Dilok Klaisataporn

By Melda Mergen

Focus on quality for success with equities in the new year

2022 was a bruising year for equity markets, and I don’t think that investors should just expect everything to go “back to normal.” Higher inflation and a weaker economic environment will mean that not all companies will thrive. Here’s how I am thinking about opportunity as we head into 2023.

Inflation will begin to settle down, but it will settle at a higher number than we had pre-pandemic

As the economy reopened after the pandemic, we saw many one-off drivers of inflation. At the same time, longer lasting drivers have also been unleashed. We are seeing changes in supply chains (reshoring and building out new networks) and geopolitics, and these don’t resolve quickly. I expect inflation to fall, but not back to pre-pandemic levels. When a dislocation like this happens, you never go back to where you started – and where we end up is one of the key questions for 2023.

At the lower end of the growth spectrum, we’ll see a re-rating in valuation

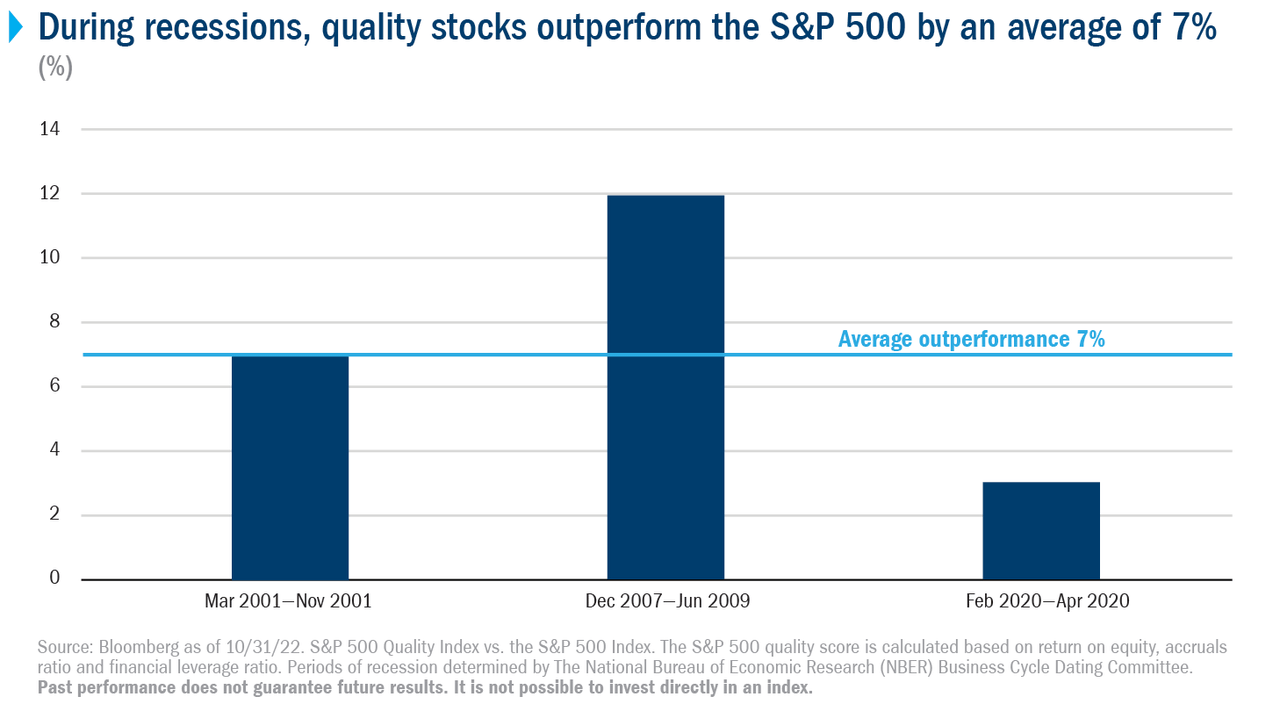

Inflation generally means equity valuations come down, and we saw that through 2022, but on a broad market basis. I think that we’ll see greater dispersion in terms of valuation in 2023, with longer duration equity – companies with growth expectations farther out in the future – suffering more. Investors will have to be more careful about what they are willing pay for future earnings, and demands for profitability will come sooner. All of this means that companies that can’t deliver earnings are more likely to see the market take down their valuation.

