imagedepotpro

The last few weeks have left many investors feeling giddy once more.

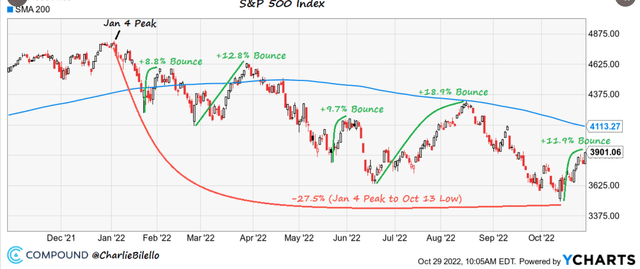

The stock market is up 12% off the October 13th lows, the 5th major bear market rally of 2022.

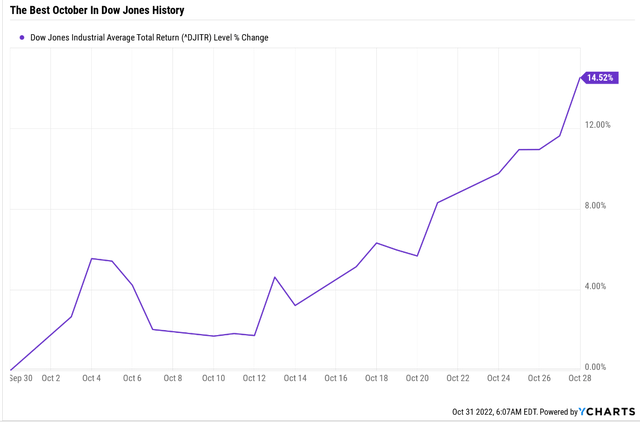

The Dow is having its best October in history, up almost 15% in four straight weeks of gains.

This might seem odd given that none of the risk factors we’re facing have receded:

- the Fed is still on the inflation-fighting war path

- inflation is still 8.2% and core inflation is still rising

- tech earnings week was poor, with MSFT, GOOG, AMZN, and META all disappointing

- 2023 recession risk is now 100% according to the bond market.

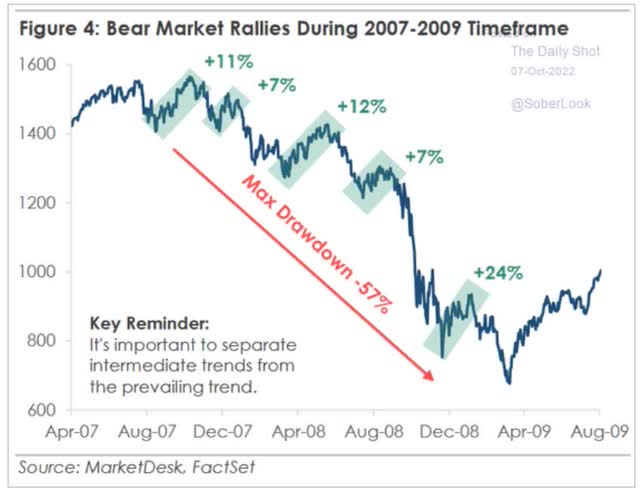

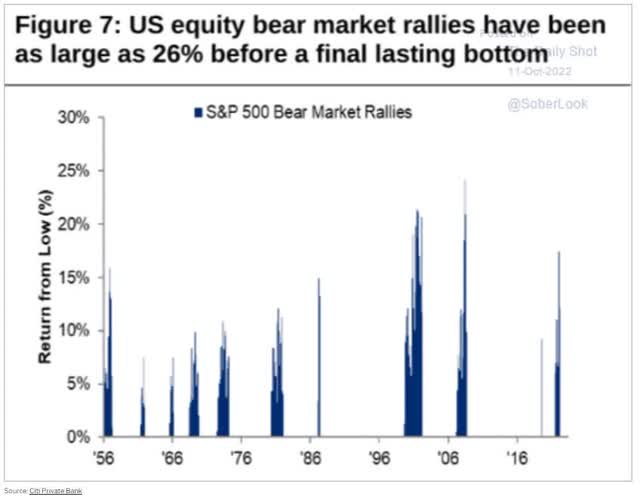

However, such bear market rallies are perfectly normal and to be expected. Stocks don’t just fall straight down in a bear market, but trend lower in a period of high volatility to the downside and upside.

