inside-studio/iStock via Getty Images

Foreword

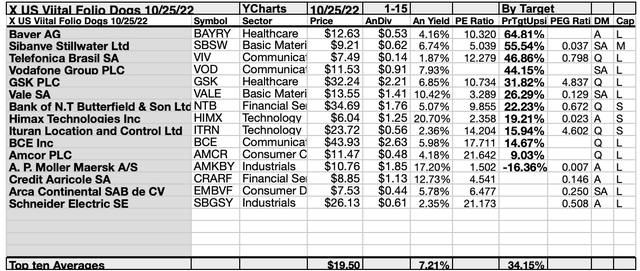

None of this collection of 15 Viital Ex-US Dogs is too pricey to justify its dividends. The consequence of stock market popularity (measured by stock price) is skinny dividends. The contrarian approach finds the top dogs by looking for high dividends. All fifteen of these highest yield Viital Ex-US dogs, live up to the dogcatcher ideal. That is, they pay annual dividends (from a $1K investment) exceeding their single share prices.

As we are now nearly eight months beyond two-years removed from the anniversary of the 2020 Ides of March dip, the time to snap-up any of fifteen top yield Viital Ex-US dogs is at hand… unless another big bearish drop in price looms ahead. (At which time, your strategy would be to add to your position in any of those you then hold.)

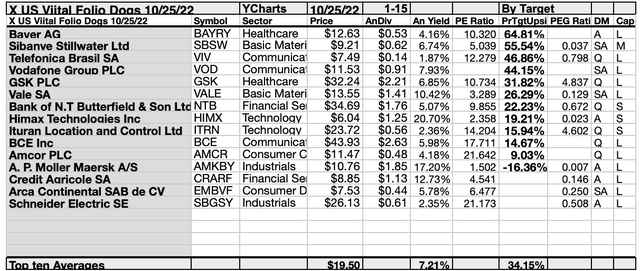

Actionable Conclusions (1-10): Analysts Predict 17.3% To 67.85% Top-Ten Viital Ex-US Net Gains To October 2023

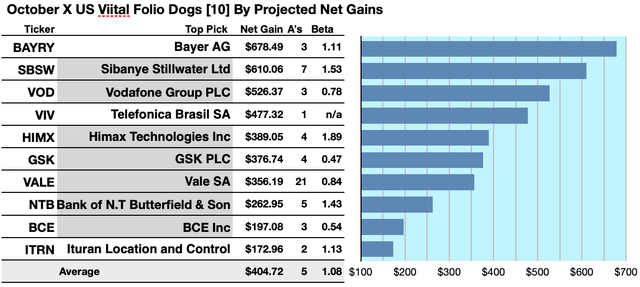

Seven of the ten top Viital Ex-US by yield were also verified as being among the top ten gainers for the coming year based on analyst 1-year target prices. (They are tinted gray in the chart below.) Thus, this yield-based October 28 forecast for Viital Ex-US was 70% accurate.

Estimated dividend-returns from $1000 invested in each of these highest-yielding stocks and their aggregate one-year analyst median target prices, as reported by YCharts, produced the 2022-23 data points for the projections below. Note: target prices from lone-analysts were used. Ten probable profit-generating trades projected to October 25, 2023 were:

Bayer AG (OTCPK:BAYRY) was projected to net $678.49, based on the median of target price estimates from 3 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 11% greater than the market as a whole.

Sibanye Stillwater Ltd (SBSW) was projected to net $610.06, based on dividends, plus the median of target price estimates from 7 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 53% greater than the market as a whole.

Vodafone Group PLC (VOD) was projected to net $526.37 based on target price estimates from 3 analysts, plus annual dividend, less broker fees. The Beta number showed this estimate is subject to risk/volatility 22% below the market as a whole.

Telefonica Brasil SA (VIV) was projected to net $477.32, based on the one-year target estimate from 1 analyst, plus dividends, less broker fees. A Beta number was not available for VIV.