How much cash a company has on hand is going to matter more

Many investors think of valuation in terms of P/E multiples. That metric is useful, but it’s not the only measure of a company’s value. I think that free cash flow will be a more important metric because it will provide a good indication of how resilient a company may be in a high-inflation, weaker economic environment. Cash on hand can also help deliver stock buybacks, which can support a company’s stock price. It will be a lot more expensive to fund buybacks through debt. Because of this, free cash flow and dividend growth (rather than the absolute level of yield) are both metrics that may indicate a higher quality company.

There are some relative opportunities to consider, but the primary focus should be on finding resilient companies

While economic growth is slowing, at this point, it doesn’t look like a recession in the U.S. will be very deep. In contrast, economies in Europe are under significant stress, and a deeper recession there seems likely. In emerging markets, we have seen economies under stress from China’s zero-COVID policies, the strong U.S. dollar and geopolitics. When thinking about global opportunities at a high level, the U.S. is more attractive than other regions. I also think that small caps may offer greater opportunity than large caps – especially since larger companies tend to have greater non-U.S. revenue exposure (~35% of revenue is outside the U.S.).1 I also still think that a tilt towards value over growth makes sense.

You’ll need to go deeper than big-picture observations to succeed in 2023 though – meaning an active, company-by-company approach. Passive indexes (especially in international) can have embedded concentrations that can hurt portfolio performance. To succeed in 2023, you’ll really need to distinguish between companies that are more resilient and those that aren’t.

1 FTSE Russell as of March 31, 2022. 39.2% of Russell 1000 company revenue comes from non-U.S. sources, compared with just 17.9% of Russell 2000 company revenue.

Disclosures

The S&P 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks. The S&P 500 Quality Index is designed to track high quality stocks in the S&P 500 by quality score, which is calculated based on return on equity, accruals ratio and financial leverage ratio. The Russell 1000 Value Index measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values. The Russell 1000 Index tracks the performance of 1000 of the largest U.S. companies, based on market capitalization. It is not possible to invest directly in an index.

© 2016-2022 Columbia Management Investment Advisers, LLC. All rights reserved.

Use of products, materials and services available through Columbia Threadneedle Investments may be subject to approval by your home office.† By clicking the Glossary link above, you will be leaving columbiathreadneedle.com/us. View our Terms and Conditions above for our hyperlinking disclosure.

With respect to mutual funds, ETFs and Tri-Continental Corporation, investors should consider the investment objectives, risks, charges and expenses of a fund carefully before investing. To learn more about this and other important information about each fund, download a free prospectus. The prospectus should be read carefully before investing. Investors should consider the investment objectives, risks, charges, and expenses of Columbia Seligman Premium Technology Growth Fund carefully before investing. To obtain the Fund’s most recent periodic reports and other regulatory filings, contact your financial advisor or download reports here. These reports and other filings can also be found on the Securities and Exchange Commission’s EDGAR Database. You should read these reports and other filings carefully before investing.

The views expressed are as of the date given, may change as market or other conditions change and may differ from views expressed by other Columbia Management Investment Advisers, LLC (CMIA) associates or affiliates. Actual investments or investment decisions made by CMIA and its affiliates, whether for its own account or on behalf of clients, may not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not take into consideration individual investor circumstances. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be appropriate for all investors. Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Since economic and market conditions change frequently, there can be no assurance that the trends described here will continue or that any forecasts are accurate.

Columbia Funds and Columbia Acorn Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA. Columbia Funds are managed by Columbia Management Investment Advisers, LLC and Columbia Acorn Funds are managed by Columbia Wanger Asset Management, LLC, a subsidiary of Columbia Management Investment Advisers, LLC. ETFs are distributed by ALPS Distributors, Inc., member FINRA, an unaffiliated entity.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment