3alexd/E+ via Getty Images

Kingdom Capital covered 1847 Goedeker (NYSE:GOED)(GOED.WS) last summer, the only non-buy rating it has received on Seeking Alpha since their merger with Appliance Connection. Since then, this online appliance retailer has transitioned from special situation to deep value opportunity. Despite solid trends, we believe the proverbial baby has been thrown out with the home furnishing bathwater. Goedeker has officially announced their rebranding to “Polished”, with shares set to trade as POL and POL.WS going forward, in what shareholders hope is a catalyst for the beaten down stock:

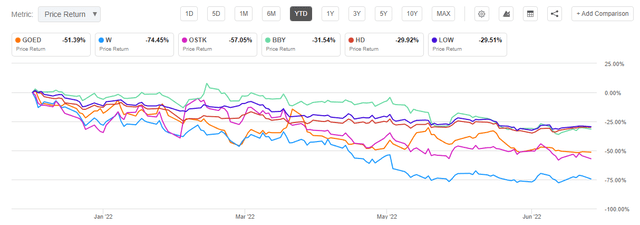

As previously mentioned, despite solid underlying trends, we believe the proverbial baby has been thrown out with the home furnishing bathwater. Consider their performance vs appliance/e-commerce peers YTD:

While larger peers Home Depot (HD), Lowe’s (LOW), and Best Buy (BBY) have performed better, Overstock (OSTK), Wayfair (W), and Goedeker were more than halved as the market shuns any stock perceived as a COVID beneficiary. Is this treatment of GOED fair? We think not, as GOED grew revenues 32% in Q4 and more than 20% in Q1-22 while peers contracted. GOED has consistently hit revenue and margin guidance throughout their stint as a public company.

Let’s deal with the most prominent bear case first: Appliances are cyclical and you’re buying at the top of the cycle.

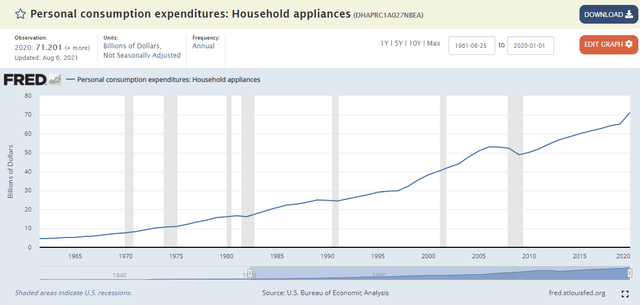

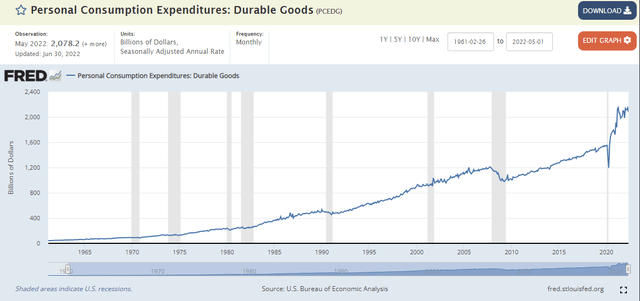

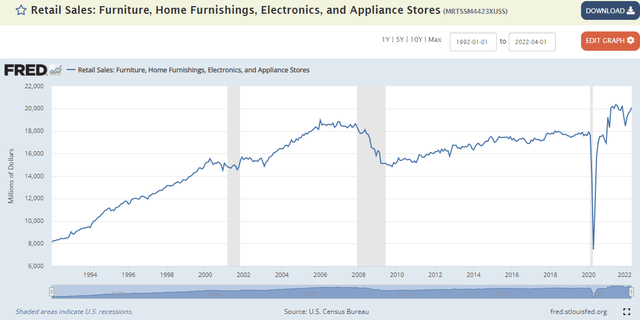

FRED Database FRED Database FRED Database

Spending on appliances pulled back 10% in 2009 – less than half as much as broader durable goods spending. Housing prices were in freefall and unemployment was soaring, causing consumer durables like furniture and home furnishings to pull back more severely as they are more exposed to precipitous drops in new home starts.

