Fnadya76

Gift-giving is an incredibly human act. Although it can be costly, it has many benefits that are worthwhile. Examples include helping us to connect with one another, creating a shared sense of celebration, expressing one another’s emotions, and so much more. One company that’s dedicated to helping customers give more is 1-800-FLOWERS.COM (NASDAQ:FLWS). In addition to being an interesting place to put your money, the company also has a great track record of growth under its belt. Although its fundamentals have been volatile and, from a profitability perspective, the current fiscal year is not looking all that great, shares do look attractively priced at this time. All things considered, the company definitely makes for a solid ‘buy’ prospect that has the potential to generate a lot of upside for investors moving forward.

It’s the thought that counts

As I mentioned already, 1-800-FLOWERS.COM is a business dedicated to providing gifts to its customers to give to others. The company does this through a variety of industry-leading brands that it currently owns. Examples include, but are not limited to, 1-800-Flowers.com, 1-800-Baskets.com, Cheryl’s Cookies, Harry & David, Moose Munch, The Popcorn Factory, Wolferman’s Bakery, And so much more. Part of the company’s business model also centers around what it calls its Celebrations Passport, which operates as a loyalty program that provides members with free standard shipping and no service charge across its entire portfolio of brands. On top of all of this, the company also has another business under its belt called BloomNet, which operates as an international floral and gift industry service provider aimed at helping its members grow their businesses in a profitable fashion. Its Napco business serves as a resource for floral gifts and seasonal decor, and DesignPac Gifts operates as a producer of gift baskets and towers.

Much of the company’s business model has historically centered around providing direct-to-consumer products and services. As its name suggests, customers have historically been able to order flowers and other gifts online to be delivered to the intended recipient. Over the years, the company has evolved to have a significant online presence. And in addition to traditional flowers and gifts, the firm has expanded into a variety of gourmet foods and gift baskets. On the gift side of things, the company even provides ones that can be personalized, such as those that involve sublimation, embroidery, digital printing, engraving, and even sandblasting. Regardless of what a customer orders, the end product is ultimately handled through the company’s hybrid fulfillment system. Its network also includes a network of independent florists that offer their own retail flower shops and franchise florist shops. This, combined with its own distribution centers and vendors who ship directly to its customers, as well as other related parties, allows the company to offer same-day, next-day, and even any-day delivery.

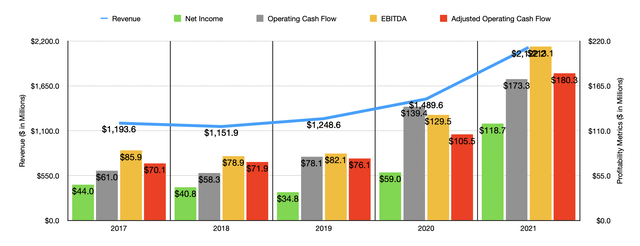

Over the years, the management team at 1-800-FLOWERS.COM has done a solid job growing the company. Between 2017 and 2020, sales generated by the firm expanded from $1.19 billion to $1.49 billion. Then, in 2021, revenue jumped by 42.5% to $2.12 billion. Management attributed this strong sales growth in 2021 to a three-year initiative that the business embarked on in 2018 aimed at nurturing and growing some of the company’s strongest assets. The greatest growth for the company during this time frame came from its Consumer Floral & Gifts category, with sales skyrocketing by 72.8% year over year. The business benefited from a 52.8% rise in e-commerce sales, and it benefited from the acquisition of PersonalizationMall.com back in 2020. Excluding that acquisition, sales for the year would have risen a more modest 26.6%.

As revenue has risen, profitability has also improved. Although net income has been lumpy, it ultimately rose from $44 million in 2017 to $118.7 million last year. Operating cash flow followed a similar trajectory, rising from $61 million to $173.3 million. If we adjust for changes in working capital, it would have risen consistently as well, climbing from $70.1 million to $180.3 million. Meanwhile, EBITDA has also mostly improved, rising from $85.9 million in 2017 to $213.1 million last year.

