porcorex

High yielding investments are great for the income portion of retirement portfolios, considering that taxes can eat into big chunk of dividends in a regular taxable account. As such, when held in a retirement account, high dividend investments enable a far quicker payback period and compounding, not to mention the satisfaction of seeing real money come into one’s account versus unrealized capital gains.

This brings me to Ares Commercial Real Estate (NYSE:ACRE), which is backed by a well-respected and seasoned asset manager. ACRE hasn’t much participated in the recent market rally, and in this article, I show why it’s attractive at the current price for high yield.

Why ACRE?

ACRE is a leading REIT that is engaged in originating commercial real estate loans. It’s externally managed by its “big brother” Ares Management (ARES), a well-known asset manager that also happens to manage Ares Capital (ARCC), the largest BDC by asset size. ACRE benefits from its affiliation Ares Management, as the latter has $51 billion in real estate assets under management, thereby giving deal flow and line of sight that it would not otherwise have.

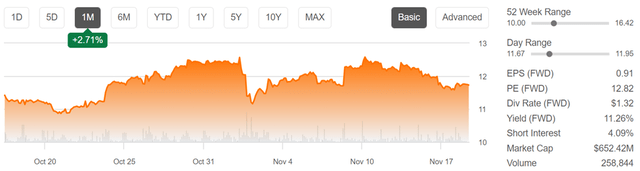

The recent market rally may have been disappointing for value investors seeking to layer more capital at low prices. However, important to keep in mind that it’s a market for stocks rather than the stock market. ACRE stock hasn’t much participated in the market rally over the past month, rising by just 2.7%, sitting well below the 5.7% rise in the S&P 500 (SPY) over the same timeframe.

Meanwhile, ACRE recently posted strong third quarter results, with distributable earnings per share coming in at $0.39, more than covering the $0.33 per share regular quarterly dividend, and the $0.02 supplemental dividend on top of that.

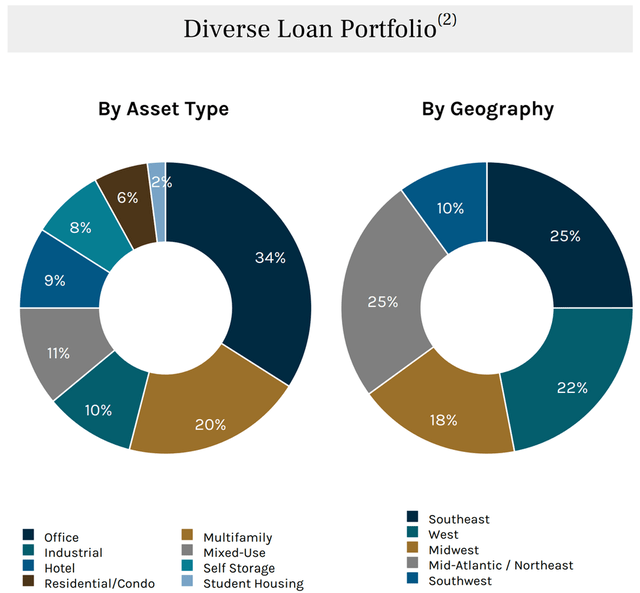

The investment portfolio is well diversified and sizeable with a $2.5 billion outstanding principal balance, comprised of relatively safe 98% senior loans, which sit on top of the capital stack in the event of a borrower default. As shown below, office, multifamily, and industrial segments make up nearly two-thirds of ACRE’s debt investment portfolio.

ACRE Portfolio Mix (Investor Presentation)

Moreover, ACRE is benefiting from rising rates, with 98% of its loan portfolio being floating rate, comparing favorably to 68% of ACRE’s debt being interest rate sensitive, enabling ACRE to benefit from a larger investment spread in rising rate environment. One potential overhang is ACRE’s high exposure to office, which suffers from headline risk due to the work from home trend.

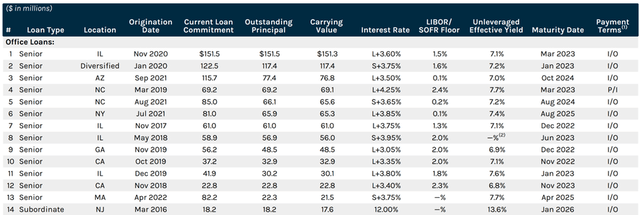

However, I believe office occupancy rates should normalize over the long-run, especially for newer buildings in which ACRE typically invests. Plus, ACRE is somewhat protected in the event of long-term weakness in the office space market, as most of its loans come due over the next 1-2 years, as shown below.

ACRE Office Loan Portfolio (Investor Presentation)

Also, management is deploying capital into loans tied to lower risk assets such as multifamily and self-storage properties, as noted below during the recent conference call:

In terms of deployments during the third quarter, we were highly selective. We closed $50 million of floating rate investments across multifamily and self-storage properties and $28 million of AAA-rated, newly issued CRE liquid debt securities. Across both public and private market opportunities, we believe that our new investments are on property types and markets with strong underlying demand drivers to counteract higher rates and risk premiums, while also possessing more conservative structures and wider spreads.

By way of example, during the third quarter, we originated a senior whole loan secured by a portfolio of well-located multifamily properties in the Sunbelt with a well-regarded repeat sponsor. The all-in spread on the whole loans was 80 basis points higher than our post-pandemic average spreads for multifamily whole loans and with a greater equity subordination and enhanced structural terms, further driving the attractiveness of the loan.

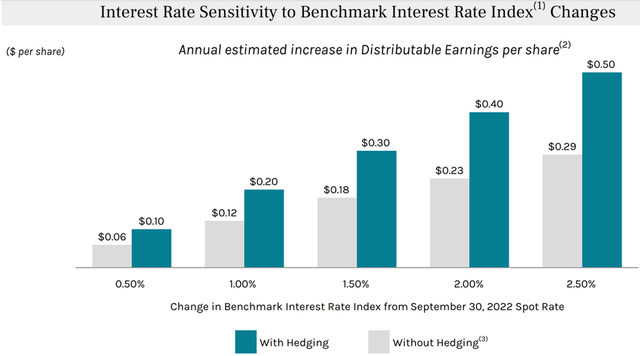

Moreover, ACRE maintains a healthy balance sheet with a modest amount of leverage with a debt to equity ratio of 2.3x and a recourse debt to equity ratio of 1.3x. ACRE is also well-positioned to benefit from rising rates. As shown below, management expects to see earnings accretion with every 50 basis points rise in interest rates.

ACRE Interest Rate Sensitivity (Investor Presentation)

Lastly, I see value in ACRE at the current price of $11.74 with a price to book value of just 0.83x. As shown below, this sits towards the low end of ACRE’s valuation range over the past 5 years. Analysts have a consensus Buy rating with an average price target of $13.36, implying potential for double digital returns, especially including the dividend.

ACRE Price to Book (Seeking Alpha)

Investor Takeaway

ACRE is a solid, diversified commercial mortgage REIT that provides investors with an attractive and well-covered 11% dividend yield. The company has strong fundamentals and is well-positioned to benefit from rising interest rates, while also maintaining a healthy balance sheet. Given its discounted valuation compared to its historical range, ACRE’s current price provides investors with an attractive buying opportunity for high income.

Be the first to comment