MJ_Prototype/iStock via Getty Images

111 Inc. (NASDAQ:YI) is a Chinese sophisticated online drug platform with the main business coming from its B2B platform serving as a one-stop shop for pharmacies, clinics, and hospitals to source pharmaceuticals, adding services like inventory management and analytics tools generating efficiencies across the supply chain.

It has a small B2C segment that is competing with the big boys like Alibaba Health, Baidu Health, WeDoctor from Tencent Holdings Ltd. (OTCPK:TCEHY), and JD Health Inc.

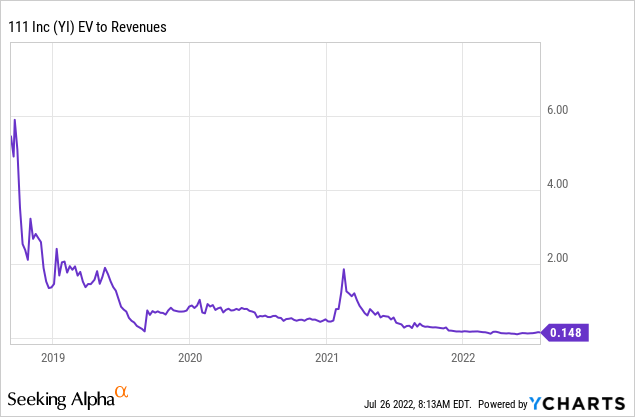

The shares have been obliterated like so many other Chinese ADRs and small growth stocks, but the company is making continued progress and the shares have become almost ridiculously cheap. Compare the share price:

FinViz

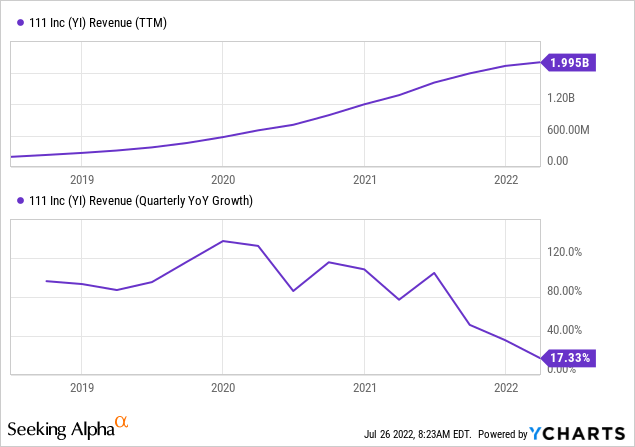

With company growth:

This is why we added shares at $2.17 and $2.25 recently for our subscribers. While revenue growth has slowed down as the company gets bigger (and growth slowed down further to 15% in Q1 as there were strong headwinds from Covid), the company has made large strides in operational improvement and predicts to reach non-GAAP operational breakeven later this year.

We’ll describe a few elements that are responsible for the company’s growth and competitive advantage.

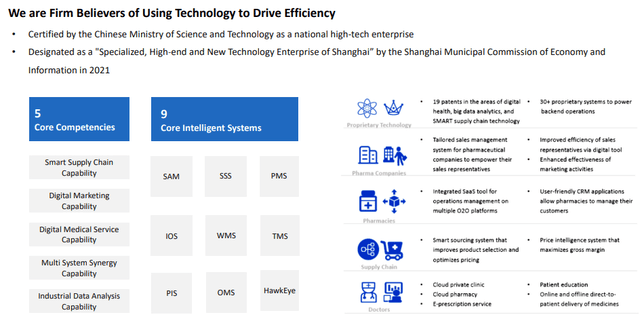

Technology

The company has the backing of Chinese authorities, which in that environment is pretty important. The company is betting on the digitization of healthcare, which is a national priority, and it seems pretty well placed to take advantage of that.

It’s technology and ecosystem are important sources of competitive advantage (Q1CC):

We have built an industry leading smart supply chain platform that is uniquely tailored to optimize our S2B2C business model and in our rivaled national sales network providing comprehensive coverage and a sophisticated multi-channel digital platform that serves numerous unmet needs in this massive market. This has made us an attractive commercialization partner as evidenced by our growing number of partnerships with pharmaceutical companies.

