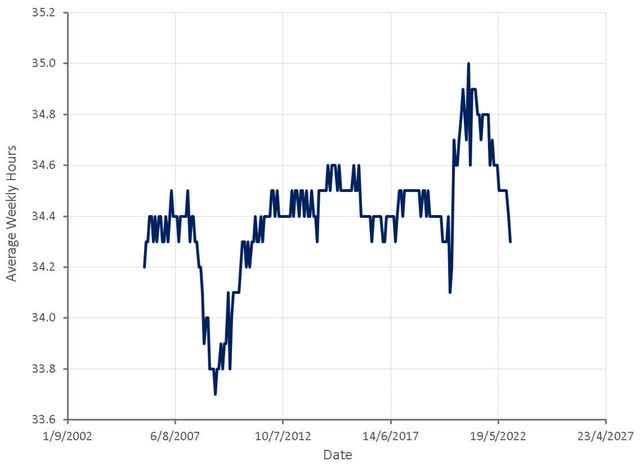

While labor markets remain tight, there is evidence that they are beginning to normalize somewhat, which should feed through to lower wage growth and eventually rising unemployment. Quit rates have begun to come down and the average number of hours worked is showing economic weakness.

Figure 3: Quit Rate (source: Created by author using data from The Federal Reserve) Figure 4: Average Weekly Hours (source: Created by author using data from The Federal Reserve)

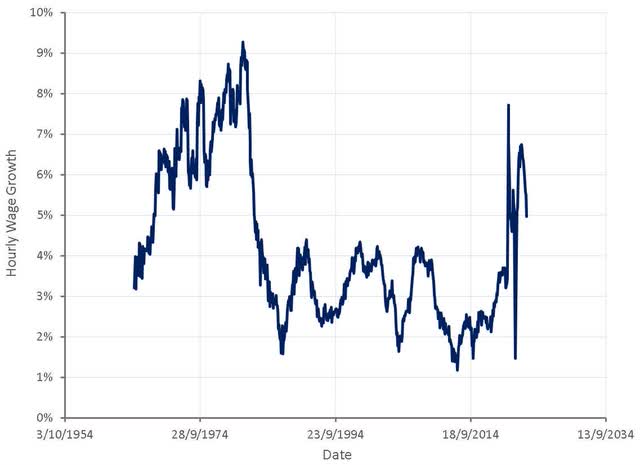

Hourly wage growth is still robust, but is also beginning to come down, even as the number of hours worked contracts. If wage growth remains below inflation, consumer spending will remain under pressure, increasing the probability of a hard landing.

Figure 5: Hourly Wage Growth (source: Created by author using data from The Federal Reserve)

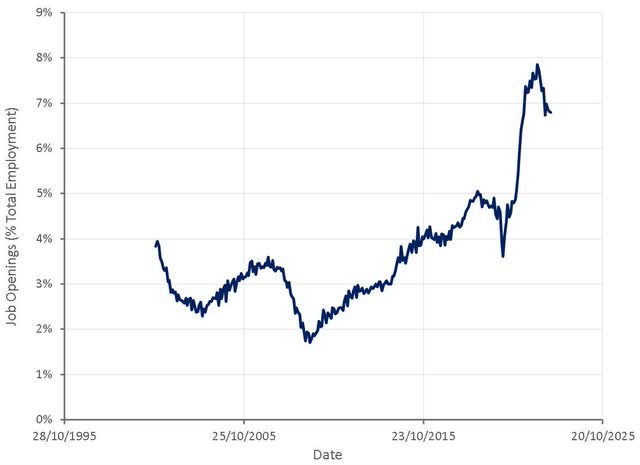

Job openings have also begun to come down, although it is not clear how much information job openings contain. Directionally they are probably correct, but have obviously become inflated in recent years, leading to an overestimation of labor market tightness.

