PeopleImages/iStock via Getty Images

Co-produced with “Hidden Opportunities.”

Retirement is a major moment in life, bringing about all sorts of changes. For starters, your morning routine is different. No more alarm clock, fighting traffic, balancing your breakfast in your hands so that you can make polite gestures to the other drivers – just to let them know you’re thinking of them!

Retirement is something people often look forward to, and create dream-like scenarios in their heads that have little to do with the reality of being retired. Don’t get me wrong, there are a lot of benefits to being retired. There are also new concerns. Ones that you might not even think of until you are retired.

If you are retired or are looking to retire in a few years, it is normal to be concerned about the following:

1. Outliving your savings: One of the biggest threats most retirees face is outliving their retirement savings – what is termed the Longevity Risk.

Thanks to innovation in medical sciences, Americans are living longer, which is excellent news. But those extra years come at a price. Your savings need to support more retirement years, and you have retirement planners recommending you delay retirement until age 70 to take full advantage of Social Security payments.

2. Higher than expected medical expenses: One of the most miscalculated retirement expenses is healthcare. The average 65-year-old retired couple can now expect to pay $315,000 on medical costs in retirement. Fidelity first began calculating the figure 20 years ago. Since then, retiree healthcare costs have almost doubled, and the vast majority of Americans report they aren’t prepared to cover the skyrocketing prices.

3. The volatility of investments: If you were looking to slowly sell your equities at a gain to fuel your retirement, 2022 should have been a serious eye-opener. Baby boomers are getting wiped out by high inflation and a volatile stock market.

During a bull market, investors are euphoric and fearless. Redditors and YouTubers become financial advisors, and greed dictates your investment choices.

It’s only when the tide goes out that you learn who has been swimming naked. – Warren Buffett.

Retirement is different. You will no longer have the option of waiting decades and adding new capital to cover up your mistakes. You should be investing, not gambling with what would provide for you in your golden years. If the market movements are stressing you out in retirement, you are managing your retirement wrong. Don’t get pushed into the workforce because of poor management of your savings.

4. Political Influence on Social Security: In 2022, an average of 66 million Americans will collect monthly retirement benefits from the Social Security Administration. The SSA estimates this to be a trillion dollars in benefit payments during the year.

The future of this program remains uncertain, with the board of trustees projecting that the cash reserves will deplete by 2034. Franklin D. Roosevelt signed the Social Security Bill into law in 1935. Since then, every U.S. president (except George H.W. Bush) has introduced amendments to the program. While some changes resulted in rising payments for Americans, others raised the retirement age, forcing people to delay tapping into their benefits.

To lead a long and stress-free retirement, you must stop letting Mr. Market and politicians dictate your retirement planning. Our income method aims to transform your portfolio into a paycheck generator so you will never run out of money in retirement and can better sustain unexpected expenses. We have two picks with up to 7% yields to help you take control of your financial posture to beat the long-term effects of inflation.

Pick #1: BTO – Yield 7.4%

In addition to owning debt, it can be worthwhile also to own those that originate debt in a rising interest rate environment. The banking sector is poised to do well in this climate because it benefits from higher net interest income (“NII”) fueled by rising interest rates.

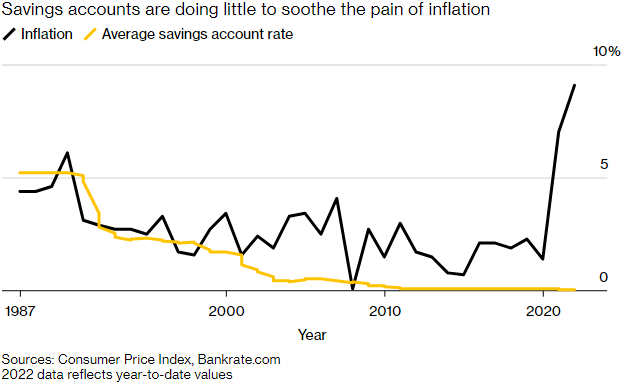

Are you expecting your money market income (or CDs) to help combat inflation? Not so fast. Despite rate hikes, the gap between deposit interest and inflation is the widest in years.

Bankrate.com

Additionally, the gap between what banks pay depositors and what they earn from giving out loans hasn’t been this wide in the past fifty years. The average savings account pays a measly 0.06%! This means the coffers of big U.S. banks are filling up with large sums of money, and we will look into collecting our share.

John Hancock Investments, a U.S. division of Manulife Investment Management (MFC), is a global financial services firm with operations in 5 continents, managing over 300,000 retirement plans. MFC is notably the 5th largest global insurance company (2nd largest in North America). Today, we discuss the income method of investing in large banks through a Closed-End Fund (“CEF”) from JH Investments.