These pharma partnerships now exceed 550, and this works both ways as it also enables the company to lower sourcing cost, further cementing its advantage and increasing gross margins.

Ecosystem

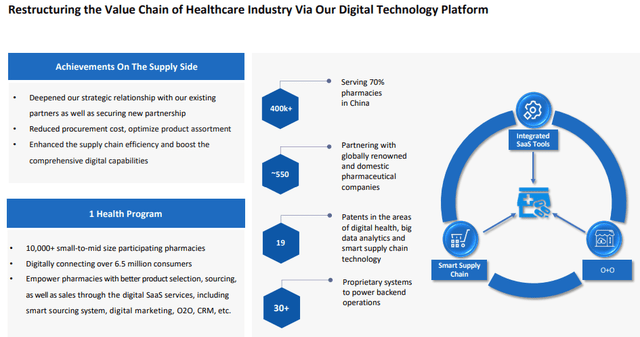

111 Inc has created an ecosystem with over 100K different types of drugs selling on its platform and offering a host of additional services for 550+ globally renowned and domestic pharma companies, 400K pharmacies, hospitals, wholesalers, distributors, insurance companies, doctors and patients, keeping them connected through proprietary analytics systems.

This ecosystem is difficult to reproduce for competitors and creates stickiness to the platform that keeps customers returning.

And they keep expanding the pharma companies which they use to direct source medicines and the company offers marketing, distribution, and analytics services to the pharma companies. At the end of 2019, they had 188 pharma partners, growing to 330 at the end of 2020 and 550 at the end of Q1/22.

They have become an effective commercialization partner for pharma, distributors, and pharmacies. Given the scale of parties they reach, there are potential network effects operative here.

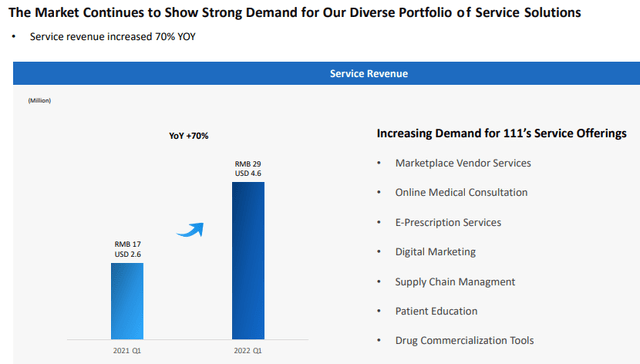

Services

The services part is still fairly small (RMB29M in Q1), but growing at 70% and boosting margins. Here are some of the services the company deliver (Q1CC):

On the services revenue and services margin part, our digital platform provides a comprehensive solution for pharmaceutical companies by integrating doctors, pharmacists, medical assistance, patients and medical representatives onto our Internet hospital. The service module also provides online remote consultation and provide e-prescription, patient-to-patient and also patient support, and refill services. And these features enable us to provide customized omni-channel digital marketing solutions for our pharmaceutical partners.

They also have services like market vendor services (for vendors), a commercial online marketplace model where licensed third-party distributors and resellers can offer inventory.

They offer online medication consultation services and e-prescription services (for patients and consumers), supply chain services, digital marketing, patient education and drug commercialization tools (for pharma companies), etc.

New deals are closed regularly, like this one with Beilin Pharmaceutical showing that it’s not just for pharma companies. The marketing services for pharma companies (as well as distributors and pharmacies) remind us of OptimizeRx (OPRX) and the market opportunity in China is pretty big.

Given their position with pharmacies serving a whopping 400K, and also hospitals and doctors, they must be a pretty interesting partner for pharma companies distributors and pharmacies.

