William_Potter/iStock via Getty Images

Co-produced with “Hidden Opportunities”

Introduction

Billionaire Warren Buffett has been all over the news with his aggressive Occidental Petroleum (OXY) share purchases in recent months. The Oracle of Omaha now owns ~19% of OXY and was quoted to say that this was a bet on long-term oil prices and the quality of the Permian Basin oil field.

He is right. Despite investors’ fears of a cyclical boom and bust in the energy sector, hydrocarbon prices are expected to remain elevated in the near term due to several factors shaped over several years.

1. Constrained Supplies and Stable Demand

Despite the West Texas Index dropping over 20% from its recent highs, the energy industry maintains strong fundamentals due to tight supplies and stubborn demand. The investment in exploration and production in the past 5+ years has been significantly lower than in previous years.

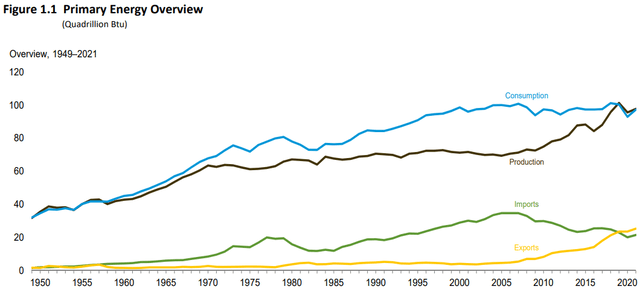

Wall Street has successfully transformed Big Oil into an industry that merely caters to demand. Since the oil price crash in 2015, OPEC+ has realized that maintaining excess supply is not in their best interests. Notice how tight the supply-demand situation has become today. The last time we saw this wasn’t 2008, not the 1970s, but all the way back in the 1950s.

Contrary to what the politicians tell you, the higher output cannot be ordered online with 2-day free shipping. It takes billions of dollars spent over several years to create a surplus. Experts agree that the petroleum products supply deficit isn’t going away anytime soon, and prudent investors like Warren Buffett have understood this very well. As U.S. field oil production remains below pre-pandemic levels, the supply-demand balance will remain favorable for the industry despite recession concerns.

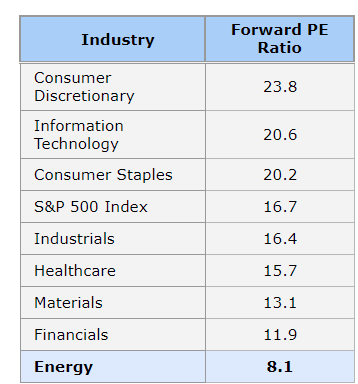

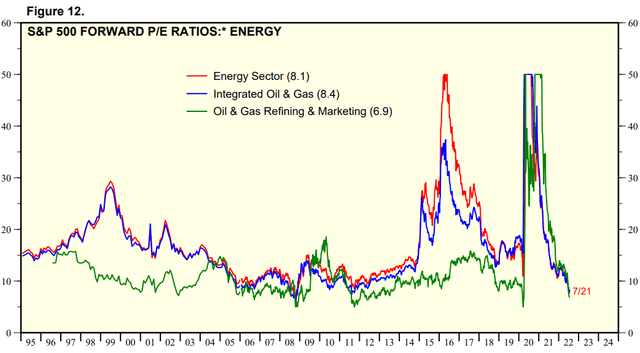

2. Highly Favorable Valuations

Oil prices are off their highs, and Wall Street is projecting demand destruction due to recession pressures. As the hottest industry of 2022, Energy is trading at historically cheap valuations.

Data Source: Yardeni Research Yardeni Research

Mr. Buffett recognizes the long-term value proposition of this cheap industry and has been loading up.

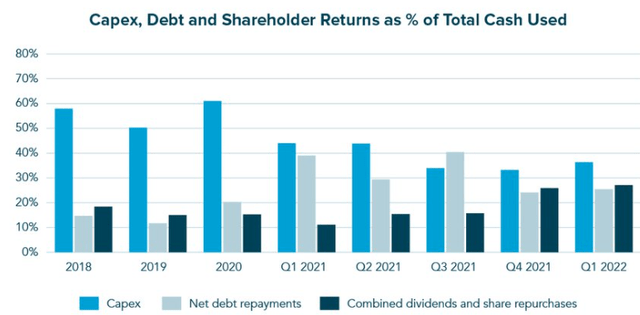

3. Free Cash Flow

Thanks to higher commodity prices, companies like OXY are generating massive piles of free cash flow cash. This directly benefits investors, since U.S. energy companies are reducing debt and increasing the provision for dividends and share repurchases.