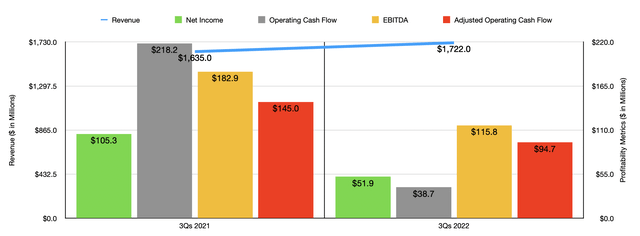

For the current fiscal year, we have seen some mixed results. Revenue, for starters, has performed exceptionally well, rising from $1.64 billion in the first three quarters of 2021 to $1.72 billion the same time this year. At least some of this sales increase came from some other activities the company engaged in, such as the acquisition of Vital Choice and its acquisition of Alice’s Table, both deals at work completed in late 2021. Profitability, on the other hand, has suffered to some degree. Net income, for instance, fell from $105.3 million in the first nine months of the company’s 2021 fiscal year to $51.9 million at the same time this year. A big contributor to this seems to have been a decline in the company’s gross profit margin from 42.7% of revenue to 38.2%.

Management attributed this pain to economic issues that impacted margins. Examples included disruptions in the global supply chain, higher commodity costs, a rise in labor costs, and other factors. Naturally, this has served to negatively affect the other profitability metrics for the company. Operating cash flow in the first nine months of 2021 came in at $218.2 million. That’s dropped to $38.7 million the same time this year. Even if we adjust for changes in working capital, the metric would have fallen from $145 million to $94.7 million. Meanwhile, EBITDA for the business also fell, dropping from $182.9 million to $115.8 million.

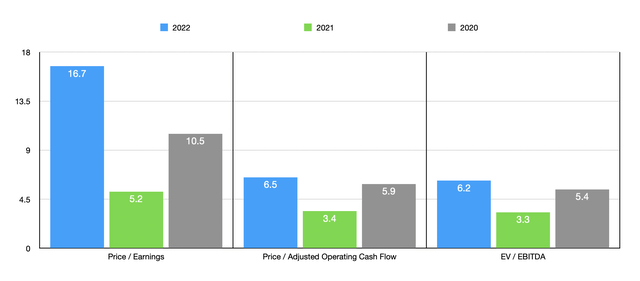

When it comes to the 2022 fiscal year as a whole, management expects revenue to climb by between 3% and 5%. They are also forecasting EBITDA of between $110 million and $115 million. Using that midpoint figure on a year-over-year basis, we can estimate that adjusted operating cash flow Should be around $95.2 million. Meanwhile, the earnings per share forecast implies net income of roughly $37.1 million for the year. Using these figures, we can estimate that the company is trading at a forward price-to-earnings multiple of 16.7. The price to adjusted operating cash flow multiple should be lower at 6.5, while the EV to EBITDA multiple should come in at 6.2. Although this makes the company cheap on an absolute basis, it’s not as cheap as the business was if we use 2020 for 2021 figures. Now when it comes to the issue of comparing the business to other firms, there really aren’t any great comparables. The three closest firms that I was able to pick out were, as you can see in the table shown below, all more expensive than 1-800-FLOWERS.COM is on a forward basis.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| 1-800-FLOWERS.COM | 16.7 | 6.5 | 6.2 |

| Baozun (BZUN) | N/A | 18.3 | 9.3 |

| Lands’ End (LE) | 21.7 | N/A | 9.0 |

| Liquidity Services (LQDT) | 17.6 | 16.3 | 14.6 |

Takeaway

For investors who like ‘feel good’ companies that happen to be generating attractive revenue growth and have a good track record of profitability, 1-800-FLOWERS.COM is definitely a good prospect to consider. This current fiscal year is hurting the company’s bottom line and it’s unclear how long that trend will last. But at the end of the day, the company should fare just well and the stock is cheap enough today, both on an absolute basis and relative to similar players, to warrant some upside potential moving forward. For these reasons, I have no problem rating the enterprise a solid ‘buy’ at this time.

Be the first to comment