AndreyPopov

Right now, real estate investment trusts (“REITs”) are priced at historically low valuations.

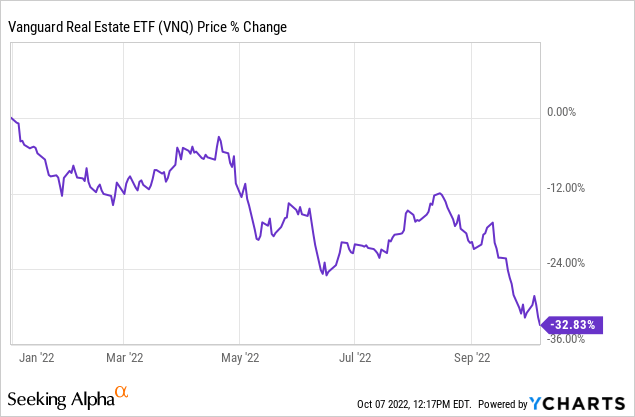

The biggest REIT ETF (VNQ) is down 33% year-to-date, and you should note that this is a market-cap weighted ETF that holds mostly large-cap, investment grade-rated REITs:

If that’s the average performance of the sector, you can imagine that there must be a lot of smaller and lesser-known REITs that must have performed even worse.

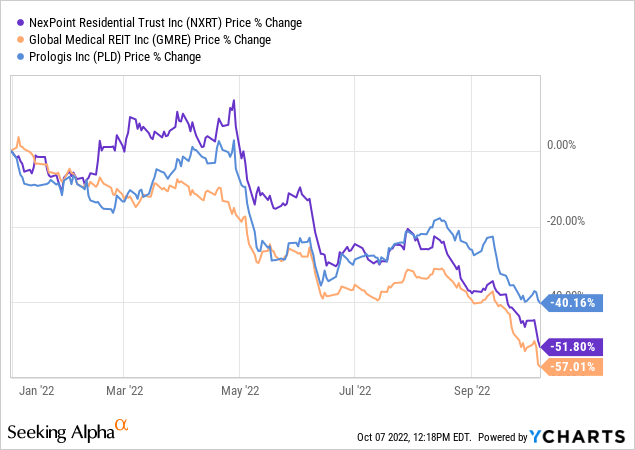

Many of them have dropped as much as 40%, 50%, or even 60% since the beginning of the year. Here are just a few examples (PLD; GMRE; NXRT):

But interestingly, the value of commercial real estate has not changed materially in 2022. Yes, interest rates have risen a lot, but so has the cash flow that properties generate. Inflation is at a 40-year high and, not surprisingly, this has led to rapid rent growth and higher property replacement values. Cap rates may have expanded a bit, but not as much as investors may have expected because there is still a lot of demand for real estate. A lot of investors fear inflation and have sought refuge in commercial real estate.

Case in point, Blackstone (BX) recently reported that real estate vehicles have experienced a slight increase in net asset value in 2022:

“In real estate, while the public REIT index fell 17% in the quarter, our Core+ funds were up 2.3%. I’ll do that again for you. The index is down 17%, we were up 2.3%. And our opportunistic funds protected capital, down only 1%, so we only performed by 16% for our customers over the index.”

Blackstone is just one example. Canadian REITs must disclose real asset values according to IFRS accounting rules and just like Blackstone, they have reported stable values in 2022. BSR REIT (OTCPK:BSRTF) is a Canadian REIT that only owns apartment communities in Texas and its NAV per share was flat in the last quarter, but it is up significantly year-to-date.

“NAV per unit was $22.35 at the end of Q2 ’22, an increase of 51.4% from $14.77, a year earlier… and 1.7% sequentially from $21.98 as of Q1 2022, driven by higher NOI.”

The point here is that private values have not changed materially, but REITs are down 30, 40, or even 50% in some cases. As a result, REITs are now priced at large discounts relative to the underlying value of the real estate they own, which makes them ideal buyout targets for private equity.

Blackstone has clearly noticed this buying opportunity. Here is what they recently commented:

For the first six months of the year, our real estate strategies appreciated 9% to 10% versus a 20% decline in the REIT index, equaling an outperformance of roughly 3,000 basis points. I don’t know many asset classes that perform — outperform indexes by 3,000 basis points. The best opportunities today are clearly in the public markets on the screen and that’s where we’re spending a lot of time.”

And this is not just talk.

