AdrianHillman

Introduction

Frac sand prices for Permian oil producers have reportedly soared by 150% compared to a year ago and that there could be a shortage of more than 1 million tons. In discovering this, the first company that came to mind was Smart Sand (NASDAQ:SND). It’s a small frac sand producer that is currently unprofitable, but the recent increase in the price of the product is likely to push it into the black and I think this is a good time to open a small position. Let’s review.

Overview of the business and financials

Smart Sand was founded in 2011 and is a fully integrated frac sand supply and services company whose operations include the excavation, processing and sale of frac sand. This is a type of sand with small, uniform particles which fracking companies inject into the rock formation along with water with the idea of propping open the fractures that are created. Smart Sand also offers proppant logistics and wellsite storage solutions and it late 2021 it created an industrial products solutions that sells sand to the glass , foundry, and building products sectors among others.

Smart Sand currently operates two frac sand production facilities in the USA that have a combined annual processing capacity of around 7.1 million tons, with the ability to boost this number to 10 million tons with the reopening of a third one. All facilities have rail access, and the company also has two terminals. The Van Hook terminal in North Dakota handled around 12% of volumes in the first quarter of 2022 and the Waynesburg terminal Pennsylvania is expected to boost this share as it ramps up operations. This terminal will serve the Appalachian Basin, including the Marcellus and Utica Formations, and was opened in January 2022. It has an initial transloading capacity of one million tons of frac sand per year.

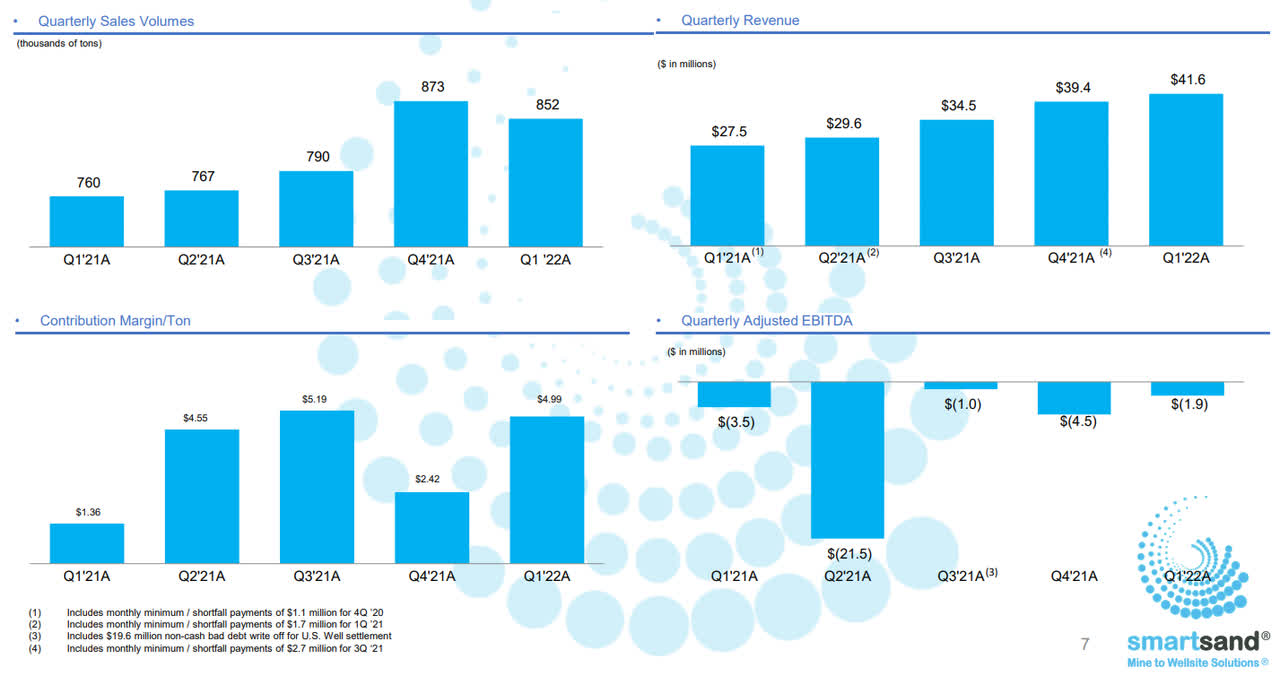

Turning our attention to the latest quarterly results, the picture is not pretty as quarterly sales are still below 1 million tons of frac sand and EBITDA has been negative for some time now.