In the Great Recession we had five bear market rallies, including one as strong as 24%.

Since 1956, the largest bear market rally was 26%.

This is what makes it impossible to time the bottoms of bear markets. By the time you can be sure it’s over (at new record highs), the incredible bargains are gone.

Worse still, the market has rocketed higher while the headlines are still terrible.

- the recession didn’t end until Q3 2009, but stocks bottomed 6 months earlier.

Don’t try to buy at the bottom and sell at the top. This can’t be done – except by liars.” – Bernard Baruch

The only way to guarantee you nail the bottom of every bear market is to buy stocks every day (possible with commission-free trading and fractional shares).

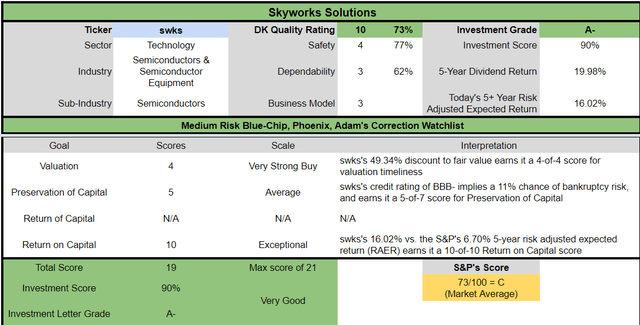

Today I wanted to share with you why Comcast Corporation (CMCSA) and Skyworks Solutions, Inc. (SWKS) are two 50% undervalued crazy, stupid, cheap bear market bargains that you can safely buy today.

- meaning their 50% discount to fair value is not due to poor fundamentals

- just negative market sentiment not supported by objectively strong fundamentals.

Comcast: One Of The Best Times Ever To Buy This Media Giant

Further Reading

- 5 Reasons The Market Is Dead Wrong About Comcast

- a full deep dive into CMCSA’s investment thesis, growth outlook, and risk profile.

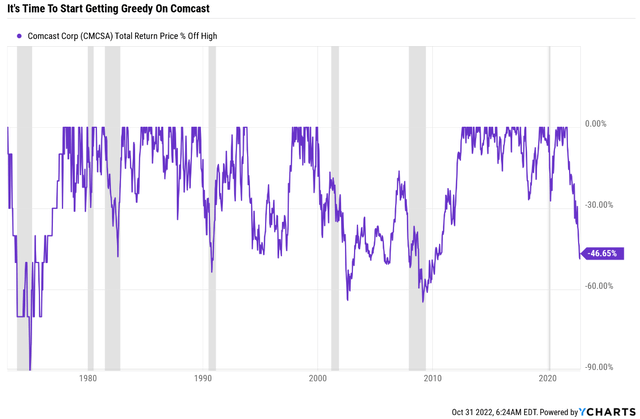

Comcast has been almost cut in half in this bear market.

- the forward P/E has plunged to 8.4X

- 6.4X cash-adjusted P/E = pricing in -4.2% CAGR growth.

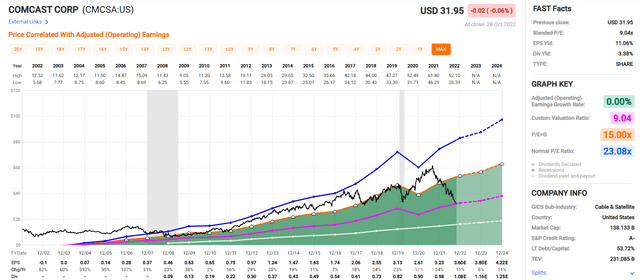

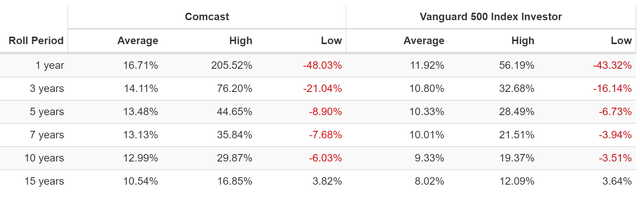

Comcast Rolling Returns Since 1985

From bear market lows, Comcast is capable of 30% annual returns for the next decade and 45% annually for the next five years.