Then there is their virtual franchise model for over 10K small and medium-sized pharmacies called One Health (Q1CC):

All the participating pharmacies can use our platform to better manage their product selection, procurement, and inventory management, as well as accessing our distribution tools through our digital SaaS services, including smart sourcing, digital marketing, O2O, and CRM. This CRM initiative has assisted over 10,000 pharmacies in delivering improved medical services and personalized marketing to over 6.5 million consumers… In this year, we expect more and more pharmacies to join our One Health program.

Finances

Net revenues were RMB2.98 billion (US$470.5 million), representing an increase of 14.9% from RMB2.59 billion in the same quarter of last year.

In RMB, from the 8-K:

|

2021 |

2022 |

YoY |

|

| B2B Net Revenue | |||

| Product | 2,440,504 | 2,851,396 | 16.8% |

| Service | 12,025 | 18,360 | 52.7% |

| Sub-Total | 2,452,529 | 2,869,756 | 17.0% |

| Cost of Products Sold(4) | 2,364,354 | 2,701,643 | 14.3% |

| Segment Profit | 88,175 | 168,113 | 90.7% |

| Segment Profit % | 3.6% | 5.9% |

The B2C segment is very small and declining, although services are rapidly increasing:

| 2021 | 2022 | YoY | |

| B2C Net Revenue | |||

| Product | 137,150 | 102,131 | -25.5% |

| Service | 5,063 | 10,704 | 111.4% |

| Sub-Total | 142,213 | 112,835 | -20.7% |

| Cost of Products Sold(4) | 114,618 | 88,413 | -22.9% |

| Segment Profit | 27,595 | 24,422 | -11.5% |

| Segment Profit % | 19.4% | 21.6% | |

| Gross Segment Profit | 115,770 | 192,535 | 66.3% |

(4) For segment reporting purposes, purchase rebates are allocated to the B2B segment and B2C segments primarily based on the amount of cost of products sold for each segment. Cost of products sold does not include other direct costs related to cost of product sales such as shipping and handling expense, payroll and benefits of logistic staff, logistic centers rental expenses and depreciation expenses, which are recorded in the fulfillment expenses. Cost of service revenue is recorded in the operating expense.

It remains to be seen whether the B2C segment can revive growth, Q1 likely suffered considerably from the pandemic and Q2 will still see those headwinds. Some more data:

- Service revenue +70% to RMB29M

- Non-GAAP loss 2.4% down from 5.2% Q1/21

- Goal non-GAAP operating breakeven in 2022

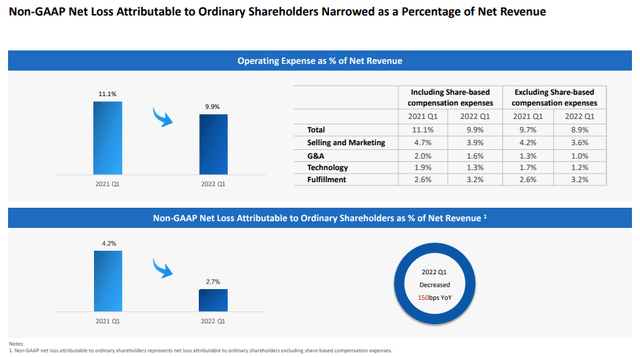

- As a percentage of revenues, total operating expenses were down to 9.9% from 11.1%; total operating expenses for the quarter were up 2% to RMB295 million

- S&M down to 3.9% from 4.7%

- G&A down to 1.6% from 2%

- Technology expenses down to 1.3% from 1.9%

- Fulfillment expenses 3.2% up from 2.6% in Q1/21 on investment in fulfillment centers and pandemic cost

- Non-GAAP loss from operations RMB72.4M down from RMB135.9M or 2.4% of rev down from 5.2% Q1/21

- Non-GAAP loss RMB80.6M down from RMB109.3M or 2.7% of revenue down from 4.2% in Q1/21. Two reasons: gross margins increase from 4.5% to 6.5% and increased operational efficiency.