The HDO portfolio has carefully selected securities from the energy sector that prioritize shareholder value creation without the volatility associated with commodity prices. We expect hydrocarbon supplies to remain tight and their prices to be elevated over the near term. This article discusses two picks with up to 9% yields to fortify your income from this promising industry with sustainable cash flows and significant moat.

Pick #1: OKE, Yield 6.3%

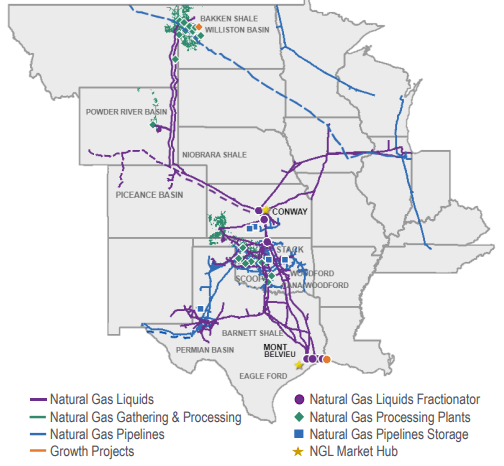

ONEOK, Inc. (OKE) is a leading U.S. midstream company with a 40,000-mile network of NGL (natural gas liquids) and natural gas pipelines connecting mineral-rich basins with key market centers in the country.

June 2022 Investor Presentation

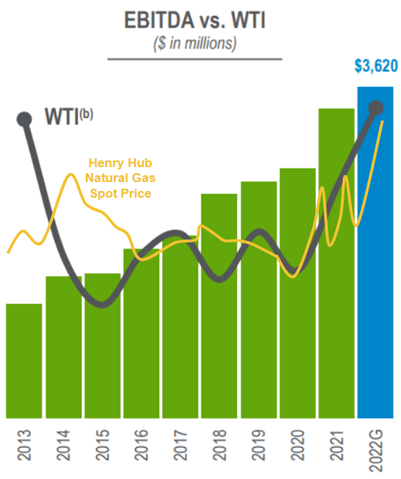

Midstream companies are like toll booths on the highway; their earnings don’t change if the passing vehicle is a Honda or a Lamborghini. In a similar comparison, OKE’s earnings growth has remained insensitive to fluctuating hydrocarbon prices. For 2022, OKE provides the following guidance for earnings:

-

NGL: >90% fee-based

-

Natural Gas gathering and processing: >80% fee-based

-

Natural Gas pipelines: >95% fee-based.

June Investor Presentation (Modified by Author)

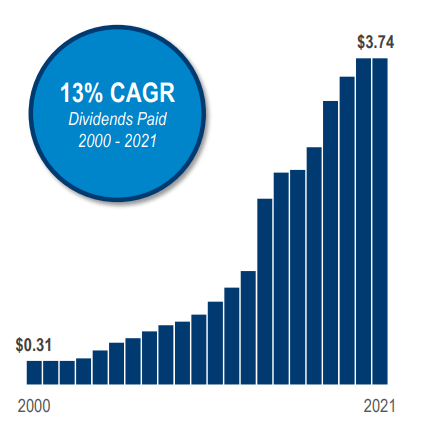

OKE has a remarkable track record of 25+ years of paying growing dividends, with a 13% dividend CAGR since 2000.

June 2022 Investor Relations

The $0.935/share dividend represents a 6.3% annualized yield. It is important to note that OKE pays qualified dividends with a 1099 tax form (no K-1 related complications).

The company maintains investment-grade ratings with leading credit agencies and a healthy balance sheet with a leverage ratio below 4x. The company continues to work to bring this down to 3.5x. OKE projects a ~3-22% increase in net income for FY 2022, ~4-7% reduction in interest expenses, and ~3-12% increase in Adj. EBITDA. This means more capital is coming up to pursue our favorite activities – raising dividends, buying back shares, and reducing debt.

Natural gasses produce among the lowest carbon dioxide emissions and are vital for global net-zero targets. NGLs, on the other hand, are essential feedstock that forms the backbone for manufacturing, industrial, and numerous domestic applications. As a midstream company with robust operations associated with storage, transmission, and processing of Natural Gas and NGLs, OKE’s future is bright, and shareholders are well-positioned to receive growing dividends.

