D3signAllTheThings

This article first appeared on Trend Investing on June 9, 2022, but has been updated for this article.

2022 Bear Market Bargains Series – Pilbara Minerals Limited

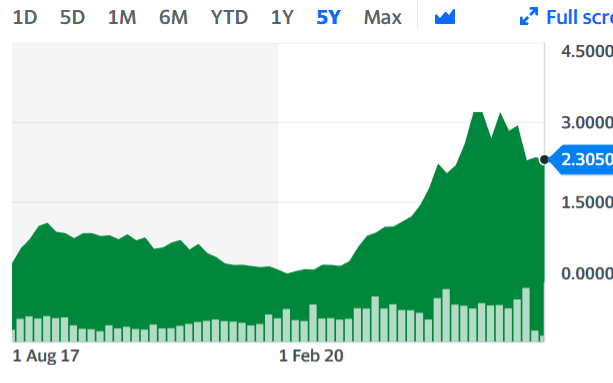

Pilbara Minerals Limited [ASX:PLS][GR:PLR] (OTCPK:PILBF) – Price = AUD 2.30, USD 1.67

Yahoo Finance

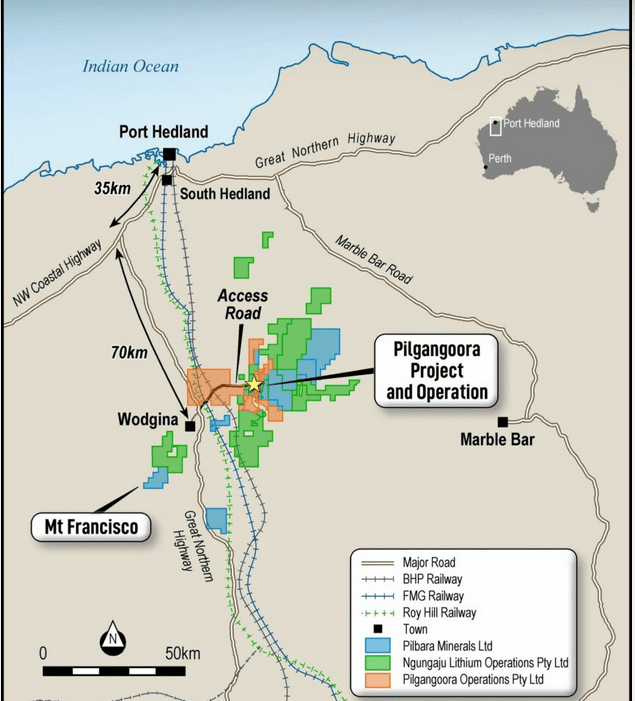

Pilbara Minerals Limited 100% own the massive Pilgangoora Lithium and tantalum mine in Western Australia (“WA”).

Pilbara Minerals mines/projects summary:

- Pilgangoora Lithium Operation (includes the original Pilgan Plant and the ex-Altura Mining’ Ngungaju Plant and mine).

- Mt Francisco JV (Pilbara Minerals (70%): Atlas Iron Limited (30%)) – Located 50km south-west of the Pilgangoora Project and hosts the last remaining large occurrence of outcropping pegmatites located in close proximity to Port Hedland.

- Other exploration projects in WA – Pilbara Minerals holds an extensive project portfolio outside of the Pilangoora mine area with over 1000 km2 of tenements in the prospective Strelley, Tabba Tabba, and Wodgina districts. All are greenfields exploration opportunities and are prospective for a range of commodities including rare metals, gold and base metals.

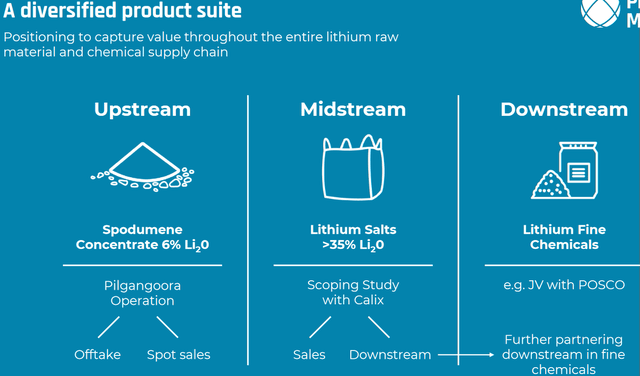

- 43ktpa Li Hydroxide (“LiOH”) conversion facility JV in South Korea (18% Pilbara Minerals (option to increase to 30%): 82% POSCO). Pilbara Minerals’ initial 18% equity participation in the JV will be largely funded from a A$79.6M 5-year Convertible Bond being provided by POSCO. Commissioning of the conversion facility is expected from late 2023 and ramp up in 2024. Details here.