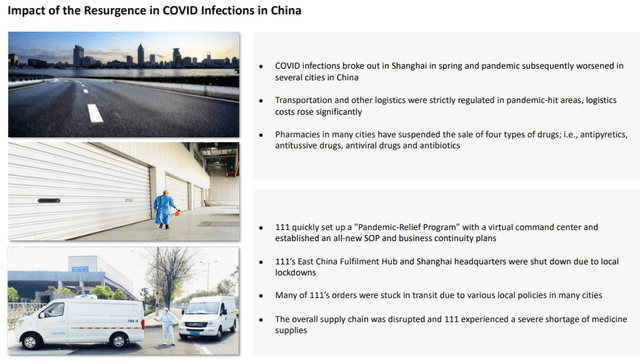

Covid headwinds

- The majority of its staff is in Shanghai and many couldn’t leave their house

- Many orders are stuck in transit, significantly increasing fulfillment cost

- The company was unable to replenish inventories

- They set up a relief program for patients and pharmacies

From the Q1CC:

pharmacies in many cities have suspended the sale of full type of drugs i.e. antibiotics, anti-toxic drugs, anti-viral drugs, and antibiotics. In the face of these challenges, 111 quickly set up a pandemic relief program with a virtual command center providing instructions on a constant basis… Many pharmacies and medical institutions struggled with supply chain issues over the past few months and we have stepped in and filled this supply gap.

While leading to additional costs (much of which were unavoidable), the relief program will have increased their goodwill and standing with the authorities who have embarked on stressing social responsibilities of companies. Indeed (Q1CC):

We received so many letters from customers praising our services, which further proves the social value we deliver to our communities. Our One Clinic online hospital platform has launched a free virtual clinical services program where doctors can provide online consultation, prescription renewal, and other services to the public.

Yet despite these considerable headwinds, the company was able to keep on growing and improving margins.

Regulation

The company has been spared the regulatory onslaught on other segments as it’s mostly a B2B platform rather than a B2C platform. However, its share price has suffered nevertheless. Now that this seems to subside as Chinese authorities prioritize growth in the face of the Covid lockdowns, we think this should put tailwinds behind the shares.

Management is actually pretty optimistic about regulation, like Healthy China 2030 (Q1CC):

Healthy China 2030 and the 14th five-year plan, where the government has elevated the health of the country, of its citizens to a level of the national strategy. And there are lots of tailwind for us and we’re [still] [ph] very excited about. We spoke about this the previous few quarters, and I didn’t elaborate in so much of a detail on today’s call, but we see digitization and the investment in the healthcare industry will provide a lot of tailwinds for us… the recent consultation paper where the regulatory bodies are coming out of detailed measures to make sure the industry is going to be compliant to many new rules. I’m assuming right. We believe this is good for the development of the industry and some companies might be impacted negatively, but the measures like no AI involvement in the doctors’ consultation, and users will have to upload their health record and the previous diagnosis, etcetera.

Then there is the threat of US delisting under the Holding Foreign Companies Accountable Act, as the SEC has determined the Company used an auditor whose working paper cannot be inspected or investigated completely by the PCAOB (Public Company Accounting Oversight Board of the United States) to issue the audit opinion for the Company’s financial statements for the fiscal year ended December 31, 2021.

This would set the ADRs up for delisting in three years, but management is exploring alternatives (Q1CC):

Yes, we are still in the process of preparing for the domestic listing for key subsidiaries in China. And we are also evaluating options for both Shanghai Stock Exchange and [indiscernible].

We would like to know what that indiscernible was, perhaps Hong Kong? There is still plenty of time for this issue to diffuse if US and Chinese authorities arrive at an agreement, there has been progress in talks.

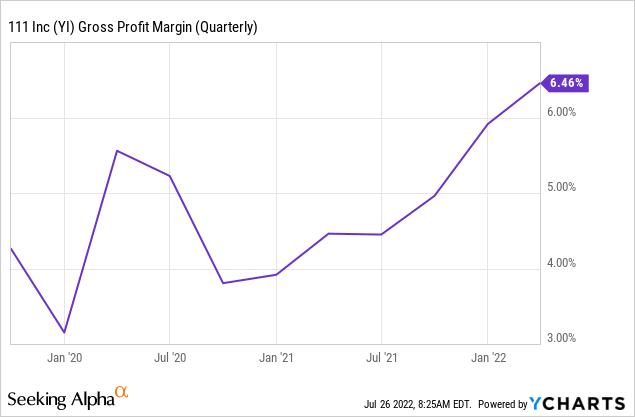

Gross margins

Platform economics are some of the best business models, as they are endlessly extendible and scalable, reaping economies of scale and scope. We are starting to see this in the continuous improvement of gross margins:

