AdrianHancu

This article first appeared in Trend Investing on June 14, 2022, when Tesla stock price was US$647; but has been updated for this article.

2022 Bear Market Bargains Series – Tesla Inc.

As the 2022 U.S. equity bear market rages on (S&P 500 index (GSPC) now at 3,863, down 18.95% YTD, P/E is now 19.41), we take a look at Tesla Inc. (NASDAQ:TSLA).

For a background on Tesla, you can read our article:

- Feb. 2022 – A Brief Update On Tesla And What Is A Fair Valuation Today Plus My PTs For The Years Ahead

Or our Tesla article when Tesla was having Model 3 production ramp difficulties and the stock price had fallen to bargain levels of US$50 (adjusted pre-split):

Today’s article looks at Tesla’s 2022 key news (the good, the bad, and the ugly) and explains why Tesla looks to be a 2022 beaten-down bargain. Tesla is currently ranked the number 2 globally YTD for electric car sales with 12.6% global market share.

Tesla’s closing stock price peaked on November 1, 2021 at US$1,222.09. Today, the stock is at US$720.20, or 41% lower.

Tesla Inc. – Price = USD 720.20

Yahoo Finance

2022 Tesla news summarized – The good, the bad, and the ugly

2022 good news for Tesla

- April 21, 2022 – “Tesla crushes Q1 estimates, warns that supply chain issues are far from over…..The company detailed revenues of $18.76 billion and $2.86 worth of earnings per share, up from its Q1 2021 results of….earnings per share of 93 cents.”

-

May 4, 2022 – “Tesla confirms plans for second plant in Shanghai….. production facility with an annual capacity of 450,000 vehicles is planned near the current plant.”

- March 21, 2022 – “Musk reveals plan to scale Tesla to ‘extreme size’.”

- March 22, 2022 – “Elon Musk breaks out the dance moves as he opens new Tesla factory in Germany.“

- April 8, 2022 – “Tesla opens Texas Gigafactory…..”

- May 12, 2022 – “Elon Musk reveals Tesla Cybertruck is sold out until 2027.”

- May 15, 2022 – “Tesla Semi truck orders open as release date looms.”

- May 26, 2022 – “Tesla already wants more space for the Berlin Gigafactory.”

- May 30, 2022 – “Tesla Shanghai plant restores weekly output to 70% of pre-lockdown level -sources.”

- June 9, 2022 – “Tesla’s China production roars back with output tripling….. Even so, EVs produced in May were still only about 50% of what Tesla’s China plant does in a regular month.”

- June 10, 2022 – “Tesla files for 3-for-1 stock split.”

- June 10, 2022 – “Tesla is the most preferable brand for prospective EV buyers.”

- June 16, 2022 – “Elon Musk’s Tesla raises prices across car models in the U.S.”

- June 23, 2022 – “Tesla Model Y = 1 out of every 3 new EVs registered in US in 2022.”

2022 bad news for Tesla

- May 19, 2022 – “Tesla drops below $700 as bulls reset expectations…..

Wedbush Securities lowered its 12-month price target on Tesla to $1,000 from $1,400 as it acknowledged that the current headwinds are too hard to ignore. Analyst Dan Ives said the reality is that the current Shanghai lockdowns have been an epic disaster so far in the second quarter and Tesla is expected to see modest delivery softness with a slower growth trajectory in the key China region right in front of the second half of the year. The Wedbush forecast for Q2 deliveries was lowered to 277K from 297K. Ives and team kept an Outperform rating on Tesla, but lowered earnings estimates for Q2, FY22 and FY23 to reflect softness in China.”

- June 4, 2022 – “Exclusive: Elon Musk wants to cut 10% of Tesla jobs…. CEO Elon Musk has a “super bad feeling” about the economy.”

- June 21, 2022 – “Tesla supply chain problems are paramount concern – Musk…..He explained that production has been hindered by raw material shortages and shutdowns of assembly lines in China.”

- June 22, 2022 – Tesla Cybertruck delayed again. “Tesla Cybertruck design is ‘finally locked’ and gets an updated timeline……to production for mid-2023.”

2022 ugly news for Tesla

- May 10, 2022 – “Tesla’s China-made sales in April dropped drastically due to Shanghai lockdown….Tesla delivered just 1,512 vehicles from its Shanghai plant…..vs. 65,814 units in March.”