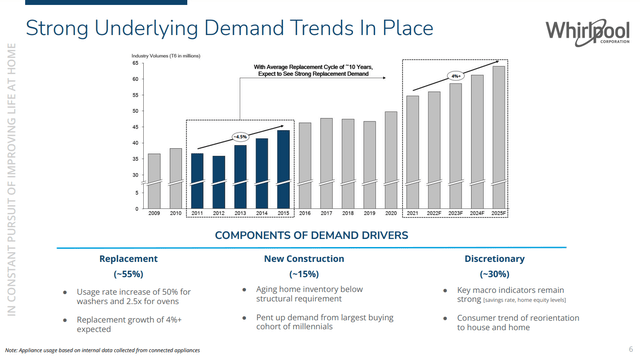

Peers like Whirlpool (WHR) saw revenue drop 10% from FY07 to FY09, and net income declined almost 50% in the same period, but Electrolux (OTCPK:ELUXY) managed to grow revenue in FY08 and FY09. Automakers like Ford (F), home goods retailers like Williams-Sonoma (WSM), and mattress manufacturers like Tempur Sealy (TPX) all experienced ~30% revenue declines from 2007 to 2009. These observations drive home that appliances are not as fiercely cyclical as other consumer durables, but a steadier business driven primarily by replacement:

Whirlpool Investor Presentation

Valuation

With a $1.20 share price (~$130m market cap) and $30m of net debt, the business is valued at less than 10x EV/TTM EPS and 5x EV/TTM EBITDA. If the company hits their FY22 growth and margin guidance, they will earn ~$650m revenue and ~$60m EBITDA, which would be 2.7x EV/EBITDA at today’s share price.

GOED has an attractive capital structure arbitrage opportunity, with over 90m warrants outstanding that will convert at $2.25 per share. GOED can buy back shares under $2.25 until the share price exceeds the warrant strike and then “sell them back” into the market at a higher price. The resulting ~$200m cash infusion would also curtail any leverage used to build out their distribution network and reduce the share count.

Zooming out a bit further and ignoring the accretive potential of repurchases, the business is targeting $1B of annual sales in 2024/2025. There are puts and takes on margins that I believe will skew to the upside, but if we continue to assume 9% EBITDA margins, the business would earn $90m of EBITDA. A similar growing business should trade at a minimum of 10x EBITDA, a $900m valuation. With approximately 200m shares outstanding after warrant issuance and $200m net cash position from their exercise, the stock would trade around $5.50/share. If they spend $25m+ buying back shares under $1.50, the math gets more interesting.

Comparison Valuation

Some might use BrandsMart as the best recent comp for GOED, which Aaron’s (AAN) just acquired for $230m. Given the business did $757m revenue and $46m EBITDA in FY21, that’s a 5x multiple that says GOED might be trading close to fair value. My main disagreements:

-

BrandsMart is more diversified than appliances, which suggests more exposure to slowdown in consumer discretionary spending.

-

BrandsMart has 10 physical stores, resulting in more capital intensity and lower margins.

-

BrandsMart grew 10% in FY21 and Y/Y in Q1-22 – less than half the growth rate of GOED.

In other words, it’s not apples to apples. Even so, if GOED only trades to 5x TTM EV/EBITDA, you’ll still make a good bit of money here.

Risks

Given the valuation, one could argue a tremendous number of risks are priced into the GOED stock. The most common fears I’ve found are:

-

The market is now heavily forecasting a recession, which should lead to reduced demand for appliances, especially for remodels. Per the Whirlpool slide above, this accounts for ~30% of demand. The recent Craig Hallum initiation notes that Goedeker is well insulated from this risk with ~80% of sales into higher-end markets, a less sensitive category, compared to ~20% for peers like BBY, HD and LOW.

-

The housing market is locking up, which would decrease the demand for new home builds being outfitted with new appliances (15% of demand per WHR slide). However, GOED has immaterial B2B sales historically so the impact should be minimal.