- Mid-stream JV [MoU stage] – Pilbara Minerals and Calix Limited [ASX:CXL] – To produce value-added lithium phosphate salts. Scoping study completed, demo plant next (if approved). Details here.

Summary of Pilbara Minerals business and plans to add value

Location map of the Pilgangoora Operation and surrounding areas

Pilbara Minerals

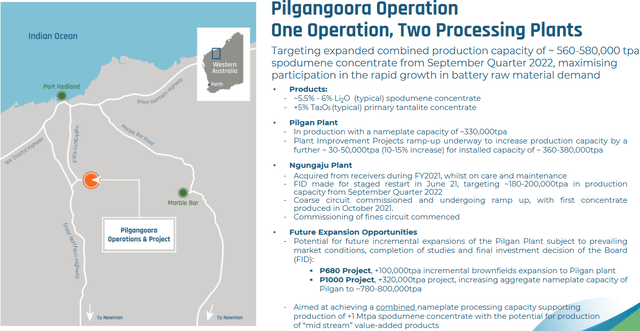

The Pilgangoora Operation and production expansion plans

The Pilgangoora Resource is one of the largest hard rock lithium deposits in the world. As at October 6, 2021, Total Ore Reserves are 162 Mt grading 1.2% Li 2O, 100 ppm Ta 2O5 and 1.0% Fe 2O3. As at 30 June 2021, the Total Mineral Resource estimate is 308.9 Mt grading 1.14% Li2O (as spodumene), 105 ppm Ta2O5 and 0.59% Fe2O.

Production for 2021 totaled 324,200t of spodumene.

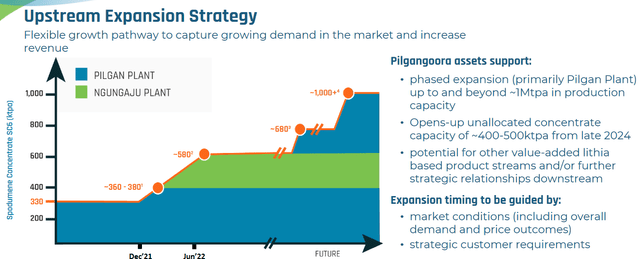

2022 production has had some COVID-19 related staffing shortages which has impacted production. FY22 annualized production guidance is in the range of 340-380,000 tpa of spodumene. The Pilgan Plant improvements now mean the Pilgan Plant capacity has increased to 360-380,000 tpa of spodumene.

The Ngungaju Plant restart operations mean the plant should reach full capacity of 180-200,000 tpa of spodumene from the September 2022 Quarter (Q3, 2022).

Adding the two plants capacity (Pilgan & Ngungaju) gives a capacity of about 580,000 tpa from Q3, 2022, and a good indicator of what production to expect in 2023.

Pilbara Minerals states:

Following the ramp-up of the Ngungaju operation, the next phase of incremental expansion for the Pilgangoora operation is the “P680 Project”, providing an incremental increase of 100ktpa of spodumene concentrate from the Pilgan Plant. This will increase overall total installed production capacity at the Pilgangoora Project from 580ktpa to 680ktpa…….The next expansion is targeted to increase total Pilgangoora production capacity to up to 1Mtpa and will be referred to as the “P1000 Project”. The target date for FID for the P1000 Project is expected in the December Quarter of 2022.

Pilbara Minerals state in their company presentation that they plan to build capacity to 1 million tpa of spodumene (~150k tpa LCE) from their total combined project. No date is given, but rather to meet market demand, which suggests by about 2025/26 is possible. The Company may even be able to expand to 1.25m tpa at some point (~2027/28).

An estimate of Pilbara Minerals potential expansion plan of lithium spodumene from the Pilgangoora Operation

| 2022 | 2023 | 2024 | 2025/26 | |

|

Spodumene production (tpa) |

~330,000 | 540-580,000 |

680,000 |

1,000,000 (P1000 Project) |

Source: Author’s estimates based on company information

The Pilgangoora Operation (includes both the Pilgan Plant and the Ngungaju Plant)

Summary of Pilgangoora Operation

Pilgan Plant

Pilbara Minerals

Ngungaju Plant

Pilbara minerals

Off-take agreements

Pilbara Minerals has Stage 1 Pilgan Plant off-take agreements with Ganfeng Lithium, General Lithium, Great Wall Motor Company (SVOLT) and Yibin Tianyi, which is affiliated with global battery manufacturer CATL. They also have Stage 2 (Pilgan Plant – 800ktpa spodumene stage) conditional agreements with Great Wall Motor Company, Ganfeng Lithium and POSCO.

Pilbara Minerals BMX Auction spot sales of spodumene

Off-take from the Ngungaju Plant can be sold via Pilbara Minerals BMX Auctions on the spot market, where record prices are being achieved.