- June 10, 2022 – “Tesla’s China output decline trending deeper than Musk forecast, data and internal memos show. Production at Tesla Inc’s Shanghai factory is on track to fall by over a third this quarter from the first three months of the year as China’s zero-COVID lockdowns caused deeper disruptions to output than Elon Musk had predicted. The U.S. automaker is aiming to make more than 71,000 vehicles at its Shanghai plant in June.

Together with the 44,301 units it produced in April and May, according to data from China Passenger Car Association (CPCA), that would add up to around 115,300 units in the second quarter……In the first three months of the year, Tesla Shanghai manufactured 178,887 cars, according to the CPCA.”

- July 2, 2022 – Q2, 2022 deliveries fell due to China factory close. “The delivery of 254,695 is 17.9% lower than 1Q22 deliveries of 310,048.”

Finally, the news of a Shanghai production stoppage was both good and bad news for Tesla.

June 2023 – “Tesla plans 2-week suspension for most Shanghai production for upgrade – memo. Tesla Inc plans to suspend most production at its Shanghai plant in the first two weeks of July to work on an upgrade of the site, according to an internal memo seen by Reuters. After the upgrade, the U.S. automaker aims to boost the plant’s output to a new record high by the end of July to get closer to its goal of producing 22,000 cars per week in Shanghai, according to the memo.”

Comments on the above news

Tesla had a superb Q1 2022 with record electric car sales and the opening of two new gigafactories (Berlin in late March and Texas in early April 2022).

Tesla had a poor Q2 2022 as Shanghai production came to a halt due to the China Covid-19 lockdowns.

Looking ahead if Tesla is able to successfully ramp up production and reach the goal of 50% production growth, then 2022 deliveries should hit 1.4m despite the poor Q2. This assumes no more serious disruptions.

Tesla’s stock price has been severely punished in 2022 due to the above news and the U.S. equity bear market. This has left the stock at a much more reasonable valuation.

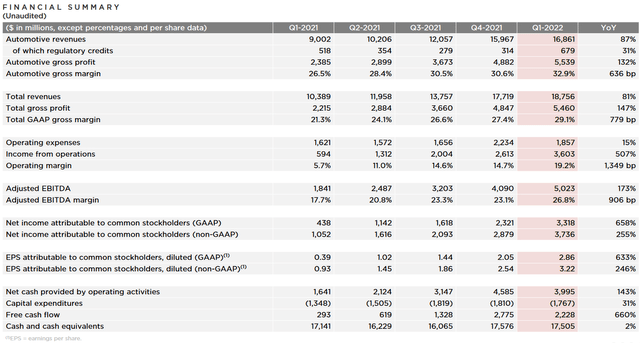

Tesla Q1 2022 financials update

Tesla’s Q1 2022 results were released on April 20, 2022 and can be viewed here.

Q1 2022 was a knockout quarter for Tesla as stated in their release:

First quarter of 2022 was another record quarter for Tesla by several measures such as revenues, vehicle deliveries, operating profit and an operating margin of over 19%.

Tesla’s Q1 2022 financials (highlighted column and far right column gives a comparison YoY)

Outlook for the rest of 2022

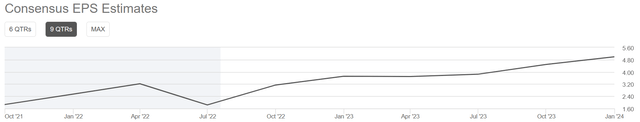

Tesla’s Q2 2022 results will be announced on July 20, 2022. Consensus is for EPS of US$1.83, which is well below the Q1 result of US$3.22. As shown in the chart below Q2 2022 is expected to be just a blip along the road of higher earnings each quarter for Tesla.

Tesla quarterly past EPS and forecast EPS in the quarters ahead

Tesla’s H2 2022 outlook is still very uncertain and will depend a lot on whether their Shanghai gigafactory can run without further closures. It will also depend on the performance of their California factory production and to a lesser degree the ramping of new production at Berlin and Texas. Energy storage and solar should also help but are still less than 10% of revenues.

Given the severe interruptions from the China factory in Q2 2022, we have cut our 2022 Tesla electric car production target as shown below.