The Lowest P/E In History

(Source: FAST Graphs, FactSet)

Comcast has literally never had a lower P/E in its history. Not in the Pandemic, and not even in the Great Recession.

If you like this business it’s the best time ever to buy it.

Reasons To Potentially Buy Comcast Today

| Metric | Comcast |

| Quality | 86% 12/13 Quality Super SWAN (Sleep Well At Night) Media Conglomerate |

| Risk Rating | Very Low Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 166 |

| Quality Percentile | 67% |

| Dividend Growth Streak (Years) | 14 |

| Dividend Yield | 3.4% |

| Dividend Safety Score | 84% |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.85% |

| S&P Credit Rating | A- stable |

| 30-Year Bankruptcy Risk | 2.5% |

| LT S&P Risk-Management Global Percentile | 82% Very Good |

| Fair Value | $63.41 |

| Current Price | $31.95 |

| Discount To Fair Value | 50% |

| DK Rating |

Potential Ultra Value Buy |

| P/E | 8.4 |

| Cash-Adjusted P/E | 6.2 |

| Growth Priced In | -4.6% |

| Historical P/E | 17.5 to 18 |

| LT Growth Consensus/Management Guidance | 10.5% |

| PEG Ratio | 0.59 |

| 5-year consensus total return potential |

31% to 32% CAGR |

| Base Case 5-year consensus return potential |

32% CAGR (6X the S&P 500) |

| Consensus 12-month total return forecast | 33% |

| Fundamentally Justified 12-Month Return Potential | 102% |

| LT Consensus Total Return Potential | 13.9% |

| Inflation-Adjusted Consensus LT Return Potential | 11.6% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 3.00 |

| LT Risk-Adjusted Expected Return | 9.49% |

| LT Risk-And Inflation-Adjusted Return Potential | 7.20% |

| Conservative Years To Double | 10.00 |

(Source: Dividend Kings Zen Research Terminal)

Comcast is a 50% discounted bear-market blue chip that could deliver Buffett-style returns in the coming years.

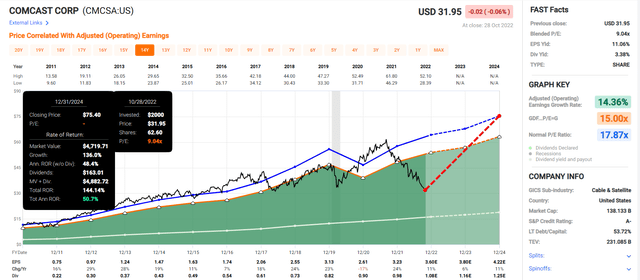

Comcast 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

From its lowest P/E in history Comcast could deliver 144% total returns in the next two years if it grows as expected and returns to historical mid-range market-determined fair value.

- Buffett-like 51% annual return potential

- 5X more than the S&P 500.

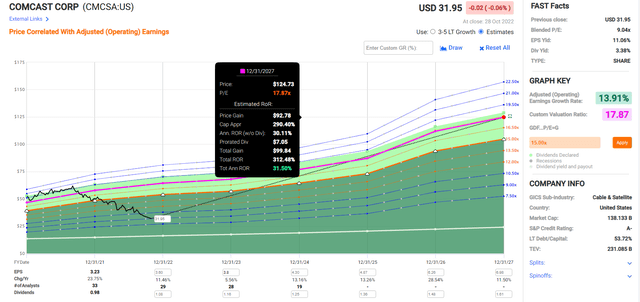

Comcast 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

Comcast from its lowest P/E in history could be 4X bagger in the next five years, with 32% annual returns.

- consistent with its historical returns off of bear market lows

- 6X more than the S&P 500.