The latest in June 2022 was a pre-auction offer of US$6,350/dmt SC5.5, FOB Port Hedland basis, which equates to an approximate price of US$7,017/dmt on a SC6.0 CIF China basis after adjusting for lithia content on a pro rata basis and freight costs. The 5,000t sale equates to about US$35m (~AUD 51.4m) and follows the May sale that raised US$32.9m (~AUD 46m). Certainly if Pilbara Minerals can continue with this it will be a huge bonus to current revenues and ultimately profits. If prices remain this strong then 12 months of this would equate to an ‘additional’ approximate A$600m (12 x A$50m) in revenues for Pilbara Minerals on top of their other revenues from the larger production at the Pilgan plant.

The current spodumene price as of July 11, 2022 as quoted by Metals.com is CNY 33,480/t (~US$4,988/t).

Pilbara Minerals BMX Auction results for June sets yet another new record high

Valuation

Pilbara Minerals current market cap is A$6.86b (US$4.97b) with forecast zero net debt in 2022. As of March 31, 2022, cash was at A$284.9m (inclusive of $75.2m of irrevocable bank letters of credit for shipments).

Forecast 2023 PE is 4.86 and 2023 dividend yield is 4.13%. Forecast 2023 net profit margin is 52%.

Analyst’s consensus is “outperform” with a consensus price target of A$3.19 representing 36% upside.

Based “only” on the Pilgangoora Operation, our price target for end 2025 (assumes 1mtpa spodumene production at OpEx US$330/t) is:

- Bear case (assumes spodumene selling at US$1,000/t) – A$1.88 (18% downside).

- Base case (assumes spodumene selling at US$1,500/t) – A$3.36 (46% upside).

- Bull case (assumes spodumene selling at US$3,000/t) – A$7.81 (3.4x upside).

- Super Bull case (assumes spodumene selling at US$4,000/t) – A$10.78 (4.7x upside).

Significant further upside if production volumes grew beyond 1mtpa spodumene and potentially from the POSCO or Calix JVs. Given the market deficits for lithium expected this decade, both the above “bull” and “super bull” cases are well worth considering.

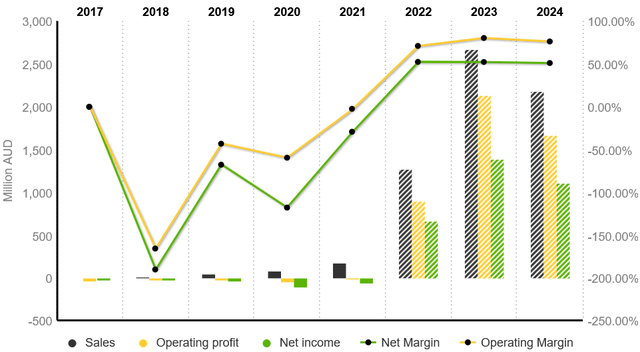

Pilbara Minerals financials and forecast financials

Risks

- Economic slowdown resulting in less electric vehicle (“EV”) sales, therefore less demand for batteries and hence lithium.

- Falling lithium prices. Spodumene prices are currently at record levels and may likely fall back if supply starts to exceed demand. New supply is expected but demand continues to grow strongly from surging EV sales.

- The usual mining risks – Exploration, permitting, production, JV partners, environmental risks.

- Business risks – Management (Dale Henderson is the new Managing Director and CEO, replacing the very successful Ken Brinsden who ends on 30 July 2022), liquidity, debt, and currency risk.

- Sovereign risk – Low in Australia. Low in South Korea.

- Stock market risks – Dilution, lack of liquidity (best to buy on local exchange), market sentiment.

Further reading

Pilbara Minerals has huge expansion plans ahead

Conclusion

Pilbara Minerals is a 2022 beaten down bargain. In 2022 the stock price has fallen significantly (22%) from its high of A$3.20 during a period which has seen lithium spodumene prices more than triple.

The Company plans to grow lithium spodumene production from ~330,000 tpa now to 1m+ tpa in the next few years (~2025/26) based on market demand. Additionally they plan to value add with their LiOH conversion facility JV with POSCO (set to start late 2023) and possibly a midstream JV with Calix to produce value-added lithium phosphate salts.

Valuation looks very attractive on a 2023 PE of 4.86 and a 2023 dividend yield of 4.13%. Analyst’s consensus 1 year price target is A$3.19 (36% upside); however our price target suggests further potential upside when looking out to 2025/26, especially if we get a continuation of high spodumene prices and the Company executes its LiOH JV plan with POSCO. With LiOH prices near US$70,000/t there is significant upside by shifting from a spodumene producer to a LiOH producer.

Risks revolve mostly around lower spodumene prices or production issues. Please read the risks section.

We view Pilbara Minerals as a buy, suitable for a 5-year-plus time frame, especially if you are positive on the outlook for lithium prices.

As usual, all comments are welcome.

Be the first to comment