Tesla’s 2022 actual electric car sales (Q1) and our forecasts for 2022

| Q1, 2022 [a] | Q2, 2022 | Q3, 2022 [e] | Q4, 2022 [e] | 2022 total [e] |

| 310,048 | 254,695 | 375,000 | 450,000 | ~1.4m |

Note: Assumes no more serious production disruptions in 2022. Our 2022 deliveries forecast has been cut from 1.6m to 1.4m due to the China factory disruptions and 2022 supply chain issues.

Valuation

The current market cap of Tesla Inc. is US$746b. As of end Q1 2022, Tesla Inc. has US$18.0b in cash (including cash equivalents and short-term marketable securities) and less than US$0.1b in debt.

Yahoo Finance shows a 1-year analysts price target of US$882.90. 4-traders MarketScreener shows Tesla as an ‘outperform’ with a price target of US$891.52 representing 24% upside.

- Our end 2022 price target (assumes Tesla sells 1.4m EVs in 2022) is US$894, representing 24% upside.

- Our end 2025 price target (assumes Tesla sells 4.725m EVs in 2025) is US$1,707, representing 2.37x upside.

- Our end 2030 price target (assumes Tesla sells 20.35m EVs in 2030) is US$2,211, representing 3.07x upside.

See table below for details.

Our Tesla price targets based on a price earnings model

| 2022 | 2023 | 2024 | 2025 | 2030 | |

| No of EVs sold (millions) | 1.4 | 2.1 | 3.15 | 4.725 | 20.35 |

| Assumed EV production growth | 50% | 50% | 50% | 50% | 30% |

| Assumed PE ratio | 90 | 80 | 70 | 60 | 20 |

| Our Price Target (US$) | 894 | 1,163 | 1,490 | 1,707 | 2,211 |

|

Upside potential (from current $720) |

24% | 1.6x | 2.1x | 2.4x | 3.1x |

Notes

The price targets above are a bit lower than previously due to slightly lower production number forecasts.

Assumptions

- Assumes Tesla delivers ~1.4m EVs in 2022 (50% up YoY), then this grows each year to 2025 by 50%, then each year to 2027 by 40%, then each year to 2030 by 30%. Note Musk minimum target is 50% pa growth in the near term and 20 million pa by 2030.

- Assumes Tesla’s average EV selling price is US$50,000, dropping to US$45,000 in 2025 and again to US$40,000 by 2027.

- Assumes growing revenues from energy storage/solar/subscription services. Does not factor in any FSD or humanoid robot revenues yet.

- Assumes Tesla makes and maintains a 13% net profit margin on total revenues. 4-traders has 2022 forecast net margin at 14.77%.

- Assumes 2.5% pa increase in share count due to staff bonuses, etc.

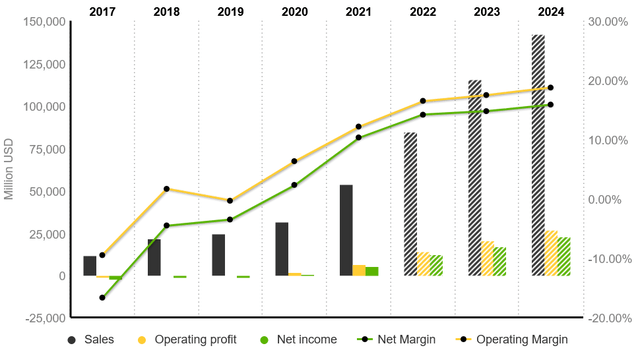

Tesla’s financials and forecast financials

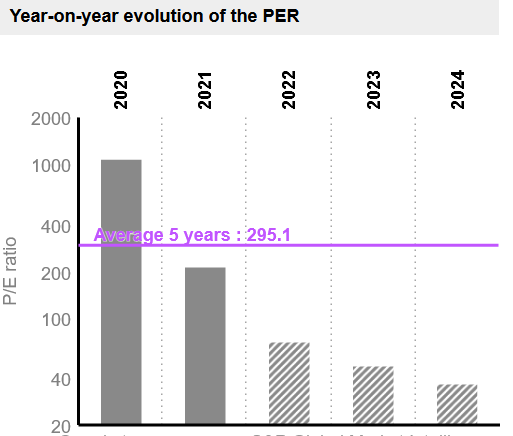

Tesla’s P/E is forecast to reduce steadily – Forecast P/E’s – 2022 P/E is 70, 2023 P/E is 50, 2023 P/E is 38

MarketScreener

Risks

- Electric vehicle sales may stall or slow down perhaps due to reducing or removing of subsidies or some macroeconomic event such as a global slowdown/recession. Tesla’s sales are mostly reliant on USA, China, and Europe, but are growing globally and supply constrained. Tesla has been reported as having well over 1m orders for Cybertruck and Model Y should also be hugely popular.