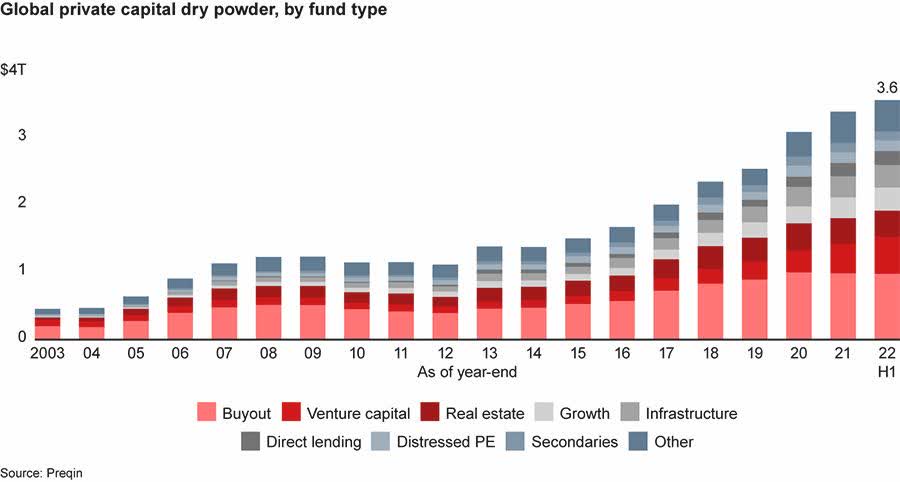

They have already acquired 4 REITs, representing nearly $30 billion in 2022. Those acquisitions were made when prices were higher than today and right now, Blackstone, Brookfield (BAM), KKR & Co. (KKR), and other private equity players are sitting on mountains of cash waiting to be deployed:

Preqin

I think that this means one thing: a lot more M&A in the REIT sector in the coming quarter. Just recently, STORE Capital (STOR) was the latest REIT to be bought out by private capital, and it surely isn’t the last one.

At High Yield Landlord, we have structured our portfolio to profit from these takeovers. STOR was our largest position and it earned us a large gain. We also owned 2 of Blackstone’s 4 REIT takeovers in 2022 (ACC and PSB).

We think that many more of our REITs will be taken private in the coming quarters because they allow an opportunity for private equity to buy good real estate at a steep discount to fair value.

In what follows, we highlight 2 examples of likely buyout targets:

UMH Properties, Inc. (UMH)

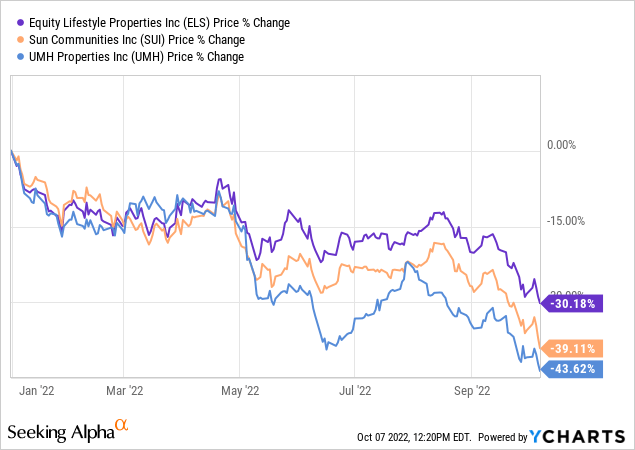

UMH Properties is one of just 3 manufactured housing REITs. The other two are Equity Lifestyle (ELS) and Sun Communities (SUI). All three are down heavily in 2022, but UMH is down the most of the three:

UMH sold off particularly hard because it is a small REIT with a market cap of just $900 million, but its fundamentals have remained resilient and the growth hasn’t stopped. Its communities are in high demand because they offer affordable housing in a world of historically low housing affordability. Its rents are up % year-to-date, and in a recent interview with the management, we learned that they expect to grow their funds from operations (“FFO”) per share by 50% over the coming 5 years.

What makes UMH a probable buy-out target?

Three reasons:

#1) Deeply discounted valuation: Following the recent sell-off, we estimate that the company is priced at a 35% discount to NAV. It is currently priced at an implied $40,000 per lot, but private market values are closer to $50-60 per lot.

#2) Difficulty to assemble a portfolio of manufactured housing communities: Today, it is very difficult to open new manufactured housing communities because most people don’t want one in their back yard. Therefore, there is only a limited number of buying opportunities, but a lot of interested buyers for these communities. They are popular investments because they generate highly resilient cash flow during good and tough times.

