Rafael_Wiedenmeier

General Electric Company (NYSE:GE) has released its second-quarter results, and my worst fears were realized. Despite the fact that the industrial conglomerate gained from an aviation sector revival in 2Q-22, pressure is mounting on the firm to abandon its 2022 guidance.

General Electric cut its free cash flow forecast for 2022 by $1.0 billion due to supply-chain problems and inflation, making the company’s earnings prospects significantly more costly almost overnight.

Inflation will continue to be a huge concern for companies such as General Electric, which use a large amount of raw materials to manufacture engines, turbines, and other equipment that industrial corporations sell to customers all over the world.

With General Electric’s free cash flow projection for 2022 effectively lowered and the economy probably on the verge of a recession, there are few to no positive catalysts for General Electric shares.

Aerospace Is Saving The Day For General Electric

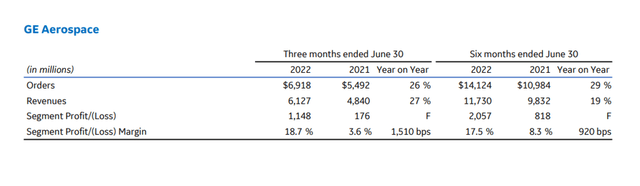

Despite good improvements in the aerospace industry, which resulted in solid order (+26% YoY) and revenue (+27%) growth for General Electric in the second quarter, the firm is feeling the pinch from inflation, which increases the cost of raw materials and squeezes profit margins.

Aside from Aviation, only GE Healthcare recorded 1% YoY sales increase, while Renewable Energy and Power reported -23% and -2% YoY revenue declines for the second quarter, respectively. Aerospace’s strong performance translated into a 1,510 bps margin increase to 18.7%. For General Electric, no other segment generates a higher profit margin than aviation.

General Electric reported better-than-expected 2Q-22 results, owing primarily to the Aerospace division. The industrial firm posted earnings per share of 78 cents, easily exceeding projections of 38 cents. Sales also exceeded expectations, coming in at $18.65 billion versus a prediction of $17.38 billion.

General Electric’s Free Cash Just Got A Whole Lot More Expensive

As I stated in my previous piece on General Electric, ‘Say Goodbye To The 2022 Guidance‘, the macro climate is driving the industrial behemoth to be a bit more conservative with respect to its free cash flow. The company has reduced its free cash flow projection for the current year, currently expecting $4.5-5.5 billion.

General Electric has not stated its free cash flow expectations for 2023, but we know from previous statements that the firm expected $7.0 billion in free cash flow next year. The new 2022 guidance takes into account, among other things, higher working capital requirements for General Electric’s Renewable Energy orders.

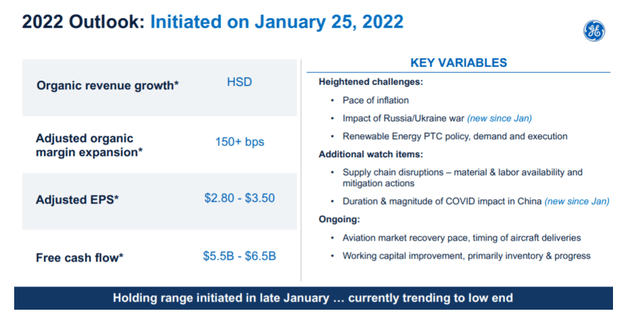

This is General Electric’s guidance from January:

2022 Outlook (General Electric)

In any case, reduced free cash flow always results in a higher valuation multiple. General Electric has a 16.0x free cash flow multiple based on $4.5-$5.5 billion in 2022 free cash flow, compared to a 13.3x multiple before earnings when the market was still persuaded the guidance held at $5.5-6.5 billion.

I believe the valuation is unreasonable for a cyclically exposed industrial sector, especially given that the U.S. economy appears to be on the verge of a recession and that inflation could result in General Electric’s profit margins shrinking in the future.

Why General Electric Could See A Higher, Not A Lower Valuation

The first estimate for U.S. GDP growth will be released later this week. The United States’ GDP fell 1.6% in the first quarter, and if it falls again in the second quarter, the United States’ economy will be formally classified as in recession, which might lead to a significant downgrade of General Electric’s growth prospects.

With that stated, if the United States’ economy grew surprisingly strong in the second quarter and avoided a recession, General Electric and its individual businesses may do well, but I believe this is improbable.

In all likelihood, inflation reached a new high of 9.1% in June, causing significant economic damage. Despite the fact that this week’s GDP release is simply the first reading and may be amended later as more information becomes available, cyclical industries such as General Electric are likely to struggle.

My Conclusion

You don’t want to hold an industrial conglomerate with variable profitability and free cash flow at the start of what may be a long-term economic downturn.

The unfortunate takeaway from General Electric’s earnings was that, despite the Aerospace segment’s strong performance and increased profit margins, General Electric had to cut its free cash flow projection for 2022 by $1.0 billion, thus removing the company’s free cash flow guidance.

Be the first to comment