Justin Sullivan

Everyday all the financial channels are interviewing Cathie Wood and talking about her ARK Innovation ETF (ARKK). She claims that her holdings are the companies that have disruptive technology. Tesla (TSLA) is her largest holding at 9.21% of her fund so I guess that is her favorite. Since the Barchart Trend Spotter signaled a sell on 9/29 the stock gained11.22%.

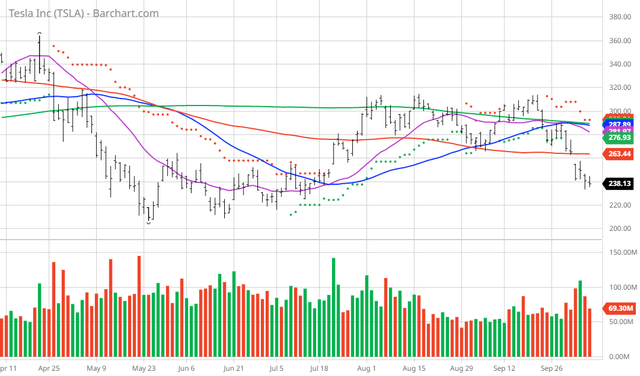

TSLA Price vs Daily Moving Averages

Tesla, Inc. designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally. The company operates in two segments, Automotive, and Energy Generation and Storage. The Automotive segment offers electric vehicles, as well as sells automotive regulatory credits. It provides sedans and sport utility vehicles through direct and used vehicle sales, a network of Tesla Superchargers, and in-app upgrades; and purchase financing and leasing services. This segment is also involved in the provision of non-warranty after-sales vehicle services, sale of used vehicles, retail merchandise, and vehicle insurance, as well as sale of products to third-party customers; services for electric vehicles through its company-owned service locations, and Tesla mobile service technicians; and vehicle limited warranties and extended service plans. The Energy Generation and Storage segment engages in the design, manufacture, installation, sale, and leasing of solar energy generation and energy storage products, and related services to residential, commercial, and industrial customers and utilities through its website, stores, and galleries, as well as through a network of channel partners. This segment also offers service and repairs to its energy product customers, including under warranty; and various financing options to its solar customers. The company was formerly known as Tesla Motors, Inc. and changed its name to Tesla, Inc. in February 2017. Tesla, Inc. was incorporated in 2003 and is headquartered in Austin, Texas.

Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 56% technical sell signals but increasing to buy

- 19.21 negative Weighted Alpha

- 11.66% loss in the last year

- Trend Spotter buy signal

- Below its 20, 50 and 100-day moving averages

- 8 new highs and down 17.63% in the last month

- Relative Strength Index 30.87%

- Technical support level at 234.13

- Recently traded at 238.13 which is below its 50-day moving average of 287.01

Fundamental factors:

- Market Cap $740 billion

- P/E 87.04

- Revenue expected to increase 56.80% this year and another 49.30% next year

- Earnings estimated to increase 82.70% this year, an additional 42.90% next year and continue to compound at an annual rate of 54.98% for the next 5 years

Analysts and Investor Sentiment – I don’t buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it’s hard to make money swimming against the tide:

- Wall Street analysts have 15 strong buy, 7 buy, 11 hold and 4 sell opinions on the stock

- Analyst’s price targets all over the place from 24.33 to 530.00 with an average of 306.92

- The individual investors following the stock on Motley Fool voted 3,690 to 1,054 for the stock to beat the market with the more experienced investors voting 734 to 97 for the same result

- 1,020,000 investors are monitoring the stock on Seeking Alpha

Ratings Summary

Factor Grades

Quant Ranking

Sector

Industry

Ranked Overall

Ranked in Sector

Ranked in Industry

Be the first to comment