imaginima

Enterprise Products Partners L.P. (NYSE:EPD) is a leading blue chip midstream master limited partnership (i.e., MLP) that boasts a broadly diversified portfolio of pipelines and related midstream assets.

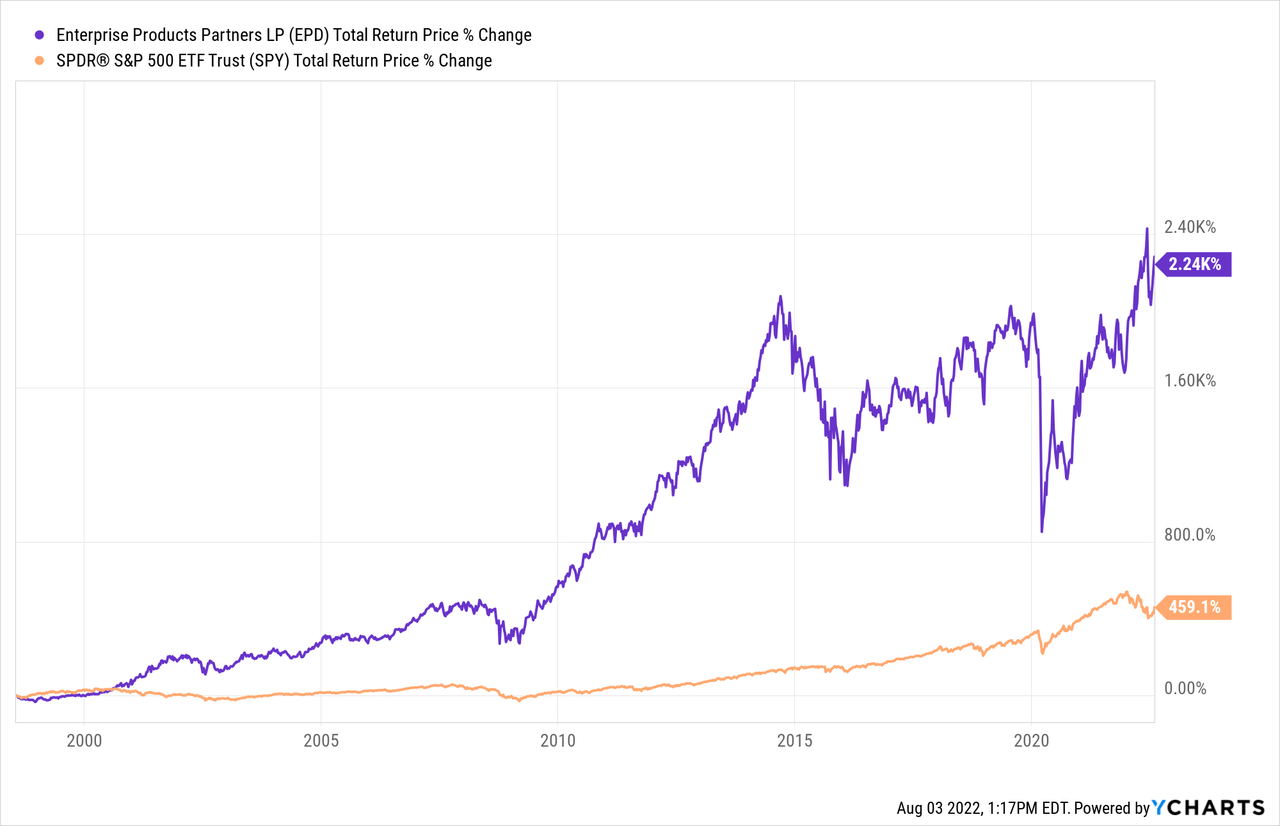

The partnership also has a fantastic track record for growing distributions regularly, with a growth streak that now spans 24 years, helping it to deliver market-crushing returns since going public:

On top of that, insiders are fully aligned with public investors, as they own roughly one-third of the partnership’s equity.

In this article, we will discuss three important takeaways from EPD’s Q2 results and provide our updated outlook on the stock.

#1. EPD Remains Poised To Continue Increasing Unitholder Capital Returns

While EPD has already been accelerating unitholder capital returns with two distribution increases thus far in 2022, the numbers and management commentary imply more is on the way.

First and foremost, EPD posted 1.9x distribution coverage in Q2, implying that the distribution is not only very safe but has significant room to grow down the road.

Second, management announced a fairly aggressive equity buyback program for the second half of the year, stating on the earnings call:

On August 1, we provided notice of our intention to redeem $350 million of the $700 million of junior subordinated notes D with a redemption date of August 31, 2022.

These hybrid notes that were originally issued in August 2017 are redeemable on or after August 16. These notes have a fixed rate coupon of 4.875% for the first 5 years and then become floating at LIBOR plus, call it, 3% beginning August 16. Based on current floating rates, the indicative spot floating rate for this note will now jump to 5.8%, making these notes one of our highest cost debt issues and really our only issue that is redeemable without a premium.

