ogichobanov/iStock via Getty Images

Co-produced with Treading Softly

Does your car need gasoline if it has an internal combustion engine? Yes. It’s a no-brainer.

We have a lot of “no brainer” situations around us every day. Sometimes we like to simply say “It just makes sense”. Yet when it comes to investing, few choices feel like they fall into the realm of no-brainers.

People have wide and varied opinions on how to invest, when to invest, and where to invest. People have different goals and risk tolerances. There is no single investment that is right for everyone.

So how can I say I have two big dividend offering no-brainer picks? Simply put, they will meet the goals of a large swath of the investors who read my articles. Investors who, like me, are always on the hunt for high-yielding dividends to fuel their portfolio’s income. While at the same time, both picks are also at a price that should appeal to investors who take a different tact and like to trade frequently. I expect both to rise in price while paying out substantial dividends – a win for income investors and those total return fanatics out there.

Let’s dive in.

Pick #1: RVT – Yield 7.8%

Royce Value Trust (RVT) is a diversified equity closed-end fund that specializes in small-cap value opportunities.

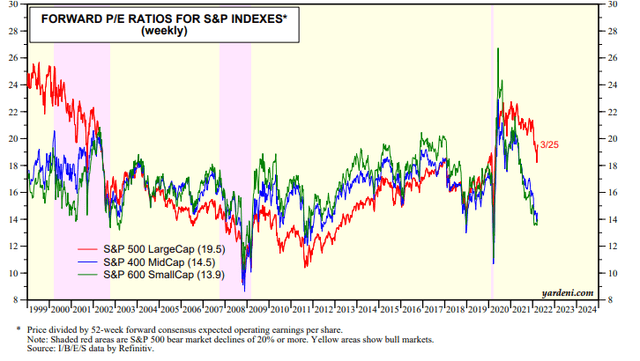

Small-cap stocks are trading at very low valuations, even as earnings have increased. They are roughly comparable to the correction of December 2018 while large-cap stocks remain relatively highly valued.

In 2019, RVT had a total return of over 35%, we could be looking at an equally strong or even stronger rebound from here as the market regains confidence and starts buying up small-cap stocks again.

In 2022, the economy is speeding up. Today, there is a major advantage compared to 2019, when the economy was starting to slow down. Often, small-cap stocks tend to be more economically sensitive. They are able to grow earnings more aggressively relative to larger peers that require more effort to “move the needle”.

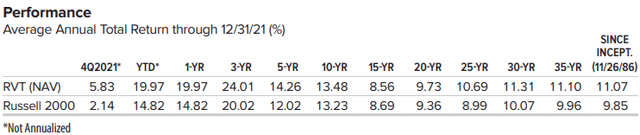

One thing that makes RVT a rare CEF is its long history under the same manager. RVT has been around since 1986 and has beaten its index, the Russell 2000, for over +35 years.

Since 1986, RVT has seen inflation, deflation, booms, busts, recessions, wars, terrorist attacks, pandemics, and seven Presidents. Royce Value Trust has been through a lot and has rewarded shareholders.

RVT has a managed distribution policy where its quarterly dividends are directly linked to its NAV. This explains the slight variation in quarterly distributions, and the large 4th quarter payout last year.

What does this mean?

“The fund pays quarterly distributions at an annual rate of 7% of the average of the prior four quarter-end NAV, with the fourth quarter being the greater of these annualized rates or the distribution required by IRS regulations.” – Source: RVT Annual Report

RVT increased its dividend every quarter in 2021, paying $0.26, $0.30, $0.33, and a Q4 distribution of $0.78! RVT’s IRS requirements were higher than their 7% calculation this past year. Coming into 2022, RVT is paying $0.36 in Q1. Next quarter, we can expect the dividend to be flat, but as the market recovers and starts hitting new highs there will be room for more dividend growth in the second half of the year.

Right now, we can buy RVT at a 5% discount to NAV, providing additional upside potential and a higher dividend yield. The market is recovering quickly, and RVT is one of the best options to hop on the elevator for the ride up!

Pick #2: BRSP – Yield 8.2%

2022 is off to a rough start for many investors, yet at HDO we are off to a great start as our income keeps growing. BrightSpire Capital, Inc. (BRSP) became the latest holding of ours to raise its dividend, it raised another 5.6% to $0.19/quarter. This is BRSP’s fourth consecutive dividend increase, and the dividend is now up 190% since it was reinstated in March of 2021.