Figure 6: Job Openings (source: Created by author using data from The Federal Reserve)

Investment

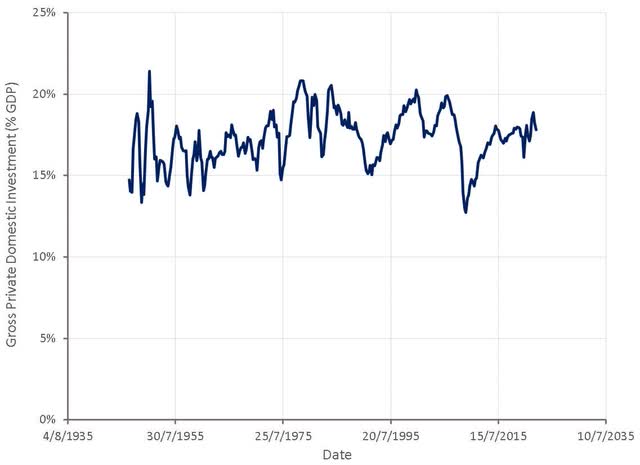

The impact of tighter monetary policy is not currently clear, given the potential long and variable lag, but it is likely that investment is currently being effected more than consumption. Interest rate sensitive parts of the economy, like housing construction, have already slowed, as has the technology sector. Absent a loosening of financial conditions, weak investment growth could feed through to the labor market and aggregate demand as the year progresses. Receding recessionary fears and loosening financial conditions could lead to a rebound in investment going forward though.

Figure 7: Gross Private Domestic Investment (source: Created by author using data from The Federal Reserve)

Consumer Spending

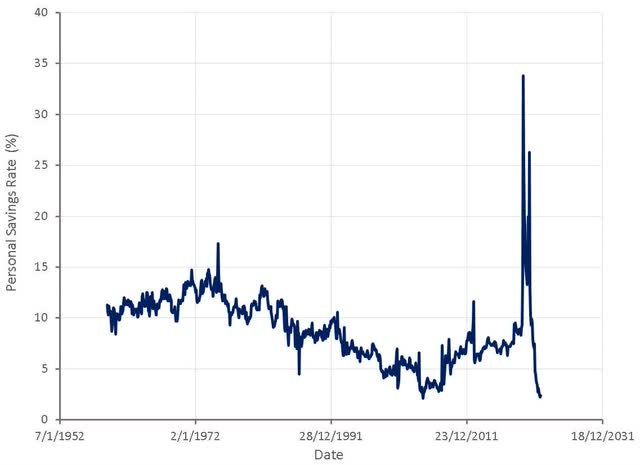

Consumer spending remains extremely robust and is used by many as evidence that the economy is strong. The real question is how sustainable the current level of spending is, and while it is widely acknowledged that the personal saving rate is extremely low, this is typically dismissed by pointing to excess savings from the pandemic. Excess savings are rapidly being exhausted, and debt levels are rising rapidly, because consumers are currently spending beyond their means. At some point this situation will need to be resolved, through either lower expenditures or increased income, with the former appearing far more likely. The outcome of this situation likely won’t become apparent until the second half of the year.

Figure 8: Personal Saving Rate (source: Created by author using data from The Federal Reserve)

Equity Markets

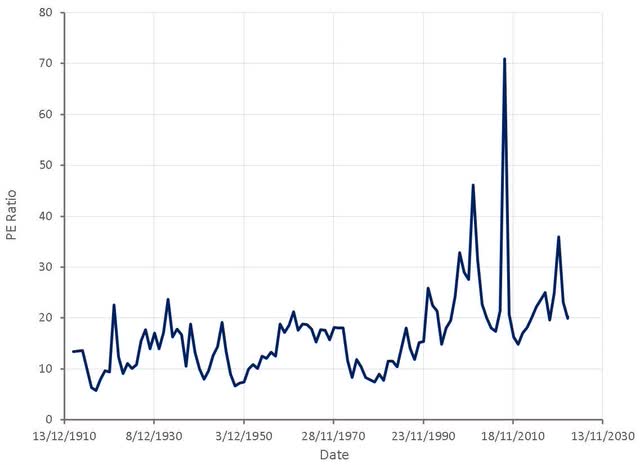

Equity market multiples currently appear reasonable, although may still be somewhat elevated if interest rates remain at current levels. At this point, any potential downside is more likely to be driven by weak sales and margin compression than multiple compression. If investment and consumer spending are weak in 2023, sales growth is also likely to be low and there is likely to be margin compression, the combination of which could potentially reduce earnings significantly.

Figure 9: S&P 500 PE Ratio (source: Created by author using data from multpl.com) Figure 10: S&P 500 Sales Growth and Profit Margin (source: Created by author using data from multpl.com)

Bond Markets

Similar to equity markets, bond markets appear to be pricing in lower interest rates without significant economic weakness. While this is possible, and there is no reason to expect a 2008 style financial crisis, access to financing has been declining, which may lead to higher spreads in the future.

Figure 11: Yield Curve Slope and High Yield Spread (source: Created by author using data from The Federal Reserve)

Be the first to comment