#3) Management’s history and high skin in the game: UMH was founded by the Landy family, which used to also manage another REIT called MNR. But last year, they accepted to sell MNR and this leads us to think that they would also be willing to sell UMH. It may even indicate that perhaps they are even planning their exit already. The insiders have a lot of skin in the game, owning 10% of the company so surely, they wouldn’t mind getting bought out if the price is right.

UMH Properties

And the great thing about UMH is that even if it is never bought out, we think that it is likely to deliver strong returns in the long run.

It pays a 5.5% dividend yield and it has a clear path to 50% FFO per share growth over the coming 5 years as it hikes rents and develops/buys new communities. This should allow UMH to deliver double-digit annual total returns, whether it gets bought out or not.

NewLake Capital Partners, Inc. (OTCQX:NLCP)

NewLake Capital Partners is one of just a few cannabis REITs, and it went public last year at $30 per share.

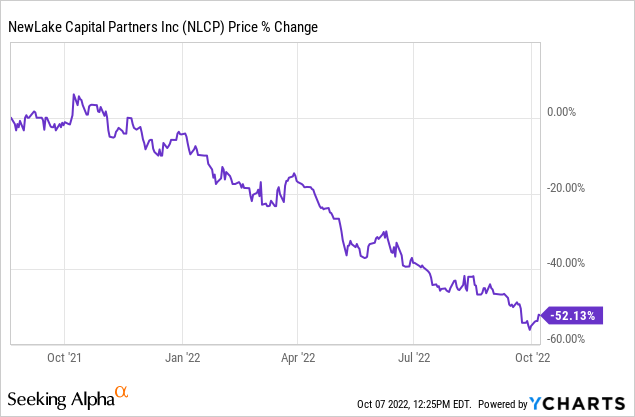

But shortly after, the entire sector, including its larger peers (IIPR), began to sell off as the Cannabis sector fell out of favor:

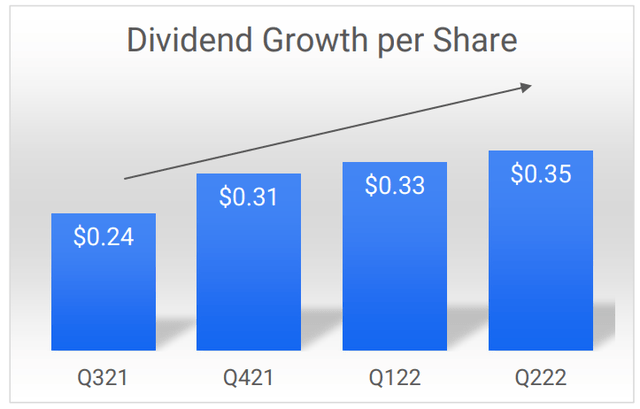

By now, NLCP is down 52% and this staggering drop happened even as NLCP posted solid growth. Here is how it grew its dividend over this same time period:

NewLake Capital Partners

The declining share price coupled with the large dividend hikes has led to NLCP trading now at a 10% dividend yield, which is very uncommon for a REIT that’s growing at this pace.

There has been a clear disconnect between the fundamental performance and the market performance of the company and it appears to have led to a significant mispricing.

Right now, the company is priced at an implied ~15% cap rate, which is far above the 10-12% cap rates of the facilities that it is buying. The discount to NAV is estimated to be around 30%.

If you listen to the company’s conference calls, you will note that the management has grown increasingly annoyed by the market’s response. They have sought to get a better listing to resolve this issue but they haven’t been successful so far.

This leads me to wonder: when will the management simply throw in the towel, partner with a private equity player, and go private?

At these prices, they cannot access public equity markets anyway so there is no major benefit for them to be public. It just leads to higher costs and compliance requirements and limits their ability to grow at this point. The private market values their properties at higher valuations and partnering with a private equity group would give them the needed capital to grow.

Perhaps, they are still hoping that the market will bounce back and reprice them at a premium to NAV, which will finally allow them to grow accretively. This may happen, but if it doesn’t in the coming 12-24 months, I wouldn’t be surprised if NLCP decides to go private.

In the meantime, you earn a 10% dividend yield and the dividend has been growing every quarter since they went public. Between the yield and the growth, investors can expect to earn ~12-15% annual total returns, and beyond that, the company offers high upside if and when the company finally goes private.

Bottom Line

Right now, most REITs are undervalued, and some are so steeply undervalued that they have probably become buyout targets. We have positioned our portfolio to profit from this at High Yield Landlord.

Be the first to comment