Smart Sand

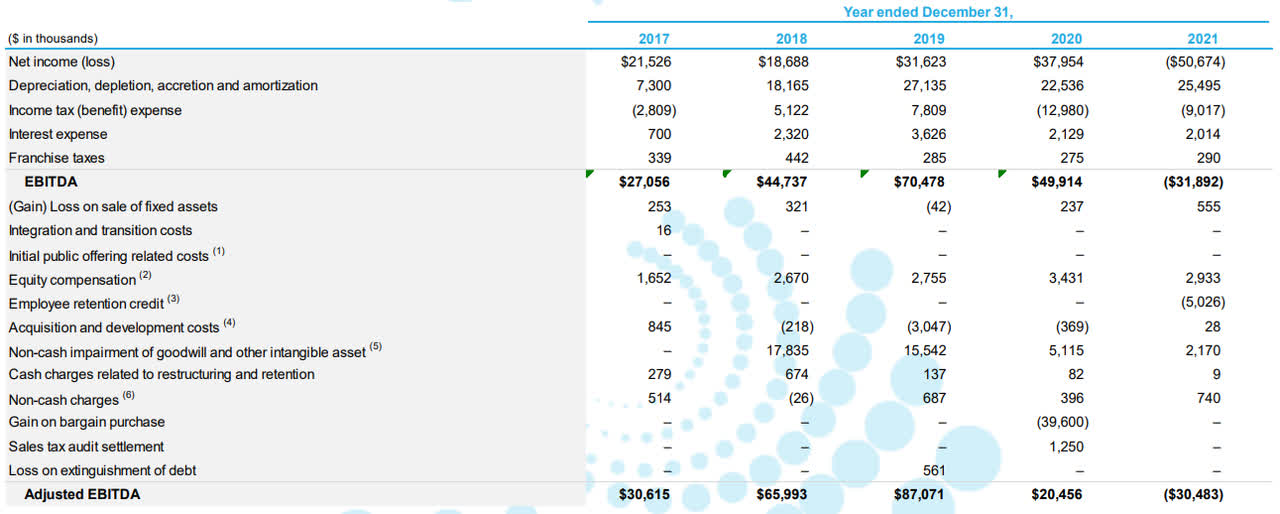

Smart Sand was severely affected by the COVID-19 pandemic as low oil prices led to decreased fracking activity in the USA. Before that, it was a highly profitable company with adjusted EBITDA surpassing $85 million in 2019.

Smart Sand

Yet, I think that Smart Sand could find it difficult to return to those levels of profitability even with high frac sand prices. You see, Schlumberger’s (NYS: SLB) Hess Corporation, and U.S. Well Services (NASDAQ: USWS) account for just over 30% of total revenues in 2019 and there have been issues with these two customers. In January 2019, Smart Sand filed suit against Schlumberger for contract breach over a take-or-pay agreement and in September of that year Hess notified the company it was terminating its product purchase agreement. In the case of U.S. Well Services, Smart Sand sued this company also in 2019 alleging that it breached a multi-year frac sand supply contract. Smart sand was claiming $54 million in total damages and In 2021, the two companies entered into a $35 million settlement. The issue here is that Hess and U.S. Well Services are no longer clients of Smart Sand and this can limit sales volumes going forward as the company relies on a limited number of clients. Smart Sand currently has only around 20 customers and just 3 of them accounted for 52% of revenues in Q1 2022.