Himax Technologies Inc (HIMX) was projected to net $389.05, based on dividends, plus the median of target price estimates from 4 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 89% greater than the market as a whole.

GSK plc (GSK) was projected to net $376.74, based on the median of target price estimates from 4 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 53% under the market as a whole.

Vale S.A. (VALE) was projected to net $356.19, based on dividends, plus the median of target price estimates from 21 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility16% less than the market as a whole.

Bank of N.T. Butterfield & Son Ltd (NTB) netted $262.95 based on a median target price estimate from 5 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 43% greater than the market as a whole.

BCE Inc (BCE) was projected to net $197.08, based on the median of target price estimates from 3 analysts, plus the estimated annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 46% less than the market as a whole.

Ituran Location and Control Ltd (ITRN) was projected to net $172.96 based on dividends, plus the median of target price estimates from 2 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 13% greater than the market as a whole.

The average net gain in dividend and price was estimated to be 40.47% on $10k invested as $1k in each of these ten stocks. The average Beta ranking showed these estimates subject to risk/volatility 8% greater than the market as a whole.

Source: Open source dog art from dividenddogcatcher.com

The Dividend Dogs Rule

Stocks earned the “dog” moniker by exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as “dogs.” More precisely, these are, in fact, best called, “underdogs”, even if they are “Viital Ex-US Dogs.”

Top 12 Dividend Viital Ex-US Dogs By Broker Targets

This scale of broker-estimated upside (or downside) for stock prices provides a measure of market popularity. Note: no broker coverage produced a zero score on the above scale. These broker estimates can be seen as the emotional component (as opposed to the strictly monetary and objective dividend/price yield-driven report below). As noted above, these scores may also be regarded as contrarian.

Top 15 Dividend Viital Ex-US Dogs By Yield

Actionable Conclusions (11-20): Ten Top Stocks By Yield Are The October Dogs of The Viital Ex-US Collection

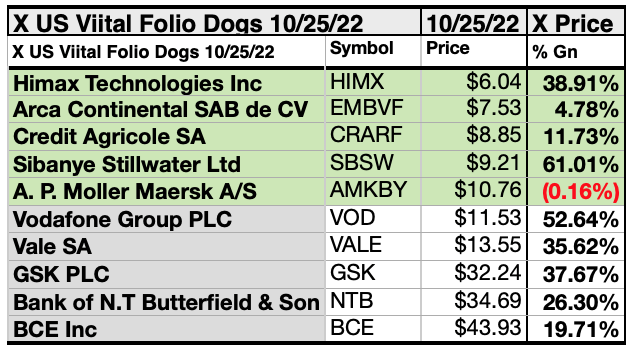

Top ten Viital Ex-US Dogs selected 10/25/22 by yield represented seven of eleven Morningstar sectors. First place went to the lone technology sector Viital Ex-US Dog, Himax Technologies Inc [1].

One industrials representative, placed second, A.P. Moller – Maersk A/S, (OTCPK:AMKBY)[2].

Thereafter, two financial services firms placed third and tenth, Credit Agricole SA (OTCPK:CRARF) [3] and Bank of N.T. Butterfield & Son Ltd [10].

Then, two basic materials representatives took the fourth and seventh slots, Vale S.A. (VALE) [4], and Sibanye Stillwater Ltd [7].

Two communication services representatives, placed fifth, and eighth, Vodafone Group PLC, [5], and BCE Inc [8].

Then one healthcare member placed sixth, GSK PLC [6]. and a consumer defensive sector representative placed ninth, Arca Continental, S.A.B. de C.V. (OTCPK:EMBVF) [9]. This completed the October Viital Ex-US top-ten, by yield.