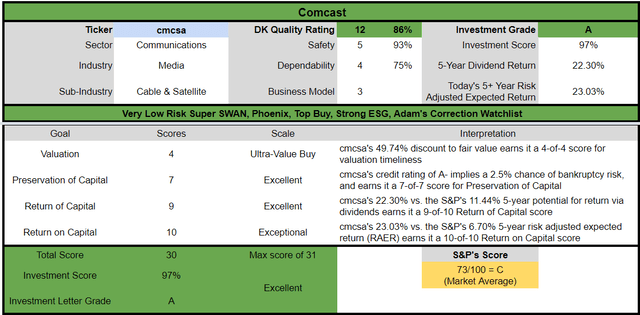

Comcast Corp. Investment Decision Tool

DK (Source: Dividend Kings Automated Investment Decision Tool)

CMCSA is a potentially excellent fast-growing high-yield anti-bubble bargain for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 50% discount to fair value vs. 1% S&P = 59% better valuation

- 3.4% very safe yield vs. 1.8% S&P (almost 2X higher and much safer)

- 40% higher annual return potential

- about 4X higher risk-adjusted expected returns

- 2X the consensus 5-year income.

Skyworks: Time To Start Getting Greedy On This Fast-Growing Chip Blue-Chip

Further Reading

- Skyworks Solutions: Dividend Blue-Chip That Could Triple In 5 Years

- a full deep dive into SWKS’s investment thesis, growth outlook, and risk profile.

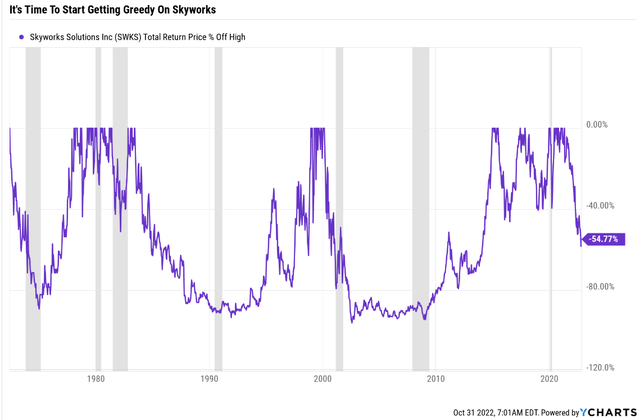

The semiconductor bear market has ravaged SWKS, which is now in its largest bear market since the Great Recession.

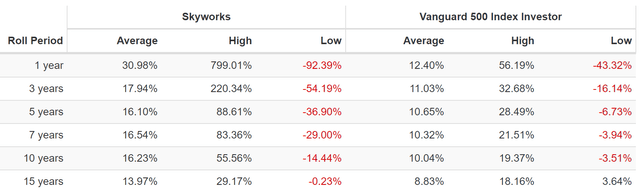

Skyworks Rolling Returns Since 1985

Skyworks bear markets can be ferocious, but so are its rallies off those lows.

- as much as 29% CAGR for the next 15 years

- 46X return in 15 years.

Reasons To Potentially Buy Skyworks Today

| Metric | Skyworks Solutions |

| Quality | 73% 10/13 Quality Super SWAN Blue-Chip Semiconductor Company |

| Risk Rating | Medium Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 420 |

| Quality Percentile | 17% |

| Dividend Growth Streak (Years) | 8 |

| Dividend Yield | 2.8% |

| Dividend Safety Score | 77% |

| Average Recession Dividend Cut Risk | 1.0% |

| Severe Recession Dividend Cut Risk | 2.40% |

| S&P Credit Rating | BBB+ stable |

| 30-Year Bankruptcy Risk | 5.00% |

| LT S&P Risk-Management Global Percentile |

34% Below-Average |

| Fair Value | $173.20 |

| Current Price | $88.06 |

| Discount To Fair Value | 49% |

| DK Rating |

Potential Very Strong Buy |

| P/E | 7.5 |

| Cash-Adjusted P/E | 6.8 |

| Growth Priced In | -3.4% |

| Historical P/E | 14 to 15.5 |

| LT Growth Consensus/Management Guidance | 13.3% |

| PEG Ratio | 0.51 |

| 5-year consensus total return potential |

18% to 29% CAGR |

| Base Case 5-year consensus return potential |

24% CAGR (5X the S&P 500) |

| Consensus 12-month total return forecast | 46% |

| Fundamentally Justified 12-Month Return Potential | 100% |

| LT Consensus Total Return Potential | 16.1% |

| Inflation-Adjusted Consensus LT Return Potential | 13.8% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 3.65 |

