VioletaStoimenova/E+ via Getty Images

Co-produced with Treading Softly

When it comes to fishing, it can be said that the least sustainable methods of fishing – bottom trawling being considered among the worst – involve casting massive nets and hauling in all types of sea life when looking for specific varieties of fish. You get a lot of content but not much of what you’re looking for.

When it comes to the market, passive ETF investing has often been touted as among the best methods for hands-off investors to match the market’s returns. It’s a nice catch-all method for those who do not have well-defined or specific goals in mind. You can own “everything” in the market. That means the good and the bad. A passive ETF is not very effective for a retiree who needs income.

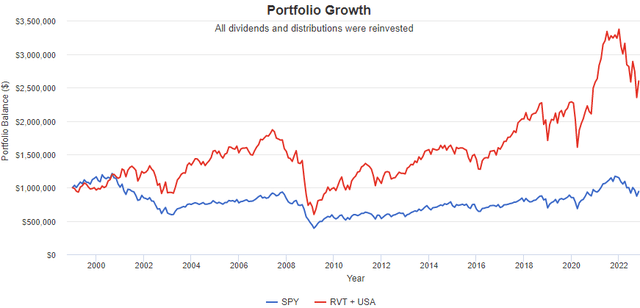

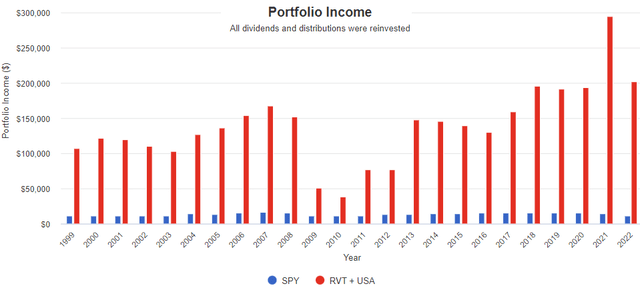

When you’re retired, you can see how holding two market-wide style funds can vastly benefit you over a passive ETF. Using the 4% annual withdrawal, the two funds we’re about to talk about vastly outperform the beloved S&P 500 ETF (SPY): (Source)

The blue portfolio is simply the SPY being held, dividends reinvested, and $40,000 being withdrawn annually for living expenses. The red portfolio is a 50/50 mix of RVT + USA, the two funds we’re about to discuss. The portfolio is rebalanced annually, with excess dividends reinvested and $40,000 taken out each year.

So how does RVT+USA stomp SPY so well? Simple – it produces enough income to have dividends reinvested and portfolio balance increase over the timeframe instead of slowly eroding. This graph runs from 1998 until last month. That includes the COVID drop, Dot-com bubble burst, and the Great Financial crisis.

So you want proven outperformance and outstanding income? Look no further than these two funds.

Let’s dive in.

Pick #1: USA – Yield 9.5%*

The Liberty All-Star Equity Fund (USA) provides investors with diversified exposure to the U.S. stock market. USA provides exposure to many stocks that don’t fit with the Income Method strategy.

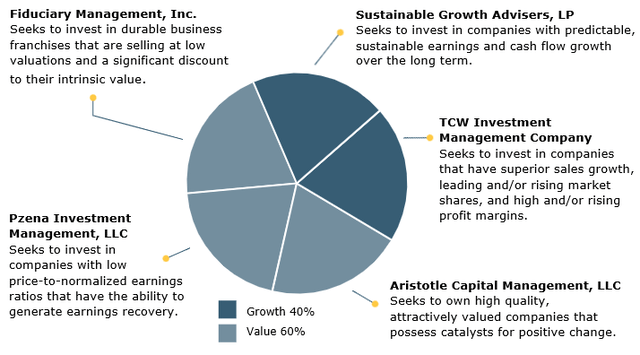

Its investments are diversified among five portfolio managers, two with a Growth strategy and three that follow Value strategies. Source