- EV production risks – Delays, cost overrun, supply chain issues, etc. China’s Zero tolerance policy of COVID-19 may cause further production problems at Tesla’s Shanghai factory.

- Competition – Many companies aiming to gain EV market share. Tesla is about 5 years ahead of its competitors.

- Country risk – Tesla is currently quite reliant on China production, this will ease in future years with new factories recently started in the USA and Germany.

- Management risks – Tesla is very reliant on their key man Elon Musk. The Elon Musk Tesla acquisition (if it goes ahead) may create pressure on Musk to sell further Tesla shares.

- Business risks – Debt, currency, car industry risks (recalls, warranty expenses, litigation, natural disasters, etc.). There have been some investigations into Tesla crashes and Tesla’s FSD product.

- The usual stock market risks (liquidity, dilution, sentiment, etc.).

Catalysts

- 2022 – Each quarterly earnings report with EV and energy storage/solar/insurance/services revenues and profits announced. H2 2022 should potentially see some strong recovery after Covid-19 interrupted Q2 2022.

- 2022 – Tesla’s Full-self Driving (“FSD’) and the potential robotaxi business advancing. Tesla humanoid robot progress.

- Late 2022 – Possible Tesla announcement on the next gigafactory location.

- 2023 – Tesla Cybertruck production, Tesla Semi, perhaps Tesla Roadster. HVAC house systems for heating and cooling.

- 2024/25 – ?Tesla Compact car, ?Tesla van, other new product launches.

Further reading

Tesla’s Model Y [deliveries now] and Cybertruck [deliveries from mid-2023] should be huge contributors to Tesla’s sales volumes in the years ahead.

Conclusion

The Tesla July 2022 story is reminiscent of the Tesla May 2019 story. Both times saw Tesla stock price fall significantly due to production issues. Had investors bought when we wrote about Tesla in 2019 at US$50 (split adjusted), prior to the 5 to 1 stock split and S&P 500 inclusion, you would now be up a very nice ~14x return. The similarities continue with Tesla recently announcing plans for an upcoming 3 for 1 stock split.

Whilst the huge and fast Tesla stock gains have already been made, Tesla still offers enormous growth potential this decade across a number of sectors such as EVs, autonomous driving robotaxis, energy storage, energy production and distribution (solar, power distribution software), robotics (humanoid robot), insurance, Tesla subscriptions/services, and potentially more to come.

Tesla’s H1 2022 is a story of 2 completely different quarters. Q1 2022 saw record sales and record profits and Tesla was riding high. Q2 2022 has been marred by several weeks of no production in Shanghai followed by a slow ramp back to full production. At least, Berlin and Texas have been slowly ramping up production at Tesla’s new gigafactories.

Tesla’s H2 2022 outlook is still cloudy given the China uncertainty and supply chain issues. Demand is there but can Tesla achieve their 50% production growth target in 2022? Given Tesla delivered 930,422 electric cars in 2021, a 50% increase in 2022 would mean about 1.4m deliveries in 2022. This is still very possible if Tesla has no more serious disruptions.

Valuation for Tesla is now more reasonable after a 41% stock price fall from its November 2021 high. MarketScreener shows a consensus price target of US$891, representing 24% upside. Our end 2022 price target is US$894 (24% upside), end 2025 is US$1,707, and end 2030 price target is US$2,211. Further significant upside to our price targets if Tesla succeeds with FSD/robotaxi fleet, humanoid robot, or other new products.

Risks revolve around achieving the stated targets in the stated time frames to make the forecast profits. China production risk is the main concern for now. Please read the risks section carefully.

We rate Tesla Inc. as a buy for investors ideally with a long-term time frame. The key is to look beyond Q2 2022’s production troubles and where Tesla is heading this decade.

As usual, all comments are welcome.

Be the first to comment