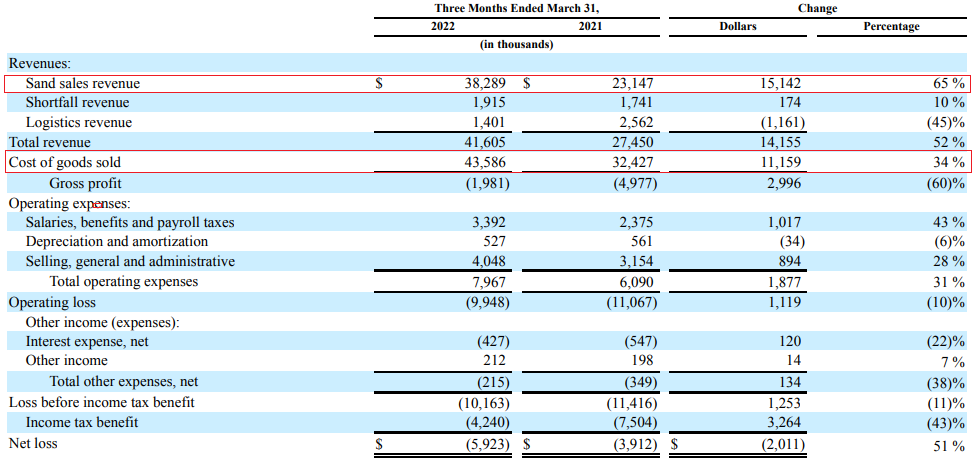

So, what’s ahead for Smart Sand? Well, I think that a positive financial result is possible for 2022 but it’s hard to predict just how large it can get. Smart Sand CEO Charles Young said during the Q1 2022 earnings call that the company expects to achieve record volumes in 2022 so it seems demand is strong at the moment. Sales volumes in Q2 2022 are forecast to rise by more than 25% quarter on quarter. In addition, Q1 2022 results reflected pricing that was put into place in the Q4 2021. This means that Q2 2022 should reflect improved pricing from Q1 2022 as less than 15% of Smart Sand’s capacity is signed up under long-term contracts. Young mentioned during the May earnings call that the FOB equivalent to mine gate pricing was well into the $30s per ton compared to low to mid $20s at the start of Q1 2022. However, it’s unclear whether that will be able to fully counter increased costs due to inflation, logistical constraints and labor shortages. For example, sand sales revenues soared by 65% in Q1 2022 thanks to an increase in total volumes sold of about 12% and significantly higher prices. However, the cost of goods sold increased by 34% as a result of higher freight costs driven by a shift of sales to more in-basin deliveries.

Smart Sand

This means that the two terminals of the company are crucial to keeping freight costs down in the future. Things are looking positive on that front as over half of the tonnes shipped through the Waynesburg terminal in Q1 2022 were processed in March.

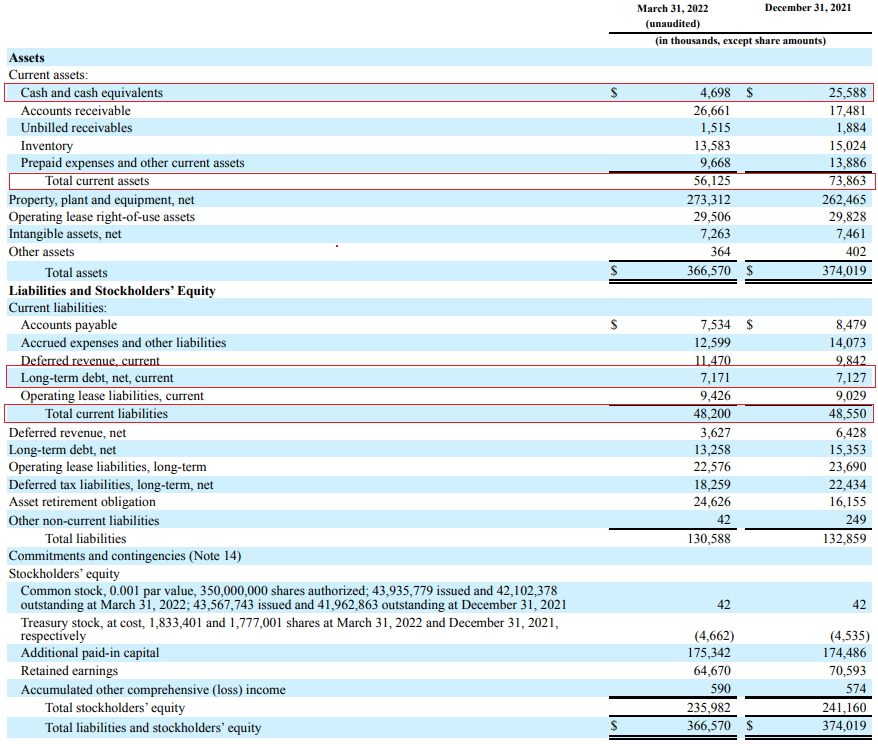

Turning our attention to the balance sheet, I think the situation looks good at the moment. As of March 2022, Smart Sand had $4.6 million in cash as well as $16.9 million in undrawn availability on its asset-based lending credit facility. Working capital was positive and short-term debt was just $7.2 million. Capital expenses are expected to stand at around $25 million to $30 million in 2022.

Smart Sand

Turning our attention to the risks for the bull case, I think there are two major ones. First, a global recession could lead to a slump in oil prices which would negatively affect fracking and frac sand demand. This is likely to lead to low frac sand prices, just like in 2020. Second, startups like Nomad Proppant are developing machinery that can go directly to the frac wells which leads to a large reduction in the burden of freight costs. If this process proves to be economically feasible, mined frac sand can become a thing of the past.

Investor takeaway

One of the effects of the COVID-19 pandemic was low oil prices and this negatively impacted frac sand companies like Smart Sand. The firm also lost two major clients over the past years. However, its fortunes seem to be turning thanks to high oil prices.

Smart Sand expects sales volumes to increase by more than 25% QOQ in Q2 2022 and I think that realized prices are likely to be at least 20% higher than Q1 2022. If the company managed to get around freight cost issues thanks to higher utilization of its terminals, we could see a significant improvement in its profitability in 2022, and I expect the share price to follow suit. I rate this one as a speculative buy.

Be the first to comment