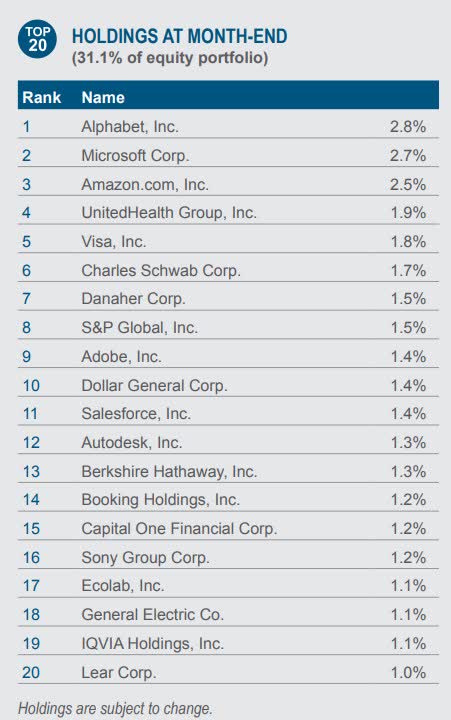

USA’s portfolio is full of large-cap readily identifiable companies.

All-Star Funds

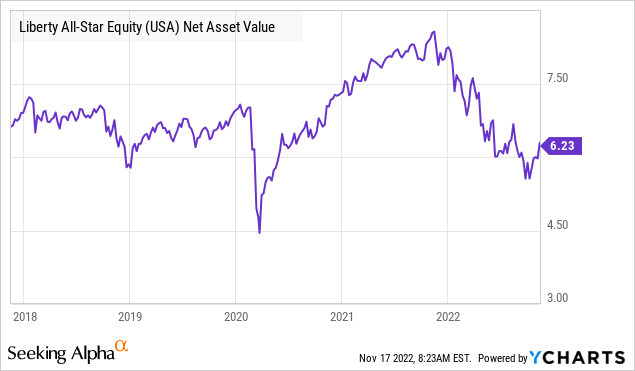

Such companies will drive the market indexes but generally don’t pay out the yield that we are looking for at HDO. USA is conservative, using no leverage, and utilizes a variable distribution policy. Each quarter, USA pays out 2.5% of its NAV. When NAV is high, the dividend is higher. When NAV is low, the dividend is lower. This policy means that the dividend is self-correcting. USA is never overpaying or underpaying the dividend.

*The 9.5% yield calculation is based on a conservatively-low recent 6.00 NAV.

Over the past year, the market indexes have been pummeled, and USA has fallen with them. When prices are down, it is a great time to accumulate USA. In time, the market will recover, and when it does, we will benefit from both a price upside and a climbing dividend.