-

With large appliance retailers like Home Depot, Lowes, and Best Buy, some people question GOED’s necessity/market niche. GOED’s growth and ~$600m revenue suggests they have found their niche, but many investors aren’t yet convinced.

-

GOED recently implemented a $25m buyback, which currently equates to about 20% of their outstanding shares. If GOED increases leverage to buy back shares, the impact of slowing demand on the business could be magnified.

-

GOED has launched their rebranding as “Polished,” and if this goes poorly the business could be negatively impacted. One would hope “Polished” is at least more relatable than the former branding “1847 Goedeker.”

- Most investors new to the Goedeker story cite poor free cash flow conversion as a reason to avoid the name. This reasoning ignores working capital pressures from legacy Goedeker and inventory builds in an attempt to improve fill rates. On paper, this headwind should shortly convert into a tailwind, but if cash flow conversion remains poor the valuation will be impacted.

Upside Considerations

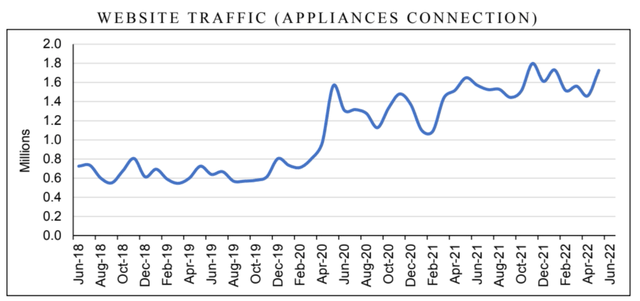

After posting a strong fiscal Q1, SimilarWeb shows no sign of a slowdown for Appliances Connection:

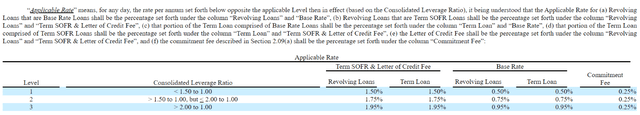

In May, Bank of America announced a new $140m credit agreement with GOED on very reasonable terms:

I haven’t recently seen new loans to companies in microcap land on such favorable terms, especially companies with less than $4m of PP&E in the event of a forced liquidation. Bank of America appears to be lending against the business and seems comfortable with their future earnings power.

Lastly, I want to include some high-level margin considerations:

-

Long-term margins on appliances are around 30%. This is a broad industry metric confirmed with various analysts. It’s not perfect, but that’s my starting point.

-

GOED disclosed they spend 8-10% of revenues on transportation/delivery. This number can come down ~25% if/when they build out their delivery network, but I use the current number as a starting point.

-

Taking the two items above, I get comfortable with 20-22% gross margins at GOED.

-

A highlight in Corporate OpEx is their impressive ~3-4% ad spend. GOED has indicated they minimize ad spend by targeting ad buys at specific SKUs instead of broader buzzwords like “dishwasher.” This allows them to target individuals who already have a specific model in mind and convert to sale at a higher percentage.

-

Another reason ad spend is low is company “fill rates” have been stuck around 60% for most of the past year – many orders cannot be filled due to lack of product. As inventory normalizes and fill rates increase, GOED will be better positioned to increase ad spend and make incremental sales with a deeper inventory.

-

Margins are pressured by low fill rates as manufacturers are not offering the rebates historically provided to distributors. Offsetting this, tight inventory gives GOED increased pricing power.

-

In summary, I expect future margin pressure from reduced pricing power to be offset by vendor rebates, increased ad spending to be offset by better fill rates (and better scale economics), and possible margin improvement from building out a better distribution network. Even with current margins, I own a business trading under 3x EV/EBITDA on this year’s forecast, on which Bank of America underwrote a $140m loan.

Conclusion

At $1.20/share, or $0.25/warrant, I see the GOED risk/reward significantly skewed to the upside. GOED feels like the kind of investment that could 10x over the next 5 years and looking back one would realize the pieces were there for all to see. We are long warrants and welcome your feedback below. Thanks for reading.

Be the first to comment