Given the forecast that the Fed will increase floating rates by at least another 1% or more, we elected to redeem half of this issuance now using cash on hand and commercial paper to fund the redemption. Considering these notes received 50% equity credit from the rating agencies, we decided to redeem half of the notes at this time. And in addition, we plan to opportunistically buy back up to $300 million of EPD common units over the remainder of the year.

Our common units are a more expensive cost of equity versus the cost of the equity embedded in the hybrids.

Management then went on to elaborate on its general philosophy surrounding the return of capital to unitholders moving forward:

our thoughts are still come in and take all of the above approach. And that’s — I think that’s reflected by what we’re doing on this call of part of this hybrid note issue. I mean it’s really — it’s not the highest coupon, but it’s near the highest coupon debt we have and the other side of it is we’re looking to come in and buy back up to $320 million, $350 million of equity between now and the end of the year, too. So a balanced approach between buybacks and debt reduction.

I think the other thing, and — yes, I think this was represented what we did in 2021 is we came in and retained cash and really have been self-sufficient in funding our growth CapEx. But the other thing we had coming into the year is we almost — we had quite a bit of cash on hand and that enabled us to come in and fund a substantial amount of our acquisition of Navitas Midstream with cash and gave us the flexibility that the remainder that we could come in and just use commercial paper.

So again, I think coming in and retaining cash for balance sheet flexibility paid off in how we came in and were able to capture opportunities that we didn’t come in and stress the balance sheet by coming in and doing an acquisition. So I don’t think you’ll see much change for us. You did see us come in also this time and bumped the distribution 5.6% compared to last year. So again, I think you still come in and see us taking an all of the above approach.

This commentary tells us three things about EPD’s forward outlook:

(1) They are going to continue returning a lot of capital to unitholders, and likely more than they have in the past.

(2) Unit repurchases are going to be increasing from previous levels as a $300 million or so unit buyback in half a year is a significant upgrade from prior buyback programs.

(3) EPD will continue to prioritize distribution growth. As management stated in its remarks: “I don’t think you’ll see much change for us. You did see us come in also this time and bumped the distribution 5.6% compared to last year.” In the past, EPD has emphasized again and again that distribution growth is generally their preferred method of returning capital to unitholders and – given the accelerated pace of distribution growth and remarks about not much changing for them – it appears that will likely continue to be their method of choice for returning capital to unitholders. The fact that they are accelerating the unit buyback only further emphasizes just how much capital they expect to be able to return to investors.

#2. EPD Is In Excellent Shape To Weather A Recession

With the U.S. GDP declining for two quarters in a row, inflation still raging near four-decade highs, interest rates potentially heading higher, and global supply chains still suffering some strain, the macroeconomic outlook does not look great.

However, there are few better places to invest for high income than EPD for investors looking to defend their portfolio against these macro threats. EPD’s sector-leading BBB+ balance sheet is particularly robust, boasting a 3.1x leverage ratio that is well below the partnership’s target level of 3.5x (plus or minus 0.25x) and $4.1 billion in total liquidity. On top of that, EPD is very well insulated against rising interest rates, as 97% of its debt has fixed interest rates and the average term to maturity is 21 years. As management emphasized on the earnings call:

We’ve been preparing for this environment for a dozen years.

Last, but not least, its cash flow profile is quite stable and commodity price resistant, with most of its cash flows coming from long-term fixed fee contracts with strong counterparties. As a result, its fundamental performance should be relatively unimpacted by a recession, even if it turns out to be a longer or more severe one.

#3. EPD’s Growth Profile Remains Robust

On top of its defensive posture, EPD’s growth profile is also quite good at the moment. First and foremost, distributable cash flow jumped 30% in Q2 to a record $2B from $1.6B for the prior-year period, reflecting its current strong growth momentum.

Looking ahead, EPD just announced three organic growth projects in the Permian Basin, which will add two new natural gas processing plants and expand its NGL pipeline system in the region.

It plans to spend $1.6 billion in 2022 and ~$2 billion in 2023 on growth CapEx, with numerous major growth projects in the NGL, natural gas, and petrochemical and refined products businesses. Most of these projects are expected to come online in 2023, too, which should provide a nice tailwind to cash flows in the coming years.

Investor Takeaway

EPD put up another quality, low-drama quarter in Q2. It is gushing cash flow, enabling it to accelerate returns to investors via a combination of accelerating distribution growth, more debt and equity buybacks, and continued aggressive and opportunistic organic and M&A growth investments.

Moreover, the balance sheet is as solid as ever, the cash flows are highly recession resistant, and its growth pipeline is robust. When taking all of that into account alongside the fact that its relatively safe distribution yields well over 7% at the moment, EPD is clearly an attractive Buy, especially in the early stages of an economic downturn.

As a final note, it is important to remember that, as an MLP, EPD issues a K1 tax form, which can result in complications for certain non-U.S. investors as well as investments held in retirement accounts. As a result, each investor would be prudent to consider the tax implications before making a purchase of EPD units.

Be the first to comment