Reaching 6.5% in Q1, up from 4.5% a year ago. Despite the Covid headwinds, 14.9% growth and gross profit came in at RMB192M a growth of 66.3% or 4x revenue growth.

B2B was the key driver with revenue growth at 17% to RMB2.87B, gross profit growing 90.7% to RMB168M, and gross margin rising from 3.6% to 5.9%.

Apart from the economies of scale and scope, there are other reasons for the rise:

- Increased direct sourcing from pharma companies

- Focusing on high-margin products. The company has some 5K SKUs with very good margin, including their private label products

- Improve their digital capabilities

Operational leverage

Apart from the considerable rise in gross margins there is also a good deal of operational leverage:

From the Q1CC:

So, why we grow our top line at 15%, our spending on sales and marketing expenses, general and administrative expenses, as well as technology expenses have been reduced by 6.2%, 7.9%, and 21.5%, respectively.

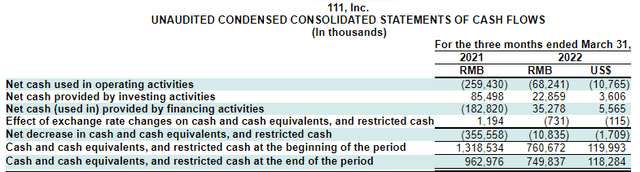

Cash

From the 8-K:

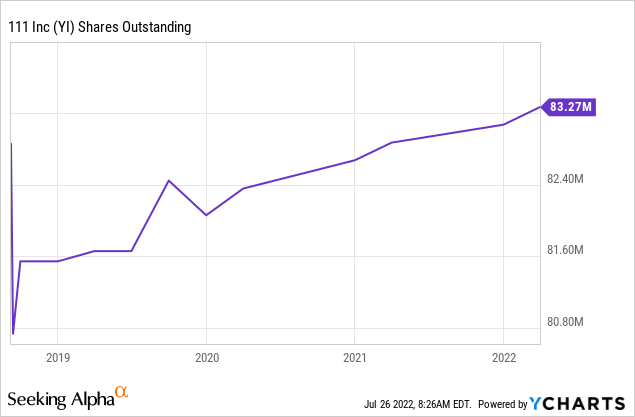

Adding short-term investments their cash position becomes RMB901.4M, which seems way more than they need to survive until they become cash flow positive. They have been managing their cash well and despite losses to date there hasn’t been a need for additional finance, which has kept dilution in check:

Valuation

With a market cap of $230M and $130M in cash, the company is selling at an EV of just $100M with sales expected to reach $2.5B this year. While this year, analysts still expect a loss of $0.11 per share but rising to $0.16 in profits for next year.

Conclusion

We see numerous reasons to be bullish on the shares:

- The company’s B2B segment (which counts for nearly all of its business) has a well-entrenched ecosystem that will be difficult to dislodge or reproduce by competitors.

- The company’s technological capabilities are impressive and a source of competitive advantage.

- The company’s services are rapidly increasing which put upward pressure on margins.

- The company is continuously increasing gross margins and operational leverage.

- The company performed well in Q1 despite strong Covid headwinds.

- The company is losing little cash and has an iron-clad balance sheet.

- The shares are almost ridiculously cheap, selling almost at cash value.

On the downside, there is always the off-chance that policy authorities embark on a new regulation drive, but we don’t directly see why 111 Inc. should be in any direct firing line as it provides an important societal service bringing meds to all corners of China.

Q2 is likely to be soft as this is the quarter that bore the brunt of the Covid lockdowns, but the trend upwards in revenues and gross margin seems pretty firm to us.

Be the first to comment