ONEOK reports earnings on the morning of August 8th.

Pick #2: CEQP-, Yield 9%

Crestwood Equity Partners LP (CEQP) owns and operates midstream assets located primarily in the Williston Basin, Delaware Basin, Powder River Basin, and Marcellus Shale. The partnership’s operations are around:

Natural Gas: gathering, processing, treating, compression, storage, and transportation

Natural Gas Liquids: storage, transportation, and marketing

Crude Oil: gathering, storage, transportation, and marketing.

The partnership maintains a strong balance sheet with a pro forma leverage ratio of 3.8x in Q1 2022. CEQP projects leverage below 3.5x in 2023 once the recently acquired assets are fully integrated and operations are synergized. CEQP is immune to commodity price fluctuations through its solid base of fixed-fee contracts. The partnership has been expanding through several acquisitions over the past year. This provides long-term benefits to common unitholders, but there is something else we find more attractive.

Crestwood Equity Partners LP, Cumulative Perpetual Preferred Units (CEQP.PR) is a unique preferred from CEQP that is a must-have for income investors. CEQP- is unique since it has numerous protections that are not typically seen in preferred shares available to retail investors. These include:

-

No call provision: CEQP- is convertible, but the company cannot force conversion until the common shares close above $136.91 for 20 out of 30 consecutive days, an unlikely 407% upside from current levels.

-

Voting rights: Ordinarily, preferred shareholders often do not get to vote on corporate matters. But CEQP- preferred shareholders get to vote on all matters as common shareholders, a rare benefit. This is important as it helps ensure that if CEQP gets acquired, the terms are favorable for preferred investors.

-

Missed distribution penalties: It is common to see preferreds having “cumulative” distributions, where if a distribution is not paid, it accumulates and has to be paid in full in the future before the common units can receive anything. CEQP- takes the protection a step further and implements a penalty, where if a single distribution is missed, the distribution immediately increases 22% to $0.2567/quarter. Additionally, any accrued and unpaid distributions will be increased by 2.8125% each quarter. This structure of penalties incentivizes management not to miss any distribution.

CEQP’s 2022 EBITDA guidance range of $800-840 million adequately covers the $60 million in annual preferred dividends. CEQP-‘s $0.8444 in yearly distributions calculates to an attractive 9% yield. Structurally and financially, CEQP-‘s distributions are protected, making it a safe investment during volatile market conditions.

Initially, these preferred units were created as a private placement connected with a corporate merger. They have no call date nor stated redemption price. There is no stated coupon rate – only the quarterly $0.2111 distribution amount. When the CEQP- preferred units became available on the secondary market in 2018, the trading price wasn’t anchored to a customary $25 par value. The price has only been bound by the yield that the market demands, generally ranging $9-$10.

Note: Each broker has its own ticker symbol for the Crestwood preferred. Crestwood issues a K-1 tax form which can create UBTI tax consequences if CEQP- is owned in a retirement account. More details here.

Warren Buffett supported Occidental with the acquisition of Anadarko Petroleum by purchasing $10 billion of OXY preferred stock carrying an 8% dividend. It was during the pre-pandemic days and the industry wasn’t this cheap. The irrational sell-off in the sector is pushing Mr. Buffett to load up. While those 8% yielding OXY preferreds were a private placement and remain inaccessible to retail investors, we share his views on the energy industry and pick CEQP- for its 9% yields with excellent protections for reliable income.

Conclusion

The energy deficit has been a problem in creation for several years, and the Russo-Ukrainian war became the last straw. Sanctions on a significant player in the energy mix come at a cost: energy uncertainty. Today, commodity prices are significantly elevated, and we expect them to remain this way due to years of underinvestment in hydrocarbon production.

Despite the overwhelming importance of energy independence, the energy industry is trading at historic low valuations thanks to recession fears. Investors like Warren Buffett recognize the importance of oil in the energy mix and the competitive advantage of the companies in this industry. The best part is that leading energy companies are great stewards of returning capital to shareholders.

Midstream companies own assets with powerful long-term monetization capability through fee-based contracts. As income investors, we invest in midstream to shield ourselves from volatile energy prices and increase the consistency of our dividends. This article discusses two midstream picks with up to 9% yields to print money in the era of energy independence.

Be the first to comment