GBP price, UK inflation, UK PMIs, news and analysis:

- UK inflation was lower than forecast last month, weakening GBP/USD.

- By contrast, the flash estimates of the UK PMIs this month were all stronger than expected.

- The Bank of England will likely look through the numbers but Sterling could still have further to fall.

GBP/USD at risk of further losses

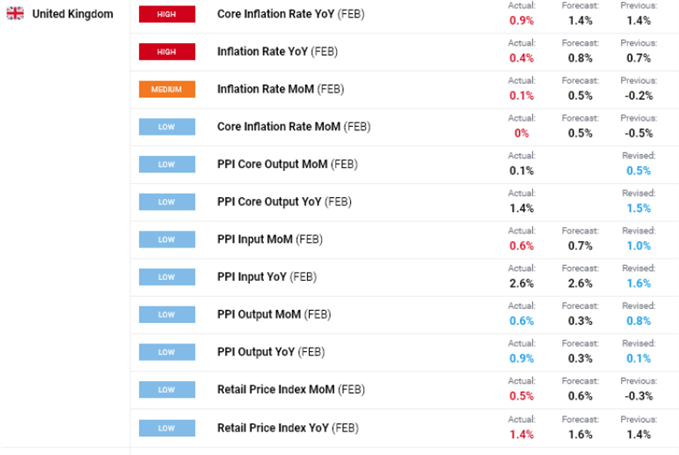

UK inflation last month was weaker than analysts polled by the news agencies had predicted, with the headline year/year rate falling to 0.4% from the previous 0.7% rather than rising to the forecast 0.8%. That has weakened GBP/USD again Wednesday as the data suggest the Bank of England will continue to keep UK interest rates low for the foreseeable future.

In reality, the figures are unlikely to influence the central bank one way or the other but the weakness in GBP/USD still looks likely to persist for a while longer. Note that the pair is still in the downtrend that began on February 24 and has already taken out both the 20-day simple moving average at 1.3895 and the 50-day sma at 1.3827. Now it could well drop to the 100-day sma at 1.3617 and even to the channel support line currently at 1.3508. To the upside, the key resistance level remains at 1.40.

GBP/USD Price Chart, Daily Timeframe (November 9, 2020 – March 24, 2021)

Source: IG (You can click on it for a larger image)

Recommended by Martin Essex, MSTA

How to Trade GBP/USD

Looking at the inflation data in more detail, the falls were due mostly to the biggest annual drop in clothing prices since 2009 and cheaper second-hand cars, toys and computer games. Consumer prices could well rise in the months ahead as UK economic activity picks up after the slump caused by the coronavirus pandemic. However, that’s unlikely to prompt an increase in interest rates given that the BoE will not want to snuff out a nascent economic recovery.

Latest UK inflation data

Source: DailyFX economic calendar

Discover what kind of forex trader you are

UK PMIs beat expectations

The latest UK purchasing managers’ indexes for March also missed analysts’ expectations – but to the upside. IHS Markit, which compiles the data, noted that the UK private sector returned to growth last month, led by the fastest increase in service activity since August 2020.

“The UK economy rebounded from two months of decline in March, with business activity growing at its fastest rate since last August as children returned to schools, businesses prepared for the reopening of the economy and the vaccine roll-out boosted confidence,” commented Chris Williamson, the company’s chief business economist.

Latest UK PMIs

Source: DailyFX

Sentiment data point to bearish trading bias

Meanwhile, IG client positioning data show 60.67% of traders in GBP/USD are net-long, with the ratio of traders long to short at 1.54 to 1. The number of traders net-long is 0.64% higher than Tuesday and 14.48% higher than last week, while the number of traders net-short is 7.51% lower than Tuesday and 22.39% lower than last week.

At DailyFX, we typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.Traders are further net-long than Tuesday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

| Change in | Longs | Shorts | OI |

| Daily | -1% | -7% | -3% |

| Weekly | 12% | -20% | -4% |

— Written by Martin Essex, Analyst

Feel free to contact me on Twitter @MartinSEssex

Be the first to comment