Actionable Conclusions: (21-30) Ten Viital Ex-US Stocks Showed 14.73% To 64.69% Upsides To October 2023; (31) On The Downside Was One -16.36% Loser

To quantify top-yield rankings, analyst median-price target estimates provided a “market sentiment” measure of upside potential. Added to the simple high-yield metrics, analyst median price-target-estimates became another tool to dig-out bargains, (or unrealistic expectations).

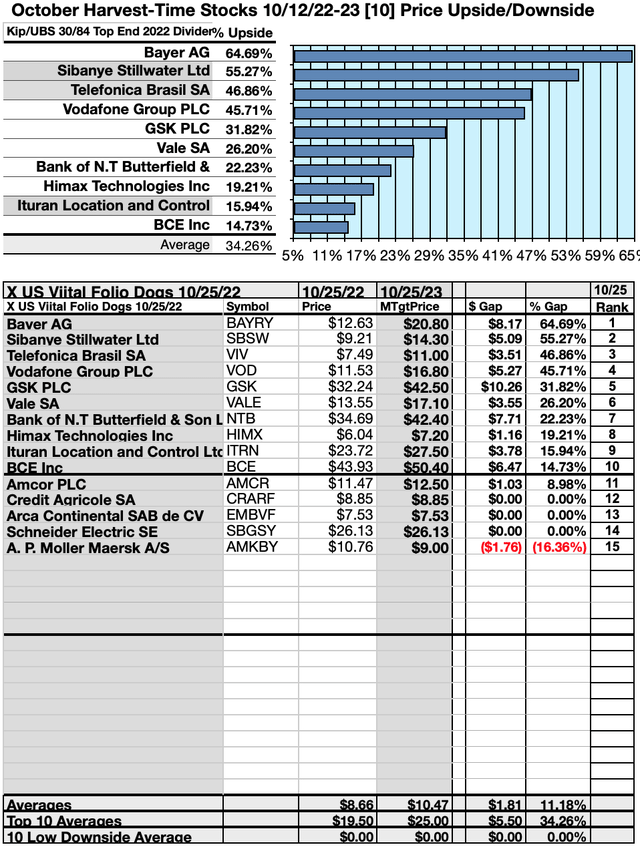

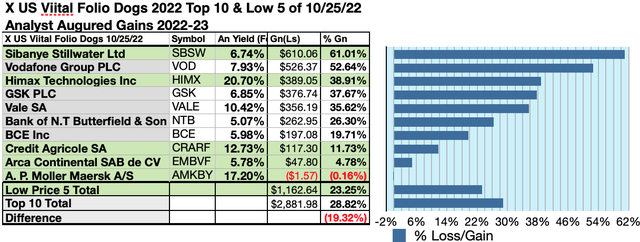

Analysts Estimated A 19.32% Disadvantage For 5 Highest-Yield, Lowest-Priced, of Top Ten Viital Ex-US Stocks To October, 2023

Ten top Viital Ex-US stocks were culled by (dividend/price) yield results for their monthly update.

As noted above, top ten Viital Ex-US stocks by yield selected 10/25/22 represented seven of eleven sectors in the Morningstar sector scheme.

Actionable Conclusions: Analysts Estimated 5 Lowest-Priced Of Ten Highest-Yield Dividend Viital Ex-US Stocks (32) Delivering 23.25% Vs. (33) 28.82% Net Gains by All Ten, Come October 2023

$5000 invested as $1k in each of the five lowest-priced stocks in the top ten Dividend Viital Ex-US dog kennel by yield were predicted (by analyst 1-year targets) to deliver 19.32% LESS gain than $5,000 invested as $.5k in all ten. The fourth lowest-priced Viital Ex-US top-yield stock, Sibanye Stillwater Ltd, was projected to deliver the best net gain of 61.01%.