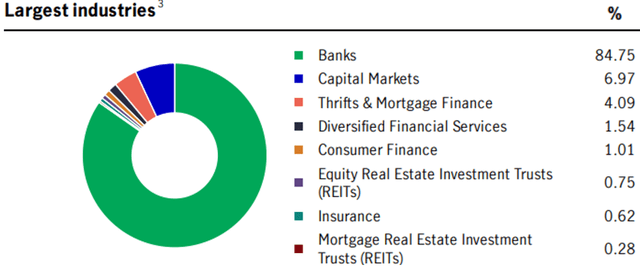

John Hancock Financial Opportunities Fund (BTO) is built with objectives to achieve current income and capital appreciation. This CEF invests at least 80% of assets in equity securities of U.S. and foreign financial services companies, with banks being the most significant constituent. Source: BTO Fact Sheet.

BTO Fact Sheet

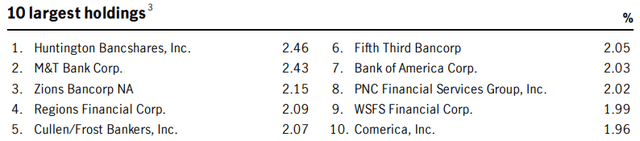

BTO’s top 10 positions constitute ~22% of the portfolio and some of the largest banking institutions in the U.S.

BTO Fact Sheet

The Fed’s 2022 stress test shows that large banks have sufficient capital to absorb more than $600 billion in losses and continue lending to households and businesses under stressful conditions. In Q3 2022, the U.S.’s largest lenders took a combined $6 billion in loan-loss provisions, up 23% from Q2. This is mainly since the economic uncertainty brought about by COVID-19 in Q3 2020. As inflation, energy prices, and geopolitical tensions are creating dark clouds over the economy, these regulated institutions are required to proactively manage risks in anticipation of adverse economic effects such as high unemployment rates.

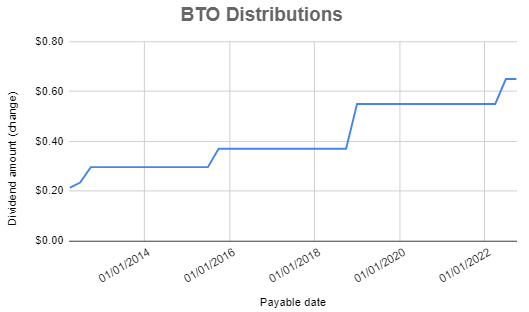

BTO has paid growing distributions to shareholders in the past ten years, where we have witnessed an interesting combo of near-zero rates and quantitative tightening. Notably, there were two big payout raises in the 2015-2018 Fed tightening.

Author’s calculations

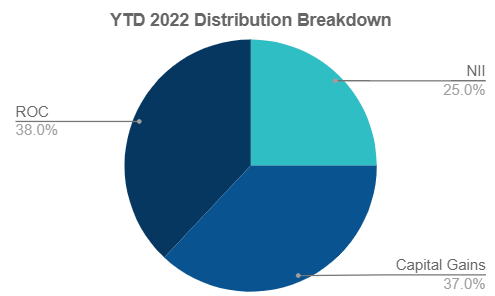

BTO issued an 18% distribution increase this past June, and the fund is well-positioned to continue to reward shareholders as the Fed continues its hawkish moves to curb inflation. YTD 2022, these distributions came from NII, Capital Gains, and Return of Capital (“ROC”) as shown below.

Author’s calculations

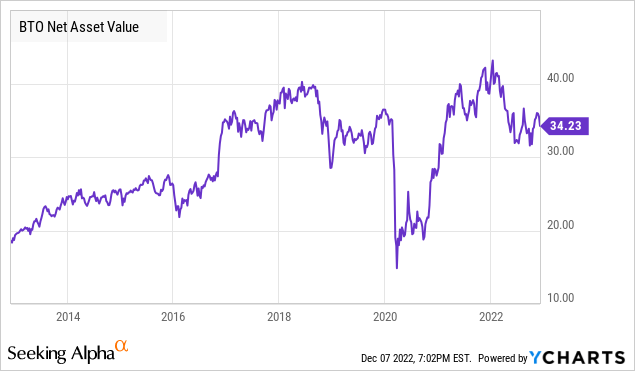

Along with growing distributions over the past ten years, BTO has also done a fantastic job growing its NAV. Today, you can buy this CEF almost at par with NAV, and it presents an excellent opportunity to lock in a reliable 7.4% yield.

Major banks and money managers are reaping big windfalls from interest rate increases. BTO presents the income method of buying into this sector and setting yourself up for growing distributions.