BRSP is firing on all cylinders, its book value is $12.37, it has $269 million in cash ($2.02/share), earned $0.27/share in adjusted distributable earnings last quarter, and has raised its dividend for four consecutive quarters. Even at its current dividend, BRSP is only paying out 70% of distributable earnings in a sector where paying out 90%+ is common.

BRSP transformed significantly through the COVID pandemic. The old management is gone, and the company internalized management, getting rid of the external manager DigitalBridge (DBRG). BRSP sold off large portions of its portfolio and has changed its strategy.

Today, BRSP is focused on senior first lien commercial mortgages. The management only invests in mezzanine level loans when it also has the first lien loan, to borrowers with a good historical relationship. This ensures that BRSP is calling the shots and that the borrower is of higher quality when extending riskier loans. This common-sense quality check is something that former management ignored, choosing instead to reach for yield without regard for the risk.

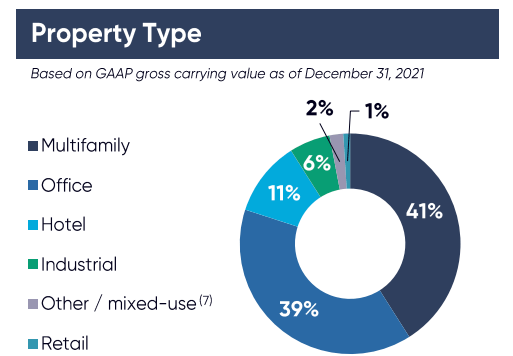

BRSP has also shifted the portfolio to be more heavily exposed to multi-family properties. (Source: BRSP Supplemental Financial Report)

BRSP Supplemental Financial Report

Commercial mREITs, like BRSP, lend floating rate loans, while also usually borrowing at a floating rate. As a result, rising rates are generally positive for earnings. However, most of the loans they lend have “floors”, meaning that when interest rates are below the floor, to borrower pays the floor instead. Meanwhile, the mREIT itself has a high enough credit quality to get loans without floors. So for a brief period, while rates rise the mREIT doesn’t get more revenue, but it does pay higher interest on its debt until rates are above the floors.

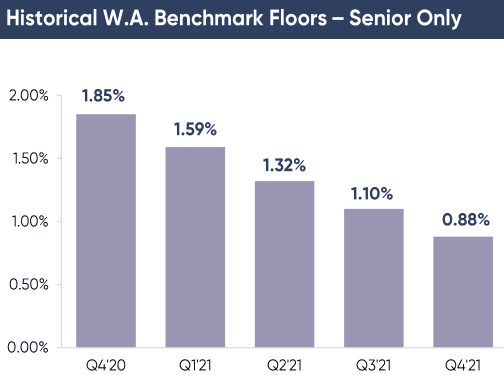

BRSP’s average floor is currently at 0.88%, as new loans generally have had lower floors. (Source: BRSP Supplemental Financial Report )

BRSP Supplemental Financial Report

With 3-month LIBOR currently at 1.01%, BRSP is now at the point where rising rates are a positive. We’ll see a slight headwind on Q1 earnings from rising rates of maybe $0.01/share. Going forward, rising rates will be a distinct positive and result in earnings growth. Since the Fed’s current plan is to raise again in May, we likely won’t have to wait long to see that benefit.

BRSP is yielding over 8%, is trading at a 25% discount to book value, and will see earnings growth throughout the year. It is very likely we see at least one more dividend raise in 2022. There is a good chance we see multiple raises as we saw in 2021! BRSP has pulled back, and it is a great time to buy!

Conclusion

RVT and BRSP allow you to position a portion of your portfolio to benefit from the strengthening economy. Both allow you to see rising dividends as these firms see strong tailwinds.

RVT is laser-focused on a more economically-sensitive part of the market, which will be a net beneficiary of the continued strength we are seeing from the U.S. economy. As the market realizes the world has not ended, we’ll see a sharp rebound among the smaller caps that RVT invests in.

Meanwhile, BRSP is knee-deep in providing that capital to help that economy grow. Rising rates presented a temporary headwind to BRSP, but in the long run, rising rates directly benefit them as rates move above their floor levels. We can get a high yield today, and enjoy future dividend increases as BRSP’s earnings rise.

For you, I want you to have the best retirement possible and to achieve your portfolio goals. For me and the rest of the High Dividend Opportunities team and community, we are focused on growing our recurring income stream and using those dividends to pay for our retirements.

Be the first to comment