Source: YCharts

The five lowest-priced top-yield Viital Ex-US stocks as of October 25 were: Himax Technologies Inc; Arca Continental SAB de CV; Credit Agricole SA; Sibanye Stillwater Ltd; A.P. Moeller Maersk, with prices ranging from $6.04 to $10.76

The five higher-priced top-yield Viital Ex-US stocks as of October 25 were: Vodafone Group PLC; Vale SA; GSK PLC; Bank of N.T. Butterfield & Son; BCE Inc, whose prices ranged from $11.53 to $45.93.

This distinction between five low-priced dividend dogs and the general field of ten reflected Michael B. O’Higgins’ “basic method” for beating the Dow. The scale of projected gains based on analyst targets added a unique element of “market sentiment” gauging upside potential. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised, however, since analysts are historically only 20% to 90% accurate on the direction of change and just 0% to 15% accurate on the degree of change.

Afterword

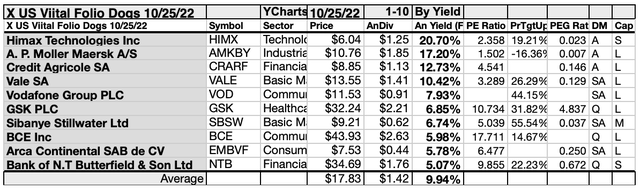

If somehow you missed the suggestion of the fifteen stocks ripe for picking at the start of the article, here is a repeat of the list at the end:

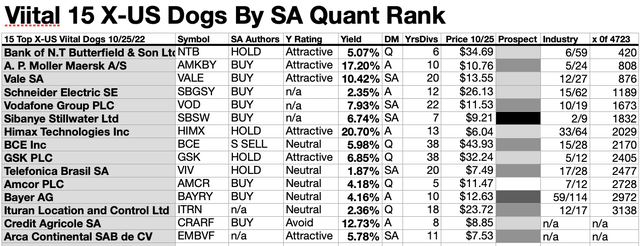

The following 15 (as of 10/25/22) all realized the ideal of offering annual dividends from a $1K investment exceeding their single share prices. Not mentioned, so far, was Schneider Electric S.E. (OTCPK:SBGSY).

Choosing One Top Ex-US Viital Winner

Sources: SeekingAlpha.com/YCharts.com

The chart above uses nine selective columns to rank the fifteen chosen Viital Ex-US stocks. The top dog in the pack, Bank of N.T. Butterfield & Son, showed the best score in four of nine columns and the second-best rank in one more. None of the other fourteen did better.

The categories used to rank the top dog were: (1) Seeking Alpha Author Rating; (2) Over-all YCharts Y Rating; (3) Yield as of 10/25/22 market close (highest being best); (4) Dividend Mode (Annual worst to Monthly best); (5) Number of years increasing dividends have been paid (highest best); (6) Stock price (lowest being best); (6) Future prospects from dismal to bright; (7) Quant rank by industry (#/of #); (8) Quant rank overall (#/of 4723). All but the Y-rating categories were collected from Seeking Alpha charts.

Stocks listed above were suggested only as possible reference points for your Viital Ex-US dividend dog stock purchase or sale research process. These were not recommendations. Seeking Alpha editors have informed the author that this article does not qualify for the contributor-contest for the best article recommending a non-US based stock (Ex-US), since it does not advocate for just one stock. Nevertheless Bank of N.T. Butterfield & Son is an intriguing small cap investment and, by my estimation, the top Ex-US member of my current collecting Viital Stock portfolio behind the Seeking Alpha Marketplace paywall.

Disclaimer: This article is for informational and educational purposes only and should not be construed to constitute investment advice. Nothing contained herein shall constitute a solicitation, recommendation or endorsement to buy or sell any security. Prices and returns on equities in this article except as noted are listed without consideration of fees, commissions, taxes, penalties, or interest payable due to purchasing, holding, or selling same.

Graphs and charts were compiled by Rydlun & Co., LLC from data derived from www.indexarb.com; YCharts.com; finance.yahoo.com; analyst mean target price by YCharts. Dog art: Open source dog art from dividenddogcatcher.com.

Be the first to comment