Pick #2: AT&T – Yield 5.7%

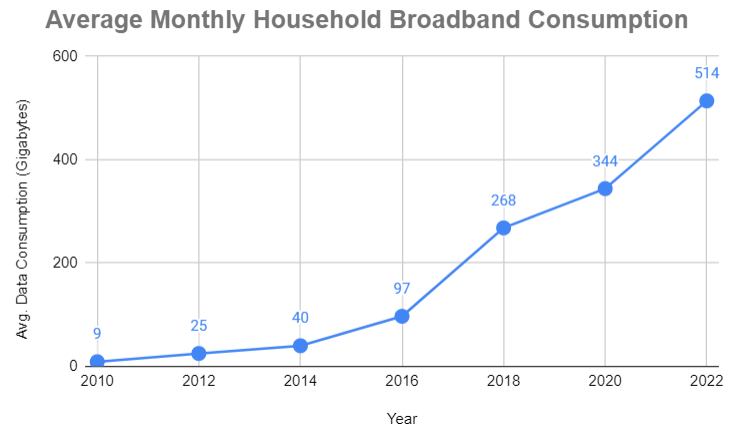

In the data-driven world, telecommunications has become an increasingly essential industry that is impervious to business cycles. Since 2010, there has been a mind-boggling 22,000x increase in the average household data consumption, and this trend is only set to increase.

Data Source: Allconnect.com

As internet speeds continue to improve, brilliant minds are coming up with newer applications and use cases to simplify our everyday activities and improve our quality of living.

In the U.S., just a few big companies control much of the telecom industry and can charge higher prices for these services. According to Numbeo, the U.S. ranked #5 globally in the cost of wireless internet services. On a national level, we only have three major carriers – Verizon (VZ), AT&T Inc. (T), and T-Mobile (TMUS) – that have over 98% of the market share. This may be upsetting for a consumer, but it is great for an investor. Big U.S. Telecom is an excellent dividend steward, and we want to collect reliable income from this essential utility of the information age.

The Nation’s 2G and 3G infrastructure are being shut down and upgraded to 4G/5G. This will bring a strong device refresh cycle, boosting wireless adoption. With this, we expect data consumption to climb, providing tailwinds for T’s wireless operating margins. During Q3, AT&T’s wireless revenue YoY growth was its highest (5.6%) in more than a decade, indicating that the catalysts are in action. Additionally, the company has been working to reduce its operating expenses and is on track to deliver +4 billion out of its run rate target of $6 billion in cost savings by the end of 2022.

Bottom-line improvement is critical in these times of recession fears and rising rates and we are seeing notable progress with T. AT&T’s balance sheet has significantly improved with a reduction of $25 billion in debt YTD. Management has said that they will continue to use excess cash after dividends to reduce debt to reach a net debt-to-adj. EBITDA range of 2.5x. The company is on track to achieve the target $14 billion free cash flow for 2022, which adequately supports the $8 billion annual dividend payments. As debt decreases and operating margins improve, long-term investors can expect growing dividends from this telecom giant.

In 2007, Steve Jobs revealed the first iPhone and revolutionized the concept of everyday computing. Today, we can’t live without the internet. The majority of our daily tasks are increasingly becoming online. It is to such an extent that if people lose their jobs, they look online to find the next one and even go through the initial rounds of interviews over web conferencing. Despite economic downturns and recession, internet usage will remain high, and bills will be paid. We will collect handsome dividends from this sticky connectivity infrastructure. T is cheaply valued at a forward PE of 7.3x, making it a tremendous bargain at current prices.

AT&T demonstrates strong financial flexibility and is an excellent inflation-fighter with its 5.7% yield. Prior to the spin-off of Warner Brothers, T was a Dividend Aristocrat providing regular annual dividend hikes. We look for T to resume its pattern next year. T returned to its roots divesting several large business segments, including WB. Now it is time for it to return to its dividend-hiking roots.

Conclusion

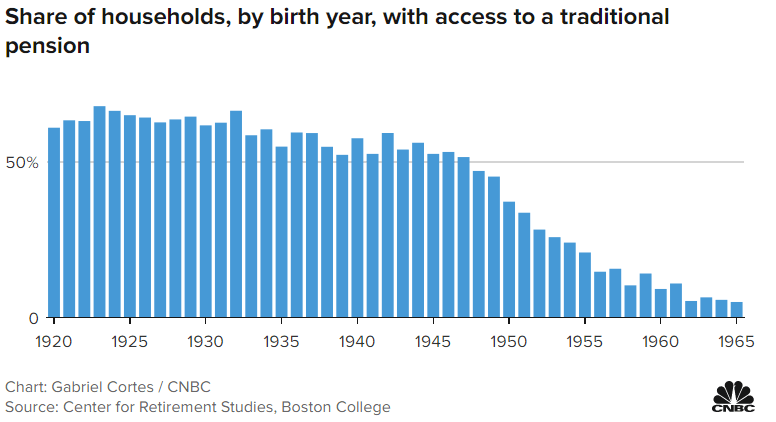

The 4% rule is almost three decades old and doesn’t serve a society with rising life expectancy and where only a fraction of Americans have access to a traditional pension. Source.

CNBC

The Income Method is designed to help your portfolio to keep providing through your retirement years and let you sleep well at night through volatile markets. At HDO, we emphasize the creation of a well-diversified stream of dividend payments to sustain your retirement expenses. This way, you will never have to tap into the principal during weak markets.

Stop hemorrhaging your retirement portfolio by trading the news. It is time you make your savings do all the work. We have two picks with up to 7% yields, so your income stream keeps flowing strong like the Amazon river.

Be the first to comment