Pick #2: RVT – Yield 7.5*

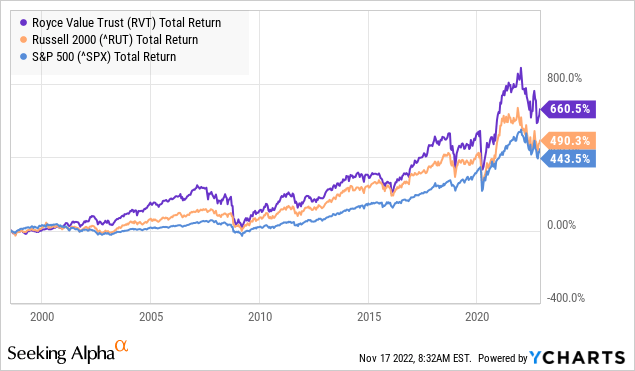

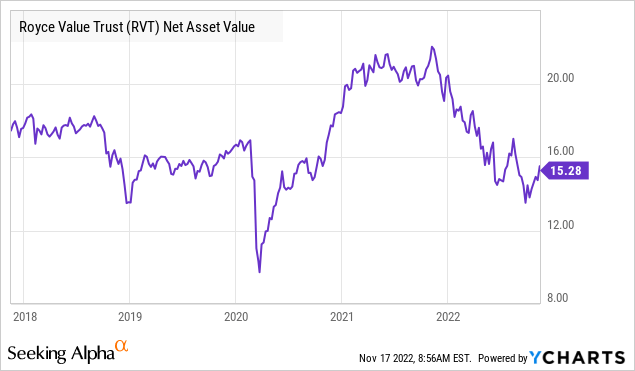

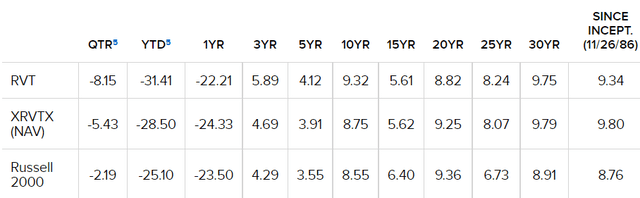

Royce Value Trust (RVT) is a CEF that has been around for a long time. Since November 1986, RVT has been investing in Small-cap Value stocks and beating its benchmark, the Russell 2000 index.

RVT has a very impressive measure of outperforming the Russell 2000 for over 35 years. In just a couple of weeks, they will have notched another year onto that track record and have outperformed over 36 years. Happy Birthday, RVT! (Source: Royce Value Trust)

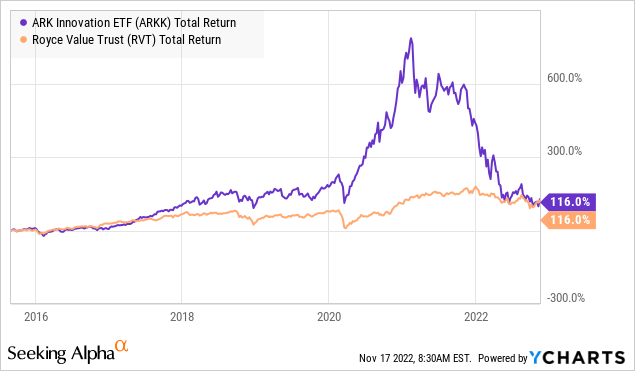

Experienced investors know that outperforming the market, in the long run, is a very different beast than outperforming over a few years. Over the decades, Royce has seen many “Wall Street Wonders” come and go. A new manager comes on the scene, crushes the market for a few years, gets a ton of publicity, and then goes down in flames before fading to obscurity.

You see charts like this, where the manager swings for the fences and hits a home run.

When investing, the tortoise wins the race. Investors who don’t take crazy risks, who aren’t out there chasing “the next big thing”, will outperform as the years become decades.

RVT is not the kind of fund that will run ahead of the market and beat it by 30%+ in a single year. It is the kind of fund that beats the market by a few percent here and there several times a decade.

Over time, this small edge adds up to large gains:

RVT has a variable distribution policy, paying out 1.75% of the rolling average of the prior 4-quarters NAV. As a result, we expect that RVT’s distribution will continue to trend downwards for Q4 and possibly Q1 2023. After that, the bias should be for the payout to start trending upward again.

*Our 7.5% yield calculation is based on a conservatively-low recent 15.28 NAV.

This variable distribution policy ensures that the fund pays out a reasonable amount relative to NAV and is not forced to sell at low prices. It also provides investors confidence that as the market recovers, they will receive a fair amount of the gains.

RVT has proven itself, outperforming the market indexes over many decades. A feat that few managers have performed. As the market starts recovering from the current bear market, we can participate in the recovery through RVT. Confident that as prices recover, we will be rewarded with more dividends!

Shutterstock

Conclusion

RVT and USA have been two long-running and long-standing income generators for decades. Their ability to outperform the market in generating income and meeting the needs of investors and retirees cannot be denied. This is the power of having active management. Instead of just trawling and buying everything, these managers make educated decisions on where to invest capital.

Using the above-mentioned portfolios, we can see just how much more these two funds together outproduce in income:

With $1 million invested – split evenly between them – or just in the SPY, we can see how much these funds throw off. No wonder only taking $40,000 allows them to continue to grow. Even in the worst of 2009 and 2010, they still produced more income than was being withdrawn!

As retirees seek income to meet their bills, USA and RVT should not be ignored! They can and should play a vital role in your portfolio. Their variable dividends will produce lumpy income at times, but if you settle on a stable amount to withdraw, you will be pleasantly surprised at their ability to outperform even much-beloved ETFs.

That’s the beauty of income investing. That’s the joy hiding in our Income Method.

Be the first to comment