| LT Risk-Adjusted Expected Return | 10.71% |

| LT Risk-And Inflation-Adjusted Return Potential | 8.42% |

| Conservative Years To Double | 8.55 |

(Source: Dividend Kings Zen Research Terminal)

SWKS is trading at just 6.8X cash-adjusted earnings, a 49% historical discount and a PEG of 0.51.

Analysts think it will deliver 46% total returns in the next year and its fundamentals justify up to a 100% return within 12-months.

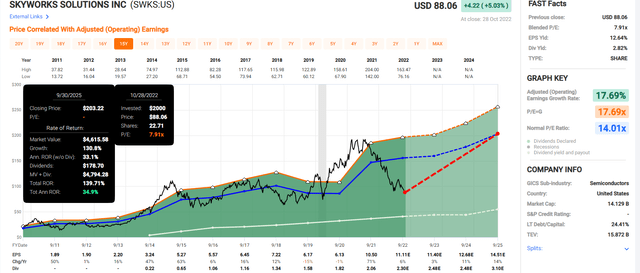

Skyworks 2024 Consensus Total Return Potential

From its 50% historical discount and anti-bubble valuation SWKS offers the potential for 140% returns within two years.

- Buffett-like 35% annual return potential

- 5X more than the S&P 500.

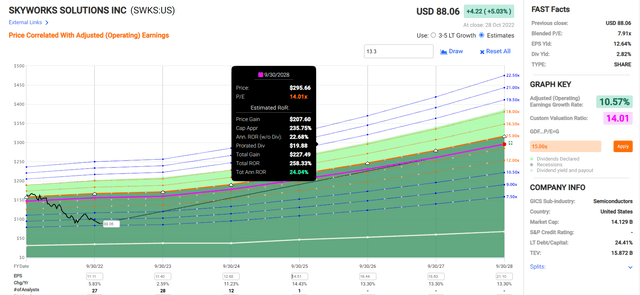

Skyworks 2027 Consensus Total Return Potential

Over the next five years, if SKWS grows as expected and returns to historical fair value, it could deliver 260% total returns or 24% annual returns.

- 5X more than the S&P 500.

Skyworks Investment Decision Tool

DK (Source: Dividend Kings Automated Investment Decision Tool)

SWKS is a potentially very good fast-growth anti-bubble opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 49% discount to fair value vs. 1% S&P = 48% better valuation

- 2.8% very safe yield vs. 1.8% S&P (1.5X higher and growing 13% to 14% over time)

- 60% higher annual long-term return potential

- about 2.5X higher risk-adjusted expected returns.

Bottom Line: Skyworks And Comcast Are Crazy, Stupid, Cheap Bear Market Bargains You Might Want To Buy

Let me be clear: I’m NOT calling the bottom in Comcast or Skyworks (I’m not a market-timer).

Sleep Well At Night doesn’t mean “can’t fall hard in a bear market.”

Fundamentals are all that determine safety and quality, and my recommendations:

- over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

- in the short term; luck is 25X as powerful as fundamentals

- in the long term, fundamentals are 33X as powerful as luck.

Bear markets can be exhausting and terrifying for many, but also incredibly profitable for smart long-term investors.

Today Comcast and Skyworks are 50% undervalued blue chips growing at double-digits.

They have strong investment grade or even A-rated balance sheets.

They have strong growth outlooks over the long term, but are anti-bubble stocks priced for negative growth.

From bear market lows, both are capable of Buffett-like returns over the medium-term.

- 3.5X to 5X over the next five years.

If you’re looking to take advantage of this bear market, through Buffett-style “fat pitch” dividend blue chips, Comcast and Skyworks are two excellent names to consider.

Be the first to comment